- Osome SG

- Bookkeeping Services

Bookkeeping services in Singapore

Free up time to grow your business by choosing us for your bookkeeping services. Onshore experts paired with a single online platform for paying taxes, reconciling transactions, and preparing invoices.

Professional bookkeeping services with Osome

Expert bookkeepers

Our in-house professionals will help you streamline your business's bookkeeping. With our online service, you'll pay the right tax from day one.

User-friendly software

Online software where all your important business documents are stored in one, secure place. Our software gives you a clear overview of your daily bookkeeping.

Clarity on your cash flow

Get a clear view of your cash flow whenever you need to, wherever you are. And our professional bookkeeping services will help you make sense of it all.

Compliance and Reporting

Leave the boring stuff to us — we'll handle the tax, deadlines, and filing with IRAS. Our online bookkeeping services ensure you make the correct tax and stay compliant.

Benefits of Osome services

Bringing order to your documents chaos

We believe your books should be organised and updated daily, not just at the end of the month. We do this for you so that you have financial visibility at all times.

Speedy bookkeeping

Have documents you want included in your books? Send them to use and we'll reconcile them quickly. We'll let you know what's missing so that you don't have to spend hours tracking down old invoices.

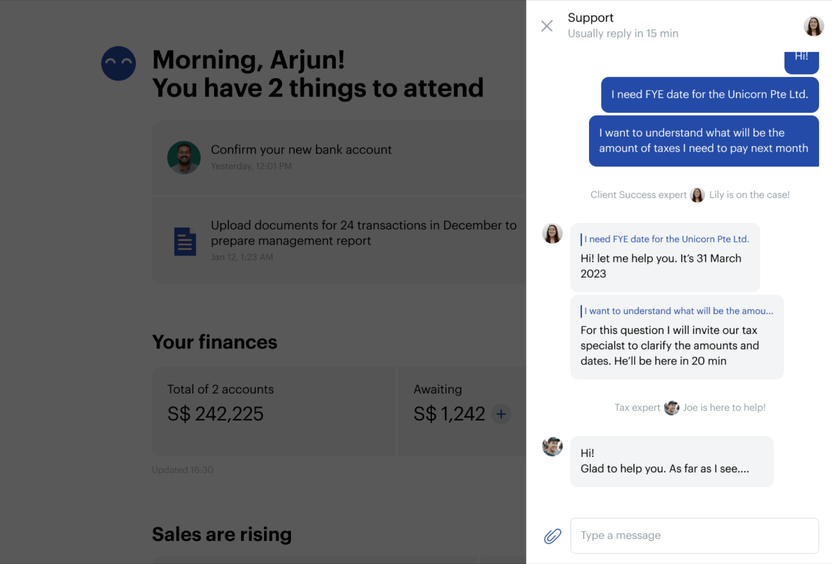

Your very own bookkeeper

Whether it's late at night or over the weekend, we respond to live chat queries as quickly as we can.

Included in every

Easy-to-use tools to handle all your business operations

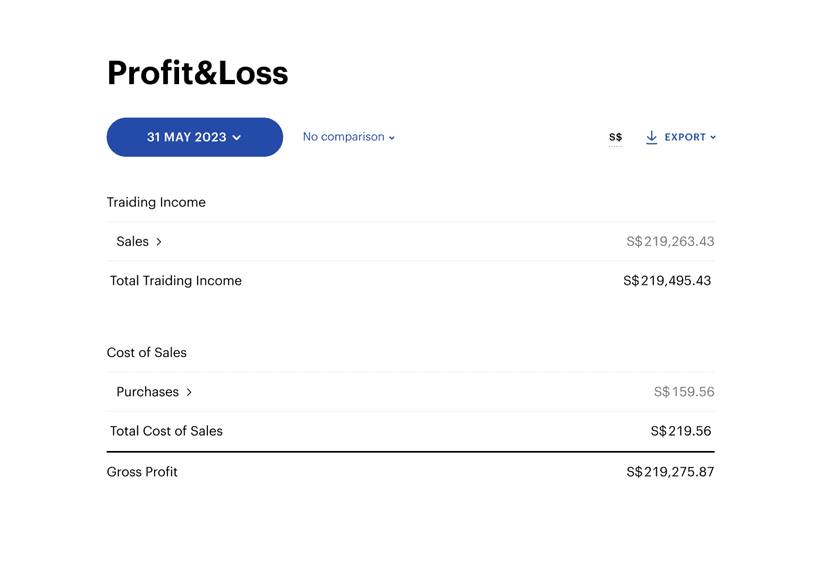

Financial admin, done

From bookkeeping to filing tax, we make sure all your financials are up-to-date and ready for timely reporting. When it's time to file, you just need to click 'approve'.

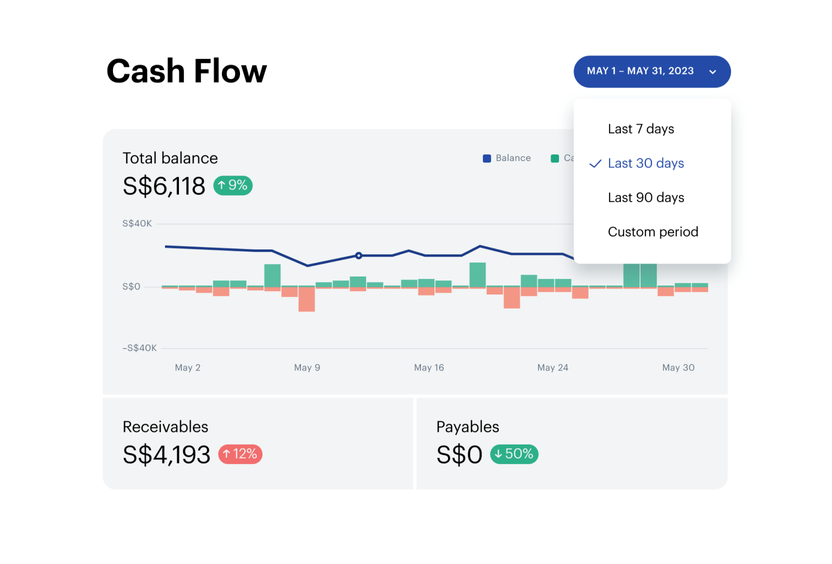

Get clarity over your cash flow

View all of your integrated bank accounts to see how your money is moving.

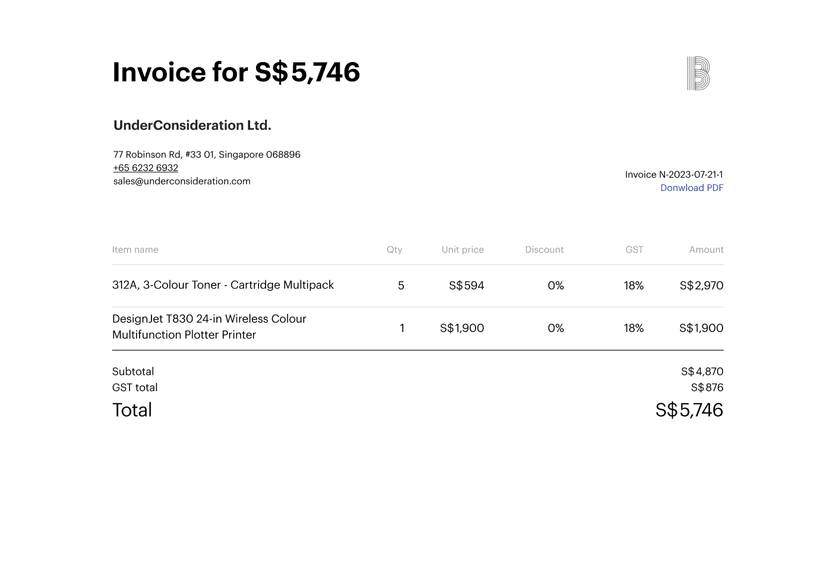

Get paid quicker

Effortlessly send invoices, reminders to late payers, and get paid faster. Pre-filled fields in the invoice template means the days of manual data entry are gone.

Your accountant: ready when you need them

Send your accountant a message via live chat and get a response within 24 hours.

Plans to fit your business

Our packages are tailored to your business stage and annual revenue. When your revenue falls above or below the selected threshold, we'll either invoice you for the difference or credit your account. As your business grows, you can customise your package with add-ons to meet your evolving needs.

Operate

If you want to nail your first year of business and stay compliant

from

S$ 816 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Optional add-ons

Grow

For those growing a team and needing payroll and employee services

from

S$ 1,080 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Optional add-ons

Scale

For founders wanting a financial co-pilot and strategic accounting support

from

S$ 2,480 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Optional add-ons

Add-ons you might need

Urgency filing

S$ 750

Where applicable, an urgency fee may be applied depending on your filing deadline.

Simplified XBRL filing

S$ 300/y

The Simplified XBRL template caters to smaller businesses and non-publicly traded companies in Singapore. It provides a simple report and a complete set of financial statements in PDF format.

Full XBRL filing

S$ 500/y

Osome will provide a Full XBRL report including primary statements and selected notes to the financial statements. This comprehensive report represents a company’s financial performance and position.

What our clients think about Osome services

“I use Osome to help me succeed”

91 %of customers recommend Osome services

“Osome and their team makes accounting and getting the correct documents in order for company and bookkeeping easy and reliable.”

Peter Riverwind

FAQ

How does your pricing work?

Our pricing is tied to your revenue rather than being dependent on the volume of transactions within your account or the number of invoices you upload. Additionally, our pricing structure operates on a financial year basis rather than a calendar year basis.

What bookkeeping services do you offer?

Bookkeeping, which is included in your package, includes collecting all supporting documents and categorising them into corresponding accounts. Every day we look at your integrated bank accounts to reconcile incoming documents with transactions. If a document is missing, we reach out to you immediately. This way you won’t have to wait for the end of the month for your books to be ready if you need an updated look at them — data is updated every 24 hours.

How do you do bookkeeping for small businesses and startups?

Send your remote bookkeeper your receipts and invoices in any format you have them in, whether it's an email, scan, or phone picture. If anything is amiss, the Osome platform highlights the transaction and notifies you. You will never have to spend hours trying to track down long-forgotten documents to complete your bookkeeping.

How do I outsource my bookkeeping?

When you outsource to a bookkeeping company, you can scale your services up or down as your business needs change. In many cases, outsourcing your bookkeeping is more cost-effective (sometimes by a substantial amount) than hiring a full-time bookkeeper. It also saves you heaps of time and stress so that you can focus on growing your business instead.

How do payroll services differ from bookkeeping?

Payroll and bookkeeping services serve different functions within a business's financial operations. Payroll services focus on managing employee payroll and ensuring compliance with labour and tax laws, while bookkeeping involves recording, organising, and reporting on all financial transactions of the business. Both functions are essential for the overall financial health and compliance of the organisation.

What if my actual annual revenue differs from my chosen accounting plan's revenue range?

No worries! We'll adjust your accounting plan to match your actual revenue — either by sending you an invoice for the pro-rated package or crediting the amount back to your account.

Fresh insights from our business blog

Opening a Corporate Bank Account in Singapore

Opening a corporate bank account in Singapore is easy and straightforward, but we also understand that it can be pretty daunting for new business owners.

Singapore Company Constitution — Everything You Need To Know

The Company Constitution is one of the legal requirements in your company’s incorporation process in Singapore. As a new business owner, you would need to know about Singapore’s Company Constitution as you are required to submit it during incorporation.

A Complete Guide to Ecommerce Accounting

Ecommerce accounting covers all your financial management as an online seller, from bookkeeping and invoices to record keeping and filing your taxes.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?