All You Need To Know About IRAS (Inland Revenue Authority of Singapore)

Top Singaporean tax body — Inland Revenue Authority (or IRAS) deals with collecting taxes and helping out the government with any tax matters. Osome guides you through its functions and structure.

The Inland Revenue Authority of Singapore (or IRAS) is a governmental body that deals with collecting taxes. It’s under the Ministry of Finance’s authority and also acts as a chief tax advisor to the government.

Let’s have a look at how IRAS functions and what it is responsible for in particular.

What does IRAS do?

All the questions either an individual, or a company, or even a country might have on taxes — the Inland Revenue Authority deals with all of them in Singapore. But the two main functions of the body that can be outlined are collecting taxes of all types and acting as a tax advisor to the government.

Collects taxes

That is the part your accounting services provider in Singapore is surely well aware about.

Let’s have a quick look at what types of taxes IRAS deals with.

- Income tax — a tax chargeable on the income of individuals and companies.

- Goods and Services Tax (or GST) — basically, a tax on consumption of any goods and services, including imports. Charged by the supplier of the above and usually included in the price.

- Property Tax — applied to any property owners, based on the expected rental values of the properties.

- Stamp Duty for Property

- Stamp Duty for Property-Holding Entities

- Stamp Duty for Shares

- Withholding Tax

- Trust

- Estate Duty

- Private Lotteries Duty

- Betting and Sweepstake Duties

- Casino Tax

- Clubs and Associations

- Charities

Dividends, capital gains and inheritance are not to be taxed.

IRAS collects taxes that make 70% of the Government’s Operating Revenue, with the sum mostly going to support the countries’ economic and social programmes.

Advises the government on tax

IRAS is the main tax advisor for the Singaporean government. It drafts the tax policy, aids the Ministry of Finance to draft tax legislation and deals with drawing up any tax treaties. For example, Singapore has nearly a hundred of double taxation agreements with other countries, which helps people to avoid being taxed twice on their income.

What is special to know about taxation in Singapore?

Singapore follows a territorial tax system which means that taxes companies pay are based on where the profits come from, not where the company is registered.

Paul’s construction engineering company is registered in Singapore. However, he’s based in France and all his clients are in France. He issues bills for them in France and they pay him money to his company's French bank account. The only money from his profit that reaches his Singaporean bank account is his company expenses. IRAS taxes only this sum.

A paragraph of IRAS history

The body as it is dates back to 1992. The highlights of the IRAS history are 1947 — when the Singapore Income Tax Department was formed, dealing with both individual and corporate tax returns; and 1960 — when the Inland Revenue Department was formed, paving the way to the IRAS creation.

What is the IRAS’ structure?

As IRAS deals both with individuals and businesses, it’s divided into departments accordingly. You can check out its full structure below.

How to deal with IRAS?

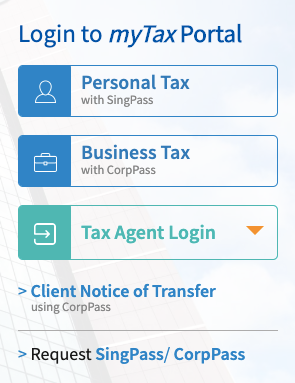

Whether you are an individual or a business, to find out your tax status, you should sign in to the IRAS personal account known as myTax Portal.

If you enter your individual account, you will need your SingPass ID. For businesses — it’s a CorpPass ID.

If you want to connect IRAS and your accounting software — it is possible. However, your accounting software must meet the technical requirements IRAS has set and must make it to this list of approved software.

How to get in touch with IRAS?

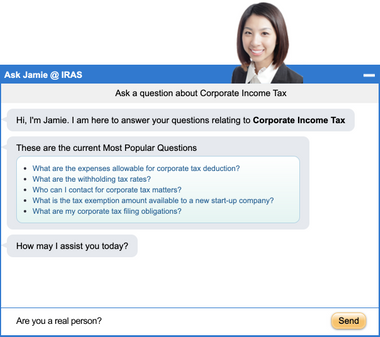

And, of course, with IRAS trying to get as digital as possible — you can always turn to Virtual Assistant “Ask Jamie”, who was designed to make interactions with taxpayers easier. Meet Jamie, who appears in the right corner of the IRAS website:

Conclusion

Main IRAS agendas are to make collecting taxes easy, keep tax levels competitive and help to boost Singapore’s economy. It’s been getting more and more digital to ease the burden of tax reporting for Singapore-incorporated companies and local residents.