- Osome Blog HK

- The Entrepreneur's Guide to Offshore Company Setup in Hong Kong in 2025

The Entrepreneur's Guide to Offshore Company Setup in Hong Kong in 2025

- Modified: 30 April 2025

- 10 min read

- Foreigner's Guide, Incorporation

Jon Mills

Author

Jon's background is in copy and content writing for brands. He relishes writing educational and entertaining content. He's told unique stories in creative ways, and has added value to products in the luxury sector. Now, his stories bring the advice and journeys of Osome's accounting experts and small business owners to life, hoping to inspire entrepreneurs to be ambitious, set their sights high, and take pride in their growing businesses.

In today's interconnected global economy, entrepreneurs are increasingly eyeing foreign markets for expansion. Hong Kong emerges as a prime destination for international businesses due to its vibrant and business-friendly environment. This article will guide you through establishing a Hong Kong offshore company, highlighting why it could be a strategic move for your business.

Key Takeaways

- Hong Kong offshore companies, conducting most operations outside the city, provide benefits like a favourable tax system, asset safety, and global market access.

- Entrepreneurs seeking international expansion, emerging market growth, or tax advantages should consider an offshore company in Hong Kong.

- Hong Kong is attractive for offshore company setup due to its fast registration, low tax rates, English usage, political stability, and global finance hub status.

What Is an Offshore Company in Hong Kong?

An offshore company in Hong Kong refers to a corporation that is formed under Hong Kong's jurisdiction but conducts its business operations primarily outside the city. Hong Kong offshore entities are completely legal and are fully recognised by the government.

Expand your business into Hong Kong with Osome's seamless company registration services. Let our experts handle the paperwork while you focus on growth. Get started today!

Advantages of Offshore Companies in Hong Kong

An offshore status offers a host of benefits, including but not limited to:

1 A favourable tax system

Hong Kong follows a territorial taxation principle, meaning it only taxes profits derived from or arising in Hong Kong. Therefore, profits that offshore companies earn outside Hong Kong are generally not subject to Hong Kong income tax, which allows them to structure business activities in a way that optimises their tax obligations.

2 Safeguard your assets

Assets held by these companies are protected under Hong Kong law, which offers strong property rights protection. This could be especially helpful for offshore businesses dealing with substantial assets or those in high-risk industries.

3 Operational agility

They are not subject to the stringent regulations and bureaucracy that may apply in other jurisdictions. Such flexibility can be valuable for offshore businesses that need to adapt quickly to market changes or business opportunities.

4 A gateway to global markets

Setting up an offshore company in Hong Kong can act as a springboard to global markets, especially in Asia. Given Hong Kong's strategic location and its role as an international financial hub, businesses can leverage their Hong Kong presence to forge partnerships and access markets worldwide.

Importantly, Hong Kong's adherence to international standards and its unmatched legal system provide an added layer of security to entrepreneurs. It's not just a city, it's a secure base for your global business ambitions.

Why Should You Set Up an Offshore Company

The easy and fast company formation process

Setting up an offshore company in Hong Kong is efficient and straightforward. The Hong Kong government offers a streamlined business registration process, allowing incorporation within a week if all necessary documents are ready and correctly filled out. This speed makes Hong Kong a preferred destination for offshore company incorporation.

Lowest tax rates and share capital

Hong Kong boasts one of the world's lowest corporate tax rates, with a current rate of 16.5% for profits over HK$2 million. There is no minimum share capital requirement, and dividends, capital gains, and offshore profits are not taxed. This fiscal environment supports effective tax planning and significant savings.

Access to China and the rest of East Asia, and Southeast Asia

Hong Kong's strategic location provides unmatched access to the booming East and Southeast Asian markets, particularly China. As part of China, yet with its own legal system, Hong Kong is an ideal gateway for businesses targeting these markets, supported by robust logistics and communication networks.

Align your business goals with Hong Kong's advantages. Prepare documents carefully to avoid delays. Engaging professionals can streamline compliance and let you focus on growth.

English as a second official language

As a Special Administrative Region of China, Hong Kong uses English as an official language, widely spoken and understood. Legal documents and proceedings are available in both English and Chinese, facilitating international business and reducing language barriers for entrepreneurs.

The political stability of the country

Hong Kong enjoys significant political stability under the "one country, two systems" principle. This ensures a separate legal system from mainland China, making Hong Kong an appealing environment for foreign businesses seeking stability and predictability.

Reputable country

Renowned as a global financial hub, Hong Kong adheres to international business standards and boasts a robust legal system. This reputation makes it a trustworthy jurisdiction for international operations, enhancing the credibility of businesses incorporated here and providing a competitive edge in global markets.

Who Can Set Up an Offshore Company in Hong Kong?

Starting a business in Hong Kong is accessible to anyone over 18, regardless of nationality or residency. This inclusive environment means that wherever you're from, Hong Kong offers equal business opportunities.

The company structure is straightforward, requiring at least one director and one shareholder. These roles can be filled by the same person, simplifying the setup process.

However, it's essential to have local expertise, which is where company secretarial services are beneficial. The company secretary must be a Hong Kong resident or a registered Hong Kong company, ensuring compliance with local regulations.

Hong Kong offers ample flexibility with directors and shareholders, too. There's no requirement for company directors or shareholders to be Hong Kong residents. Even corporations are allowed to play the role of directors, offering yet another level of flexibility.

The Difference Between Opening a Company Onshore vs Offshore

Onshore and offshore status refers to where a company is incorporated and operates. An onshore company is formed and primarily conducts business in its home country. In contrast, an offshore company is incorporated in one jurisdiction, like Hong Kong, but mainly operates outside that area.

Entrepreneurs might choose offshore incorporation for benefits like favourable tax conditions, enhanced confidentiality, asset protection, ease of international business, and access to new markets.

In simple terms, onshore and offshore describe a company's incorporation location and main business activities.

| Aspect | Onshore Company | Offshore Company |

| Definition | Operates in the country of incorporation. 🏠 | Operates outside the country of incorporation. ✈️ |

| Taxation | Subject to local tax policies. 💰 | May benefit from favourable tax conditions. 🏦 |

| Business Focus | Primarily serves local customers. 👥 | Focuses on international markets. 🌎 |

| Regulatory Familiarity | Aligned with local laws, culture, and practices. 📜 | Requires understanding international regulations. 📖 |

| Privacy | Limited confidentiality for directors and shareholders. 👁️ | Often offers increased confidentiality. 🔒 |

Home ground advantage of onshore companies

An onshore company is incorporated and operates mainly within its home country. For example, a company registered and operating in the UK is considered onshore. These companies benefit from familiarity with local laws, culture, and corporate practices, and can easily connect with local networks. However, they are subject to local taxation and regulations, which can be complex or high.

Exploring new horizons with an offshore company

An offshore company is incorporated in one jurisdiction, like Hong Kong, but conducts its business primarily outside that jurisdiction. The appeal of setting up an offshore company includes potential tax benefits, as profits earned outside Hong Kong are typically not taxed. Offshore companies often enjoy increased confidentiality, as some jurisdictions protect the privacy of directors and shareholders, making them attractive for those seeking privacy.

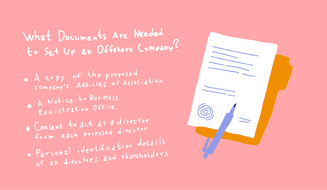

What Documents Are Needed To Set Up an Offshore Company?

Setting up an offshore company in Hong Kong comes with its own checklist of essentials. One of the primary tasks is gathering the right documents, as thorough paperwork is crucial to a smooth and successful offshore company incorporation process. Below are the key documents you'll need to prepare:

Articles of Association

The Articles of Association, often abbreviated as AoA, outline the regulations for the business operations and define the responsibilities of the directors and how the shareholders exert control over the board of directors. This document is basically the rulebook for your company and must be submitted during the registration process. We can prepare your articles of association for you.

Notice to the Business Registration Office

Hong Kong requires a formal notice to the Business Registration Office as part of the offshore company incorporation process. This notice serves as a declaration of your intent to establish a company in Hong Kong and includes essential details about your company, such as the proposed company name and address.

The Business Registration Office in Hong Kong is a division of the Inland Revenue Department responsible for administering the Business Registration Ordinance.

Consent to act as director

Every proposed director of your offshore company must provide a formal consent to act in this role. This document confirms that the individual is aware of their directorship and agrees to the responsibilities that come with the position.

Personal identification details

Lastly, you'll need to provide personal identification details for all the proposed directors and shareholders of your offshore company. This typically includes a copy of their passport or other valid ID and proof of residential address, like a utility bill or bank statement. These details ensure that the company's leadership can be properly identified and held accountable, in line with Hong Kong's commitment to corporate transparency.

While the documents mentioned above form the backbone of your application, check with Osome directly to make sure you've covered all your bases. We can provide you with the most current, comprehensive list of requirements based on your specific situation and the latest regulations in Hong Kong.

Steps To Set Up Your Hong Kong Offshore Company

Setting up an offshore company in Hong Kong involves several crucial steps:

1 Choose and confirm your company name

First, pick a unique company name that's not too similar to existing ones or infringing trademarks, and confirm its availability.

2 Prepare necessary documents

Next, prepare the required documents, including the Articles of Association, a Notice to Business Registration Office, and consent forms for each proposed director. Gather the personal identification details of all directors and shareholders.

3 Register your company

Submit your documents to the Hong Kong Companies Registry for registration. It usually takes about 4 days to process. You'll receive a Certificate of Incorporation and a Business Registration Certificate (BRC) upon successful registration. BRC is a mandatory document issued by the Inland Revenue Department (IRD) in Hong Kong

4 Open a corporate bank account

Once your documents are submitted to the Companies Registry, you can begin to open a corporate bank account. Contact the bank in advance to understand their specific requirements.

5 Ensure compliance with local regulations

Finally, ensure that your company complies with all local regulatory requirements, including obtaining necessary business licenses such as the Business Registration Certificate and a Certificate of Incorporation, as well as permits.

The process typically takes a week if you have all documents ready, leading to a smooth setup of your Hong Kong offshore company.

An Estimated Total Cost of Registering and Maintaining a Company in Hong Kong

Launching an offshore company in Hong Kong comes with its expenses, but having a clear grasp of these costs can make the planning process a lot smoother.

Initial setup costs

The initial expenses encompass mandatory government fees for offshore company incorporation, payable to the Hong Kong Companies Registry and the Inland Revenue Department, respectively. Please refer to our pricing.

Annual maintenance costs

Keeping your offshore company afloat includes recurring costs like the annual return filing fee and business registration renewal fee. Additionally, hiring a company secretary, a requirement, and opening a representative office in Hong Kong may add up to HK$3,000 annually.

To maintain company compliance in Hong Kong, you should have an accountant to prepare the financial statements and tax filings. Accounting and audit fees are on top of the set-up fee.

Conclusion

Offshore companies offer potential benefits over onshore ones, such as tax advantages, confidentiality, asset protection, and ease of international business.

Necessary documents for offshore company setup include Articles of Association, a Notice to Business Registration Office, director consent forms, and directors' and shareholders' identification details.

Setting up involves selecting a company name, preparing documents, registering the company, opening a business bank account, and ensuring local regulatory compliance.