Sole Proprietorship in Hong Kong: What Is It, How To Register and Apply

- Modified: 17 May 2024

- 8 min read

- Starting a Company

Gabi Bellairs-Lombard

Business Writer

Gabi creates content that inspires. She's spent her career writing compelling website copy, and now she specialises in product marketing copy. As the voice of our products and features, Gabi makes complex business finance and accounting topics easy to understand. Her top priority is ensuring that her words impact and inspire her readers.

Registering a sole proprietorship is quick to do, requires low maintenance, and offers good tax advantages. Discover everything you need to know about sole proprietorship business registration in Hong Kong with this easy-to-follow guide.

Sole Proprietorship: Key Facts

Let’s start with a few key facts:

- A sole proprietorship is the best form of business structure. It’s a non-incorporated entity. You can set one up quickly.

- There’s no minimum capital investment required to apply for a sole proprietorship.

- Because it isn’t a separate legal entity, any debt, liability, or lawsuit can be extended to you personally due to unlimited liability. Your personal assets (like your home and savings) may not be protected.

- A sole proprietor must register with the Business Registration Office at the Inland Revenue Centre.

- Sole proprietors must choose a unique business name, and the name must include the business owner’s name.

- When it comes to tax, any profits from your activities will be included on your individual return and taxed at a fixed rate of 15%. You don’t file a separate business return. Be sure to use reliable accounting services to help you with this!

- It can be harder to get a loan or secure funding under this type of business structure.

Looking to register your company hassle-free? Our company registration services ensure compliance and smooth setup, allowing you to focus on your business growth.

Advantages and Disadvantages of a Sole Proprietorship

The primary advantages are the ease of set-up and the tax benefits you’ll enjoy. There are clear disadvantages to consider, particularly around your personal exposure to risk.

Advantages:

- Easy to start: There’s not much red tape and no capital requirements.

- Full control: There is only one owner calling the shots — that’s you.

- Access to profits: All profits generated belong to you as the business owner.

- No double taxation: Profits for this business structure are taxed as part of your individual income, without being taxed at a company rate or on any dividends.

- Flat tax rate: A sole proprietorship in Hong Kong is taxed at a fixed rate of 15% — lower than corporate rates.

- Sole proprietorships may qualify for tax credits such as work-from-home expenses.

Disadvantages:

- Unlimited liability: Under this business structure, you are personally liable for all losses, expenses, liabilities, claims, and personal assets. This is why many sole proprietors choose to convert to a private limited company.

- Tax deductions: Owners of sole proprietorships cannot deduct business expenses against their taxable income.

- Credibility: It might be difficult to be taken seriously when you’re competing against a larger, incorporated company.

- Financial confusion: Without a clear bookkeeping system, it can confuse which money belongs to you or the business.

- Investors: It may be difficult for a sole proprietor to raise financing due to the limited liability structure.

How To Set Up a Sole Proprietorship: Registration Procedure

Sole proprietorship business registration is simple in Hong Kong. You must register within one month of starting to trade. These are the steps to follow:

1. Choose a name

- Choose something that’s unique and isn’t trademarked.

- Sole proprietorships can register with an English name, a Chinese name, or both languages. Note that with a Chinese name, you may include English letters but not English words.

- No misleading information should be conveyed within the name, such as suggesting limited liability or connections with government or public organisations.

2. Register With the Business Registration Office at the Inland Revenue Center

3. After you apply for your sole proprietorship, you’ll receive a Business Registration Certificate. This usually takes 24 hours, provided there are no problems with your documentation or chosen name. You must display this certificate prominently within your premises.

4. Once you have a sole proprietorship business registration certificate, you can apply for your tax file number from the Inland Revenue Department.

5. Depending on the nature of your planned activities, you may be required to apply for specific licenses or permits from relevant governmental bodies.

Documents Required for a Sole Proprietorship Registration

These are the documents required to register a sole proprietorship business in Hong Kong:

- Proof of identity (e.g. HKID) of the applicant. Non-residents can use a certified copy of their passport or identity card issued by the relevant governmental authority.

- An application form (Form 1a), including your proposed name.

You’ll also be required to pay the applicable registration fee and levy.

Anna has always been a foodie and wanted to know what it's like to start a business in Hong Kong. She turns her hobby into reality and becomes the proud owner of "Anna's Bakery."

Anna gathers the necessary documents and submits a registration form to the Inland Revenue Department. She also applies for a bakery license from the Department of Food and Environmental Hygiene.

Anna opens her bakery in the Central District and begins selling her baked goods to locals and tourists alike. She keeps track of her finances and pays taxes accordingly. She chooses to run the business single-handedly, without hiring any employees.

"Anna's Bakery" quickly gains popularity among local food lovers, who appreciate the fresh and delicious baked goods.

Registering a Sole Proprietorship for Foreigners

Registering a sole proprietorship as a foreigner in Hong Kong is not difficult. There are just additional measures to consider.

The first step is to register as per the steps above. To do that, though, your business has to be operating in Hong Kong. You can't register a sole proprietorship if there are no local operations. The Inland Revenue Department requires evidence of this.

Non-residents must provide an office address, a business description, the nature of activities to be carried out and a start date.

As a foreign owner, not based in Hong Kong, you must appoint a local agent to represent you. The agent must show an appointment letter, a Hong Kong identity card, and a residential address.

Once registered, you'll need to follow the standard procedural steps of applying for the appropriate license(s).

Post Registration Formalities

Once registered, there are a few formalities to check before you can get going with your business operations. Two things to consider are whether you need to apply for a license and where to open a bank account.

Apply for a Business License

After registering with the Inland Revenue Department, you may find that you’re still required to obtain a business license before you can start trading.

In Hong Kong, most types of businesses are required to obtain a license, including but not limited to:

- Retail

- Service

- Manufacturing

- Financial services

- Educational institutions

- Import/Export

- Travel agencies

- Food and beverage

- Restaurants

- Ecommerce businesses

The specific requirements for obtaining a business license vary depending on the type and scope of activities. It’s recommended to check with the relevant government departments of your industry for further details.

Opening a Business Bank Account as a Sole Proprietor

One of the other things you should do is open a business bank account. Keeping your finances separated from your personal money will go a long way in helping you manage your cash flow.

There are a number of both local and international banks in Hong Kong to choose from, including:

- HSBC

- Bank of China

- Hang Seng Bank

- Standard Chartered Bank

- Back of East Asia

- DBS Bank

- OCBC Wing Hang Bank

It's best to compare the services and bank fees across each bank before choosing one.

Some banks may require the owner to be physically present to open a bank account.

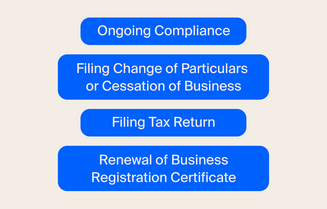

Ongoing Compliance

Business ownership always requires ongoing compliance. You'll be obliged to update the Internal Revenue Department of any changes, file annual tax returns and renew your business registration certificate. It's important to stay on top of these requirements to keep in good standing with the IRD.

Filing Change of Particulars or Cessation of Business

Sole proprietorships are required to keep the Internal Revenue Department updated on any changes to their business information and status. These can include changes in:

- Your business address

- Business name

- Nature of operations

- Ownership

All sole proprietorships must notify the IRD of any changes within one month of any changes, in writing.

Filing Tax Return

For sole proprietorships, like all businesses, a tax return must be submitted annually. The tax year runs from 1 January to 31 December each year in Hong Kong. Once you receive your tax return filing notification from the Internal Revenue Department, you have one month from the issue date to file your return.

If you’ve recently registered, expect to wait around 18 months before you receive this notification from the IRD for the first time.

If your annual business revenue is less than HKD $2 million, you are not required to submit any financial statements with your return. But you are still required to prepare them. Your tax return must reflect the accuracy of your financial statements and supporting documentation. All these financial records should be stored in case the IRD wants to audit your return.

If your annual business revenue exceeds HKD $2 million, you’re also required to submit a certified copy of your Profit & Loss Statement and Balance Sheet together with your return, as well as the calculations and supporting documents used to arrive at your final tax figure.

Renewal of Business Registration Certificate

In Hong Kong, a Business Registration Certificate is valid for either one or three years from the date of issue. Sole proprietorships must renew their registration annually (if validity is one year) or every three years (if applicable). Renewal must be done one month before the expiry date.

You can renew your certificate by submitting a renewal application and paying the relevant fees to the Inland Revenue Department (IRD).

FAQ

What taxes do sole proprietors pay?

Sole proprietors declare their profits on their individual tax returns and pay a flat rate of 15% of net profits. The owner may also be liable for other taxes, such as salary tax.

What is an example of a sole proprietorship?

A good example is any one person who is the owner and operator of their own small business. This could be a graphic designer freelancing under her own name, providing services to other companies. Another example could be a small retail store run by a single owner.

What are the documents required for sole proprietorship Hong Kong registration?

The documents required for sole proprietorship Hong Kong registration include:

- Proof of identity (e.g. HKID) of the applicant.

- If you're a non-resident, you can use a certified copy of a passport or identity card issued by the relevant governmental authority.

- A registration application form (Form 1a), including your proposed name.

Why register a sole proprietorship in Hong Kong?

There are clear benefits to registering, including:

- A quick, simple process

- A low, fixed tax rates

- Less red tape and paperwork

- Being able to trade under a formal name

Choosing a sole proprietorship is a great starting point for anyone considering starting a small business in Hong Kong.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?