How To Open a Bank Account in Hong Kong Online

- Modified: 25 February 2025

- 9 min read

- Starting a Company

Heather Cameron

Author

Heather is here to inform and inspire our readers. Boasting eight years in the world of digital marketing, working in diverse industries like finance and travel, she has experience writing for various audiences. As Osome’s resident copywriter, Heather crafts compelling content, including expert guides, helpful accounting tips, and insights into the latest fintech trends that will help entrepreneurs, founders and small business owners in Hong Kong take their businesses to the next level.

Opening a bank account in Hong Kong can be pivotal for individuals and businesses looking to establish a financial presence in one of Asia's leading financial hubs. Hong Kong offers a stable and efficient banking system, making it an attractive choice for both residents and non-residents. In this comprehensive guide, we'll walk you through the process to open an account in Hong Kong, including the necessary documents and options available. This subject guide will help you manage your funds effectively.

Key Takeaways

- Opening a bank account in Hong Kong requires company registration, key documents, and a local director in most cases.

- Traditional banks have strict requirements, while fintech alternatives offer faster and more flexible solutions.

- The process involves due diligence checks, which vary depending on the bank and business risk level.

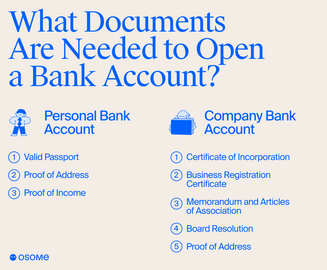

What Documents Are Needed To Open a Bank Account?

To open bank accounts in Hong Kong, whether it's a personal or business account, you'll need to provide certain documents and meet specific requirements. The exact requirements may vary slightly from one bank to another and for different types of bank accounts (such as a joint account or new account), but generally, you will need the following. In any case, remember to fill out the application form accurately and check if you are eligible for the account type you wish to open.

| Account Type | Required Documents |

| Personal bank account | - Valid passport or HKID (Hong Kong Identity Card/China Resident Identity Card) |

| - Proof of address (e.g., utility bills, bank statements, or rental agreements) | |

| - Proof of income (e.g., payslips, employment contracts, or source of funds documentation) | |

| Company bank account | - Certificate of Incorporation (from the Hong Kong Companies Registry) |

| - Business Registration Certificate (from the Inland Revenue Department) | |

| - Memorandum and Articles of Association | |

| - Board Resolution (authorising signatories, with handwritten signatures) | |

| - Proof of address (e.g., for the company’s registered address) |

Personal bank account

If you're an individual interested in a current or savings account opening, you will typically need the following documents to be eligible:

- Valid passport: You will need a copy of your valid passport with at least six months of validity remaining, or for HKID holders, your Hong Kong Identity Card or China Resident Identity Card.

- Proof of address: Hong Kong bank accounts require proof of your residential address. You can provide utility bills (e.g., electricity, water, or gas), bank statements, or rental agreements in your name confirming your address. Opening bank accounts online may also accept other official documents as proof of address, depending on the type of Hong Kong account holder.

- Proof of income: Depending on the bank's policies, you may be asked to provide proof of your source of income. This can include recent payslips, employment contracts, or other documents demonstrating a stable source of income. You may also need to demonstrate the origin of any new funds being deposited.

Simplify your company registration and banking setup with our expert assistance. We specialise in guiding businesses through the process, ensuring efficiency and compliance. Contact us today!

Company bank account

If you are interested in a company account opening, you'll need a set of business-related documents. The specific requirements can vary depending on the type and structure of your company, but here is the common documentation needed:

- Certificate of Incorporation: A copy of your company's Certificate of Incorporation issued by the Hong Kong Companies Registry. This document proves that your company is legally registered in Hong Kong.

- Business Registration Certificate: A Business Registration Certificate from the Inland Revenue Department confirms that your business is registered for tax purposes in Hong Kong and is important when opening bank accounts online.

- Memorandum and Articles of Association: These legal files govern your company's operations and are typically required by banks.

- Board Resolution: This is a resolution passed by the board of directors specifying authorised signatories. This document outlines who has the authority to operate the new account on behalf of the company. Ensure that each signatory provides a handwritten signature for verification.

- Proof of Address: You may need to provide documents confirming the business address, such as utility bills or rental agreements. Additionally, some banks might require a recent bank statement as part of the proof of address documentation.

Requirements for Non-residents

If you are a non-resident of Hong Kong, additional requirements may apply. You will need a copy of your valid visa or exit/entry permit for Hong Kong. Some banks may also require a detailed business plan outlining your company's activities and the purpose of opening bank accounts in Hong Kong, including any plans to trade in foreign currencies. Depending on your needs, you may require a multi-currency account, an account with wealth management features, or one with a low account maintenance fee.

Outsourcing to a company specialising in bank account opening can help you choose the best local bank based on your needs. Check with your chosen bank for the most up-to-date information on their account opening requirements. For example, some banks might require a minimum time deposit to open the account or might offer a cash rebate for maintaining a certain balance.

How To Open a Bank Account Online

Many banks in Hong Kong offer online banking services that are convenient. To open an account online, you will generally need to:

- Visit the bank's website and fill out the online application form.

- Upload scanned copies of the required documents.

- Complete identity verification through video call or other methods.

- Wait for approval, after which you will receive your account details.

It can be a time-saving option, especially for non-residents who want to manage their finances efficiently and benefit from features such as cash rebate offers and a favourable exchange rate.

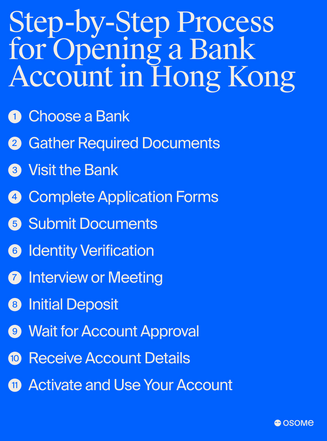

Step-by-Step Process for Opening a Bank Account in Hong Kong

Opening a bank account in Hong Kong involves a series of steps and documentation, whether you're opening a personal or business account. Here's a general process:

- Choose a bank and consider account types, fees, services, and accessibility.

- Gather the necessary documents, including an official ID (passport or HKID card for HKID holders), proof of address, and a valid visa.

- Visit the bank or apply online, depending on the bank's requirements and your needs.

- Complete application forms by providing personal information and details about your source of existing and new funds.

- Submit documents, ensuring all documents are clear and in order.

- Comply with the bank's Know Your Customer (KYC) procedures for identity verification.

- Make an initial time deposit and check the specific amount required by the bank.

- Wait for account approval.

- Receive account details, including your account number and relevant information, upon approval.

- Activate and start using your individual or joint account via mobile banking or by visiting the branch to conduct transactions.

How Much Does It Cost To Open a Bank Account in Hong Kong?

The cost of a bank account opening can vary depending on several factors, including the type of account you are opening, the bank you choose, and the specific features you require. For example, some banks may offer a cash rebate for maintaining a certain balance or favourable exchange rates for international transactions. Additionally, some banks may require an initial time deposit to secure certain account features.

It's important to note that the specific procedures and requirements may vary between banks and can change over time. Therefore, contacting the bank you intend to open an account with for the most up-to-date information and guidance on the opening process is essential.

Personal bank account

- Account maintenance fees: Many banks in Hong Kong offer basic current or savings account with no monthly maintenance fees. However, some premium or specialised accounts may have maintenance fees and minimum balance requirements. It is essential to review the important notice provided by the bank regarding these fees.

- Minimum deposit: Some banks may require an initial deposit for an account opening. The minimum time deposit account amount can vary, so check with the specific bank for their requirements.

- Transaction fees: Personal accounts may have transaction fees for certain activities, such as wire transfers, foreign currency exchanges, and ATM withdrawals at non-affiliated ATMs. Be aware of the exchange rate implications when conducting foreign currency transactions.

- Debit or credit card fees: If you request a debit, credit, or ATM card associated with your account, there may be annual fees or issuance fees for these cards. Some banks may offer cash rebate incentives for using these cards.

Business bank account

- Account maintenance fees: Business bank accounts in Hong Kong often have monthly maintenance fees, which can vary based on the type of account and the bank you choose.

- Initial deposit: Similar to personal accounts, business accounts may require an initial deposit, and the minimum deposit amount can vary.

- Transaction fees: Business accounts typically have transaction fees for activities like wire transfers, foreign currency transactions, and electronic fund transfers. Always check with the regulatory authority for updated guidelines on these fees.

- Checks and chequebooks: If your business requires checks or chequebooks, fees may be associated with ordering and using them.

- Additional services: The cost of additional services, such as business loans, trade finance, and merchant services, can vary based on your specific needs and the bank's pricing structure. It is advisable to consult with a dedicated team at the bank to understand the details.

- Business registration and compliance costs: You'll need to provide certain company documents, and there may be costs associated with obtaining and maintaining these documents, such as the Business Registration Certificate. Companies like Apple Inc. often have higher compliance costs due to regulatory requirements.

- Corporate debit or credit cards: If your business needs corporate debit or credit cards, there may be fees for card issuance and annual maintenance.

It's essential to thoroughly review the fee schedules and terms and conditions of the bank you choose to understand the costs associated with your account. Additionally, consider comparing the offerings of different banks in Hong Kong to find the one that best suits your financial needs and budget.

Remember that some Hong Kong banks may offer promotional offers, fee waivers for a certain period, or discounts on specific services, so it's worth exploring these options to potentially reduce your initial and ongoing banking costs. Make sure to review any related risk factors, past performance and likely future performance of the bank's offers.

Which Bank Should I Choose to Open a Bank Account?

Osome is partnered with the most popular banks in Hong Kong that specialise in supporting SMEs and ecommerce businesses. We also provide exclusive discounts and benefit programmes for our existing and new customers.

When choosing a bank in Hong Kong, consider the types of current accounts available and if they meet your needs, whether for personal, business, or foreign currency use. Compare fees and charges to ensure they fit your usage patterns. Evaluate the bank's services, such as online banking, mobile app services, and investment options like mutual funds. Consider the accessibility of branches and ATMs, especially if you prefer in-person services. If you need international services, choose a bank with a strong global presence. Assess the bank's digital banking capabilities and customer support. Finally, check the bank's requirements for opening an account, including minimum time deposits and documentation.

| Bank | Remote Account Opening | Mobile Banking | Multi-Currency Support | No Monthly Fees | Ecommerce Integration | Global Presence |

| ABC Banking Corp | ✅ | ✅ | ❌ | ❌ | ❌ | ✅ |

| Citibank | ❌ | ✅ | ✅ | ❌ | ❌ | ✅ |

| Transwap | ✅ | ✅ | ✅ | ✅ | ❌ | ✅ |

| Currenxie | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Airwallex | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| DBS | ❌ | ✅ | ✅ | ❌ | ❌ | ✅ |

| HSBC HK | ❌ | ✅ | ✅ | ❌ | ❌ | ✅ |

ABC Banking Corporation

ABC Banking Corporation provides a valuable and preferred banking experience for your business in Hong Kong and personal needs. It is the only traditional bank that allows for remote account opening, alongside convenient mobile banking services.

Citibank

Citibank ranks as the number one bank for customer experience and provides consumers, corporations, governments, and institutions with a full range of financial and investment products, services, and other current accounts tailored to your needs, including convenient mobile banking and internet banking services.

Transwap

TranSwap accounts give users instant access to local Hong Kong dollars, EUR, GBP, and SWIFT accounts in 34 markets without any set-up or maintenance fees, alongside convenient mobile account opening.

Currenxie

With a multi-currency Global Account, businesses have account numbers in every major market, so payments are fast and convenient. Enjoy the added benefits of mobile account opening and internet banking for seamless financial management. Their app is available for both Android version (Google Play) and iOS users.

Airwallex

Open your business current account in Hong Kong with no sign-up fee and zero monthly account fees. Enjoy seamless integration with ecommerce platforms like Amazon, Shopify, and benefit from convenient mobile banking services. Airwallex's services are subject to regulatory requirements in different regions.

DBS

DBS delivers a new kind of banking that is simple and seamless so that customers have more time to spend on the people or things they care about. With DBS, customers can also benefit from convenient mobile account opening and robust internet banking solutions.

HSBC HK

HSBC is a premier banking and financial institution in Hong Kong, serving more than 40 million existing customers throughout global business areas. It has its own HSBC HK mobile app (Google Play and Apple Inc) with full access to all the mobile banking services, investment products, and investment services. The HSBC name and logo are a registered service mark.

Summary

From a bank statement delivered consistently on time to being able to effortlessly send cash or money back to your home country, the right account will depend on what your needs are, both personal and professional. It's best to keep ease of service, application processing time, and overall customer experience at the front of mind when choosing, as well as a bank that offers mobile banking and account opening options that will work for your business operations. To save time and stress, consider outsourcing a service that can fast-track you with the best banks in Hong Kong.

FAQ

How to make a bank account online in Hong Kong?

In Hong Kong, you can easily open a bank account online by visiting your chosen bank's website, filling out the application, and submitting necessary identification documents. Many banks offer digital onboarding for both local and foreign individuals.

How to transfer money to another bank account in Hong Kong?

To transfer money between accounts in Hong Kong, use the bank's online platform or mobile app. You’ll need the recipient’s account details and may be required to provide a reason for the transfer. Some banks also allow international transfers.

Can I open a bank account in a foreign country?

Yes, it’s possible to open a bank account in a foreign country, though you will typically need to visit in person or submit documents online, such as proof of identity, proof of address, and sometimes a reference from your home bank.

How many digits are there in a bank account number in Hong Kong?

Bank account numbers in Hong Kong typically range from 10 to 12 digits, depending on the bank. This number includes the branch code and account number.

Should married couples have joint bank accounts?

It depends on the couple’s preference. A joint account can be useful for managing shared expenses, but many couples prefer to keep separate accounts for financial independence while maintaining a joint account for mutual savings.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?