Opening a UK Bank Account for Non-Residents: The 2026 Guide

- Modified: 11 July 2025

- 13 min read

- Starting a Company

Gabi Bellairs-Lombard

Author

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

Mosan Ali

Reviewer

Mosan Ali is our Accounting Manager based in the UK and has a wealth of knowledge of UK GAAP, VAT, and PAYE. With 12 years of experience crunching numbers and ensuring compliance, he keeps our financial reporting ship-shape. Think of Mosan as our blog's accounting guru. He carefully reviews our UK-focused content, ensuring it's accurate, up-to-date, and packed with helpful tips for UK businesses. Get your taxes right from day one with our informative blog posts.

Embarking on the journey of establishing yourself in a new country brings new opportunities and challenges. And one of the most vital tasks many need to complete in their new venture is setting up a bank account for UK non-residents. For non-residents in the UK, understanding the banking system and navigating the process of opening a bank account is an important step in establishing financial stability in your new home. This guide aims to demystify and simplify the process, providing clear insights into the requirements, procedures, and potential challenges you might encounter while opening an account for non-residents in the UK. Let’s dive in!

Key Takeaways

- Non-residents of the UK can open a bank account by providing necessary documents and meeting certain requirements.

- Having a local account offers numerous benefits, such as simplified financial oversight, lowered currency conversion charges and higher interest rates.

- Non-residents can avail themselves of financial protection up to £ 85k per person with easy online access to funds. Business accounts typically start from around £ 6–£ 12 per month, depending on the bank and services selected. Tax implications must also be considered.

Understanding Non-Resident Status

A non-resident in the UK refers to anyone residing in a country other than the one of their origin. This includes both temporary and permanent residents in a country different from their birthplace. Non-residents can open various types of accounts in the UK, including a savings account. If you’re wondering whether it’s possible for non-residents to open a traditional bank account in the UK, the answer is yes, subject to meeting certain requirements.

Non-residents should keep their tax responsibilities in mind as they can open an account. It’s advisable to seek advice from a professional tax adviser to ascertain any potential tax liabilities, especially when opening a business bank account.

However, opening a bank account in the UK as a non-resident comes with its own set of hurdles. One of the major challenges non-residents face is providing proof of address. Traditional banks retain the discretion to refuse account opening, so understanding the fundamentals of the UK banking system is crucial. One way to overcome this challenge is by providing a bank statement from another bank as address verification.

Requirements for a Non-Resident Bank Account

Grasping the requirements and eligibility criteria is a vital step in the process of opening a non-resident UK bank account. To do this, non-residents must provide a passport or driving licence for identity verification, along with proof of address. Some banks may even require a photograph. Additionally, some banks offer multi-currency accounts for non-residents.

Several banks that extend their services to non-residents in the UK include:

- HSBC

- NatWest

- Barclays

- Lloyds

- Royal Bank

These banks may offer Euro bank account options, including current accounts with added benefits such as international money transfers and multi-currency account options.

Though the process of opening a bank account may seem intimidating, it can be relatively simple if you come prepared. Whether you choose to open a UK bank account online or in person, it’s important to have all the required documents ready. Remember, the requirements may vary from one bank to another, so it’s advisable to do your research or consult with the bank directly to ensure you’ve got everything needed to open your account. Here are some common documents you may need:

- Proof of identification (e.g. passport, driver’s license)

- Proof of address (e.g. utility bill, bank statement)

- Social Security number or Tax Identification Number

- Employment or income information

- Initial deposit amount

By having these documents ready, you can easily streamline the process and open your account.

The Advantages of Having a Local Bank Account in the UK

Having a local account as a non-resident brings many benefits. These benefits range from simplified financial oversight to lowered currency conversion charges. Furthermore, non-residents can consider opening post office savings accounts as an alternative.

Various reasons might prompt a non-resident to consider opening a UK account. It can also facilitate payments for expenses such as rent, mortgage, and utility bills. It’s also useful for receiving payments from UK clients or businesses. If you plan to invest in UK stocks or manage finances locally while studying or working temporarily in the UK, having a British account can be advantageous. Some banks may even offer Euro bank accounts for non-residents.

A local UK bank account doesn’t just make day-to-day transactions smoother — it can also unlock better interest rates, reduced fees, and access to exclusive local banking perks for non-residents.

Accounting Manager

Additionally, non-residents may benefit more from UK savings and investment accounts because of the higher interest rates available. On top of that, several bank accounts are provided free of charge in the UK. Certain banks even have promotional offers, like offering up to £ 250 for switching to them or providing packaged accounts with benefits like a mobile phone or travel insurance.

Accounting Manager

Step-by-Step: Opening Your UK Bank Account Remotely

With the advent of the digital era, the ability to open a bank account remotely has emerged as a handy alternative. Non-residents can open a bank account online with traditional banks accepting them as clients. Online services such as Monzo and Revolut provide assistance to non-residents in the process of opening a UK account. These services offer flexibility and are less emphatic on providing proof of location.

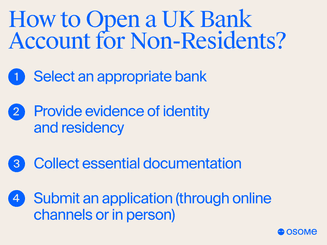

The process of opening a UK bank account remotely involves selecting an appropriate bank according to your needs, providing evidence of identity and residency, collecting essential documentation, and submitting an application either through online channels or in person. Specific requirements include demonstrating identity and residency and providing details about your income. Additionally, many banks also offer options to open savings and investment accounts, which can be a valuable consideration depending on your financial goals.

Virtual banks like Monzo and Revolut extend services to non-residents, providing an account number, sort code, and debit card for in-store and online transactions. This simplifies the procedures for individuals without UK address documentation. However, remember that establishing a virtual banking account typically requires approximately 3 to 4 weeks to complete.

Documents Needed To Open an Account

A number of documents need to be provided by non-residents when opening a financial account in the UK. Essential identification documents such as a passport or another valid form of ID are typically required.

In addition to identity verification, non-residents seeking to open a bank account in the UK are required to provide proof of income and proof of address. However, for non-EU/EFTA residents, there may be additional requirements, such as the need to provide visa details.

Accepted forms of address confirmation for verifying identity with banks in the UK include:

- Utility bills

- Bank statements from other banks

- Tax documents

- A driver’s license

- Other ID cards

It’s important to note that these requirements can vary between banks, so it’s advisable to check with the specific bank for their list of acceptable documents. Additionally, if you are looking to open savings or investment accounts, you may need to provide further documentation related to your financial situation and goals.

Common Challenges for Non-Residents

A variety of challenges may be faced by non-residents when trying to open a UK bank account. These include:

- Limited availability

- Address verification requirements

- Documentation requirements

- Potential rejection by banks

Fortunately, there are strategies that non-residents can utilise to navigate these banking restrictions. These include:

- Thorough research on banks that accommodate non-residents

- Ensuring they have all required documentation

- Exploring the option of opening an account remotely

- Considering international banks

- Seeking support from specialised services.

Banks in the UK provide alternative services such as building societies, credit unions, and National Savings to assist non-residents facing difficulties. Additionally, banks like Revolut, Monese, and Monzo offer the option for non-residents to open a UK bank-like account without traditional address documentation, although the approval to open an account is not assured.

Non-residents can face a few challenges when opening a UK bank account, such as limited options from traditional banks, difficulty verifying UK addresses, and strict regulatory checks. Some of the best solutions are choosing digital banks over traditional banks, providing alternative proof of address via international services, and consulting banking experts who know the process in depth.

Operations Lead

Business Banking Solutions for Non-UK Residents

Non-UK residents can open business bank accounts in the UK, even without holding a personal account with a local bank. Services such as Barclays International Bank cater specifically to overseas businesses that do not have UK-resident directors or signatories and seek to operate outside standard UK financial regulations.

Business bank accounts fulfill essential spending and transaction requirements for non-residents and may also provide billing, accounting, and tax assistance services. Additionally, many business banking solutions include options for savings accounts, which can be beneficial for managing surplus funds and earning interest.

Furthermore, non-resident directors can use virtual bank accounts for efficient tax payments and dividend receipts.

In order to open a business bank account in the UK, non-UK residents typically need to provide a list of essential documents, such as ID and address confirmation. Some banks, such as Lloyds, may require the director or signatory to visit a local branch to submit these personal legal documents.

The Role of Proof of Address

Providing proof of address is a crucial prerequisite when opening a bank account in the UK. It allows banks to:

- Verify the current residential address of the account holder

- Minimise fraud

- Ensure the security of the banking system

- Pass a credit check to manage banking products.

It can come in various forms. British banks typically recognise the following as valid forms of address confirmation for non-residents:

- Utility bills

- Council tax bills

- UK driving licence

- Bank statements

However, providing address verification can come with its own set of challenges. Non-residents may encounter difficulties obtaining satisfactory proof of residency, facing potential issues with their residency status in the UK, and being confronted with the mandatory UK address requirement for bank account opening.

Bank Account Types Available to Non-Residents

A range of banking account options is accessible to non-residents in the UK. Most banks provide a range of choices to accommodate diverse banking requirements.

One such option is opening a current account. These accounts are typically utilised for various daily spending needs, including:

- Debit card transactions

- Bill payments

- ATM withdrawals and deposits

- Receiving salary or wages

Another option includes basic bank accounts. Designed specifically for individuals with limited financial resources or a less-than-ideal credit history, basic bank account provides essential services without:

- Credit

- Checking

- Interest

- Overdraft facilities

Basic accounts are available to non-residents, and many banks offer them.

Choosing a Bank

The selection of the right bank plays a key role in the process of opening a UK savings account. Non-residents should consider the following factors when choosing a bank:

- Whether the bank provides a non-resident account

- The associated monthly fees

- The account’s features

- Whether the bank operates a physical branch or is solely online-based

- The customer service feedback for the bank

Some recommended options for non-residents seeking to open a bank account include Lloyds Bank and Barclays International. The top-rated UK banks for non-residents are Barclays, Lloyds Bank, Halifax, and Starling Bank. Each bank offers its own unique set of services. For instance, Lloyds Bank provides international money transfer services, such as international bank or savings accounts, for non-residents. On the other hand, Barclays International offers various services, including mortgages, investments, foreign currency savings accounts, and other banking services.

Osome partners with trusted fintech platforms like Airwallex and Revolut to help you open an account quickly – no local address or branch visit required. If you choose to open with Wise, a local physical address would be required. Whether you're just incorporated or expanding into the UK, we'll guide you through the process so you can start sending and receiving payments without delay.

Financial Protection for Non-Residents

Financial protection is a crucial aspect to consider when opening a bank account in the UK. The Financial Services Compensation Scheme (FSCS) is a statutory fund in the UK that offers compensation to customers of authorised financial services firms in case of their failure.

The FSCS provides protection for non-resident UK bank accounts up to a maximum limit of £ 85,000 per person. This protection extends to individual accounts and maintains the same coverage for each person in the case of a joint account.

In addition to the FSCS, the accounts are safeguarded by the UK Payment Services Regulations 2017, providing supplementary protections for banking operations.

How To Manage and Access Your Bank Account

With the help of online and mobile banking services, managing and accessing a British bank account as a non-resident is now more convenient than ever before. Options such as Revolut, Monese, and Monzo provide app-based online banking and expat accounts, allowing non-UK residents to avail financial services such as merchant services and international money transfers without requiring proof of address.

Even when overseas, non-residents can efficiently oversee their accounts, providing them with the flexibility to monitor and manage their finances without the necessity of being physically located in the UK.

When it comes to withdrawing funds, non-residents have several options. These include:

- Transferring funds into the account

- Utilising ATM withdrawals

- Conducting online transfers

- Visiting a bank branch

However, providing valid proof of identity is important and considering potential tax implications related to earned interest is important.

The Impact of Banking Choices on Credit and Transactions

The credit scores of non-residents can be greatly influenced by their banking choices. Accumulating debts and failing to repay them can negatively affect their credit score. Furthermore, opening several bank accounts in a short period can also be detrimental. It’s crucial for non-residents to responsibly manage their debts and ensure timely repayments to establish and sustain a favourable credit score in the UK.

Choosing a particular UK bank can influence the ability of non-residents to build a credit history in the UK. While credit history does not transfer when moving abroad, the obligation for any outstanding debts remains. Lenders may find it difficult to evaluate creditworthiness without a UK credit history. Nevertheless, opening a UK bank account is a crucial initial step in creating a credit footprint in the country.

The type of account chosen can also significantly influence transaction fees. Utilising a non-UK account for transactions can result in elevated charges, as UK banks commonly apply approximately 3% for foreign transactions. Fees may also arise from international withdrawals and purchases conducted outside the UK, underscoring the significance of choosing the suitable type to mitigate transaction expenses.

Alternatives to Traditional Bank Accounts

Non-residents have options beyond traditional banking. Digital banks and online payment services provide a more flexible solution for those who may face difficulties when trying to open a UK bank account. Leading digital banks offer services to non-residents in the UK:

- Revolut

- Chase

- Starling Bank

- Monzo

- Monese

- Tandem

They provide a convenient and easy-to-use platform for managing finances.

Digital banks offer reduced fees, increased interest rates, and convenience. However, a potential drawback is that digital banks may not provide the extensive banking services available in traditional banks. Nonetheless, they offer a viable alternative for non-residents who may have difficulties opening a traditional bank account.

Summary

In conclusion, opening a UK bank account as a non-resident is possible and can offer a range of benefits. From simplifying financial management to facilitating transactions, a UK money account can provide non-residents with the tools they need to navigate their financial journey in the UK. The process may involve challenges, but these can be overcome with the right information, preparation, and guidance.

Whether you’re looking to open a traditional or business bank account or explore alternatives such as digital banking, options are available. Remember, the key to a successful banking experience in the UK is understanding your needs, doing your research, and making informed decisions. With this guide, you’re well on your way to financial stability in your new home.