Annual General Meeting (AGM): Definition and Meaning

- Published: 8 May 2024

- 10 min read

- Grow Your Business

Gabi Bellairs-Lombard

Author

Gabi creates content that inspires. She's spent her career writing compelling website copy, and now she specialises in product marketing copy. As the voice of our products and features, Gabi makes complex business finance and accounting topics easy to understand. Her top priority is ensuring that her words impact and inspire her readers.

If you’re approaching an annual general meeting (AGM) – either for a public company, private company or any other company, and are seeking clarity on its process and purpose, you’re in the right place. An annual general meeting is not just a formal requirement; A company's AGM is a forum for shareholder democracy and a cornerstone of its corporate accountability. This article strips away the complexity of an annual meeting, offering you a practical guide to the AGM from the legal necessities and an AGM agenda all the way to the strategies that encourage active shareholder participation.

Key Takeaways

- An annual general meeting (AGM) is a key event for shareholders to participate in critical decisions such as casting their vote on issues, electing directors, and approving financial statements, fostering transparency and accountability within the company.

- Organising an annual general meeting requires careful planning, including preparing financial statements, setting an agenda with a clear period of notice, and facilitating shareholder voting and participation through various means, such as proxy votes and electronic submissions.

- The practices and requirements of an annual general meeting vary internationally and also from smaller to large companies. Some organisations, particularly private or single-member entities, also have the flexibility to opt out or adapt the format of the traditional annual general meeting. These trends reflect changes such as the rise of virtual and hybrid meetings.

What Is an Annual General Meeting (AGM)?

An annual general meeting (AGM), also known as an annual meeting, is a yearly gathering that brings together a company’s interested shareholders and all the members of its board. This meeting serves as a platform where directors present an annual report, allowing shareholders with voting rights to:

- Vote on current issues

- Discuss and make decisions on important matters

- Elect or re-elect directors

- Approve financial statements

- Approve the appointment of auditors

However, the significance of an annual general meeting extends past its legal compliance aspect, as seen in places like Hong Kong. Here, this annual meeting also serves as a vital tool for promoting transparency, engaging shareholders in decision-making, and holding the management responsible.

Our company secretary services ensure that your AGM is conducted smoothly and in compliance with all legal requirements.

The core objectives of an annual general meeting

The main aims of an AGM are:

- To meet legal obligations

- To present the annual report, which provides a comprehensive review of the company’s performance

- To outline the company’s future strategy to shareholders

Furthermore, AGMs foster a culture of accountability and transparency, allowing shareholders to participate in the company’s decision-making processes. Shareholders are given the opportunity to vote on key issues, which may include electing directors, approving compensation, and making decisions on mergers and acquisitions.

AGM requirements across different jurisdictions

Despite the fundamental structure of an AGM remaining constant, the specific prerequisites can greatly differ across various jurisdictions. Public companies are typically required by law to hold their general meeting in major jurisdictions, whereas private companies generally have more flexible requirements.

For instance, in India, AGMs must occur between 9:00 am and 6:00 pm on non-national holidays, with a minimum notice of 21 days required. On the other hand, Hong Kong mandates that a company hold an AGM for each financial year without specifying a particular timeline. These variations in AGM guidelines concerning timing, quorum, voting, and documentation create unique challenges for companies operating across multiple jurisdictions.

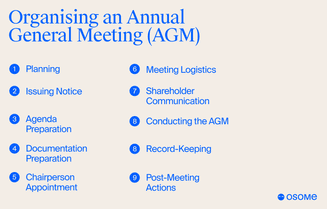

How To Organise an AGM: A Checklist for Companies

The organisation of an AGM is a complex task necessitating meticulous planning and execution. Certain company officers, like the president, vice-president, secretary, or board member, typically bear this responsibility. What are the essential steps in planning an AGM, and how can firms guarantee a seamless and productive meeting?

Preparing financial reports and statements

Preparing statements and reports regarding the company's finances for the accounting reference period is one of the most essential elements in organising an annual general meeting. These documents provide shareholders with a clear picture of the company’s past year’s results and insights into the forthcoming year’s activities.

The financial reports presented at the AGM typically include the annual financial report of the company, the director’s report and the auditor’s report. These documents are essential for providing an overview of the company’s financial health and operations. Companies are required to prepare these reports annually and deliver them for registration for every financial year, ensuring regular updates on the company’s financial status.

Setting the agenda and notice period

Establishing the agenda and notice period is another crucial stage in planning an annual general meeting. The agenda should cover items requiring a vote to ensure orderly meeting conduct and be shared in advance, often as part of the meeting invitation.

The notice for an AGM must include essential details such as:

- The company name

- Convenor

- Meeting leader

- Date

- Time

- Location

- Discussion points

- Voting topics

- URL for virtual meetings

In jurisdictions like Hong Kong, the standard notice period for an annual general meeting is 21 days, though a shorter notice is permissible with unanimous consent or 95% majority agreement of voting rights.

The Role of Company Officers in an Annual General Meeting

Holding AGMs is not a solo act. It necessitates a collective effort, with company officers playing key roles. This includes the company secretary, who is tasked with convening, conducting, and attending the AGM, which includes organising board and annual meetings.

Company officers, as well as company members, have several responsibilities during the meeting itself, including:

- Ensuring that the company and its directors act in accordance with relevant laws, rules, and corporate governance practices

- Evaluating the performance of the board

- Maintaining essential corporate records

These responsibilities contribute to the overall governance of an annual general meeting.

Presenting the company's accounts

Presenting the company’s accounts is one of the primary duties of company officers during an AGM. This involves providing a detailed report of the company’s performance over the previous year or past fiscal year and its strategic plans for the future.

During the AGM, members of the board engage in discussions about the company’s financial performance in the past year, as well as the strategic direction to be adopted moving forward. This transparency allows shareholders to make informed decisions and contribute to the company’s future success.

Electing new board members

The election of board directors is another significant element of an AGM. This process involves both the proposing of new members and the re-election of current members of the board.

Even if a company does not hold an AGM, elections or re-elections of directors can still be managed through other forms of general meetings or via written resolutions. This flexibility ensures that the company continues to function smoothly, regardless of the circumstances.

Engaging Shareholders: Voting and Representation at AGMs

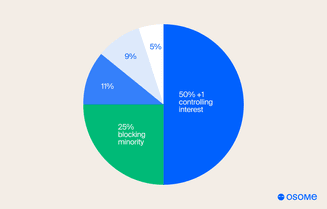

Engaging the company’s shareholders constitutes a significant portion of an AGM. These meetings are a critical occasion for shareholders to participate in company governance, including officer and directors' elections and information dissemination.

How do firms involve shareholders in the AGM process? This is done through a combination of voting and representation. Let’s delve into these aspects in the following sections.

Understanding proxy votes and electronic means of submission

Proxy voting is a crucial part of engaging shareholders who are unable to attend. It’s a process where shareholders can exercise their extensive rights and submit their vote electronically for an AGM using systems provided by the company.

Electronic proxy submission enables registered shareholders to vote online before the meeting, allowing for efficient participation without their physical presence. A person who submits their proxy electronically can do so through mail, phone, or online. A proxy vote must typically be received no later than 24 hours before the shareholder holds an AGM.

Encouraging active participation

In addition to voting, a company should also foster active participation in AGMs. This involves using the AGM as a platform for shareholders to directly question the board and directors about company matters and voice their opinions on presented business topics.

Companies can also make use of governance roadshows in the weeks leading up to the AGM to facilitate direct engagement with shareholders. By researching investor profiles and historical proxy voting behaviours, a company can customise it's engagement strategies to address the specific interests and concerns of it's shareholders.

Special Considerations for Private Companies and Exemptions

Though AGMs are typical among public companies, private firms and certain exemptions might have distinct considerations. Take the dormant company for instance.

A dormant company is exempt from the requirement to hold AGMs as clearly stated in the company's articles.

Private companies, including those registered as limited companies, can also opt out of holding an AGM if all members pass a unanimous resolution. This flexibility of AGM requirements, depending on the specific circumstances of each private company, highlights the unique considerations for these entities.

The single-member company exception

Another distinct consideration relates to single-member entities, as opposed to those with all the members entitled. These entities have a unique exception from the general requirement to hold an AGM in jurisdictions like Hong Kong.

In fact, under certain conditions, single-member companies in Hong Kong are not mandated by law to conduct an AGM. Instead, they can choose to dispense with AGMs through the passage of a member resolution.

Alternatives to traditional AGMs for private companies

Private firms also have alternatives to conventional AGMs. These companies can pass resolutions without a meeting if all members agree, serving as an alternative to AGMs.

In jurisdictions like Hong Kong, AGMs can be waived if written resolutions are passed and signed unanimously by all members, shareholder approval is obtained and financial statements are accepted. These alternatives offer greater flexibility to private companies, ensuring they can operate smoothly and efficiently.

Adapting AGMs to Modern Challenges

Similar to many corporate aspects of large companies, AGMs are not shielded from contemporary challenges. For instance, the acceptance of virtual AGMs is growing due to technological advancements, allowing companies to adapt to new ways of conducting these meetings.

However, virtual AGMs face challenges such as legal problems, legislative necessities, and guidance from proxy advisers. Moreover, AGMs can be postponed within such provisions as defined by legal boundaries and obligations, adapting to the challenges posed by pandemics.

Virtual and hybrid AGM models and Companies Ordinance 2023

Virtual and hybrid AGM models have emerged as a response to these challenges. According to the new rules set by The Companies Ordinance (Amendment) 2023, effective from April 28, 2023, companies in Hong Kong can conduct fully virtual or hybrid general meetings.

These models allow even public companies to conduct meetings using technology that enables members to listen, speak, and vote, regardless of their physical location. This not only increases accessibility but also enhances participation in AGMs.

Postponement and adjournment protocols

Considering the unpredictability of the contemporary world, firms might need to delay or adjourn their AGMs. This can occur when provided for in a company’s constitutional documents or by the chair’s discretion in certain circumstances.

However, the need to hold AGMs within a set timeframe makes delaying due to pandemic restrictions, like those for COVID-19, a limited option. Thus, companies need to have a clear understanding of postponement and adjournment protocols to navigate these challenges effectively.

AGMs Around the World: Case Studies

While AGMs are a widespread practice globally, they can adopt distinct formats in various jurisdictions.

For instance, the Berkshire Hathaway AGM is known for its shareholder-friendly practices, including a weekend of events referred to as ‘Woodstock for Capitalists’. Warren Buffett, the chairman of Berkshire Hathaway, uses the AGM as a platform to educate shareholders and the public about the company’s investment philosophy.

Meanwhile, in different jurisdictions, local laws and rules impact AGM conduct, with variations in rules for notice periods, the inclusion of electronic attendance, and the rights of shareholders to speak.

These case studies highlight the versatility of AGMs and the various ways in which companies can engage with their shareholders to achieve their corporate goals.

Maximising the Impact of Your AGM

To optimise the influence of your AGM, it’s important to emphasise the organisation’s impact and accomplishments rather than only documenting departmental activities. Selecting a theme that aligns with the organisation’s character or yearly highlights can also make the AGM more dynamic and engaging.

Moreover, integrating other strategic objectives beyond the mandatory agenda items can improve AGM's impact. By thinking outside the box and focusing on the broader picture, companies can ensure that their AGMs are not only informative but also impactful and engaging.

Summary

AGMs play a vital role in corporate governance, providing a platform for companies to present their annual reports, engage with shareholders, and make key decisions. From setting the agenda to electing members to the board and engaging shareholders through proxy voting, AGMs require careful planning and execution.

However, with the advent of technology and evolving business landscapes, AGMs are also adapting to modern challenges. Whether it’s adopting virtual or hybrid models, adjusting to new legal requirements across different jurisdictions, or finding ways to encourage active participation, AGMs are proving to be a versatile and essential tool in the corporate world.

Are you struggling with the weight of organising your next AGM? Consult the experts at Osome and delegate all the hassle to our seasoned company secretaries. With offices in Hong Kong, UK and Singapore, we are well equipped to steer your AGM in the right direction. Allow us to handle the paperwork and administrative tasks, while you focus on business strategy. Contact us today and learn more about our company secretary packages.

FAQ

What is an AGM?

An AGM, also known as an Annual General Meeting, is a yearly event where a company's directors present an annual report and shareholders vote on current issues.

How are AGMs organised?

AGMs are organised by preparing financial statements, setting the agenda, and ensuring compliance with legal requirements. This ensures a smooth and successful meeting.

What is the role of company officers in an AGM?

Company officers play crucial roles in AGMs, including presenting accounts, electing board members, and ensuring compliance with laws and regulations. Their contributions are essential to the smooth functioning of the meeting.

How do companies engage shareholders in AGMs?

Companies engage shareholders in AGMs through various means such as voting, representation, proxy votes, and active participation. These methods help ensure shareholder involvement and representation in decision-making processes.

What is a virtual AGM?

A virtual AGM is a meeting conducted online, enabling participants to listen, speak, and vote from any location.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?