Ultimate Guide To Change a Company Name in the UK

- Modified: 14 April 2025

- 7 min read

- Running a Business

Heather Cameron

Author

Heather believes in the power of great storytelling and is here to craft compelling copy that informs and inspires readers. With an extensive background in digital marketing, she has experience writing for various industries, from finance to travel. As Osome’s copywriter, Heather creates content that empowers entrepreneurs and small business owners to boost their business with expert guidance, helpful accounting tips and insights into the latest fintech trends.

Yinghua Luo

Reviewer

Yin Luo is our Operations Manager based in the UK. She keeps our UK team running like a well-oiled machine and ensures our content resonates with our British audience. Before moving to operations, Yin had over 10 years of accounting experience and is an ACCA-qualified accountant. In her current role, she is our go-to expert for making complex topics easy to understand. Yin carefully reviews our UK-focused articles, ensuring they are accurate, relevant, and packed with actionable advice to help your business thrive on this side of the pond.

Looking to change a company name? This guide covers everything you need to know, from choosing a new name to completing legal paperwork and updating your documents. Follow these steps to ensure a smooth transition.

Key Takeaways

- Choosing a new company name requires careful consideration of legal compliance, audience feedback, and trademark availability to avoid potential issues.

- The name change process involves securing shareholder approval, completing necessary governmental forms, and ensuring that all legal documentation is updated accordingly.

- After approval, it is vital to promptly update all business documents and communicate the change to stakeholders to maintain professionalism and clarity.

Choosing a New Company Name

Selecting a new company name is the initial and perhaps most crucial step in the process. This proposed company name will represent your brand to the world, and it must comply with specific regulations set by Companies House. Verify that your chosen name does not duplicate any existing names on the Companies Register to avoid legal issues and customer confusion.

Steer clear of sensitive words or phrases that might mislead the public or suggest government affiliation without proper approval. Gathering feedback from your target audience on potential trading names or other variations can also be beneficial to avoid confusion with the old name. This ensures that the new company name resonates with a positive association and avoids any negative associations.

Choosing the perfect name is just the start. Our company registration services ensure that every step – from paperwork to compliance checks – is handled smoothly and efficiently. With our expert guidance, you can register your business quickly and confidently, allowing you to focus on building your brand.

Conduct a thorough trademark search to ensure the new name is eligible for protection and doesn’t infringe on existing trademarks. Also, choose a name that is easy to spell and pronounce to prevent customer confusion. These steps will help you choose a name that is both legally compliant and appealing to your audience.

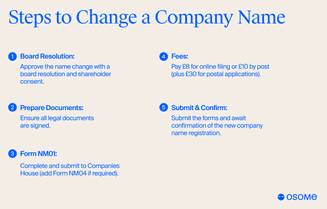

Steps To Change a Company Name

Once you have chosen a suitable new name, the next step involves formalising the change. Start with a board resolution and secure shareholder approval, ensuring all documents are correctly signed and legally binding.

Complete Form NM01 and submit it to Companies House with the following information about the change of company name to ensure proper filing. Depending on your company’s articles of association, Form NM04 may also be necessary. The filing fee for Form NM01 is £20 if done online or £83 to be completed the same day.

Once the application is finalised, submit it to Companies House for processing. This officially registers the new company name and completes the company name change process. By following these steps, you ensure that your name change is legally valid and recognised.

Legal Requirements for Changing a Company Name

Several legal requirements must be met to change the company name. At least 75% of the shareholders must pass a special resolution, usually during a board meeting or general meeting or through a written resolution, to legally approve the change the company name process. All members must be notified at least 14 days in advance.

If altering the company name according to the company’s articles of association, making sure to complete Form NM04 is necessary. The new name becomes valid with an effective date only after it is registered with Companies House as part of the limited company formation process. This ensures that all legal documentation, including the special resolution, reflects the updated name.

To officially register the change of company name, submit a copy of the special resolution, including the company number, along with Form NM01 to Companies House. Changing the company name does not alter the company’s rights or liabilities, ensuring that it remains the same limited company under its legal obligations.

Online Filing Process

Modern technology has streamlined the process of changing a company name, with Companies House allowing for electronic registration to speed up and simplify the process. Most applications filed online are approved within 48 hours, and Companies House will issue a company name change certificate, which can be downloaded for convenience.

The Companies House online service speeds up the process and reduces complexity. The filing fee for an online name change is £20, more economical than postal submissions. For those in a hurry, same-day service is available for £83, allowing for even faster processing.

The online filing process involves completing and submitting forms electronically, simplifying the procedure and ensuring quick processing. A digital version of the certificate can be easily downloaded if the original is lost.

Obtaining a Certificate of Incorporation on Change of Name

Upon approval of your name change, Companies House will issue a Certificate of Incorporation on Change of Name for your private limited company name, confirming the change certificate and its effective date. Keep this document along with the special resolution and company number at your registered office address or SAIL address for inspection purposes.

The certificate serves as proof that the same company is officially registered under the new name. It is often required for various transactions, such as updating bank accounts and finance agreements.

It’s important to note that the new certificate does not replace the original Certificate of Incorporation; it simply confirms the change.

You can start using the new name as soon as Companies House approves it, typically within 48 hours. Companies House will also notify you by email if you file online. This swift process allows you to continue operations with minimal disruption.

Updating Business Documents and Communications

After your new company name is official, update all business documents and communications, including your website, marketing materials, and company stationery, within 14 days.

Inform all relevant parties about the change, including customers, suppliers, banks, insurers, and government bodies such as HMRC. Use the Certificate of Incorporation to update business bank accounts and finance agreements, ensuring all legal documents reflect the new name.

Ensure the new registered name is updated across all platforms and document details to maintain professionalism and avoid confusion among other business contacts.

Launching Your New Company Name

Launching your new company name is an opportunity to rebrand and refresh your company’s image. Securing a new domain name for your website, especially a .com domain name, enhances your business’s professionalism.

Consistency in branding across all platforms is essential. Utilise social media to establish your new presence and ensure your new registered name is visible across all channels, solidifying your new identity in the market and reducing association with your old name.

Same-Day Service Options

The Companies House fee for a standard company name change is £20 when done online or through software, and £30 for paper applications. The same-day fee for urgent name changes is £83, regardless of submission method.

Post-Name Change Compliance

After changing your company name, continue to comply with regulations. Inform Companies House of any changes to your registered office address, which must stay within the same part of the UK. Report any changes to the company’s directors or their personal information within 14 days.

Any new shares issued must be reported to Companies House within one month. Keeping up with these compliance requirements ensures your limited company remains in good standing and avoids legal issues related to the company name change.

Summary

In summary, changing your company name involves several key steps, from choosing a compliant new registered name to passing a special resolution to ensuring post-change compliance. By following this guide, you can navigate the process efficiently and effectively, ensuring minimal disruption to your operations.

Take action now to implement these steps and rebrand your limited company with confidence. Changing your company name can be needed for many reasons, but ensuring compliance throughout the process is key to a smooth and rewarding experience.

At Osome, we handle the entire company registration process, from name selection to regulatory filings, ensuring compliance every step of the way. Let our experts manage the details so you can focus on your business growth and get started with your new brand quickly and confidently.

FAQ

How long does it take to change a company name?

Changing a company name typically takes 48 hours for online applications, with a same-day option available for urgent cases. Timely processing depends on the method chosen for filing and the articles submitted.

What forms are needed to change a company name?

To change the company name, you need to pass a special resolution, complete Form NM01 and, if necessary due to your company's articles of association, you may need to fill in Form NM04.

What is the cost of changing a company name?

Changing a company name costs £20 for online filings and £30 for postal submissions, with a same-day service fee of £83. It is important to consider these costs when planning your company's rebranding.

What happens after the name change is approved

After the company name change is approved, Companies House will issue a Certificate of Incorporation on Change of Name, which confirms the new name and its effective date. You may also want to secure your new domain name for your website.

How should I inform my business contacts about the name change?

You should promptly inform all relevant parties, such as customers, directors, shareholders, signatories of the special resolution, suppliers, and any bank or government bodies, of the name change. Ensure that all forms and communications are updated and complete within 14 days to maintain clarity and professionalism.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?