Best Personal Accounting Software Solutions for 2026

- Modified: 25 December 2024

- 15 min read

- Grow Your Business

Gabi Bellairs-Lombard

Author

Gabi creates content that inspires. She's spent her career writing compelling website copy, and now she specialises in product marketing copy. As the voice of our products and features, Gabi makes complex business finance and accounting topics easy to understand. Her top priority is ensuring that her words impact and inspire her readers.

Looking for the best personal finance software to manage your finances in 2026? This guide covers top solutions with key features, benefits, and comparisons to help you choose the right one.

Key Takeaways

- Key features of the best personal finance software include seamless bank account integration, expense tracking, budgeting tools, bill payment reminders, investment tracking, and robust reporting and analysis tools.

- Cloud-based home accounting software offers real-time financial snapshots accessible from anywhere and enhanced collaboration, making them ideal for both personal finance enthusiasts and small businesses.

- Popular personal finance software options in 2026 include Osome, Quicken, You Need a Budget (YNAB), Rocket Money, Empower Personal Dashboard, CountAbout, PocketGuard, Fudget, Goodbudget, EveryDollar, Credit Karma, and Monarch Money, each catering to different financial management needs.

Benefits of Using Personal Accounting Software

Personal accounting software is a digital tool designed to help you track your income, expenses, and overall financial health. The benefits of personal finance software include:

- Time saved through online bill payments

- Enhanced financial literacy from user-friendly interfaces

- Automation of recurring payments to ensure no deadlines are missed

With the best personal finance apps, your financial information is always at your fingertips. These apps empower you with data and the confidence to make informed financial planning decisions while upholding the highest standards of data security in the cloud.

Many personal finance platforms also offer robust accounting features for small business owners. Some even integrate seamlessly with professional accounting services. This allows business owners to manage their finances efficiently, automate tasks, and gain access to expert advice all within one software.

Top 10 Personal Finance Software in 2026

As we delve into the best personal finance software of 2025, we find a diverse array of solutions catering to different aspects of financial management. From the sophisticated needs of money management to simple budgeting, here are our top choices of personal finance apps to experiment with:

1 Quicken

Quicken stands tall as a pillar of personal finance software, offering a suite of tools for both personal and business finances. Its ability to split receipts across categories is a boon for those juggling personal and business expenses. With four distinct subscription packages, Quicken caters to a range of needs and budgets.

Specifications

A long-standing leader in personal finance, offering a desktop version and a mobile app. Features include robust budgeting tools with customisable categories, bill pay functionality, comprehensive investment management tools for stocks, bonds, and retirement accounts, and detailed reporting to analyse spending habits and financial progress.

Advantages

A well-rounded suite of features catered to various financial needs while keeping all the transactions in one place. The investment management capabilities make it ideal for those actively managing portfolios.

Disadvantages

Requires a monthly fee, which can be a barrier for some users. The extensive feature set can have a steeper learning curve compared to simpler apps.

2 Osome

With our winning combination of expert accountants, all-in-one accounting services, and easy-to-use tools, Osome’s personal accounting software is well-suited to freelancers or small businesses. Our personal finance app offers robust accounting features for managing all your financial accounts in one place.

Specifications

The perfect personal finance app is geared towards freelancers or small business owners with features like double-entry accounting, income and expense tracking with detailed categorisation, business finance tools for invoicing, managing client payments, and preparing tax reports with additional integrations with other business accounting platforms.

Advantages

Osome could provide robust accounting functionalities for in-depth expense tracking and management, which is particularly beneficial for self-employed individuals. If you’re looking for a personal accounting software that integrates with your business, Osome offers plans to suit your business needs with packages aligned with your monthly revenue.

Disadvantages

While you can use Osome's services for your personal accounting needs in general, it works best for entrepreneurs, freelancers and business owners looking to streamline their financial accounting tasks.

At Osome, we understand that managing personal finances can be challenging. Our tailored personal accounting services are designed to help you stay on top of your financial game. Whether you're looking to optimise your tax returns, manage your investments, or simply get a clear picture of your financial health, our team of experts is here to provide personalised support and advice. Feel free to contact us today!

3 You Need a Budget (YNAB)

You Need a Budget (YNAB) allows users to connect bank accounts securely to manage finances across devices, even when they're offline. With YNAB, budgeting becomes a shared experience for families and groups under one subscription.

Beyond daily budgeting, YNAB offers the following features: a loan calculator tool, detailed reports for personal and home finances, goal-setting features to prioritise spending and savings, easy progress tracking, and rigorous data security measures for peace of mind.

Specifications

YNAB is popularised for its unique budgeting methodology. YNAB focuses on assigning every dollar of your income towards specific spending goals in the future. This approach encourages proactive budgeting and helps prevent debt accumulation. Users can create spending categories, track progress towards goals, and manage overspending.

Advantages

YNAB is excellent for people who want to control their spending and avoid debt. The future-based allocation system promotes mindful spending. With an Android app and iPhone app, YNAB allows you to control your finances on the go.

Disadvantages

YNAB requires a subscription fee. YNAB's budgeting approach might differ from traditional methods and may not suit everyone's preferences.

4 Rocket Money

Rocket Money is great for tracking your bills and spotting unused subscriptions. It positions itself as a versatile choice for managing your money matters and comes with a basic free version and a paid version with premium features.

Specifications

Offers a free version and paid subscription plans and focuses on budgeting tools. The mobile app allows users to categorise transactions, track spending, and set budgets. Paid plans include concierge services like bill negotiation to reduce recurring expenses.

Advantages

The free version provides standard budgeting functionalities. Upgraded plans offer valuable features like bill negotiation assistance, which can help you save money on monthly bills.

Disadvantages

Limited investment management capabilities. Budgeting features are primarily available on the mobile app, which might be inconvenient for some users.

5 Empower Personal Dashboard

Empower Personal Dashboard, formerly known as Personal Capital, is a beacon for those seeking a no-cost investment-tracking app with a suite of retirement-planning tools. Connectivity with a vast network of financial institutions means your data is always current and comprehensive. Empower offers in-depth wealth management tools, including detailed net worth tracking and scenario planning. With the ability to track debts and a wide range of investments, Empower is a formidable contender in the personal finance software arena.

Specifications

Empower Personal Dashboard emphasises a comprehensive view of your financial well-being. Also, it connects to your bank accounts, investment accounts, and other financial institutions to provide a holistic overview of your net worth. Moreover, it offers powerful investment analysis tools to help you track portfolio performance and make informed investment decisions.

Advantages

Empower Personal Dashboard is excellent for those who want a one-stop shop for managing their entire financial picture. Investment analysis tools are valuable for active investors.

Disadvantages

Subscription fee applies. The extensive features and data analysis might be overwhelming for users who only need basic tools for daily financial transactions.

6 CountAbout

CountAbout enters the fray with a focus on automatic transaction download and categorisation, streamlining the process of keeping tabs on your personal finance.

Specifications

A lesser-known option is offering a mix of budgeting, bill tracking, and some investment tracking functionalities. It might cater to users who want a balance between features and potentially a lower cost (although pricing information might be limited).

Advantages

CountAbout could be a good option for those seeking a platform that combines budgeting, bill tracking, and basic investment management.

Disadvantages

Limited information available online makes it difficult to assess user-friendliness and specific features compared to more established options.

7 PocketGuard

PocketGuard stands as a vigilant guardian of your budget, connecting to your financial accounts and ensuring you remain within your financial limits.

Specifications

PocketGuard is designed specifically for mobile devices. PocketGuard focuses on providing real-time spending insights and bill tracking. The app categorises transactions, identifies upcoming bills, and sends alerts to help users stay on top of their finances.

Advantages

PocketGuard is useful for users who want a convenient way to track spending and manage bills on their smartphones. Real-time insights help users stay aware of their financial situation.

Disadvantages

Limited budgeting features beyond basic expense tracking. It may not be suitable for long-term planning or complex financial needs.

8 Goodbudget

Goodbudget adopts a time-tested envelope budgeting system, offering a tactile and visual approach to allocating funds across various spending categories. This aids users in their quest to manage their financial goals with precision.

Specifications

This app utilises the envelope budgeting method, a traditional budgeting approach that allocates specific amounts of money (like putting cash in envelopes) towards designated spending categories (e.g., groceries, entertainment, rent). Goodbudget uses a visual interface with virtual envelopes to represent each category. Users can easily move funds between envelopes and track remaining balances for each category.

Advantages

Goodbudget appeals to those who prefer a visual representation of their budget. The simplicity of the envelope system makes it easy to understand and manage spending within each category. It can be helpful for individuals who struggle with traditional budgeting methods.

Disadvantages

Limited features compared to more comprehensive software. Lacks functionalities like bill pay, portfolio management, and detailed financial reporting. It may not be suitable for complex financial needs or those who prefer a more automated budgeting approach.

9 EveryDollar

EveryDollar, by Ramsey Solutions, champions zero-based budgeting. It ensures that every dollar is assigned a purpose in the budget, fostering a proactive stance on money management.

Specifications

Offered for free by Ramsey Solutions, EveryDollar specifically promotes zero-based budgeting, a method where all income is allocated towards specific expenses each month. This ensures every dollar has a purpose and helps users avoid overspending. EveryDollar provides tools to categorise income and expenses, set spending goals, and track progress towards a zero balance at the end of the month.

Advantages

Focused on debt payoff and creating a budget that eliminates unnecessary spending. It is free to use, making it accessible to everyone. Tailored for those familiar with Dave Ramsey's financial philosophies and zero-based budgeting principles.

Disadvantages

Mainly only offers basic budgeting functionalities. No bill pay, investment tracking, or comprehensive reporting tools. The zero-based budgeting approach may not work for everyone.

10 Credit Karma

Credit Karma excels at credit monitoring, fetching scores from all three major credit bureaus and offering identity theft protection, all while helping you keep your credit in check.

Specifications

Credit Karma is primarily known for providing free credit score monitoring and access to credit reports. As an additional feature, it offers some simple budgeting tools. Users can link their bank accounts to track income and expenses, categorise transactions, and set basic spending goals.

Advantages

Free credit score monitoring is a valuable tool for understanding your credit health. The budgeting functionalities can be helpful for simple expense tracking and creating rudimentary spending plans.

Disadvantages

Limited budgeting features compared to dedicated personal finance software. Lacks functionalities like bill pay, investment tracking, and in-depth financial analysis. Not a comprehensive personal finance solution for managing all aspects of your finances.

How To Choose the Right Personal Accounting Software?

Choosing the right home accounting software is akin to finding a trusted financial advisor. Here are some steps to help you make the right choice:

- Begin by crystallising your financial goals.

- Consider the cost implications of the software you’re eyeing.

- Assess the features carefully.

- If you focus on budgeting, look for apps that excel in this area.

Remember, the best personal finance app is the one that resonates with your financial life and decisions.

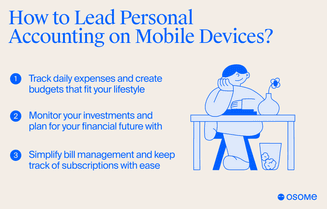

How To Manage Personal Finances on Mobile Devices?

Personal finance software has kept pace with the rise of online banking, offering robust mobile apps that bring financial management to your fingertips. These tools allow you to check account balances, view and add transactions, and receive critical credit score updates on the go.

Let’s delve into how these apps can revolutionise your approach to personal finance.

Tracking expenses and creating budgets

The cornerstone of financial stability is tracking expenses and creating budgets. Personal finance apps excel at providing a panoramic view of your spending, categorising every penny, and guiding you to make informed decisions. Real-time alerts keep you in the loop, ensuring you’re always aware of your financial standing and can adjust your spending accordingly.

With AI assistance and detailed tracking tools, you’re not just managing your finances but mastering them.

Investment tracking and financial planning

Navigating the investment landscape requires a keen eye and reliable tools. Investment-tracking apps provide a comprehensive look at your investment portfolio, arming you with the data needed to make financial decisions. Whether you’re a novice or a seasoned investor, these apps offer the advanced management tools necessary to track and analyse your investments.

Bill management and subscription tracking

Keeping tabs on bills and subscriptions is a breeze with finance apps. Some key features of these apps include:

- Bill reminders and notifications to ensure you never miss a payment

- Subscription tracking to uncover opportunities to save more money each month

- Apps like Rocket Money offer to negotiate bills and cancel unwanted subscriptions, relieving your monthly payment burdens.

With these apps, you can easily stay on top of your finances and save money.

Cloud-Based Personal Accounting Solutions

Cloud-based personal accounting solutions often come with the ability to automate accounting processes and integrate bank accounts, providing a real-time financial snapshot accessible from anywhere at any time.

Imagine collaborating with team members or consulting a financial advisor without geographical barriers. The seamless integration of financial information and other financial data makes cloud-based services ideal for small businesses and personal finance enthusiasts who value flexibility and security.

What Are the Security Measures in Personal Accounting Software?

Home accounting software providers deploy various security measures, such as advanced encryption and two-factor authentication, to protect your financial data. Backup and recovery features act as a safety net, ensuring that your data is retrievable in case of any mishaps.

Moreover, the accounting software for small businesses also emphasises security, ensuring that even small enterprises benefit from these robust protections. Adherence to data protection regulations like GDPR instils confidence that your personal and financial information is handled with the utmost care.

Free vs. Paid Personal Accounting Software

The debate between free and paid home accounting software is one of value versus investment. Free apps like NerdWallet and Credit Karma offer essential services without advanced features, while paid options like YNAB and Rocket Money serve as a more comprehensive personal accounting tool. In the end, it’s about finding the right balance of features and affordability that suits your financial needs.

Can Personal Accounting Software Improve Your Credit Score?

Some home accounting software offers a comprehensive credit report with actionable insights to enhance your score and also alerts you when your score changes. Some popular credit monitoring apps include:

- Credit Karma

- Experian

- TransUnion

- Equifax

Using these apps can help you stay on top of your credit and make informed decisions to improve your financial well-being.

Summary

Personal accounting software allows you to get a clear picture of your financial situation easily. From understanding the key features and benefits to selecting the perfect cloud-based solution, this guide has charted a course through the best personal finance software of 2026.

With these free and paid tools, you can manage your finances on a mobile device without concerns about data reaching. Are you ready to take your first steps toward better financial well-being?