- Osome Blog SG

- How To Verify a Company in Singapore

How To Verify a Company in Singapore

- Modified: 14 August 2024

- 2 min read

- Incorporation

Osome Content Team

VIP Contributor

Osome has been collaborating with 21 authors from 4 countries. We embrace diversity and are proud that lawyers and founders, journalists and financial analysts choose to work with us.

Entrepreneurs often need to interact with new partners and suppliers. Some of them may turn out to be phantom contractors and nonexistent companies. Both individuals and businesses have a credit history and a history of relations with government bodies. It is important to check the reliability of a potential client or partner for these parameters before starting a business relationship.

Why Verify a Company?

Careless choice of a business partner can lead to serious economic consequences, such as losses due to unfair behaviour of the counterparty, loss of money and time. As a result, the company may also suffer reputational risks.

Companies can be considered unreliable if they do not fulfil their obligations to both customers and government agencies. All one-day firms, bankrupt companies and others that provide false information about their activities can be called pretty unreliable, too. To protect your business from such partners, it makes sense to at least check the open sources before signing a contract.

Incorporate your company in Singapore with Osome!

Where Can I Get Information on the Company?

You can protect yourself by checking the counterparty in many ways, but, as it often happens, entrepreneurs do not always manage to find time for extensive research.

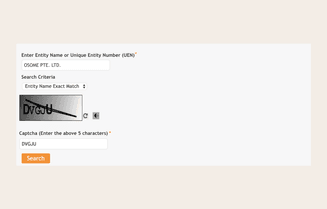

As a minimum security precaution, we recommend using the free online portal ACRA Singapore BizFile. The service is built around an intuitive interface and it is easy to verify company information and the reputation of a company. There you will receive relevant general data that you should first pay attention to.

If you have troubles with the system, ask your company secretary for help.

Step 1. Enter the name of the company you want to verify in the search bar.

Step 2. Complete the captcha.

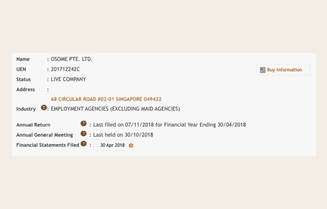

Step 3. Analyze the available information.

How Do I Know if the Company Is Legitimate?

- Company status. The “live” status indicates that the company is operational.

- Industry. The presence of a large number of very different types of company activities can be an alarming sign.

- Address details. Check if this is a legal address or just a nominal mailbox. If it is indeed a nominal mailbox, request mailbox provider's contact to verify with the provider that this business partner is legitimate.

- Annual Returns. Singapore Companies’ Act requires all companies to submit an annual report to ACRA within 30 days of the annual general meeting of shareholders.

- Annual General Meeting. This field indicates the date of last AGM held by the company. "N.A" means that the company has not notified ACRA of any AGM held by the company. Private companies may be exempted from holding AGM or may choose to dispense with holding AGM.

- Financial Statements. This field contains information on whether the company has complied with the requirements for submitting financial statements to ACRA.

Do not forget that your potential partners are likely to “google” you back. Make sure that the information about your company is accurate and complete, and that all reports are lodged with the authorities in time.