- Osome Blog SG

- Understanding the Workflow of Transfer Pricing in Singapore

Understanding the Workflow of Transfer Pricing in Singapore

- Modified: 29 April 2025

- 7 min read

- Money Talk

Anastasia Sikorskaya

Author

Anastasia Sikorskaya is an editor and a legal specialist. She studied in Moscow and Berlin and worked for an international company as a lawyer. Anastasia enjoys explaining the law in human language.

Affiliated businesses often trade on preferential conditions and thus pay less tax. To prevent that, countries developed a system to control the “family business” — the transfer pricing rules. Let’s see how they influence the prices you set, how to play by these rules and what documents to prepare.

Transfer pricing is the pricing of goods, services, or assets transferred within the same Multinational Company (MNC) or between related entities. This process can lead to tax savings for taxpayers.

Transfer pricing was introduced as a custom to control “family business” and internal deals that are kept away from the eyes of the state. MNCs are legally allowed to use transfer pricing, and it can help them move profits away from a parent company to subsidiaries and affiliates to ensure funds are more evenly distributed.

However, companies can sometimes misuse this custom unknowingly, or intentionally control it as a tactic to lower their tax – which can lead to an unwanted court battle with the International Revenue Service (IRS). That’s why it’s so important for businesses to uphold accurate record keeping.

Let’s explore how transfer pricing works in Singapore, how it can save taxpayers’ money, complying with the law and the guidelines to implement the custom into your business. You can also ask for our experienced accountants' help to make sure all your papers are in order and in compliance with the regulations.

What Is Transfer Pricing in Taxation?

So, what is transfer pricing in taxation? In simple terms, it is a custom that helps to control how much goods and services should cost when the parties that buy and sell them are “related”. Persons or entities are related to each other if:

- One of them directly or indirectly controls the other (branches and head offices)

- They are both are under common control of another person or entity (two subsidiaries having a common parent company)

Even when the related parties are interdependent, they should play fair and maintain reasonable prices as if they were regular business partners. This means that no preferential costing is allowed, and neither are hidden profits.

Preferential conditions mean that the parties underpay taxes. To prevent this from happening, the Inland Revenue Authority of Singapore (IRAS) controls related parties and fair charges. The IRAS also controls related party transactions with entities operating outside of Singapore, ensuring that profits are taxed in the same country where they were made.

How To Define the Arm’s Length Principle and Avoid Breach of the Arm's Length Principle?

The arm’s length principle is an international custom of transfer pricing. It states that a company’s goods or services must be charged to its related party for the same price as it would sell them to unrelated contractors in the same circumstances.

The custom also applies to any case where different subsidiaries perform a variety of tasks to benefit the parent firm, such as conducting marketing campaigns or retail activity.

For example, a shoe manufacturer may have several factories located on a continent, one of which produces laces. As the shoelaces move through the supply chain to a plant that manufactures the finished product, the company needs to assess the value of each shoelace and how much profit was made by each related party.

According to the arm’s length rule, a shoelace should be charged the same as it would for a company on an open market. If a similar shoelace costs S$1 elsewhere, the shoe manufacturer should be charged for the transfer of their shoelace at S$1 as well.

If an entity fails to comply with the arm’s length principle and illegally reduces the reported profits in Singapore, the IRAS will unilaterally increase the taxable profits and decrease the deduction or loss. The company will also be charged additional taxes, and may face interest and penalties.

The IRAS advises that a company should follow these guidelines to avoid breaching the arms’ length principle:

1 Complete a comparability analysis

Compare customs of the related party transaction (RPT) with the same financial transactions between independent parties and the circumstances in which the transaction takes place. Aspects that can help to evaluate the transaction include:

Terms of the transaction. Assess the written contract, including the charge, responsibilities and possible risks posed by the agreement. It’s important to not only consider the written agreement, but the verbal agreement and conduct of the related parties.

When there is no written agreement, consider how the parties transact, what goods and services they provide and what they’re being charged. For example, a restaurant purchases seafood from its subsidiary company without a contract in writing – but it does not mean that they don’t have an agreement. Verbal deals also count for the purpose of transfer pricing. The authority will assess factual supply of the seafood and money charged.

Characteristics of products or services. All goods and services presented on the market differ in their features, quality and availability, so they cost differently. This determines if they’re fairly charged. For example, brand new designer bags should not be charged the same as low-budget replicas.

Functions, assets and risk assessment. Analyse the responsibilities of the parties, assess the significant activities undertaken, the type of assets they use and the actual risks undertaken by the taxpayers.

While it is obvious how the functions performed and assets used may influence how they’re charged, the risk is also important. For example, a trader selling refrigerators with warranty bears higher risks in comparison to a trader selling the same refrigerators without warranty. Hence, the company granting warranty on the products must set higher charges.

Commercial and economic circumstances. The markets in every country have their customs and controls that should be considered. For example, the country’s geographical position and availability of a product in the market cannot help but influence how they're charged. A mango in a northern country like Sweden will cost a lot more than in Thailand.

The IRAS also suggests that companies consider additional factors to make an accurate assessment, like:

- Evaluating transactions on a separate or aggregate basis

- Using data from several years

- Considering losses

- Selecting internal and external data for comparison

2 Identify the most suitable transfer pricing method

The IRAS advises choosing one of five customs for transfer pricing: the Comparable Uncontrolled Price method (CUP), the Resale Price Method (RPM), the Cost Plus Method (CPM), the Transactional Profit Split Method (TPSM) or the Transactional Net Margin Method (TNMM).

We explain more about these five transfer pricing methods later in this article.

3 Determine results and set a fair transfer price

After considering one of the above methods, you may apply the arms’ length rules to related financial transactions and control how they’re charged accordingly. It’s custom to adjust the arm’s length results annually.

What Documents Should I Prepare for Transfer Pricing?

If the gross revenue from your activities exceeds S$10 million for the tax basis period or the IRAS specifically requests to prepare the documentation for the previous basis period, you must collect and keep all relevant documents in regard to related party transactions.

Company registration in Singapore. Let Osome guide you through the process.

The documentation should contain an overview of the business group, especially for entities dealing in Singapore, and description of taxpayer’s transactions with related parties alongside the transfer pricing analyses. Find a complete list of requirements to documentation in the Second Schedule of the Income Tax (Transfer Pricing Documentation) Rules 2018.

Bear in mind that it’s custom to only provide transfer pricing documents upon the IRAS’ request. Even if the IRAS’ does not ask for them for the relevant basis period, keep them safe for at least five years. To simplify exchanging the relevant documents with the IRAS, it may be a good idea to also use an electronic signature. If the value of Related Party Transactions (RPT) for the last financial year exceeds S$15 million, a company must also submit the Form for Reporting of RPT (ZIP, 1.70MB) together with Form C.

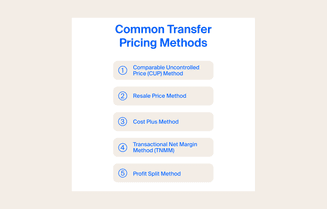

Common Transfer Pricing Methods

The IRAS uses five internationally accepted methods for evaluating a company’s transfer prices, and the custom that’s best for you will depend on your circumstances and available data. These methods can also be applied to check and control your financial transactions.

1 Comparable Uncontrolled Price (CUP) Method

The Comparable Uncontrolled Price (CUP) method compares the price charged for goods or services transferred in a controlled transaction, with the price charged for goods or services in an uncontrolled transaction between similar independent parties in similar circumstances.

If there’s a significant difference between these two prices, it may indicate that the related parties are not dealing at arm’s length. In this case, authorities may control the price in the related party transaction with the price of an independent party transaction.

2 Resale Price Method (RPM)

This is a custom where a product that has been purchased from a related party is resold to an independent party. The two prices are compared to establish whether the initial price was fair and the latter transactions make economic sense.

3 Cost Plus Method (CPM)

The CPM method usually applies to manufacturers, and is where you compare the cost of manufacturing and the gross markup in related and unrelated transactions. Additional profits must be generated for the company – so sales should not just cover the manufacturing costs.

Focus on the assessment of functions, assets, risks and economic environment of compared transactions, so far it mostly affects the gross mark up.

4 Transactional Net Margin Method (TNMM)

This is where you compare the net profit margin of a company from non-arm’s length transactions with the margins realised by arm’s length transactions.

It also examines the net profit margin relative to an appropriate base, such as costs, sales or assets. To help you establish the best price for your products, try out our margin calculator.

5 Profit Split Method

The profit split transfer pricing method is where the related parties split the profits and losses of every transaction depending on their contributions.

International Standards for Transfer Pricing: Singapore's Approach to Transfer Pricing

Transfer pricing documentation has been mandatory in Singapore since 2019 – meaning that the above transfer pricing guidelines are now required by law. Prior to this, Singapore taxpayers were not legally obliged to prepare and maintain transfer pricing documentation.

Failure to prepare the correct documentation may qualify as an offence, which will put your company at risk of being charged up to S$10,000 for each non-compliance offence. You may also be required to change the transfer price used in the non-complying transaction with the charge decided by the authorities and will have to pay taxes based on the new price.

Key Takeaways

- Set a reasonable price when contracting a related party

- Compare related party transactions with similar independent transactions. Follow the step-by-step guidelines and customs proposed by IRAS

- Collect all company documents relevant for transfer pricing and make sure you don’t miss filing any necessary forms

See also

- Details about the Income Tax Act

- Find out more about Income Tax (Transfer Pricing Documentation) Rules 2018

- Read the IRAS Transfer Pricing Guidelines

- Learn more about bookkeeping