- Osome UK

- Accounting

Your finances sorted with all-in-one accounting services

Free yourself from financial admin. Our dedicated experts and easy-to-use tools make managing your money easier.

Total visibility and control over your finances

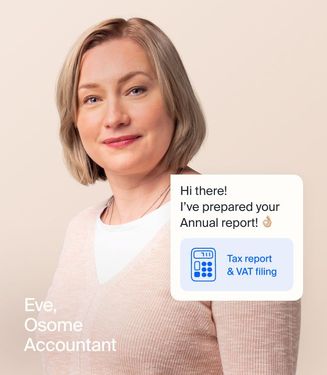

Dedicated accountant

Your dedicated accountant is on-call through live chat and responds within 24 hours.

Easy-to-use software

Our financial tools give you control, automating invoicing, payments, and expenses with real-time cash flow insight.

Unlimited bookkeeping

Bookkeeping is part of your package. We'll take care of your financial records, taxes, transaction matching, and billing.

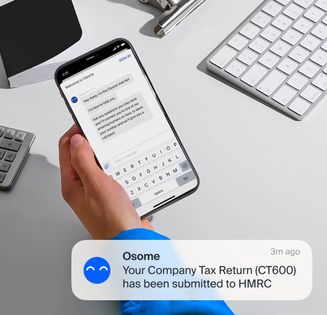

Filing and compliance

Leave the tax, deadlines, and filing with HMRC to us. We’ll make sure you pay the right tax and stay compliant.

For new founders and seasoned entrepreneurs

Solo founders

You don't have to do it alone. We help you register quickly and make sure you’re fully operational and compliant.

Small businesses

Start small and grow with confidence. We give you the experts and tools to track your cash flow, manage your finances, and pay the right tax.

Ecommerce

Forget generic accounting solutions. Our accountants know ecommerce and our software supports Amazon, Shopify, and eBay integrations.

Feel fully in control of your business finances

Experts on your side

Get a personal accountant for your business from day one. Our UK-based team helps founders get their taxes right from the start. Any questions? Get a response through live chat within 24 hours.

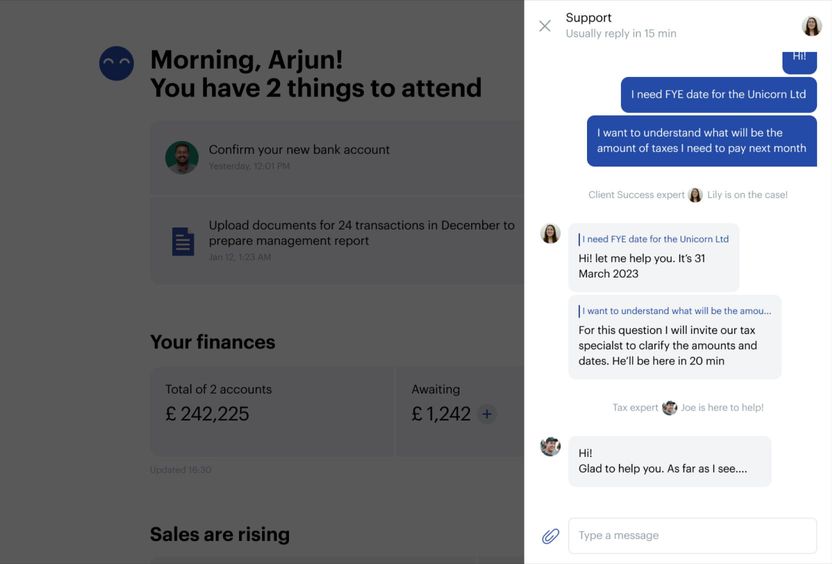

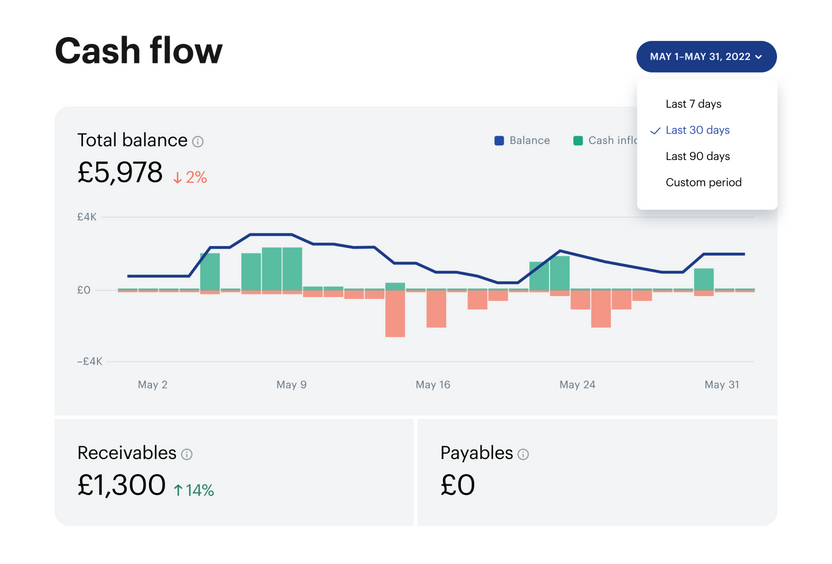

Get clear on cash flow

With our real-time dashboard, your cash flow info is at your fingertips. Quickly see the money you have, what you owe, and how much you’re owed.

Pay the right tax

We help you stay on top of your finances. We keep track of deadlines and remind you about VAT and other compliance needs. Plus, our experts handle tax returns and filing, so you’re free to focus on your business.

Bookkeeping?

Easy-to-use tools to handle all your business operations

Your accountant is always there

Talk to your accountant via live chat, ask questions and get answers within 24 hours.

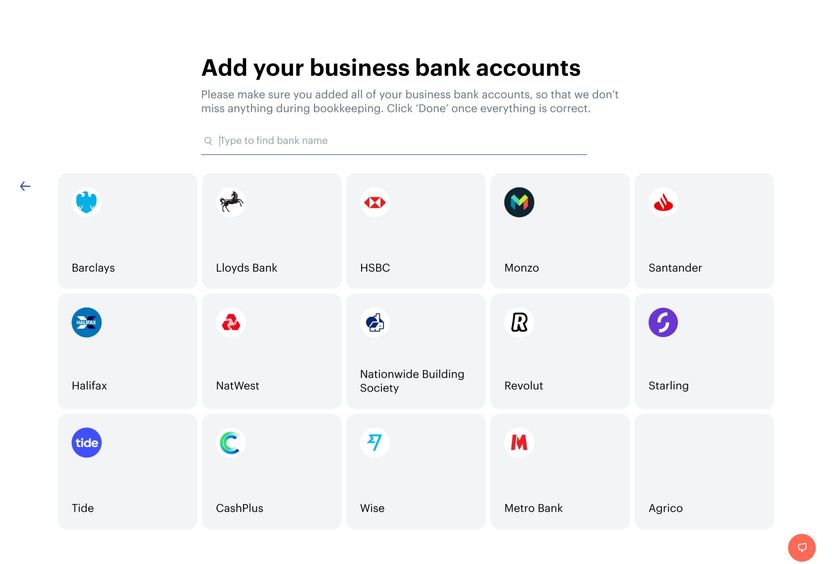

Real-time data

We connect your bank accounts via open banking and exchange data instantly to power your decision making.

Get clear on your cash flow

See a combined view of all your connected business bank accounts.

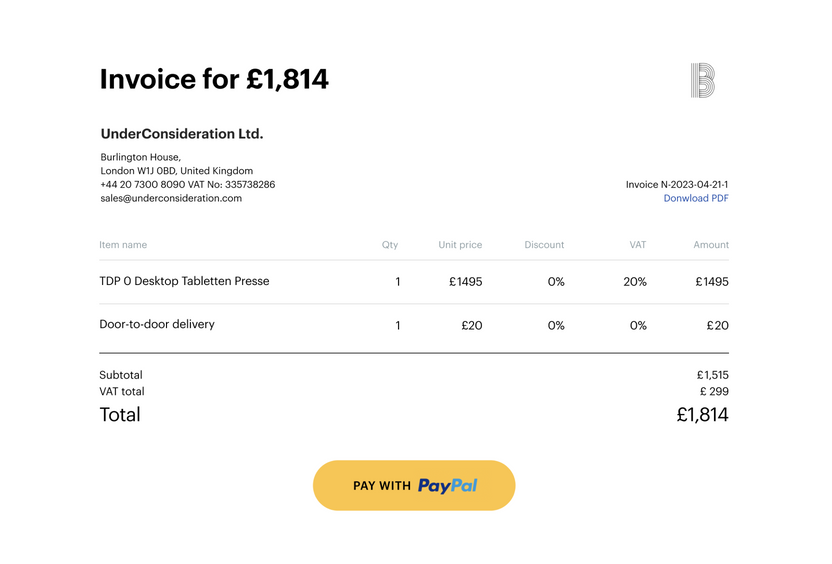

Get your invoices paid quicker

Issue invoices, nudge late payers and help your clients pay faster with embedded PayPal links.

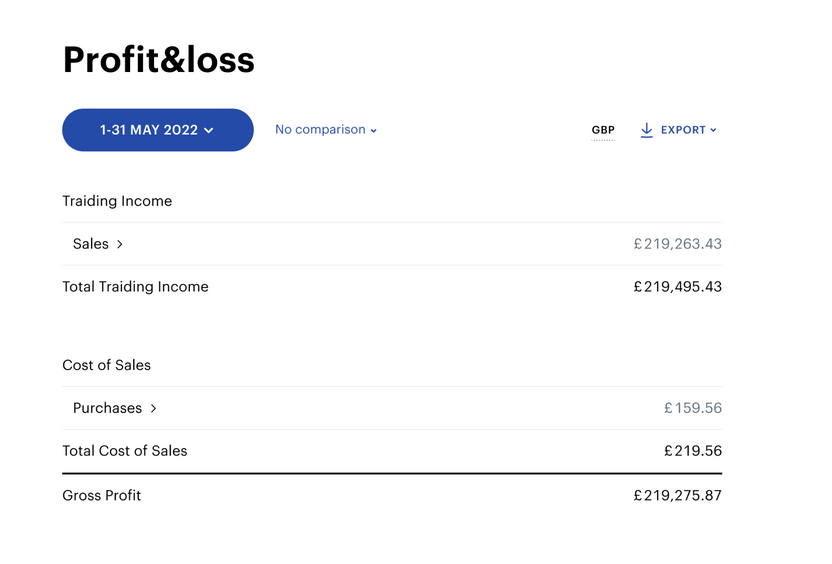

From bookkeeping to filing tax

We process documents within 24 hours, giving you a real-time snapshot of your financials. Come filing time, we'll sort the reports; you just need to click approve.

Plans to fit your business

Our packages are tailored to your business stage and annual revenue. When you reach £350,000 in revenue, we'll upgrade your account to our Scale package. As your business grows, you can customise your package with add-ons to meet your needs.

Operate

For business owners who want to ensure they tick all basic compliance boxes as they grow

from

£ 850 billed annually, per financial year + VAT

Financial software

Bookkeeping

Expert service

Tax and filings

Payroll

Company admin

Historical work

Grow

For businesses nearing VAT registration, seeking up-to-date analytics and consultations

from

£ 1,640 billed annually, per financial year + VAT

Financial software

Bookkeeping

Expert service

Tax and filings

Payroll

Company admin

Historical work

Scale

For entrepreneurs earning £350k+ annually, managing multiple roles and seeking to simplify financial tasks

from

£ 2,690 billed annually, per financial year + VAT

Financial software

Bookkeeping

Expert service

Tax and filings

Payroll

Company admin

Historical work

What our clients think about Osome

“Osome just made everything easier.”

91 %of customers recommend Osome services

“They’ve been a great help with accounts and VAT returns, answering any questions and helping me stay on top of things.”

Sarwech Shar

FAQ

Which accounting software do you use?

We have developed our software available on both desktop and mobile. It shows your daily balance, outstanding invoices, and documents you need to upload. We quickly answer questions in the chat, track deadlines, and reconcile daily transactions for you.

How does accounting software improve productivity?

With Osome, you don't need to sort through papers, figure out VAT or worry about filing deadlines. We recognise invoices and receipts, tag them, and ensure they fall into the correct tax category. Because it’s automated, we do it fast — you see updated data every 24 hours.

Will my accounting tasks be automated?

We've automated accounting and bookkeeping tasks like tagging invoices, reconciling transactions, and filing out reports. Our accountants double-check numbers, answer questions, and optimise taxes for you.

What are your accounting services?

We are here to help small businesses in the UK with accounting services. We prepare management reports, file Corporate Tax returns and handle daily bookkeeping. We can also advise on tax reliefs and incentives:

- EIS Tax relief

- SEIS Tax relief

- Entrepreneurs’ Relief

- R&D Tax Credit

- EMI Share options

- Patent Box

If your case is unique, let us know, and our specialists will help advise for your company's needs.

Can I switch from another accounting firm to Osome?

Absolutely. We make the transition seamless on your end. We’ll get in touch directly with your current accounting service provider, take over all your financial documents, and audit them to make sure your company is compliant. We check for any loose ends with HMRC, organise historical data, and then prepare and file necessary reports. We offer up ongoing advice about relevant tax exemptions, helping you be smarter with your taxes. Now that your accounting is in good hands, you can focus on what you do best: running your business.

What are Advisory Services in accounting?

Accounting Advisory services include a dedicated team that will provide you advice on accounting and financial reporting transactions or events. These include checks on how your company is adhering to current or revised accounting standards, through to how effective your company is currently managing the financial reporting process in terms of timeliness and accuracy.

When you look for an accounting advisory service, you can get help to improve your business operations, enhance your financial reporting and implement new systems to improve how you make business decisions so that you increase your profits and cash flow, and avoid any pitfalls.

What is a Business Services Accountant?

A Business Service Accountant can build a partnership with your business and offer you advice on financial accounts. From a financial perspective, they can inspect where you can make changes to improve results, increase efficiency, and grow your business.

Their responsibilities include, but are not limited to:

- Producing financial statements, including balance sheets, profit and loss statements, etc.

- Preparing business activity statements

- Preparing and filing tax returns before the deadline

What if my annual revenue exceeds £350,000?

If your annual turnover exceeds the £350,000 threshold at the end of the financial year, we'll send you an invoice for the difference. However, you can avoid unexpected costs by notifying us earlier — for instance, midway through your financial year — and we'll upgrade you to the Scale package.

Why outsource accounting services?

As entrepreneurs, we know that you want to focus on your product, people, and clients when building a company. That’s why we handle the paperwork, ensure your reports are accurate and on time, and free you up to spend time on the things that matter.

Is accounting with Osome for me?

We've built Osome for entrepreneurs. So if you have a company, Osome is right for you. We work with startups and large companies in the UK. We also manage a variety of industries, from ecommerce to the restaurant business and farming.

How much do small business accountants cost?

An accountant typically charges between £80 and £150 per hour. Their rate factors in the type of transactions, the company size and the accountant’s experience.

It also depends on how they structure service costs. Some charge based on revenue, while others charge a flat rate with extra add-ons. There will also be charges for software and bookkeeping services.

At Osome, all our plans include easy-to-use accounting software and unlimited bookkeeping in one simple price. We’ve designed packages to suit your business stage, from testing a side hustle to needing a financial co-pilot to grow.

Head to our accounting plans to find the right fit for your business.

Why do businesses need professional accounting services?

Many business owners have to learn accounting but often need help understanding the fundamental processes. As your business grows, you could need more help to keep your cash flow healthy, and stay compliant with tax, VAT returns and payroll.

Professional accounting services can help businesses advise on the best company structure, help you improve cash flow, optimise taxes and ensure effective accounting processes.

Fresh insights from our business blog

Small Business Grants: What Is Available in the UK This Year?

In this article, we run through the full list of grants available to small and medium-sized businesses across the UK. Discover the region-specific and UK grants that your business could be eligible for, and learn how you can apply for them. Let Osome lend a hand when you set up your business!

10 Steps To Starting an Online Business in 2025

Launch a successful online business in 2025 by following these 10 steps. From understanding the basics to driving traffic and setting up payment methods, Osome’s guide gives you a roadmap to a profitable venture. With expert insights and top tips, start your ecommerce journey with confidence.

How To Start a Business in 2025 in 10 Steps — A Comprehensive Guide

Ready to be an entrepreneur in 2025? Follow Osome's comprehensive 10-step guide to starting a business. From refining your idea to growing your venture, we'll walk you through each phase with clear, actionable steps. Your successful business journey starts here!

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?