Company Formation in Hong Kong: A Complete 2026 Guide

- Modified: 23 January 2026

- 11 min read

- Starting a Company

Gabi Bellairs-Lombard

Author

Gabi creates content that inspires. She's spent her career writing compelling website copy, and now she specialises in product marketing copy. As the voice of our products and features, Gabi makes complex business finance and accounting topics easy to understand. Her top priority is ensuring that her words impact and inspire her readers.

Sherman Ieong

Reviewer

Sherman Ieong is our Accounting & Tax Manager based in Hong Kong. She is on hand to help our writers level-up our blog posts and guides by making sure the information is accurate, informative and inspiring. Osome’s all-in-one accounting services make managing tax effortless - and that’s exactly what Sherman ensures we do with our Hong Kong-focused blog content, applying her knowledge of day-to-day bookkeeping, monthly financial reporting, Profits Tax Returns and much more.

Iris Kwong

Reviewer

Iris Kwong is our Corporate Secretary Manager based in the Hong Kong office. With more than 10 years of experience navigating Hong Kong's Companies Ordinance and regulatory requirements, she is our go-to expert on everything from company formation and annual returns to board meetings and shareholder resolutions. She knows the secrets to ensuring smooth business operations and carefully reviews our Hong Kong-focused content, ensuring it's accurate, up-to-date, and packed with useful tips.

Embarking on company formation in Hong Kong? Streamline your journey with this straightforward guide. From choosing a company name to opening your business bank accounts and navigating the companies registry, each step is critical — and we’ll guide you through them all.

A company incorporated in Hong Kong, be it a foreign company, offshore company or a private limited company, has to follow a specific company registration process. Discover the financial and legal implications to ensure your new enterprise is built on solid ground for thriving in Hong Kong’s vibrant market.

Key Takeaways

- To establish a company in Hong Kong, it is necessary to register with the Companies Registry and the Business Registration Office. It includes selecting a compliant company name, choosing an appropriate business structure, defining share capital and shareholder agreements, having a registered office address and preparing necessary incorporation documents.

- Companies operating in Hong Kong must register with the Companies Registry and Inland Revenue Department, comply with the Companies Ordinance, and ensure all company documentation is complete and accurate, including Articles of Association and identity documentation.

- Forming a new business in Hong Kong provides advantages such as limited liability protection for personal assets, separation of personal and corporate finances, favourable tax benefits and access to international business opportunities, with the caveat of being cognizant of potential costs and hidden fees.

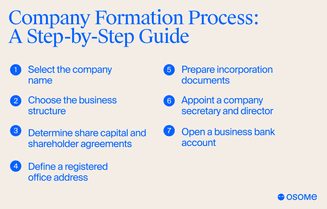

The Hong Kong Company Formation Process: A Step-by-Step Guide

Registering a new company necessitates a systematic approach to facilitate seamless operations in the future. Forming a Hong Kong company involves several crucial steps, each of which contributes to building a robust and compliant business structure.

We will now walk you through the steps in the new business registration process.

1 Select the company name

Choosing a unique and available company name is the essential first step in forming your Hong Kong company. This name serves as the initial point of contact with potential clients and must reflect your brand’s identity and goals. In Hong Kong, company names must comply with government regulations to avoid duplication or resemblance to existing names. Language requirements are strict: the name can be in English, ending with ‘Limited’ for a limited company, and/or in Chinese, ending with ‘有限公司’, but it cannot mix both languages. Once you confirm your proposed name’s availability, you can proceed to the next stage of the company formation process.

2 Choose the business structure

The business structure you choose controls your company’s operating framework and impacts elements such as personal liability and tax obligations. In Hong Kong, you can choose from several business structures, such as a sole proprietorship, a partnership, and a company limited by shares. Among these, a private limited company is a popular choice as it offers limited liability, ensuring that business owners are not personally responsible for company debts.

Moreover, these companies have their own legal identity, meaning they can acquire assets, enter contracts, and incur debts independently, amplifying their operational autonomy.

While many start with choosing a company name, defining the right business structure is just as critical — it shapes everything from liability to tax. In practice, both steps go hand in hand when forming a company in Hong Kong.

Corporate Secretary Manager

3 Determine share capital and shareholder agreements

Identifying your share capital is an integral part of the limited company process because it establishes each shareholder’s equity stake. In Hong Kong, the share capital can be denominated in any major currency, though the Hong Kong Dollar is commonly used.

Alongside share capital, it’s crucial to draft shareholder agreements for your limited company. These documents set clear guidelines for shareholder operations and company governance, ensuring smooth functioning and minimising potential disputes.

Getting your share capital and shareholder agreements right from the start sets the foundation for a well-structured company. Osome’s Hong Kong company registration services cover everything from document preparation to filing, ensuring your business is set up properly from day one.

4 Secure a registered office address

The registered office address is a mandatory requirement when forming a company in Hong Kong. It must be a physical, non-PO box address located within Hong Kong, serving as the official point of contact for all government correspondence and legal notifications. Establishing this registered office enhances your company’s professional image while ensuring compliance with legal obligations for company incorporation and ongoing business registration.

5 Prepare incorporation documents

The preparation of incorporation documents is a significant step in the process of forming a company. Among these, the Articles of Association hold a significant place as they outline the internal rules and regulations governing a company. It’s crucial to ensure these documents are duly filled and submitted to avoid any hiccups in the company incorporation process.

6 Appoint a company secretary and director

The company registration process in Hong Kong requires appointing at least one director and one company secretary. These roles must be filled by different individuals if the company has only one director. Importantly, the company secretary must either be a Hong Kong resident or a company registered in Hong Kong to ensure compliance with local regulations.

7 Open a business bank account

The last step in establishing your Hong Kong company is to open a free business bank account. This business account is essential for managing your company’s finances and facilitating business transactions. To open a business account, you’ll need a business registration certificate and your company registration number.

With the right guidance and support of business banking partners, the bank account process can be completed seamlessly, setting your company on the path to financial efficiency.

Navigating Government Regulations and Registrations for Company Incorporation

Complying with government regulations and registrations is not just a statutory requirement; it’s a cornerstone of responsible business practice. In Hong Kong, companies must adhere to a set of regulations outlined by authorities like the Companies Registry and the Inland Revenue Department (IRD).

We will now examine the main aspects of these regulations and learn how to effectively comply with them.

Business Registration with Companies Registry and Inland Revenue Department

The registration of your company with the Companies Registry and Inland Revenue Department is a significant milestone in your business journey. Upon successful registration, your company receives a Certificate of Incorporation and a Business Registration Certificate, which are essential for the legal recognition and operation of your business. These documents serve as proof of your company’s existence and provide vital information such as business address and other business details.

Furthermore, you must register your new company with the business registration office within one month of starting operations.

Understanding the Companies Ordinance and Compliance

Grasping the Companies Ordinance is vital for companies incorporated in Hong Kong to ensure compliance and seamless business operations. This ordinance outlines the legal requirements for company registration and operation, including restrictions on company names and the prohibition of bearer shares.

Staying abreast of these regulations helps ensure your business remains compliant and avoids potential penalties-which is especially important for a foreign company or even an offshore company not familiar with Hong Kong regulations.

Company Formation Documents

Several key documents come into play when setting up private limited companies or any kind of private company or offshore company in Hong Kong. These documents not only establish your company’s legal identity but also provide the basis for its structure and operations.

We will now examine these company documents, including company details, and their importance in the process to form companies.

1. Articles of Association

The Articles of Association form the backbone of your company’s legal framework. They define your company’s governance rules, including aspects like dividend distribution, director appointments, and share issuance, among others. These articles are filed with the Companies Registry during the incorporation process and serve as part of your company’s constitution.

Furthermore, the Hong Kong government requires these documents to contain mandatory articles, including the company name and the initial shareholdings.

2. Memorandum of Association

Interestingly, the Memorandum of Association, once a crucial part of company formation, has become obsolete in Hong Kong. The Companies Ordinance (Cap. 622) abolished this document to simplify the incorporation process, requiring only the Articles of Association for a new company today.

3. Incorporation form (Form NNC1)

FormNNC1, or the Incorporation Form, is another vital document for registering private companies in Hong Kong. This form requires details of the proposed company name, company type, registered address, and share capital, among other information. It also necessitates that you specify the number of directors and provide their details, as well as the details of the company secretary.

4. Identity documents

For company formation, you’ll also need to provide identity documents. If you’re a resident owner or director, a copy of your Hong Kong identity card will suffice. For non-resident individuals, a copy of the international passport, along with proof of overseas residence, is required.

5. Proof of address

Lastly, you’ll need to provide proof of your registered office address. This address is where the government entities send documents and is also the place where you must display your company’s name and liability status.

Remember, failing to maintain a registered office or notify of an address change can lead to fines.

Protecting Assets and Limiting Liability

Beyond laying the foundation for your business, company formation also plays a crucial role in protecting your own assets and limiting your liability. By incorporating your business as a separate legal entity, you shield your own private assets from any liabilities that your business might incur. Company formation agents can assist you in this process, ensuring a smooth and efficient incorporation through their company formation packages.

Let’s further explore these aspects.

The role of limited liability in business structure

Limited liability is a critical feature of the business structure in Hong Kong, particularly for a limited company. This provision ensures that business owners of a Hong Kong limited company are not personally responsible for the company’s debts and liabilities. Thus, if the company faces financial distress or claims, only its assets can be targeted by creditors, not the personal possessions of the owners.

Separating personal and business finances

Separating personal and business finances is another critical aspect of protecting personal assets and limiting liability. This separation safeguards individual wealth and maintains clear financial records. Also, it strengthens your legal stance against claims or debts incurred by the business.

Advantages of Forming a Hong Kong Company

Establishing a Hong Kong company comes with numerous advantages. From significant benefits in terms of tax to abundant international business opportunities, the city offers a conducive environment for businesses to thrive.

We will now examine these benefits in depth.

Benefits related to tax

Hong Kong is known for offering substantial benefits to businesses in terms of its business tax structures. The city employs a two-tiered corporate profits tax regime, which charges lower taxes on profits under HK$ 2 million, favouring small to medium-sized enterprises. Moreover, there is no capital gains tax, VAT or GST, sales tax, and dividends are not taxed, significantly reducing overall business costs.

International business opportunities

Hong Kong’s strategic location provides straightforward access to Mainland China and other Asian markets, making it an attractive site for businesses looking to expand internationally. Whether you’re into trading, ecommerce, consulting services, or even a digital company, Hong Kong’s free economy supports a wide range of business operations, benefiting new and established businesses alike.

In 2024, Hong Kong ranked as the world’s 7th largest merchandise trader, with HK$ 9.46 trillion in trade. Over half of its volume is re-exports involving Mainland China (HK$ 3.78 trillion), while the airport handled 4.3 million tonnes of air cargo, and Victoria Harbour saw ~220,000 vessel calls, solidifying HK as a powerful gateway to Asia.

Leveraging the Hong Kong business ecosystem

The Hong Kong business ecosystem offers a plethora of resources and opportunities to businesses, including:

- World-class infrastructure

- Robust legal system

- Strategic location

- Pro-business environment

With these elements, this vibrant city has all the necessary components to help your business thrive and grow.

Company Formation Costs and Hidden Fees

While forming a company in Hong Kong offers numerous benefits, it’s important to be aware of the potential costs and hidden fees associated with the process. We will now investigate these costs and learn how to effectively manage them.

Transparent pricing: What to expect

The cost of Hong Kong company formation can vary depending on several factors, including the type of company being registered and the region in which it is being formed. However, online company registration services like Osome offer clear, upfront pricing that helps avoid unexpected fees post-registration.

Utilising a registered office address provided by an agency can also provide cost advantages by eliminating the need to lease separate office space.

Avoiding hidden costs

While transparent pricing can give you a clear idea of the initial costs, it’s crucial to be wary of potential hidden costs. These could arise from the need to obtain special licenses, annual compliance fees, or charges for mandatory filings.

It’s also important to be cautious of service offerings that may only cover basic services, potentially incurring extra costs for additional support. Remember, thorough research, careful reading of contract terms, and planning for future compliance expenses can help avoid or mitigate hidden costs.

Worried about hidden fees? We keep things simple. Our transparent packages show exactly what’s included – no surprises. View our pricing to see how we stack up.

Company Formation Services

Although establishing a company in Hong Kong might appear challenging, numerous Hong Kong company formation services can assist in streamlining the process. For instance, Osome offers online company registration admin services, including bank accounts and compliance. These services not only streamline the registration process but also provide free customer support, a designated representative and guidance for your business operations.

Avail of Osome's services, whether its simple company formation or even a company secretary service. We give your business idea the wings it needs to take off.

Summary

Forming a company in Hong Kong can be a rewarding endeavour, offering immense potential for growth and profitability. While the process may seem complex, understanding each step, from company name selection to opening a business bank account, can significantly simplify the journey. Additionally, being aware of the government regulations and registrations and the necessary documents can help ensure a smooth and compliant company formation. Equipped with this knowledge, you are now ready to embark on your business journey in Hong Kong and reap the benefits of its vibrant and dynamic business ecosystem.