What Is a Public Limited Company in the UK? A Complete Guide

- Published: 14 January 2025

- 10 min read

- Starting a Company

Heather Cameron

Author

Heather believes in the power of great storytelling and is here to craft compelling copy that informs and inspires readers. With an extensive background in digital marketing, she has experience writing for various industries, from finance to travel. As Osome’s copywriter, Heather creates content that empowers entrepreneurs and small business owners to boost their business with expert guidance, helpful accounting tips and insights into the latest fintech trends.

Yinghua Luo

Reviewer

Yin Luo is our Operations Manager based in the UK. She keeps our UK team running like a well-oiled machine and ensures our content resonates with our British audience. Before moving to operations, Yin had over 10 years of accounting experience and is an ACCA-qualified accountant. In her current role, she is our go-to expert for making complex topics easy to understand. Yin carefully reviews our UK-focused articles, ensuring they are accurate, relevant, and packed with actionable advice to help your business thrive on this side of the pond.

A public limited company (PLC) in the UK is a type of business allowed to offer its shares to the public, making it easier to raise capital through a stock exchange. This article will the question "what is public limited company?", exploring its key features, how it operates, and its advantages and disadvantages.

Key Takeaways

- A Public Limited Company (PLC) in the United Kingdom offers its shares to the public, allowing for shares to be publicly traded on the stock market, which enhances liquidity and capital-raising capabilities.

- PLCs must adhere to regulatory requirements such as a minimum share capital of £ 50,000, transparency in operations, regular financial reporting, and holding Annual General Meetings.

- Investing in PLCs provides opportunities for share capital appreciation and dividend income, but comes with market risks and increased scrutiny compared to private companies.

Definition of a Public Limited Company (PLC)

A Public Limited Company (PLC) is a type of public company that offers its shares to the public, making it possible for anyone to invest and become a shareholder. In the United Kingdom, a PLC’s shares are publicly traded on the London Stock Exchange, which enhances liquidity and marketability. The ability to trade shares publicly distinguishes PLCs from private companies.

While Osome doesn't currently offer formation services for public limited companies, we do provide comprehensive company registration services for a wide range of business structures, including private limited companies, limited liability partnerships, and sole proprietorships. Our expert team can guide you through the incorporation process, ensuring your business is set up for success.

PLCs must be registered and headquartered in the United Kingdom to comply with Companies House regulations and meet their association requirements. However, their operations can be overseas, as many UK-listed businesses have global operations. Allowing the public to buy shares facilitates easier capital raising and enhances visibility and brand recognition. Listing on the LSE can also foster trust with consumers and business partners through the credibility of being publicly traded on a regulated exchange.

Key Features of a PLC

A PLC must include ‘PLC’ or ‘Public Limited Company’ in its name to reflect its status. This naming convention ensures transparency and helps stakeholders identify the company’s public nature. Furthermore, the formation of a PLC requires at least two directors, one of whom must be an individual over 16 years old, and at least two shareholders. Directors can also serve as shareholders. Additionally, a PLC is legally required to have a company secretary, a requirement not applicable to a private limited company (LTD).

PLCs are also required to have a minimum share capital of £ 50,000 with at least 25% (£ 12,500) paid up before the company can commence business and become fully responsible for shareholder value, ensuring they do not rely on a personal guarantee for their financial obligations. This ensures that businesses have a solid financial foundation from the outset. The presence of shareholders, who own portions of the public company, introduces a level of accountability and governance that can drive business growth and stability.

PLCs also have a unique shareholder structure, where the company's shares can be freely sold and publicly traded on the open market. This transferability makes PLCs attractive to individual investors looking for liquidity and flexibility in their investments. A PLC’s governance structure, comprising a board of directors and shareholder meetings, aligns the interests of both investors and the company.

How Do Public Limited Companies Operate?

A PLC operates as a separate legal entity from its owners, providing limited liability company protection. This means that the personal assets of the shareholders are protected from the company’s business debts and liabilities. The management of a PLC is typically handled by a board of directors, while ownership is distributed among the shareholders.

Transparency is crucial for PLC operations, ensuring accountability for money raised and safeguarding vulnerable investors through detailed financial reporting. Annual accounts must be submitted to the Companies House within six months from the company’s accounting reference date, compared to nine months for private companies, emphasising the stricter reporting requirements for PLCs.

Additionally, PLCs are required to hold Annual General Meetings (AGMs) where shareholders can pass a special resolution to decide on critical company matters. This structure demands higher transparency and accountability than what is required of private companies. The rigorous accounting standards and complete financial audits that PLCs must adhere to contribute to their credibility and trustworthiness in the eyes of investors and the public.

PLC Formation and Requirements

To form a Public Limited Company (PLC) in the United Kingdom, you must meet the following requirements:

- Minimum shares owned of £ 50,000 is required, with at least £ 12,500 paid up before starting operations;

- The company must have more than one company director and two shareholders, both of whom are held responsible for ensuring compliance with legal requirements;

- A UK-registered office;

- A qualified company secretary must be appointed to handle administrative and legal matters;

- Trading certificate from Companies House to commence trading activities;

- Higher legal obligations, including more stringent reporting and financial disclosure requirements for directors;

- Higher initial costs due to the minimum shares owned requirement and additional professional fees.

By fulfilling these requirements, you can establish a PLC in the United Kingdom and get the benefits of public company status, such as the ability to raise capital through public share offerings.

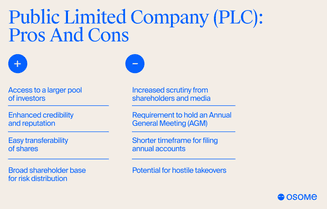

Advantages of Being a PLC

Among the topic of public limited company advantages is access to a larger pool of investors. Public companies can raise large amounts of money through public share offerings, significantly enhancing their value in the market. This share capital access is vital for the growth and success of many PLCs.

Another advantage is the enhanced credibility that comes with being publicly traded. Listing on the stock market increases a company’s reputation and prestige, making it more attractive to potential investors and business partners. This enhanced reputation can open doors to new opportunities and partnerships that might not be available to private companies.

Additionally, shares in a PLC are easily transferable, making them more appealing to investors. This liquidity allows investors to sell and buy shares as they see fit, providing flexibility and reducing risk for vulnerable investors. A broad shareholder base allows better risk distribution among investors, further enhancing the attractiveness of public companies.

Disadvantages of Being a PLC

Despite the many advantages, there are also significant disadvantages to being a public limited company. A primary drawback is the increased scrutiny from shareholders and the media, demanding higher transparency and accountability. This scrutiny can be both time-consuming and costly, as it requires extensive reporting and disclosure.

Another disadvantage is the requirement to hold an Annual General Meeting (AGM), which private limited companies are not obligated to do, this can be time-consuming, costly, and expose the company to public scrutiny, potential conflicts, and added regulatory burdens. Additionally, PLCs have a shorter timeframe of six months to file their annual accounts compared to the nine months allowed for a private limited company. These requirements add pressure on the company’s management and administrative resources, despite the public-limited company advantages.

Furthermore, the diversified ownership structure of public companies can lead to challenges in maintaining control over the business direction. Original owners may find it difficult to implement their vision if shareholders have differing opinions. There is also the risk of hostile takeovers due to the freely transferable nature of shares in a public limited company. These takeovers can result in significant changes to the company’s strategy and operations, often not in line with the original owners’ intentions.

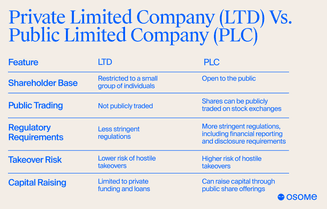

Differences Between Private and Public Limited Company

There are several differences between private limited companies and public limited companies. The primary one is the ability to sell shares to the public. While private limited companies (LTDs) and limited liability companies are not offering shares to the general public, PLCs can list their shares to be publicly traded on the stock exchange. It's important to note that public limited companies don't mean they are all listed on the London Stock Exchange, as they could be unlisted public companies. This aspect provides PLCs with greater access to capital but also subjects them to more stringent regulatory requirements. A private company does not have the same opportunities for public trading within its association structure.

PLCs require a minimum of two shareholders, compared to the single shareholder requirement for a private company. Additionally, public companies are susceptible to hostile takeovers if they become targets for larger entities or dissatisfied shareholders. This risk is lower in private limited companies and limited liability companies, where shares are privately held by a small association of investors.

Investors should be aware of the regulatory requirements PLCs must adhere to, as these can significantly impact investment decisions. These requirements include more rigorous financial reporting and disclosure standards, which can affect the company’s operational flexibility and management structure. Understanding these differences is essential for investors and business owners when considering the value of taking a limited company private or transitioning to a public limited company

Investing in Public Limited Companies

Investing in a public limited company involves buying shares that are listed on a stock exchange or other public channels. This process typically requires an account with a brokerage firm, where investors can create an account, fund it, and then purchase ordinary shares. The public accessibility of PLC shares attracts a broad base of individual and institutional investors.

The benefits of investing in PLCs include the potential for share capital appreciation and dividend income. Shares in successful PLCs can increase in value over time, providing a substantial annual return to investors. Additionally, many PLCs pay dividends, offering a steady income stream to shareholders.

Investing in PLCs also exposes investors to market risks. A share price can fluctuate based on stock market conditions, company performance, and broader economic factors. These fluctuations can result in significant gains or losses, making it essential for investors to conduct thorough research and consider their risk tolerance before investing in PLCs.

Examples of Public Limited Companies

The UK hosts many notable PLCs that play a vital role in the economy. For example, prominent PLCs include Burberry, Rolls-Royce, AstraZeneca, Vodafone, and Tesco. These companies are renowned for their contributions to innovation, employment, and economic growth.

Rolls-Royce Holdings PLC, for example, is a major player in the aerospace and defence industries, known for its advanced engineering and technological innovations. AstraZeneca, a global biopharmaceutical company, has been at the forefront of medical research and development, especially evident during the recent pandemic.

Vodafone Group PLC is another significant public limited company, which provides telecommunications services to millions of customers worldwide. These companies not only drive economic growth but also set industry standards and lead in various sectors, showcasing the potential and impact of being a public limited company.

Transitioning from Private to Public Limited Company

Transitioning from a private limited company to a public limited company is a significant decision that involves several steps through the Companies House. Firstly, businesses should be well established with a solid management structure before considering the transition. This preparation ensures that the company can meet the higher regulatory and operational demands of being a PLC.

The process of transitioning involves meeting the minimum share requirement, appointing at least two directors, and obtaining a trading certificate from Companies House. Additionally, the company must comply with the legal and reporting obligations specific to PLCs, including adhering to corporation tax regulations. If the benefits of being a PLC no longer outweigh the disadvantages, the company can choose to revert to a private limited company by submitting the correct application form to Companies House.

Businesses contemplating this transition should carefully weigh the advantages and disadvantages. Proper planning and professional advice are crucial to ensure a smooth transition and maximise the potential benefits of becoming a PLC.

Choosing the right business structure is crucial for the success of your business. Osome offers comprehensive company formation services to help you select the optimal structure and guide you through the incorporation process. Contact us today to learn more!

Summary

In summary, Public Limited Companies (PLCs) offer a unique set of advantages and challenges. The ability to raise capital from the general public, enhanced credibility, and easier share transferability are significant benefits that can drive growth and expansion. However, the increased scrutiny, regulatory requirements, and potential loss of control are important considerations that businesses must address.

Understanding the intricacies of PLCs is essential for part owners, investors, and anyone interested in corporate structures. By weighing the pros and cons, companies can make informed decisions about whether transitioning to a PLC is the right move for their businesses. The journey of a PLC can be complex, but with the right knowledge and preparation, it can also be highly rewarding.