What Is a Current Account? The Ultimate Guide

- Published: 5 December 2024

- 11 min read

- Grow Your Business

Heather Cameron

Author

Heather is here to inform and inspire our readers. Boasting eight years in the world of digital marketing, working in diverse industries like finance and travel, she has experience writing for various audiences. As Osome’s resident copywriter, Heather crafts compelling content, including expert guides, helpful accounting tips, and insights into the latest fintech trends that will help entrepreneurs, founders and small business owners in Hong Kong take their businesses to the next level.

Looking to manage your daily finances effortlessly? A current account could be the solution. In this guide, we will explain what a current account is, its key features, and why it’s a crucial tool for your financial management.

Key Takeaways

- A current account is essential for everyday financial management, enabling users to receive income, make payments with a debit card, and conduct transactions easily.

- Current accounts come in various types, including Standard, Packaged, and Basic Bank Accounts, each catering to different financial needs and offering unique features, making them possibly the biggest determinant of financial stability.

- Effective management of your current account involves regular monitoring, understanding fee structures, and utilising online and mobile banking tools for efficient transaction tracking, even during periods of heightened uncertainty.

What Is a Current Account?

A current account is specifically designed for everyday personal finances. It acts as a central pillar of your financial life, enabling you to receive your salary, pay bills, and use a debit card for transactions. Unlike savings accounts, current accounts are primarily used for daily transactions, enabling you to manage net earnings and expenses efficiently. Current accounts also serve as a key factor in managing a financial account, influencing both personal finances and a country's balance through aggregated spending patterns.

Current accounts operate within a cyclical trend, reflecting spending and income patterns that repeat regularly. This type of bank account typically does not accrue significant interest, focusing instead on easy access and transaction capabilities. The term ‘current’ reflects the cyclical nature of these funds, generally used within a monthly fee cycle.

Managing finances or starting a business could be a real challenge without the help of professionals. Partner with Osome, providing seamless company registration services and ongoing support! We can help you open a bank account via partners and establish a legal entity, ensuring your business is ready to operate efficiently.

In essence, a current account is your main tool for managing everyday financial activities seamlessly.

Are current accounts free?

Current accounts can come with a variety of fee structures, and not all are free. While some banks provide basic bank accounts with no monthly fees, others may charge for additional services or premium features. Understanding the fee structure of your current account is crucial, as these fees can significantly impact your overall costs. This is especially true for young people starting their financial journey, who might feel the impact of a monthly fee.

Factors such as overdraft charges, arranged overdraft options, monthly fees, and transaction costs can vary widely between most banks. Additionally, the availability of certain features may depend on your credit file, making it important to choose an account that aligns with your financial profile. Therefore, comparing different current accounts and choosing one that fits your financial habits and needs is important to maintain a positive balance and avoid unnecessary expenses.

Types of Current Accounts

Current accounts come in various forms to cater to different financial needs. The main types include Standard Current Accounts, Packaged Current Accounts, and Basic Bank Accounts. Each type is tailored to specific circumstances and offers unique features. For instance, some current accounts provide arranged overdraft options and extra benefits, while others are designed for individuals who may not qualify for other accounts.

Understanding the differences between these accounts, including extra benefits and features, help users evaluate their financial account needs effectively. For instance, foreign investors may prioritise accounts that support international transactions, while those in such nations with limited banking services may benefit from Basic Bank Accounts offering accessibility and inclusivity.

Standard current account

A Standard Current Account is the most common type, typically requiring a minimum average monthly balance to be maintained. These accounts allow for unlimited deposits and withdrawals, making them ideal for everyday banking needs. Most banks provide options that include features such as an arranged overdraft, which offers a safety net for unexpected expenses.

Whether you’re paying bills, transferring money, or making purchases, a standard current account offers the flexibility and convenience needed for efficient financial management. In stronger economies, these accounts are often viewed as the biggest determinant of accessible financial services for individuals.

Packaged current account

Packaged Current Accounts come with additional benefits, such as insurance, travel perks, or rewards, but typically require a monthly fee. To hold a packaged current account, you usually need to pay a certain amount into the account each month and be at least 18 years old.

For example, some banks give rewards for setting up direct debits and using their mobile app, creating an incentive for account holders to maximise the benefits. In such nations, where consumer expectations are high, these accounts cater to individuals seeking extra benefits for added convenience and perks.

Basic bank accounts

Basic Bank Accounts are designed for customers who don’t qualify for a standard bank account, often due to poor credit or other financial difficulties. These accounts provide essential banking services without the frills, ensuring accessibility during such times of financial challenges.

Examples include foundation accounts, which offer a safe and straightforward way to manage finances without the risk of overdrafts. Basic bank accounts help ensure that everyone has access to fundamental banking services, regardless of their credit history.

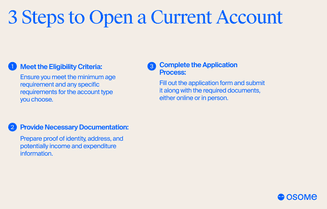

How To Open a Current Account?

Opening a current account is a straightforward process, but it’s important to understand the requirements and steps involved. Generally, individuals must be at least 18 years old, though some banks have other accounts for younger individuals, such as UK residents under 18 who may qualify for student accounts. Additionally, you should be aware of any minimum balance requirements imposed by the bank, as these can have a significant influence on the country's balance.

In stronger economies, banks often adopt stringent measures to verify applicants' identities and financial history.

Who can open a current account?

The eligibility criteria for opening a current account can vary. In the UK, the minimum age is typically 16, with specialist children’s accounts available from age 11. A UK resident may also be required to provide proof of identity and a credit file to verify their financial history.

Some banks may require a minimum initial deposit or adherence to current account measures, so if you're a UK resident, it’s important to check these details before proceeding. Knowing who can open a current account helps in selecting the right account for your specific needs.

What do you need to open a current account?

To open a current account, you typically need to provide proof of identity and address, such as a passport or utility bill. Additionally, personal information like income and expenditure may be required. For specific accounts, such as student accounts, additional documentation like an acceptance letter or UCAS code may be necessary.

Existing customers may find the process easier by using their current debit card for verification. Those opening accounts in other countries might encounter stringent measures for documentation and compliance. Being prepared with the necessary documents ensures a smooth and efficient account opening process.

How To Manage Your Current Account?

Effective management of your current account involves regular monitoring, budgeting, and understanding the fees associated with your account. Reviewing your account statements regularly can help you track spending and identify any unauthorised transactions. Keeping track of your financial account and monitoring when imports decline can also provide insights into your overall financial health. Utilising budgeting tools and setting up alerts for low balances can prevent overspending.

Additionally, choosing a current account with user-friendly online banking features can make managing your finances more convenient. Such tools are especially useful during heightened uncertainty, helping you track and maintain a positive financial status.

Using online banking

Online banking offers the flexibility and convenience of managing your finances anytime, anywhere. With 24/7 access to your financial account information, you can easily track expenses, transfer funds, manage exchange rate fluctuations, and pay bills without visiting a physical branch. Online platforms can also help account holders understand current account measures to stay financially secure.

Online banking platforms also provide features like balance monitoring, transaction histories, and the ability to set up automatic payments. Many banks boast mobile banking apps that include budgeting tools and instant transaction notifications, enabling account holders to avoid unarranged overdraft fees and prevent financial pitfalls. These features, paired with tools that make imports in decline more manageable, can strengthen your overall financial strategy.

Mobile banking features

Mobile banking apps bring the bank to your fingertips, allowing you to manage your account securely from your smartphone or tablet. These apps provide real-time updates on your current account balance, making it easier to track spending and view transaction histories. By incorporating tools to manage current account deficit concerns when a nation's net foreign assets shrink, users can stay informed about their financial health.

Additionally, mobile banking apps often feature budgeting tools and alerts for low balances, helping you manage your finances effectively on the go. In cases where import volumes typically surge, these tools can offer insights into maintaining stability. By leveraging these features, you can stay on top of your financial health, avoid potential overdrafts, and reduce reliance on official reserves during financial fluctuations.

Overdraft options

Understanding your unarranged and arranged overdraft options is crucial for managing your current account. Arranged overdrafts allow you to borrow funds up to a pre-approved limit, usually at a lower or same rate compared to unarranged overdrafts.

In contrast, unarranged overdrafts occur when you spend more than your available balance without prior arrangement, often resulting in higher fees and interest charges. While arranged overdrafts offer a safer option for a net borrower, unarranged overdrafts can lead to significant financial penalties from the net lender and can negatively affect your credit rating.

Current Account Balance and Transactions

Keeping a close watch on your current account balance is essential for effective financial management. Regularly monitoring your balance helps prevent overdrafts and ensures you can manage your finances more efficiently.

Using tools like mobile banking apps and online banking platforms can make this process easier, providing you with instant access to your account information and transaction history.

Monitoring account balance

Monitoring your account balance is a vital aspect of managing your current account. Mobile banking apps often include features like alerts for low balances, which help you stay informed and avoid overdrafts. Instant notifications for transactions can also keep you updated on your current account activities, allowing you to manage your funds wisely and prevent potential financial pitfalls.

Utilising these tools helps you maintain a positive current account balance and ensures that you can avoid a negative current account balance.

Direct debits and standing orders

Direct debits and standing orders are essential tools for managing regular payments, especially in embattled nations with volatile domestic currency markets. Direct debits allow automatic payments to be taken from your account on scheduled dates, ensuring you never miss a due date and reducing the risk of late payments. On the other hand, standing orders are fixed payments set up by the account holder, providing control over regular outgoing transactions.

Current Account Deficits and Surpluses

Current account deficits and surpluses are crucial indicators of a country’s economic health. The current account balance reflects all economic transactions, including exports minus imports, net transfer payments, and trade facilitated by foreign investors. A current account deficit indicates that a country makes imports more than it exports, which can lead to higher foreign scrutiny and reliance on external financing.

Conversely, a current account surplus means that a country's exports increase beyond what it imports, acting as a net lender globally, which relates to net factor income.

Understanding current account deficit

A current account deficit occurs when a country’s net foreign assets shrink, often leading to deteriorating trade balance and reliance on foreign aid. Fluctuating exchange rates can also impact the trade balance, further widening the deficit. Increased investor scrutiny and greater reliance on foreign aid are common consequences of a current account deficit, highlighting the importance of maintaining a balanced trade relationship and making sure that the current account deficit decreases.

Countries with chronic current account deficits may face economic instability and financial challenges.

Understanding current account surplus

A current account surplus indicates that a country exports more than it imports, resulting in a positive trade balance. This surplus boosts exports and can help with curbing currency outflows, strengthening the nation’s financial position as the current account surplus increases. This helps maintain a positive current account balance and supports stronger economies. Additionally, the concept of exports minus imports plays a crucial role in understanding this balance.

While a surplus reflects a strong economic performance, it can also signal low domestic demand, potentially leading to economic stagnation if not managed properly. Knowing the implications of a current account surplus aids in formulating effective economic policies.

Special Considerations for Current Accounts

Current accounts often come with unique features tailored to individual needs. Packaged Current Accounts, for instance, may include benefits like travel and accident insurance or discounts on other financial products. Many banks offer unique perks such as everyday banking and cash deposit limits, which can add significant value to a current account.

Impact of exchange rates

Fluctuating exchange rates can have a significant impact on current accounts, leading to variations in the value of international transactions and import volumes. These fluctuations can affect the overall current account balance, influencing how much you pay or receive in foreign currencies.

Knowing how an exchange rate impacts your current account helps you make more informed decisions when engaging in international transactions, optimising your financial outcomes.

Credit history and current accounts

Your credit history plays a significant role in determining your eligibility to open and maintain a current account. A positive history can facilitate the opening and maintenance of a current account, while poor credit may restrict access to certain account services.

Current Account vs. Savings Account

Current accounts and savings accounts serve different financial purposes. Current accounts are primarily used for day-to-day financial transactions, offering features like direct debits for regular payments. In contrast, savings accounts are intended for accumulating funds and typically offer higher interest rates to incentivise saving.

Savings accounts often limit the number of withdrawals to promote saving, whereas current accounts provide more flexibility for frequent transactions. Many banks offer various types of savings accounts, including fixed-term options that restrict access to funds, making them ideal for long-term savings goals.

Need assistance with opening a bank account or registering a company in Hong Kong? Don't hesitate to contact us! Our team of professionals can help you streamline your financial operations and ensure your business is set up for success.

Summary

In summary, a current account is a vital tool for managing your daily finances. From understanding the different types of current accounts and their features, to effectively managing your account balance and transactions, this guide has covered all the essential aspects. By choosing the right current account and utilising available tools like online and mobile banking, you can enhance your financial management and avoid unnecessary fees. Whether you’re looking to open a new account or optimise your existing one, being informed and proactive is key to making the most of your current account.