How To Open a Bank Account in Hong Kong Online

- Modified: 18 December 2025

- 9 min read

- Starting a Company

Heather Cameron

Author

Heather is here to inform and inspire our readers. Boasting eight years in the world of digital marketing, working in diverse industries like finance and travel, she has experience writing for various audiences. As Osome’s resident copywriter, Heather crafts compelling content, including expert guides, helpful accounting tips, and insights into the latest fintech trends that will help entrepreneurs, founders and small business owners in Hong Kong take their businesses to the next level.

Opening a bank account in Hong Kong can be pivotal for individuals and businesses looking to establish a financial presence in one of Asia's leading financial hubs. Hong Kong offers a stable and efficient banking system, making it an attractive choice for both residents and non-residents. In this comprehensive guide, we'll walk you through the process to open an account in Hong Kong, including the necessary documents and options available. This subject guide will help you manage your funds effectively.

Key Takeaways

- Opening a bank account in Hong Kong requires company registration, key documents, and a local director in most cases.

- Traditional banks have strict requirements, while fintech alternatives offer faster and more flexible solutions.

- The process involves due diligence checks, which vary depending on the bank and business risk level.

What Documents Are Needed To Open a Bank Account?

To open bank accounts in Hong Kong, whether it's a personal or business account, you'll need to provide certain documents and meet specific requirements. The exact requirements may vary slightly from one bank to another and for different types of bank accounts (such as a joint account or new account), but generally, you will need the following. In any case, remember to fill out the application form accurately and check if you are eligible for the account type you wish to open.

Personal bank account

If you're an individual interested in a current or savings account opening, you will typically need the following documents to be eligible:

- Valid passport: You will need a copy of your valid passport with at least six months of validity remaining, or for HKID holders, your Hong Kong Identity Card or China Resident Identity Card.

- Proof of address: Hong Kong bank accounts require proof of your residential address. You can provide utility bills (e.g., electricity, water, or gas), bank statements, or rental agreements in your name confirming your address. Opening bank accounts online may also accept other official documents as proof of address, depending on the type of Hong Kong account holder.

- Proof of income: Depending on the bank's policies, you may be asked to provide proof of your source of income. This can include recent payslips, employment contracts, or other documents demonstrating a stable source of income. You may also need to demonstrate the origin of any new funds being deposited.

Simplify your company registration and banking setup with our expert assistance. We specialise in guiding businesses through the process, ensuring efficiency and compliance. Contact us today!

Company bank account

If you are interested in a company account opening, you'll need a set of business-related documents. The specific requirements can vary depending on the type and structure of your company, but here is the common documentation needed:

- Certificate of Incorporation: A copy of your company's Certificate of Incorporation issued by the Hong Kong Companies Registry. This document proves that your company is legally registered in Hong Kong.

- Business Registration Certificate: A Business Registration Certificate from the Inland Revenue Department confirms that your business is registered for tax purposes in Hong Kong and is important when opening bank accounts online.

- Memorandum and Articles of Association: These legal files govern your company's operations and are typically required by banks.

- Board Resolution: This is a resolution passed by the board of directors specifying authorised signatories. This document outlines who has the authority to operate the new account on behalf of the company. Ensure that each signatory provides a handwritten signature for verification.

- Proof of Address: You may need to provide documents confirming the business address, such as utility bills or rental agreements. Additionally, some banks might require a recent bank statement as part of the proof of address documentation.

Requirements for Non-residents

If you are a non-resident of Hong Kong, additional requirements may apply. You will need a copy of your valid visa or exit/entry permit for Hong Kong. Some banks may also require a detailed business plan outlining your company's activities and the purpose of opening bank accounts in Hong Kong, including any plans to trade in foreign currencies. Depending on your needs, you may require a multi-currency account, an account with wealth management features, or one with a low account maintenance fee.

Outsourcing to a company specialising in bank account opening can help you choose the best local bank based on your needs. Check with your chosen bank for the most up-to-date information on their account opening requirements.

How To Open a Bank Account Online

Many banks in Hong Kong offer online banking services that are convenient. To open an account online, you will generally need to:

- Visit the bank's website and fill out the online application form.

- Upload scanned copies of the required documents.

- Complete identity verification through video call or other methods.

- Wait for approval, after which you will receive your account details.

It can be a time-saving option, especially for non-residents who want to manage their finances efficiently and benefit from features such as cash rebate offers and a favourable exchange rate.

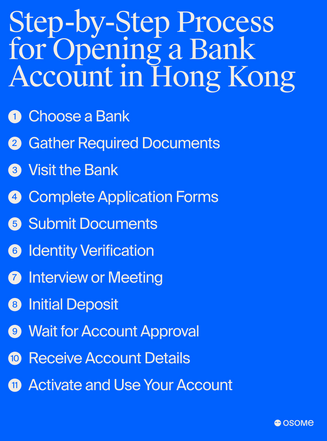

Step-by-Step Process for Opening a Bank Account in Hong Kong

Opening a bank account in Hong Kong involves a series of steps and documentation, whether you're opening a personal or business account. Here's a general process:

- Choose a bank and consider account types, fees, services, and accessibility.

- Gather the necessary documents, including an official ID (passport or HKID card for HKID holders), proof of address, and a valid visa.

- Visit the bank or apply online, depending on the bank's requirements and your needs.

- Complete application forms by providing personal information and details about your source of existing and new funds.

- Submit documents, ensuring all documents are clear and in order.

- Comply with the bank's Know Your Customer (KYC) procedures for identity verification.

- Make an initial time deposit and check the specific amount required by the bank.

- Wait for account approval.

- Receive account details, including your account number and relevant information, upon approval.

- Activate and start using your individual or joint account via mobile banking or by visiting the branch to conduct transactions.

With increasingly strict compliance checks in Hong Kong, especially around anti-money laundering, working with a local accounting firm can simplify everything from company registration to securing a business bank account.

Corporate Secretary Manager

How Much Does It Cost To Open a Bank Account in Hong Kong?

The cost of opening a bank account in Hong Kong depends on whether you are opening a personal or business account, the bank you choose, and the services you require. While banks rarely advertise a single fixed price, most fees fall within predictable ranges. Presenting these costs transparently helps users set realistic expectations before starting the application process.

Below is a practical cost overview based on common requirements across major Hong Kong banks.

Personal bank account costs

| Cost item | Typical range (HKD) | Notes |

| Account opening fee | 0 | Most retail banks do not charge an opening fee. |

| Monthly maintenance fee | 0–100 | Often waived if minimum balance is maintained. |

| Minimum balance requirement | 0–10,000 | Falling below may trigger monthly fees. |

| Initial deposit | 0–10,000 | Some banks require an initial or time deposit. |

| Local transfers | 0 | Usually free via online banking. |

| International transfers | 100–300 per transfer | Fees vary by destination and currency. |

| Debit card issuance | 0–200 | Annual fees may apply for premium cards. |

Personal accounts are generally low-cost, with most fees linked to international transactions or premium features rather than basic account usage.

Business bank account costs

Business bank accounts are more expensive due to compliance checks and ongoing account servicing requirements.

| Cost item | Typical range (HKD) | Notes |

| Account opening fee | 1,000–5,000 | Some banks waive this for existing customers. |

| Monthly maintenance fee | 200–500 | May be waived if balance thresholds are met. |

| Minimum balance requirement | 50,000–500,000 | Varies significantly by bank and account tier. |

| Initial deposit | 10,000–100,000 | Often linked to minimum balance requirements. |

| Local transfers | 0–50 per transaction | Fees may apply for manual processing. |

| International transfers | 150–400 per transfer | FX margins usually apply in addition. |

| Chequebook issuance | 200–500 | Optional and charged separately. |

| Corporate debit or credit cards | 300–1,500 per year | Depends on card type and limits. |

Additional costs to consider

| Cost item | Typical range (HKD) | Notes |

| Business Registration Certificate | 2,200+ per year | Mandatory government fee. |

| Certified company documents | 300–1,000 | May be required by the bank. |

| Ongoing compliance support | Varies | Includes company secretary and filings. |

Remember that some Hong Kong banks may offer promotional offers, fee waivers for a certain period, or discounts on specific services, so it's worth exploring these options to potentially reduce your initial and ongoing banking costs.

Which Bank Should I Choose to Open a Bank Account?

When choosing a bank in Hong Kong, consider the types of current accounts available and if they meet your needs, whether for personal, business, or foreign currency use. Compare fees and charges to ensure they fit your usage patterns. Evaluate the bank's services, such as online banking, mobile app services, and investment options like mutual funds. Consider the accessibility of branches and ATMs, especially if you prefer in-person services. If you need international services, choose a bank with a strong global presence. Assess the bank's digital banking capabilities and customer support. Finally, check the bank's requirements for opening an account, including minimum time deposits and documentation.

| Bank | Remote Account Opening | Mobile Banking | Multi-Currency Support | No Monthly Fees | Ecommerce Integration | Global Presence |

| ABC Banking Corp | ✔ | ✔ | — | — | — | ✔ |

| Citibank | ✔ | ✔ | ✔ | — | — | ✔ |

| Transwap | ✔ | ✔ | ✔ | ✔ | — | ✔ |

| Currenxie | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Airwallex | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| DBS | — | ✔ | ✔ | — | — | ✔ |

| HSBC HK | — | ✔ | ✔ | — | — | ✔ |

ABC Banking Corporation

ABC Banking Corporation provides a valuable and preferred banking experience for your business in Hong Kong and personal needs. It is the only traditional bank that allows for remote account opening, alongside convenient mobile banking services.

Citibank

Citibank ranks as the number one bank for customer experience and provides consumers, corporations, governments, and institutions with a full range of financial and investment products, services, and other current accounts tailored to your needs, including convenient mobile banking and internet banking services.

Transwap

TranSwap accounts give users instant access to local Hong Kong dollars, EUR, GBP, and SWIFT accounts in 34 markets without any set-up or maintenance fees, alongside convenient mobile account opening.

Currenxie

With a multi-currency Global Account, businesses have account numbers in every major market, so payments are fast and convenient. Enjoy the added benefits of mobile account opening and internet banking for seamless financial management. Their app is available for both Android version (Google Play) and iOS users.

Airwallex

Open your business current account in Hong Kong with no sign-up fee and zero monthly account fees. Enjoy seamless integration with ecommerce platforms like Amazon, Shopify, and benefit from convenient mobile banking services. Airwallex's services are subject to regulatory requirements in different regions.

DBS

DBS delivers a new kind of banking that is simple and seamless so that customers have more time to spend on the people or things they care about. With DBS, customers can also benefit from convenient mobile account opening and robust internet banking solutions.

HSBC HK

HSBC is a premier banking and financial institution in Hong Kong, serving more than 40 million existing customers throughout global business areas. It has its own HSBC HK mobile app (Google Play and Apple Inc) with full access to all the mobile banking services, investment products, and investment services. The HSBC name and logo are a registered service mark.

How Osome Can Help with Hong Kong Business Banking

Osome makes it easy for entrepreneurs to open a business bank account in Hong Kong, complementing our company incorporation and accounting services. We assist with both traditional banks, such as HSBC, DBS, Hang Seng, and ABC Bank, and digital banking partners, including Aspire and Airwallex, providing a smooth, guided process that saves time and ensures compliance.

Summary

From a bank statement delivered consistently on time to being able to effortlessly send cash or money back to your home country, the right account will depend on what your needs are, both personal and professional. It's best to keep ease of service, application processing time, and overall customer experience at the front of mind when choosing, as well as a bank that offers mobile banking and account opening options that will work for your business operations. To save time and stress, consider outsourcing a service that can fast-track you with the best banks in Hong Kong.