What Is a Holding Company: Structure, Benefits, and Considerations

- Published: 5 June 2024

- 12 min read

- Starting a Company

Gabi Bellairs-Lombard

Business Writer

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

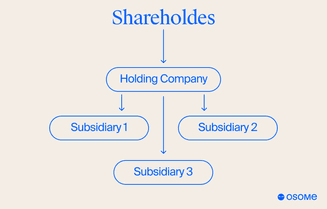

A holding company operates as a parent company and orchestrates subsidiary company operations without getting entangled in daily management. It oversees business organisation and investment strategies and also streamlines control and risk mitigation, often leading to tax optimisation for the parent company.

Key Takeaways

- A holding company, aka the parent company, owns and manages the assets of its subsidiary company, including stocks, intellectual property, and real estate.

- The holding company alone doesn't engage in the subsidiaries' day-to-day activities. Rather, it focuses on its own business operations, such as providing centralised services and leasing assets to subsidiaries, alongside other strategies.

- A holding company can profit from dividends from subsidiaries.

- These parent companies can increase structural complexity and must navigate the burdens of maintaining separate records for each subsidiary while ensuring transparency and clarity.

What Is a Holding Company?

A holding company gains a controlling interest in another company. It is often referred to as the parent company. Holding companies in the UK focus on managing assets, investments, and strategic direction. A holding company can own more than 50% of another company’s shares, gaining what is known as the controlling interest. As a result, the holding company controls the majority of voting rights and often has the power to appoint or remove a majority of the board.

Using a holding company allows you to control and manage multiple subsidiary companies to diversify business risk, protect assets, and potentially realise significant tax benefits. Sometimes, a holding company owns 100% of its subsidiaries. In that case, those companies are called wholly owned subsidiaries. When the situation arises, a holding company can force subsidiaries to dissolve, especially if those subsidiaries are wholly owned.

If you're interested in using a holding company to maximise your business efficacy, speak with Osome's UK company registration expert today and explore your options.

What Are the Types of Holding Companies?

A holding company can come in different forms.

A ‘pure’ holding company's sole purpose is to possess stock in other firms. This type of holding company does not partake in any other business activities as it entirely focuses on owning shares of other businesses. It serves as a parent company to support a corporate group structure.

A personal holding company (PHC) is a C-Corporation whose majority shares of stocks are owned directly or indirectly owned by five or fewer individuals. A PHC also receives over 60% of its income from passive sources. While a pure holding company can register as a limited liability company, a PHC is always a corporation.

Finally, 'mixed’ holding companies actively participate in other business operations and management while holding stocks of other business entities. A mixed holding company is frequently seen in the real estate industry, and it may be used to lease out investment property to subsidiaries.

How Does a Holding Company Make Money?

Instead of relying on day-to-day operations, a holding company's revenue stems from shares in its subsidiaries. The dividends generated by shares of different companies contribute significantly to a holding company's revenue stream.

A holding company can also provide services like IT, human resources, or administration to its subsidiaries to reduce the operational costs of different subsidiaries. Additionally, holding companies can lease equipment and other assets to their subsidiaries, generating long-term passive income through those transactions.

The Role of a Holding Company

Operating as a separate business entity, a holding company possesses controlling stock over its subsidiaries. As a result, the holding company simplifies the management process of multiple companies that share common ownership.

Moreover, a holding company can help protect valuable assets and mitigate liabilities. Allocating business assets to the holding company streamlines asset transactions among subsidiaries and also generates additional revenue for the holding company. Since a holding company owns assets, it can also be used to pursue acquisitions, adding new companies to the existing corporate group structure.

Finally, holding companies also help manage corporation tax obligations as they benefit from several tax advantages. For example, holding companies have no tax liabilities on dividends received from their subsidiaries.

The Advantages of a Holding Company

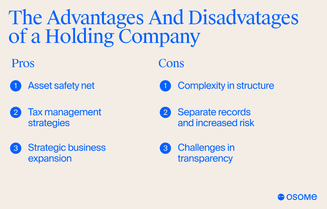

Holding companies offer many advantages that can significantly contribute to the growth and success of their subsidiary companies. These benefits extend from asset protection and tax management strategies to strategic business expansion.

1 Asset safety net

One of the main benefits offered by a holding company is an asset safety net provided to subsidiaries. By owning the assets rather than the subsidiaries themselves, holding companies protect the assets of subsidiary companies from creditors and lawsuits. Furthermore, holding companies can bolster the asset safety net of subsidiaries by obtaining loans at favourable rates and distributing funds to them.

Thus, holding companies serve as a protective shield, safeguarding the valuable assets of their subsidiaries.

2 Tax management strategies

Holding companies’ structures can also be utilised to facilitate tax planning, potentially minimising tax liability. They can potentially minimise corporation tax obligations, and dividends received from subsidiaries may not incur additional tax under certain conditions. For instance, holding companies can dispose of shares in a subsidiary without incurring capital gains tax through the Substantial Shareholder Exemption, provided active business status and shareholding period conditions are met.

Furthermore, holding companies might be exempt from VAT on their central activities, including:

- acquiring shares

- receiving dividends

- fending off takeovers

- disposing of holdings in subsidiaries

These tax management strategies underscore the financial advantages of holding companies, especially when considering how holding companies pay tax.

3 Strategic business expansion

Another significant advantage of holding companies is their capacity for strategic business expansion. They can facilitate growth through strategic acquisitions, allowing them to diversify markets and reach new demographics by establishing subsidiaries in various geographical locations. For example, Cadbury was acquired by Kraft Foods and became part of Mondelez International, exemplifying a strategic acquisition by a holding company to strengthen its global market presence.

Thus, the holding company structure provides a robust platform for strategic business expansion and market diversification.

The Disadvantages of a Holding Company

Notwithstanding their numerous advantages, holding companies are not without certain challenges. These include:

- Complexity inherent in their structure

- The need to keep separate records and assets for each subsidiary leads to increased risk

- Challenges in transparency

1 Complexity in structure

Establishing a holding company is complex, involving the selection of the appropriate structure, registration with Companies House, and the establishment of clear ownership and control relationships between the parent company and subsidiaries. Additionally, management challenges can arise when the holding company exerts influence over subsidiary policies and decisions, potentially leading to conflicts.

Thus, the complex structure of holding companies, while advantageous in many respects, can also present certain challenges.

2 Separate records and increased risk

The requirement to maintain separate financial records and properties for each subsidiary represents another disadvantage of holding companies. This requirement can complicate financial management and oversight. Moreover, the use of holding and subsidiary company structures might expose businesses to a higher risk of losing assets to creditors.

Therefore, it’s crucial for holding companies to employ meticulous record-keeping and robust risk management strategies.

3 Challenges in transparency

Maintaining transparency is a common challenge faced by holding companies. The complex structure of holding companies can make it difficult for investors and creditors to accurately assess the financial health of the holding company and its subsidiaries. The Economic Crime and Corporate Transparency Act 2023 in the UK is designed to improve transparency and address issues such as money laundering and fraud.

However, despite these measures, holding companies may face difficulties in fulfilling their filing obligations and maintaining transparency.

How To Start a Holding Company?

The process of starting a holding company, which may include a trading company, entails a sequence of steps, spanning from company registration to the creation of a comprehensive business plan, taking into account the appropriate business structure and own business operations.

Here are these steps in detail.

1 Choose a unique name and register

Choosing a unique name and registering it with Companies House is the initial step in setting up a holding company in the UK. The term ‘holding’ or ‘holdings’ can be used in the company name since the restriction was lifted in 2015. You can register your holding company as a corporation or a limited company. The business name registration can be completed online or through the mail with the necessary information such as company name, registered office address, and details of directors and shareholders.

2 Appoint directors and ensure legal compliance

To comply with legal requirements, a holding company is obligated to appoint company directors to handle decision-making. Directors can be appointed by existing directors or by a shareholders’ resolution, and their appointment must be reported within 14 days.

In the UK, there are minimal restrictions on who can become a director; individuals are not required to be residents or nationals, and corporate directors are allowed under certain conditions.

3 Open a business bank account

A holding company should open a business bank account. Having a company account can provide necessary financial insights, inform your corporation tax liability, streamline the payment process of any tax charges, and keep your company funds in one place.

Various financial institutions in the UK, including Santander and Yorkshire Bank, are receptive to opening new business accounts for companies, including those owned by a holding company. The process requires proof of identity and UK residence for all individuals involved in the account setup and business verification through specific documentation.

4 Understand financial and operational costs

Parent companies come with unique financial and operational costs, including:

- Formation fees

- Annual reports

- Tax implications, such as franchise tax, capital gains tax, and corporation tax liability

- Adherence to governance

These factors contribute to the complexity of financial management.

When setting up a holding company, it is recommended that you seek advice from accountants to navigate these complexities. Check out our incorporation pricing plans!

5 Create a comprehensive business plan

Lastly, when managing multiple subsidiaries, formulating a comprehensive business plan is of utmost importance. The business plan should include:

- A business overview

- Market analysis

- Details of products and services

- Sales and marketing strategies

- Operations plan

- Description of the management team

- A financial plan

An appendix can also be included to provide supporting documents like financial statements, market research data, legal documents, and additional business plans or procedures.

The Operational Dynamics Between Parent Companies and Subsidiaries

A holding company has strategic oversight over the other operating companies in the corporate structure, while each operating company in the corporate group conducts business autonomously. This allows subsidiaries to conduct multiple trades while benefiting from the strategic direction and resources provided by the parent company.

Each subsidiary’s administration teams handle the day-to-day business decisions. However, potential conflicts can occur when subsidiary companies resist management decisions the holding company makes or vice versa when the holding company makes a misinformed decision. Therefore, it is crucial for clear communications within the corporate group to ensure an accurate picture of the overall company structure.

Investment and Revenue Streams in Holding Companies

The financial stability and growth of holding companies are fueled by their diverse investment and revenue streams. As discussed earlier, one of the main ways holding companies earn revenue is through:

- Dividends received from subsidiary companies

- Capital gains from the sale of subsidiary companies

- Interest income from loans made to subsidiary companies

- Rental income from properties owned by subsidiary companies

This income is significantly increased when the share prices of their subsidiaries rise.

In addition to dividends, holding companies can generate revenue through:

- Leasing equipment or other assets to their subsidiaries

- Extracting surplus cash as dividends, providing a direct income stream

- Selling equity in subsidiaries, especially when their value has appreciated

These varied income streams enable holding companies to maintain financial robustness and facilitate strategic investments.

Examples of a Holding Company

Examining some real-world examples can help one understand the concept of a holding company more comprehensively.

A great holding company example is the Coca-Cola company. Coca-Cola, as the parent company, owns various operating companies within the corporate group structure. These operating companies all have their own business operations that are independent of the parent company, as well as separate income tax liabilities and legal liabilities. Each one of these subsidiary individual companies functions as a limited company. The holding company does not interfere with their day-to-day operations but instead operates as the umbrella legal entity that strategically manages each operating company in the corporate group structure.

Another prominent example is Alphabet Inc., which was created in 2015 as a holding company for Google and its subsidiaries. This restructuring allowed Google to focus on its core business while Alphabet handled strategic management and explored new business opportunities. These examples illustrate how holding companies function in real-world scenarios and demonstrate strategic decisions and diverse applications across different markets.

Summary

In summary, holding companies are powerful business structures that allow for strategic management of multiple subsidiaries. They offer many advantages, including asset protection, tax management strategies, and opportunities for strategic business expansion. However, they also present certain challenges, such as complexity in structure, the need for separate records, and potential transparency issues.

Despite these challenges, holding companies remain a popular choice for businesses looking to consolidate ownership, reduce risk, and maximise profit. Whether you’re a budding entrepreneur or an experienced business executive, understanding the concept of holding companies can provide valuable insights into strategic business structuring and management.

FAQ

What is a holding company?

A holding company is a parent company that owns and controls other companies, known as subsidiaries and focuses on managing assets, investments, and overall strategic direction. This structure is implemented by different industries throughout the UK.

How does a holding company make money?

A holding company makes money primarily through receiving dividends from its subsidiaries. A holding company can also lease assets and provide services for its subsidiaries. This allows the company to have steady passive income streams while maintaining minimal tax liability.

Do holding companies pay tax?

Holding companies, or parent companies, do have an income tax liability. A holding company is taxed as a standalone business entity and is subjected to corporation tax. However, transactions incurring tax charges are sometimes deductible, such as interest generated from owning subsidiary dividends.

If you need help with income tax for parent companies, Osome's outsourced accounting service may be the right solution for you.

What are the benefits of a holding company?

The most significant benefit of a holding company is the additional layer of safety it casts over your assets. Other benefits include tax exemptions, strategic power, mitigating legal liabilities, centralising resources, and more.

What are the disadvantages of a holding company?

Holding companies have disadvantages such as complex structure, increased risk due to the need for separate subsidiary records, and transparency challenges. Therefore, careful consideration is essential when establishing a holding company.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?