Top Benefits of Outsourced Bookkeeping and How It Works

- Published: 18 July 2024

- 11 min read

- Bookkeeping, Grow Your Business

Heather Cameron

Author

Heather is here to inform and inspire our readers. Boasting eight years in the world of digital marketing, working in diverse industries like finance and travel, she has experience writing for various audiences. As Osome’s resident copywriter, Heather crafts compelling content, including expert guides, helpful accounting tips, and insights into the latest fintech trends that will help entrepreneurs, founders and small business owners in Hong Kong take their businesses to the next level.

Is bookkeeping taking up too much of your time? Outsourcing bookkeeping can save you money and offer expert financial management. Learn how it works and why it might be the best move for your small business.

Key Takeaways

- Outsourcing bookkeeping helps small businesses save costs and time, providing specialised expertise without the overhead of full-time employees.

- Outsourced bookkeeping allows large and small business owners to focus on core tasks and growth while ensuring accurate financial records through scalable, flexible services.

- The choice between local and outsourced bookkeeping firms depends on business needs. An outsourced bookkeeping service offers flexibility and savings, while an outsourced bookkeeping service provides direct interaction and physical document handling.

How Does Outsourced Bookkeeping Work?

Wondering how outsourced bookkeeping works? Outsourced bookkeeping involves hiring an external firm or individual to manage your company’s financial transactions and prepare financial statements. This process begins with selecting the right provider, who will then dive deep into your current accounting processes and books to ensure historical records comply with reporting standards.

When working with the company, you will usually enter into a contract and make a fixed monthly bookkeeping payment for their services. This arrangement helps to ensure transparency and consistency in your business relationship. The outsourcing company will then work to understand your specific bookkeeping needs and goals, providing regular financial performance reports and being available for support as needed.

A key advantage of outsourced bookkeeping is:

- The use of cloud-based technology, which streamlines processes and allows access to your financial data from anywhere

- Seamless collaboration with your bookkeeping company

- A clear, real-time view of your finances and transactions at any given time

This modern approach makes outsourcing an online bookkeeping service an efficient and effective solution for managing financial records, especially with the help of bookkeeping software.

Even with outsourced bookkeeping, managing the complexities of finances can be challenging. Osome offers comprehensive bookkeeping services. Contact us, and we will handle everything from bookkeeping and tax preparation to accurate financial reporting and strategic analysis.

Why Should Companies Outsource Bookkeeping?

The trend of outsourcing bookkeeping is on the rise among small and medium-sized businesses. There are many reasons to work with an outsourced bookkeeping service. By outsourcing, many businesses save on the training costs and investments required for in-house bookkeeping, not to mention the expenses of hiring full-time employees. Additionally, outsourcing provides access to specialised expertise that might be otherwise unavailable or too costly to maintain in-house.

Another compelling reason businesses outsource bookkeeping is the ability to focus on core business tasks. Managing books internally can be incredibly time-consuming, diverting attention from growth-oriented activities and client relationships. Outsourcing also offers scalability, allowing businesses to adjust their financial management needs based on workload fluctuations without internal disruptions. Moreover, the remote work trend has made outsourcing even more feasible and cost-effective, eliminating geographical barriers.

When To Outsource Bookkeeping?

Recognising the right time to outsource bookkeeping can be crucial for a business’s efficiency and success. Ever feel like your business is drowning in physical paperwork? Maybe your team is overwhelmed with bookkeeping tasks, or you’re constantly playing catch-up on the books yourself.

Think about it: if bookkeeping errors are popping up like weeds or you’re constantly worried about being compliant, it’s a red flag that you might need some expert help. Same with feeling like you have no time to focus on growing your business or your finances are confusing.

What Do Outsourced Bookkeepers Do?

Have you ever wondered how some businesses seem to have their finances under control, with everything running like clockwork? A big part of the secret might be the best outsourced bookkeeping companies. The tasks of an outsourced bookkeeper include taking care of a whole bunch of essential functions that ensure your business grows.

Imagine having someone who can do all the boring stuff: record every single penny that comes in and out, create financial reports so you know exactly where you’re at, and balance your bank accounts – like a financial superhero! But that’s not all. An outsourced bookkeeper can also manage who owes you money (accounts receivable) and who you owe (accounts payable), do your payroll for your team, and send invoices and pay bills.

Taking on these bookkeeping tasks frees you up to focus on what you do best – running and growing your amazing business! No more late nights spent wrestling with spreadsheets – you can leave the financial juggling to the experts.

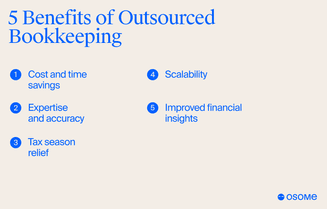

Top Benefits of Outsourcing Bookkeeping Services

Outsourcing your bookkeeping offers numerous benefits that can significantly enhance a business’s financial management. Outsourcing bookkeeping advantages include:

- Cost and time savings

- Access to specialised expertise and accuracy

- Relief during tax season

- Scalability

- Improved financial insights

Let’s delve deeper into each of these benefits to understand how they can transform your business operations.

Cost and time savings

The biggest benefit of using an outsourced bookkeeping service is the cost and time savings. In-house bookkeepers (or local bookkeepers) come with hidden costs like insurance and training. Outsourcing lets you ditch those additional costs and only pay for what you need. It’s like having a financial management team on retainer but without the hassle of hiring and managing employees and all other costs that come with having a full-time bookkeeper.

Outsourced bookkeeping can free up your time. Their processes are streamlined, so you don’t have to worry about daily bookkeeping tasks. This means you can focus on what really matters: growing your business. Imagine the time you’d have to come up with new ideas or connect with clients!

And recruitment costs. Finding a good in-house bookkeeper is hard. By outsourcing, you don’t have to.

Expertise and accuracy

Outsourcing your bookkeeping gets you more than just basic record-keeping. It means you get access to a deeper well of expertise and accuracy, including:

- Tax preparation that's a step ahead

- Financial analysis that goes beyond the surface

- Accounting services that are anything but basic

- A financial quarterback for your business

Outsourced bookkeeping teams, often found in bookkeeping firms and accounting firms, are composed of professionals who are well-versed in multiple topics and can provide these outsourced accounting services and bookkeeping services. Imagine no more worrying about errors or wondering if your numbers are off! This ensures the highest level of accuracy in your financial reporting, giving you rock-solid data to make the best decisions for your business.

Tax season relief

Tax season can be a stressful time for a business owner. No more sleepless nights! Outsourcing your bookkeeping is like having a team of tax ninjas on your side. No scrambling at the last minute or surprise penalties.

Plus, you get 24/7 access to your financial data to see exactly where your money's flowing. This makes finding those sweet tax deductions a breeze! And since everything is meticulously logged and matches your bank statements and other financial statements, filing your taxes becomes a walk in the park.

Scalability

Another perk of outsourcing your bookkeeping is scalability. As your business explodes in popularity, your financial needs will definitely transform. Outsourced bookkeeping teams are like financial chameleons - they adapt quickly. Need more services? Done! Need to scale back? No problem! This keeps your financial operations running smoothly without any internal roadblocks or long transition periods.

This adaptability is a game-changer for startups and growing businesses known for their ups and downs. Having a team of experts means your business finances stay on track, no matter how fast you're growing.

Improved financial insights

Outsourcing bookkeeping also provides improved financial insights through detailed financial reports and real-time data access. These financial reports are more in-depth than typical in-office bookkeeping and include balance sheets and cash flow reports. This level of detail can positively impact business growth, allowing for better strategic planning and decision-making.

Having all financial information readily available throughout the year offers several benefits:

- Makes tax season much easier

- Ensures that business owners always have a clear picture of their financial health

- Provides improved financial visibility, leading to better financial management

- Ultimately, it contributes to business success.

Local vs. Outsourced Bookkeeping Services

Choosing between a local and outsourced bookkeeping services depends on various factors, including accessibility, communication methods, and cost implications. In-house bookkeeping offers the advantage of face-to-face communication and physical document handling. This can be particularly beneficial for businesses that prefer direct interaction and hands-on management of their financial documents.

On the other hand, outsourced bookkeeping provides the following benefits:

- Flexibility of remote access

- Lower cost

- Access to professional bookkeeping services from anywhere

- Elimination of the need for a physical presence

- Reduction of overhead costs

- Quick adaptation to changing business needs without lengthy transition periods

How does local bookkeeping work?

Local bookkeeping is all about keeping your financial house in order right there in your own office. It involves a step-by-step process to track your money coming in and going out:

- Documenting income, expenses, purchases, and sales

- Gathering financial documents

- Choosing an accounting system

- Setting up a chart of accounts

- Recording financial transactions

Another key part of in-house bookkeeping is regularly checking your financial compass. This means reconciling your bank statements and financial statements with your accounting records and ensuring all the numbers match up. A local in-house bookkeeper will often use a double-entry bookkeeping system, where every transaction gets recorded twice (once as a debit and once as a credit) to keep your financial records balanced.

Finally, in-house bookkeeping is about creating clear financial reports that tell the story of your business. This includes income statements (how much money you made), balance sheets (what you own and owe), and cash flow statements (how your cash is moving).

How does virtual bookkeeping work?

Virtual bookkeeping is all about managing your finances remotely. Imagine having a financial wizard working their magic through the cloud! They use special cloud-based accounting software, so you can access your financial records anytime, anywhere - as long as you have an internet connection. Flexibility at its finest!

Virtual bookkeepers and other offshore freelance bookkeepers can do some pretty amazing things, all from their remote locations:

- Categorise and record your financial documents

- Generate reports that tell the story of your business

- Keep track of your expenses

- Create invoices to get paid fast

- Manage payroll and payroll taxes if needed

And since they use cloud-based software, everything is accessible and secure. Communication is also a breeze - just hop on a video call or use your favourite digital channel to stay connected with your outsourced bookkeeping team.

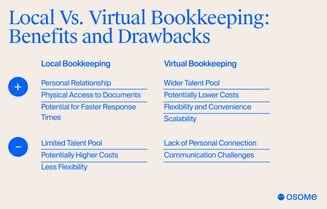

Benefits and drawbacks of local and virtual bookkeeping

Choosing between a local and virtual bookkeeper can feel like picking between a friendly neighbour and a worldwide network of experts. Here's the lowdown:

Local Bookkeeper: Like having a financial sidekick! They get to know you and your business, making communication a breeze. This is perfect if you love face-to-face meetings and handing over physical documents. However, finding the right local fit might be tricky, and their rates can vary depending on where you live. Plus, scheduling in-person meetings can add another thing to your to-do list.

Virtual Bookkeeper: Think global talent pool, potential cost savings, and ultimate flexibility! They can grow with your business, no matter where it goes. The downside? Building a trusting relationship and ensuring everything stays secure takes a bit more effort.

So, which one's right for you? It all comes down to what matters most. Tight budget? Virtual might be the way to go. Love that in-person touch? Local could be your best bet. And lastly, consider how complex your finances are. For intricate situations, a virtual team with a wider range of expertise might be a better fit.

Best Practices on How to Outsource Your Bookkeeping

Here are the steps to outsource your bookkeeping service effectively:

- Clearly define your expectations, objectives, and deliverables before engaging an outsourced bookkeeping firm.

- Establish communication protocols and align on key performance indicators (KPIs) to measure success.

- Assess the provider’s communication and ways to improve customer service for responsiveness and clarity.

Maintain open communication by regularly providing feedback, addressing concerns, and ensuring alignment with business goals. Monitor the performance of your outsourced bookkeeping team by reviewing financial information, reconciling financial accounts, and conducting periodic audits with financial advisors. Foster collaboration between your internal team and outsourced bookkeeping professionals by providing access to relevant information and resources.

How To Choose the Right Outsourced Bookkeeping Company?

When choosing between outsourced bookkeeping companies, consider providers with:

- Experience and a proven track record in your industry

- Relevant accreditations and certifications like CPA, ACCA, or CIMA

- Transparent pricing structures that fit within your budget

By considering these factors, you'll be well on your way to selecting an outsourced company that will keep your finances organised, help you easily navigate tax season, and allow you to focus on what you do best—running your business!

Finding the right outsourced bookkeeping company requires careful evaluation. Osome offers comprehensive accounting services that handle everything about bookkeeping and financial reporting and help streamline your finances. Contact us today and focus on growing your business!

Summary

Outsourcing bookkeeping offers small businesses numerous benefits, from cost savings and access to expertise to scalability and improved financial insights. By choosing the right provider and following best practices, businesses can ensure smooth and efficient financial management, allowing them to focus on business growth and success. Embrace the power of outsourcing and take your business to new heights.