- Osome SG

- Personal Expenses

Declare your personal expenses easily

Organise your personal expenses and stay compliant when you declare your personal spending with Osome. Upload receipts, select which category they fit into, and watch the deductions roll in.

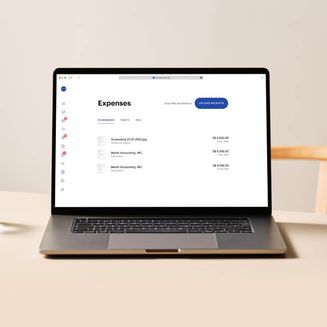

Get full control of your business finances

Upload your receipts

Drag and drop your receipts to instantly upload to your Osome account. They’ll be processed straight into accounting, where you can check on their status anytime.

Label your spending

Was that brunch you brought that client a business expense? Label your spending to get insights into where your money is going and clarity on what you can claim as an expense.

Stay compliant while getting more returns

Checked by our expert accountants they’ll help lock in more returns and tax deductions for your business the compliant way.

Get things done with Osome

- Learn more

Integrations

Connect your marketplaces and bank accounts to see real-time sales, returns, and fees and make smarter business decisions.

- Learn more

Accounting

Your dedicated accountant will know your business inside out, helping you manage your taxes, GST reports and more.

- Learn more

Ecommerce

Automate bookkeeping from all your sales platforms and lean on your accounting expert who understands ecommerce business.

- Learn more

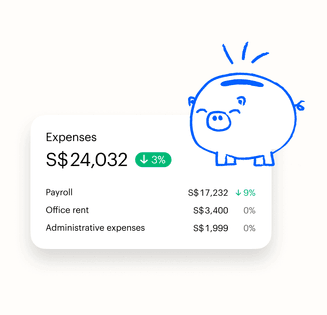

Reporting

Сlearly see how your business is doing at any point in time, take action, and make your business more profitable.

- Learn more

Invoices

Understand how much money is coming into your cash flow, create and send invoices, and get paid faster.

- Learn more

Payments

Capture bills, receipts, and have a complete control over what’s due and when.

Osome who?

We're glad you asked

We power small businesses with financial management tools and a dedicated accounting expert to maximise your business success.

Lean on your dedicated expert

You can't trust a robot for all your financial and business needs. So you'll get one of our friendly, loveable accounting experts as your dedicated go-to. Think of it as having a Financial Director – without the cost.

Smart software made for business owners

That said – robots are nice when used right. We automated menial tasks – collecting documents, recognising accounts, assigning tax rates, preparing draft reports, etc. Where necessary, our robots reroute their output to a human expert so that you can be compliant with confidence!

What our clients think about Osome services

“I use Osome to help me succeed”

91 %of customers recommend Osome services

“The good thing about Osome is that it saves a lot of time so I can do other things – the running of the business part.”

Jennifer Widjaja

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?