- Osome UK

- Ecommerce Accounting

Ecommerce accountants for effortless growth

Move on from traditional accounting. From returns to discounts, gift cards and global VAT needs, we know ecommerce.

Tailored financial management for online sellers

Accountants that know ecommerce

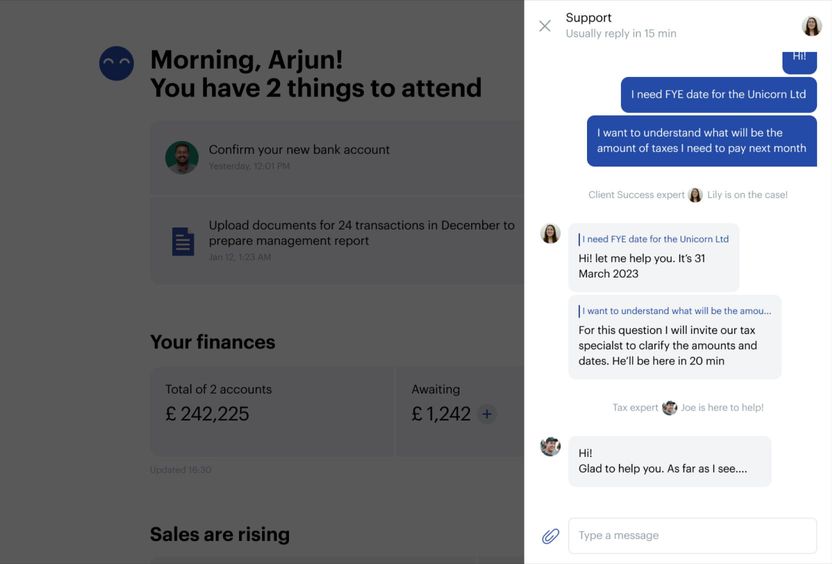

We handle processing sales platform fees, discounts, refunds and gift cards. Chat with your local accountant through our app, and they'll reply within one day.

Directly integrate sales platforms

Say goodbye to platform hopping. We process platform fees, discounts, returns, and gift cards with Amazon, Shopify and eBay connections. Plus, we process payments from PayPal, Stripe and Square.

Effortless VAT compliance

We handle VAT calculation and filing for UK businesses, making it easier for you to sell while staying compliant.

Full control and transparency of your sales

All in one place

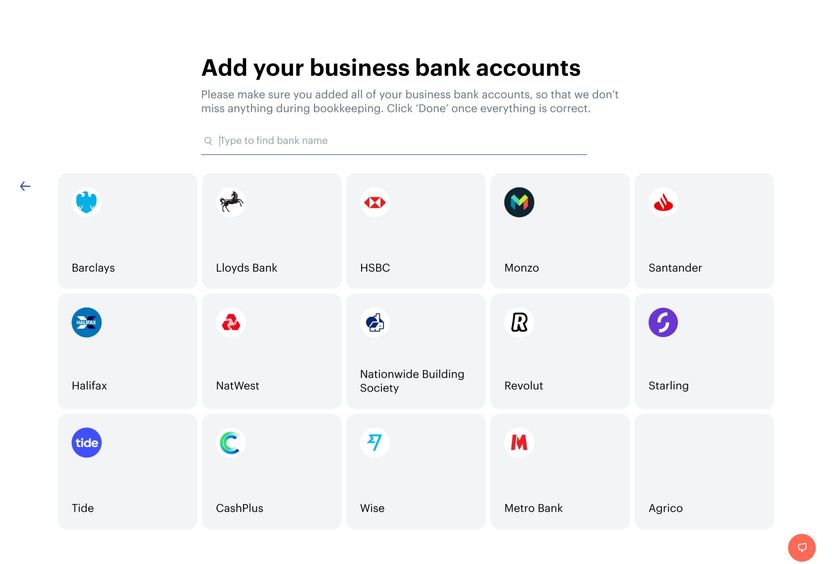

Choose which sales platforms, payment gateways and banks you want to work with.

Experts on the ground

Expand your business into new markets. Get VAT automatically calculated and returns filed for the country you sell in.

Absolute clarity

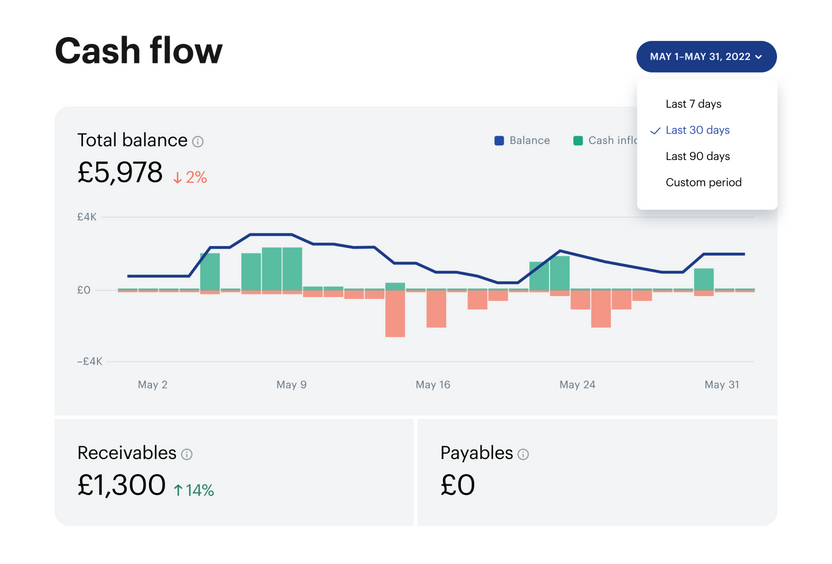

Know exactly what makes you profit. Get complete run-downs for each SKU, market and specific country tax rates.

Easy-to-use tools to handle all your business operations

Restock what sells

Know the best performing SKUs so you can order them before they run out.

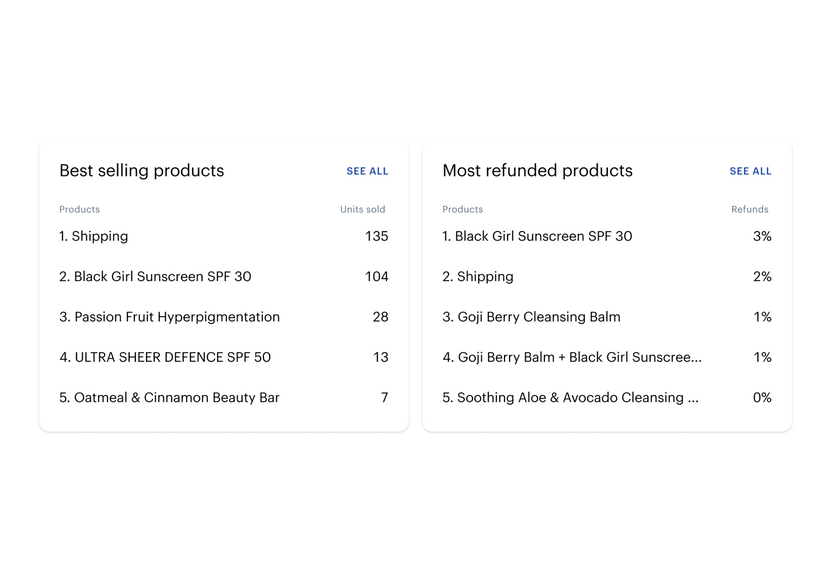

Get clear on your cash flow

See your balance aggregated from all connected ecommerce platforms and bank accounts.

Real-time data

We connect your bank accounts via open banking and exchange data instantly to power your decision making.

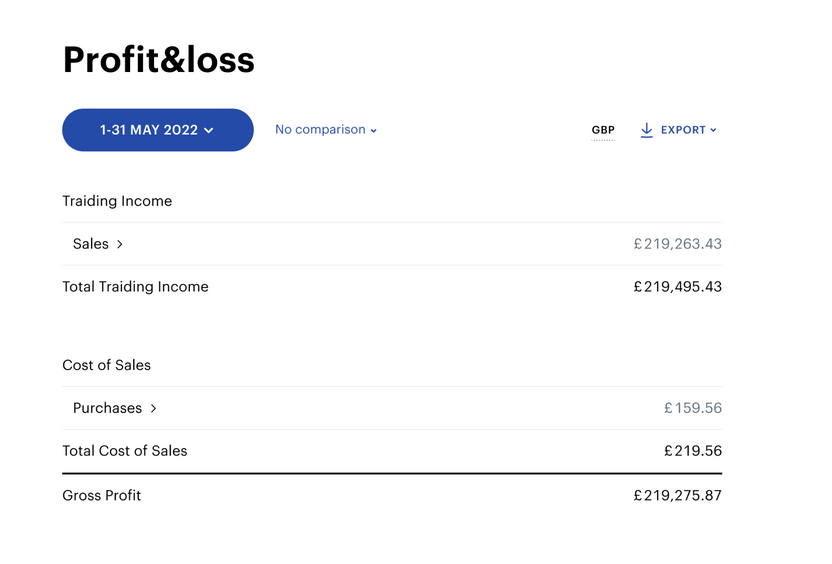

From bookkeeping to filing tax

We process your documents within 24 hours. You get a snapshot of your financials at any given moment. When it's time to file, we have reports at the ready and reach out to you to sign and approve.

Your accountant is always there

Talk to your accountant via live chat, ask questions and get answers within 24 hours.

For new and experienced digital entrepreneurs

Dropshippers

Make the most of your margins and get seamless returns support. All with the help of our experts.

Your own brand

Whether you’re set up in your garage or opening up your first office. Our services scale as and when you need them.

White-label sellers

Focus on growing your products and revenue sources. We’ll handle the taxes, filing and financial back end.

Plans to fit your business

Our packages are tailored to your business stage and annual revenue. When you reach £ 350,000 in revenue, we'll upgrade your account to our Scale package. As your business grows, you can customise your package with add-ons to meet your needs.

Operate

For business owners who want to ensure they tick all basic compliance boxes as they grow

from

£ 850 + VAT billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Payroll

Company admin

Historical work

Grow

For businesses nearing VAT registration, seeking up-to-date analytics and consultations

from

£ 1,640 + VAT billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Payroll

Company admin

Historical work

Scale

For entrepreneurs earning £ 350k+ annually, managing multiple roles and seeking to simplify financial tasks

from

£ 2,690 + VAT billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Payroll

Company admin

Historical work

What our clients think about Osome

92 %of customers recommend us

“Osome just made everything easier.”

“From the user-friendly interface to the exceptional customer support, Osome has made me a genuinely happy customer.”

Carl Maxwerth

FAQ

What is ecommerce accounting?

The definition of ecommerce accounting is reporting about your ecommerce business financials to the government. As an online vendor, you move products in and out, manage stock, and sell to customers in different countries via different channels. So, there are several things your ecommerce accounting includes:

- Bookkeeping, which lists every transaction. For example, when you accept products to your storage, or sell on Amazon, or have to accept back a pair of shoes on ebay. Bookkeeping keeps track of every money or asset movement, and provides a document covering every such event.

- Management reports, which gather all the sales data and try to make sense of it. For example, how much of each product you sold, what are the costs of operating every channel, and where do you actually make money.

- Tax filing & statutory reports. These depend on where you sell, for each government has a different tax system. Tax reports constitute a very detailed recount of every transaction and the categories they fall under. Depending on the categories, different types of tax are derived. An experienced accountant can also help make sure you get the benefits and exemptions available to your business under each specific tax code.

How do I start an ecommerce business account?

When organising accounting for ecommerce sales you need to make sure that you have all your needs covered.

- All your channels. Do you sell via different platforms? You need a way to consolidate reports from various sources.

- All your tax jurisdictions. Do you sell in more than one country? You need to report for VAT everywhere you make money.

- No manual paperwork. Processing invoices and receipts is tiresome, and you probably have better ways to spend your time than that.

How do I record online sales on Amazon?

For optimum tracking of your Amazon online sales, we recommend linking it directly with accounting software. We seamlessly integrate this feed into your Osome dashboard, which refreshes every 24 hours, enabling real-time monitoring. Subsequently, whenever Amazon sends you a statement, it gets automatically uploaded to your account. We then process it, categorising and tagging the details, ultimately providing you with current financial data daily.

Which accounting software and bookkeeping software do you use?

We've developed proprietary software that you can access from your desktop or a mobile app. This software provides daily updates of your balance from all linked bank accounts, your pending invoices, and lists documents that need to be uploaded. Additionally, we provide swift responses to queries via chat, keep track of important deadlines, and reconcile daily transactions.

Can I transition from another accounting firm to Osome?

Of course! Switching to Osome from another accounting firm is a breeze, with little effort needed from you. We'll directly liaise with your existing accounting service provider, assume responsibility for all your financial records, and thoroughly review them to ensure your company's compliance. We check for unresolved issues with HMRC, arrange historical data, and compile and submit the necessary reports. Additionally, we provide continuous guidance on significant tax exemptions, assisting you in making the best tax decisions. With your accounting in our hands, you can now devote your full attention to what truly matters: managing your business.

What if my annual revenue exceeds £350,000?

If your annual turnover exceeds the £ 350,000 threshold at the end of the financial year, we'll send you an invoice for the difference. However, you can avoid unexpected costs by notifying us earlier — for instance, midway through your financial year — and we'll upgrade you to the Scale package.

Fresh insights from our business blog

Tax Year Dates: Complete Guide to UK Tax Deadlines 2025-2026

Understanding important tax year dates is essential for every business owner, self-employed individual, and company director in the UK. Missing key tax dates can lead to substantial penalties, interests, and unnecessary stress, all of which can be avoided with proper planning. Whether you’re filing a self assessment tax return, managing corporation tax obligations, or handling VAT requirements, knowing your tax deadlines throughout the financial year is crucial for staying compliant with HM Revenue and Customs.

How to Start a Recruitment Agency: A Step-by-Step Guide for Success

Wondering how to start a recruitment agency? This comprehensive guide will walk you through everything you need to know about recruitment businesses. Let’s get started on turning your recruiting business idea into a successful reality.

Join The Hustle: The Most Popular Businesses Ideas For 2025

We asked 2000 entrepreneurs what side hustle business they want to set up. We share the results of our survey as well as advice on how to get ahead on the latest trends.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?