- Osome Blog SG

- Angels and Ventures in Singapore: Who To Pitch Your Startup Right Now

Angels and Ventures in Singapore: Who To Pitch Your Startup Right Now

- Modified: 5 May 2025

- 9 min read

- Running a Business

Osome Content Team

VIP Contributor

Osome has been collaborating with 25 authors from 6 countries. We embrace diversity and are proud that lawyers, founders, journalists, and financial analysts choose to work with us. Together, they produce content that provides Singapore readers with practical, professional, and insightful business guidance.

If you’re an early-stage startup looking for venture capital, Singapore is the place to go. Southeast Asia’s tech mecca is now home to more than 150 VC funds, not speaking of numerous angel investors, with venture funding increased more than ten times over the past six years to S$ 14.3 billion in 2018 (according to Enterprise Singapore, a government agency supervising the development of the startup ecosystem in the city-state).

And if you're only looking at a possibility to register your business, check out our guide on how to start a business in Singapore, we'd be glad to help you follow through with your amazing ideas!

Here is a list of top venture capital firms and angel investors in Singapore to look for early-stage startup fundraising and memo on how to choose the right investors.

MEMO: Angel investors vs. Venture Capital firms

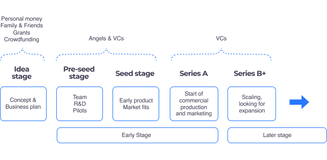

Depending on the stage your Singapore business is in, you might seek funding from an angel or a venture capitalist.

How Is Aangel Investing Different Than Venture Capital?

1 Different investors

Angel investors, sometimes known as business angels, are typically wealthy individuals, while Venture Capitalists (VCs) are professional fund managers.

2 Different source of funds

Angel investors would normally use their own money to fund the startups they consider interesting and potentially profitable. Venture capitalists use institutional money from college endowments, corporations, pension funds and foundations.

3 Different stage of funding

Angel investors would be helpful in the very beginning: they usually invest in the pre-seed and seed stages funding late-stage technical development and early market entry. Simply put: angels are the ones who would take on the risk of a brand new firm.

Venture capitalists are more eager to invest in a startup with a proven track record and get involved during later stages: they would fund more developed companies, depending on the focus of the VC firm. The larger and renowned VCs may not even enter until series D.

4 Different sum of funds

The business angel usually invests a relatively small amount of money — between S$ 35,000 and S$ 140,000. The VC firm’s financial muscles are way bigger.

5 Different responsibility

Angel investors risk their own money, while venture capitalists hold a fiduciary or trust responsibility to make a good investment that will earn a high return. That is why venture capitalists would demand board positions and veto rights to have the grip over the company's strategy and operations.Given that they have a fiduciary responsibility to their limited partners, they would demand a due diligence of a start-up business. Some angels don’t conduct any due diligence at all.

6 Different help

Angel investors are mostly there for startups to offer financial support. They might as well provide some counselling or even get you in touch with some necessary contacts, but that would be their good will only, not an obligation.

Unlike them, it is a VC firms’ role to help you build a successful business, which is where they add real value. They would offer not just funding but also advice on increasing your profitability.

Keep in mind it’s no pro bono: with both venture capitalists and angel investors, you are giving away part of the equity (ownership) in your firm.

Now when the difference between angel investors and VCs is clear, let’s see who’s handing out cash here.

Angel Investors in Singapore

Koh Boon Hwee

Type: angel investor

Stage: Pre-seed/Seed

Industries: automotive, consumer tech, business software, media services, etc.

Recent investments:

- Solarhome, a startup that sells solar power systems to households with no access to electricity

- Shohoz, a Bangladesh-based online ridesharing and ticketing platform, DocDoc, an online platform that helps patients find doctors and medical care in Southeast Asia

- Igloohome, a smart locker maker

Huang Shao-Ning and Lim Der Shing

Type: angel investors

Stage: Pre-seed/Seed

Industries: various (28 startups and VCs)

Recent investments:

- Motorist.sg, a Singapore's leading AutoConcierge platform

Extra: husband and wife, they began as co-founders of JobsCentral, a job search startup, and now run AngelCentral, an angel investment community that funds and educates startups in Singapore.

Royston Tay

Type: angel investor

Stage: Pre-seed/Seed

Industries: fintech, IT, business software, AI, retail, edutech

Recent investments:

- 99.co, Singapore’s largest geo-spatial search engine for real estate

- MoneySmart, a fintech startup offering tools to compare plans and rates for credit cards, travel and car insurance, home loans, etc.

- Koobits, an online maths learning platform.

Extra: Royston Tay is the vice president and general manager of messaging at Zendesk, a leading cloud-based customer service platform. In 2007 he co-founded Zopim, a Live Chat software company, grew it into a business serving 18,000 clients in more than 150 countries and eventually sold it to Zendesk for S$ 41.2 million.

Angel Networks

There are also networks to look for a business angel investor for your business. Business Angel Network Southeast Asia (BANSEA), Asia’s oldest angel investor network, helps startups in the seed stage to meet business angels. BANSEA invests in companies that offer exceptional opportunities for high returns on investment, which usually involves early-stage ventures with a high growth potential, either in a developing market (especially in emerging markets) or in an existing market with international expansion potential.

BANSEA and Angel Central are reputable angel groups to approach. They both offer education and have regular pitching events for selected startups.

Venture capital firms in Singapore

500 Durian

Type: a seed fund investing S$ 70,000 to S$ 415,000 in entrepreneurs based in or targeting Southeast Asia.

Stage: Pre-seed / Seed

Sectors: various (more than 150 tech startups in the region)

Portfolio and recent investments:

- OxfordCaps, a student housing startup

- Abilionveg, a plant-based product review platform

Extra: Branch of Silicon Valley-based venture capital and accelerator

Play Ventures

Type: early-stage VC fund

Stage: Pre-seed / Seed

Sectors: gaming and gaming services, incl. mobile and PC, streaming, marketing, user acquisition, data, and game studios

Portfolio and recent investments:

- Helsinki-based studios Reworks and Redhill Games

Extra: Play Ventures hopes to do six to eight investments a year, potentially making it one of the most active game investors.

SeedPlus

Type: VC fund investing S$ 500,000 to S$ 1 million in early-stage companies

Stage: Pre-seed / Seed

Sectors: SaaS, mobile, fintech, AI, network security

Portfolio and recent investments:

- HOMI SmartHome, a consumer IoT services company

- BlockPunk, collectible art marketplace

- Travelstop, business travel platform

Extra: The fund was founded by a Singapore’s well-known Jungle Ventures (see below) which had started out itself as an angel investment firm back in 2012, but then moved into Series A and B. SeedPlus takes it back to the firm’s early-stage roots, looking for startups that could subvert the industry globally.

Quest Ventures

Type: early-stage venture capital firm

Stage: Seed / Series A

Sectors: artificial intelligence, ecommerce and marketplaces, entertainment, finance, food, insurance, logistics, media, property, sports

Portfolio and recent investments:

- Carousell, a marketplace for buying and selling new and secondhand goods

- 99.co, Singapore’s largest geo-spatial search engine for real estate

- ShopBack, a startup that offers cashback, discounts and other rewards to consumers

Extra: The firm normally takes the lead as the first investor and pays attention to the team of founders when making an investment decision.

Cocoon Capital

Type: venture capital firm focusing on early-stage, enterprise tech companies across Southeast Asia.

Stage: Seed

Sectors: medtech, fintech, insurtech and general “deep” tech sectors – companies that are built around taking new, potentially patented, and highly disruptive technological innovations to market.

Portfolio and recent investments:

- Hapz, a Singapore-based events marketplace

- See-Mode, a medtech startup that gives information required for stroke prediction.

Extra: The firm has also announced its initiative of hosting public mentoring hours regularly across Singapore, Ho Chi Minh, Hanoi, Manila, Bangkok, Jakarta and Yangon to help grow the local entrepreneurial ecosystems.

STRIVE

Type: A Singapore-based VC firm

Stage: pre-Series A and Series A

Sectors: internet and mobile companies

Portfolio and recent investments:

- Saleswhale, an AI sales assistant

- Healint, a headache-focused digital health company

- Kudo, an Indonesian payment firm (acquired by Uber’s Southeast Asia rival GRAB)

- Pie, a work chat startup (acquired by Google)

Extra: formerly known as Gree Ventures, the firm is connected to the Japanese games firm GREE

KK Fund

Type: venture capital fund investing in startups across South East Asia, Hong Kong and Taiwan

Stage: Seed

Sectors: internet and mobile

Portfolio and recent investments:

- Med247, a Vietnam-based healthtech startup that gives via an app post-treatment after an offline visit to an available clinic

Extra: KK Fund is typically a lead investor in deals and predominantly looking for companies with a product or an early release in the market already.

SPH Ventures

Type: A venture capital fund investing in early-growth technology companies globally

Stage: Series A and later

Sectors: various

Portfolio and recent investments:

- PouchNATION, an event management tech startup

- DealStreetAsia, a media startup that tracks private equity and venture capital activity across Southeast Asia and India

Extra: the fund was set up by Singapore Press Holdings Limited, the leading media company in Southeast Asia.

Wavemaker Partners

Type: early-stage venture capital firm with offices in Los Angeles and Singapore.

Stage: Seed / Series A

Sectors: enterprise and deep tech

Portfolio and recent investments:

- Zilingo, a B2B fashion ecommerce platform (nearing a unicorn status)

- Luxola, a cosmetics startup (acquired by LVMH)

Extra: more than 80% of their investments have been made in enterprise and deep tech startups since 2012.

Insignia Ventures

Type: VC firm focused on investing in Southeast Asia

Stage: Seed / Series A / Series B

Sectors: various

Portfolio and recent investments:

- Igloohome, a smart locker maker

- Fore Coffee, an on-demand specialty coffee startup based in Indonesia

Extra: Founded in 2017, they don’t specialise in a specific industry, but hold a regional focus.

GGV Capital

Type: a multi-stage, sector-focused VC firm

Stage: Seed / Series A / Series B

Sectors: consumer tech, new retail, social media, digital & Internet, enterprise/cloud, frontier tech

Portfolio and recent investments:

- Trustroot Internet, a Singapore-based parent entity of fintech and ecommerce startup Udaan

Extra: An office in Singapore, the company's first in Southeast Asia and fifth globally, was opened this April by this US and China-based venture capital firm

Monk’s Hill Ventures

Type: venture capital firm focused on Southeast Asia

Stage: Series A / Series B

Sectors: education, logistics/supply chain, software, transportation

Portfolio and recent investments:

- Ninjavan, a logistics and fulfillment company

- ZipMatch, an online real estate platform

- Horangi, a cybersecurity company

- Saleswhale, an AI sales assistant

- GLINTS, a recruitment and career development platform

Extra: “We prefer asset light companies and the B2B2C drivers because we believe that consumption drives everything,” said Peng Tsin Ong, co-founder & managing partner in an interview to Entrepreneur.

Jungle Ventures

Type: A Singapore-based venture capital firm that invests in and helps build tech category leaders from Asia

Stage: Series A / Series B

Sectors: financial services, retail, software, travel, hospitality, media

Portfolio and recent investment s:

- ZipDial, an Indian startup that helps businesses connect with customers who may not have access to the Internet (acquired by Twitter)

- Pomelo, an online fashion retailer

- iflix, a digital entertainment service

- RedDoorz, a budget hotel booking platform

Extra: Since launching its first early-stage fund in 2012, Jungle Ventures has been one of the earliest VC firms to target Southeast Asia. In an interview to Bloomberg, Jungle Ventures co-founder Amit Anand differentiated the firm by “betting on grey-haired veterans with C-suite experience, rather than starry-eyed twentysomethings.”

Vertex Ventures

Type: Singapore-base VC fund

Stage: Series A / Series B

Sectors: financial services, enterprise and consumer tech

Portfolio and recent investments:

- FirstCry.com, an online shopping store

- InstaReM, a cross-border digital payments startup

- Validus, an online financing marketplace

- Binance Asia, a cryptocurrency exchange platform.

Extra: venture capital arm of Temasek Holdings (a holding company owned by the Government of Singapore).

Golden Gate Ventures

Type: An early-stage VC firm in Southeast Asia with investments across 7 countries.

Stage: Series A / Series B

Sectors: ecommerce, payments, marketplaces, mobile applications, SaaS

Portfolio and recent investments:

- Carousell, Singapore-based marketplace for buying and selling new and secondhand goods

- 99.co, Singapore’s largest geo-spatial search engine for real estate

- Carro, an automotive sales startup

- Omise, a payment gateway

Extra: Founded by three Silicon Valley entrepreneurs in 2011, the firm has made over 40 investments to date. Golden Gate Ventures LP base includes Singapore sovereign fund Temasek and Facebook co-founder Eduardo Saverin.

Qualgro

Type: venture capital firm focusing on early-stage, B2B data, AI, SaaS startups across Southeast Asia.

Stage: Seed, Series A, Series B

Sectors: B2B data, AI, SaaS

Portfolio and recent investments:

Extra: Qualgro is a Venture Capital firm based in Singapore, investing mainly in B2B companies in Data, SaaS and Artificial Intelligence, to support talented entrepreneurs with regional or global growth ambition. Qualgro invests across Southeast Asia, Australia/NZ, primarily at Series A & B.Their unique, knowledge-based approach has been affirmed by Wavecell’s notable exit – which won them the VC Exit of 2019.