From CPF to GST: Things To Check as Your Business Grows

Companies who are growing will find that they have many administrative things to do too such as calculating Skills Development Levy (SDL) and CPF Registration.

Congratulations, you've incorporated your company in Singapore! What's next? Of course, when you start a company, the ultimate goal would be to grow the business into a thriving one.

While setting up a business is easy, the feat would be how to build your company. There are still administrative things to do as your business grows. Here’s what to expect.

What To Know When You Hire Your First Few Employees

Employment in Singapore is a regulated sector, so you should get acquainted with the basic rules and regulations to comply with the Singapore law.

The regulations include the following:

- If you wish to hire a foreign employee, you have to apply and secure a valid work pass (including Work Permit, S-Pass and Employment Pass). Find out more about what the Employment Pass and S-Pass is, and the new application requirements in our article here.

- When you hire Singaporean citizens or Permanent Residents, you’ll need to make compulsory contributions to statutory funds such as the Central Provident Fund (CPF) and the Skills Development Levy (SDL). More on that below.

CPF contributions have to be paid to Singapore Citizens and Permanent Residents who are either

- Working in Singapore under a Contract of Service

- Recruited on a permanent, part-time or casual basis

Register for a Central Provident Fund (CPF) Account

How to register for a CPF Account?

To start contributing to your staff’s CPF account, you’ll need to register for a CPF Account, with a minimum lead time of 3 working days. You’ll need a CorpPass Account for this. Wondering what’s that? Read more about it here.

After registering for a CPF Account and obtaining approval from CPF Board, the next step would be to ensure that you have a proper way to pay the CPF contributions to their staff.

How do I pay CPF to my staff?

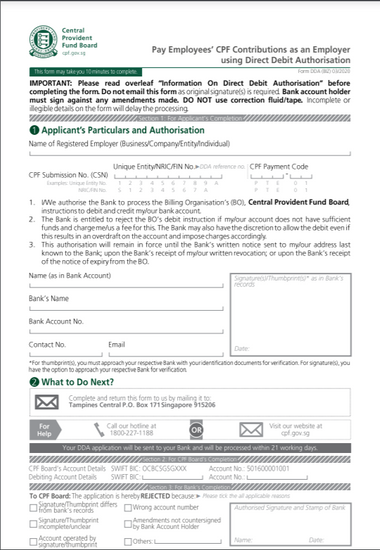

You’ll need to set up a Direct Debit between the CPF Board and your local corporate bank account via a Direct Debit Authorisation form. Take note, setting up this direct debit takes 21 working days and can even span longer. Get this done quickly to avoid any late submission of CPF!

How much CPF do I pay to my staff?

All companies in Singapore are required to deduct a portion of their employee’s salary (usually 20%) and contribute an additional 17% for their employee. The employer pays their employee’s share of Central Provident Fund (CPF) contributions monthly if the employee is paid more than S$500 per month.

Here’s a breakdown of the age and percentage contribution:

| Age of Employee | CPF contribution by Employer | CPF Contribution by Employee | Total Contribution Rate |

| Up to 55 years old | 17% | 20% | 37% |

| 55 to 60 years old | 13% | 13% | 26% |

| 60 to 65 years old | 9% | 7.5% | 16.5% |

| Above 65 years old | 7.5% | 5% | 12.5% |

Vern hires a design student from a local polytechnic as an intern for his company and pays them $450 a month. The intern is 18 years old. Vern does not have to contribute an additional 17% monthly CPF to the intern. However, he also hires a graduate intern, aged 22, at $1500 a month. He has to contribute an additional $255 to the intern’s CPF.

You can register for CPF at the CPF website.

Calculate the Skills Development Levy (SDL) You’ll Need To Pay

In addition to CPF, employers also have to pay a monthly Skills Development Levy to SkillsFuture Singapore Agency (SSG). The SDL funds collected goes to the Skills Development Fund (SDF), which is used to support workforce upgrading programmes and to provide training grants to you when you send your employees for training under the National Continuing Education Training system.

You would have to pay SDL to all your employees, including foreign employees on work permits and employment pass holders and employees hired on a temporary, casual or part-time basis.

How to calculate SDL:

SDL is payable at 0.25% of each employee's monthly remuneration. The minimum is at S$2 for employees earning below S$800 a month, and the maximum is at S$11.25 for employees earning over S$4,500 a month.

After you have computed the SDL for each employee, you need to add up the total amount of SDL payable and round down to the nearest dollar.

For example,

Tony hires a foreign worker, Employee A, as a hygiene officer, or cleaner in his office and pays him $609 as salary for the month of May 2020. He has to pay $2 SDL. This is the minimum amount as the total wages for the month is less than $800.

Tony also hires a Employee B, Marketing Director at $10,000 a month for the month of May 2020. The SDL payable is $11.25.

Let’s assume Tony only has these 2 employees for his company. He has to pay:

SDL of Employee A + SDL of Employee B

$2 + $11.25 = $13.25

After rounding to the nearest dollar, the SDL payable is $13.

You can register for SDL at the CPF website.

Get Your Business Insurance

Running a business is certainly not without risk. Safeguard your business by obtaining your business insurance, so you can also have peace of mind!

The general business insurance that is advisable for you to get include workers compensation insurance, general liability insurance and the other business specific insurance.

If you’re confused about the insurance available, you may wish to get the help of a good insurance broker, since your insurance needs are likely to grow as your company expands.

Read More: How Does Business Insurance Work in Singapore?

Check if Goods and Service Tax (GST) Applies for Your Business

GST stands for Goods and Services Tax, a Value Added Tax (VAT) with a standard 8% tax rate levied on goods imported into the country and on the goods and services within the country. Not all businesses in Singapore are required to register for the Goods and Service Tax (GST).

You will only have to do so if your company:

- Has more than S$1 million in revenues in the last 12 months OR

- Projected to have more than S$1 million in revenues over the next 12 months

As long as your company meets one of the two above requirements, you’ll need to register for GST. You will then need to charge your consumers an extra 8% on the goods and services you sell. This amount must be paid to the government and cannot be kept by your company. If your business is of a smaller scale, then you don’t need to register for GST.

Norsa has a chain of spas across Singapore. In the Year of Assessment 2018, her business’ revenue totalled $800,000. She did not have to register for GST then. However in Year of Assessment 2019, she hit $1.5 million in revenue. She will also need to charge an additional 9% to her customers for all her services after registering.

You can register for GST directly at the Inland Revenue Authority of Singapore (IRAS) website.

Focus on Growing Your Business

If you’d rather find a way to get a trusted and experienced accounting service provider in Singapore to take over your paperwork pains while you focus on your business growth, leave it to us.