Accounting Explained: Top Basics Every Beginner Should Know

- Modified: 5 September 2023

- 11 min read

- Running a Business

Jon Mills

Business Writer

Jon relishes writing content that both educates and entertains the reader. With a background in copy and content writing for brands, he's told unique stories in creative ways, adding value to products in the luxury sector. Now, he works with our accounting experts and small business owners to bring their advice and journeys to life for Osome's readers. He aims to inspire ambitious entrepreneurs to set their sights high, and build highly-respected, flourishing businesses.

Looking for an accounting guide and tips to get you started in financial management? Our beginner’s guide to accounting will help you get to grips with expenses, accounting principles and software, as well as the difference between accounting and bookkeeping. Read on for our basic accounting guide to find out more.

What Is Accounting?

Let’s start with a simple definition. Accounting is the process of measuring, recording and sharing financial transactions and information.

This complete guide to accounting basics will explain the different areas of accounting and its principles, so you can apply them to your work and finance management.

Accounting Basics Every Beginner Should Know

Understanding accounting basics is essential to running a business. The main accounting areas are management, tax and cost. There are also some key accounting documents you should familiarise yourself with including income statements as well as profit and loss and cash flow statements. These are the main documents an accountant will need to complete a finance assessment.

Profit and Loss Statement

A P&L statement or report shows profitability over a given period of time (e.g. monthly or yearly).

The key information it shows is your income, sometimes called revenue or sales, the cost of goods sold, gross profit, expenses and net profit.

The report starts with sales, before moving on to expenses or transactions and eventually your net profit, so you can understand how much money you’re left with and how much tax you owe.

Income Statement

An income statement shows your profit and loss — in other words, how much money your company has made. It’s another term for a profit and loss statement.

When paired with your cash flow statement and a balance sheet, these reports help you understand the overall financial health of your business, and improve cash flow management.

Cash Flow Statement

This document helps you track cash flow and analyses activity for operations, investing and finance. It shows where your cash is coming from and what type of expenses it’s being spent on, as well as how changes in accounts and income affect cash flow. It also documents tax payments, such as VAT and corporation tax.

Bank Reconciliation

This is a way to keep your accounting consistent and for you to double-check your bookkeeping. It compares your internal financial records with your bank statements and helps identify any unexpected transactions and activity to protect you against fraud. It also allows you to label income and expenses to different account types, so that you can produce financial reports of all your transactions.

Balance sheet

Also known as a statement of financial position, this shows your company’s net worth at a given moment in time. It goes hand in hand with your cash flow statement and your income statement and helps to show how much money you owe or are owed.

You can learn more about the balance sheet and other key accounting terminology in our business glossary.

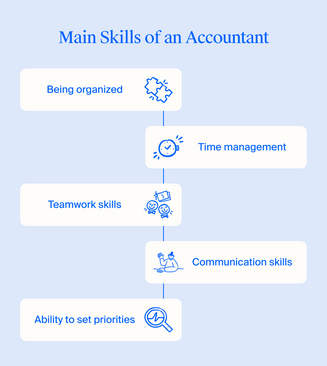

What Are the Accounting Skills Required for Beginners

There are some key accounting skills necessary for beginners that go beyond numeracy and analytical ability. You need to be organised and have good time management, and be able to listen to others and work as a team. Critical thinking and problem-solving are also helpful. But why are these important for accounting and how can you improve?

1 Get Organised and Stay Organised

Being well-organised is crucial when it comes to accounting and finance management. There’s lots of information to manage and numbers to keep track of, so it’s important to have systems in place to allow you to stay on top of your finances.

Tracking your expenses and transactions is particularly important, so you can keep on top of what you’re spending and report this to your accountant. Keeping receipts will help, and accounting software also allows you to store them electronically and immediately by taking a photo on your phone.

Similarly, you need to know when tax is due because your quarterly VAT and annual corporation tax payments can be significant. Mask sure this information is recorded in your cash flow forecast and set money aside in another bank account if you think it’ll help you stay on top of payments.

If you’re not a naturally organised person, you can find out more in our guide to organising your invoices, which contains some top tips and suggestions.

2 Manage Your Time and Learn To Delegate

When it comes to accounting, time management is vital, especially when submitting important documents such as your tax return to HMRC.

If you’re new to the finance management process, it might take time to understand how long everything takes. Use your calendar to plan your time or consider using a project management tool to stay on top of accounting tasks and deadlines.

When running your own company, it can be easy to allow things to get on top of you and try to do everything yourself. Delegating administrative tasks can be a great way to free up some of your time for other important things. That’s why Osome accounting services exist, to help business owners like you manage their time more effectively, with the help of a qualified accountant.

You should also develop a simple system for tracking expenses and transactions, so you have a clear picture of what you’re spending money on.

3 Work Well With Others

When you run your own company, you don’t always have the luxury of having a team to work alongside you. But when you do, it pays to make sure you work together effectively to manage your workload. This also applies to managing your finances and accounting.

Whether you’re enlisting the help of your team to help with accounting or financial admin, or need them to pick up other work so you can focus on accounting, good teamwork is essential. As already mentioned, if you can delegate tasks and get help, you’ll have more time to focus on other areas like finance.

Your team should also be tracking any expenses they personally incur, such as money spent travelling to a sales meeting. That means keeping receipts from any business transactions, and sharing them with you for reimbursement. These requests are normally made by email.

If you don’t have a team, this doesn’t mean you always have to work alone. You can enlist the help of professionals, freelancers or mentors, and work with them to generate ideas and manage some of the more detailed admin including accounting.

4 Ask for Advice and Learn To Listen

Being able to listen to advice is crucial, especially when you’re learning and managing areas you’re not familiar with, such as accounting.

When you’re in the throes of running a company, it’s often hard to take a step back and get some perspective. But it can be really valuable to have another pair of eyes on some of the finer details such as accounting, especially if you’ve been working on the same spreadsheet for some time!

Don’t forget to reach out to others for a second opinion on finance management, whether that’s colleagues, mentors or professional service providers including accountants.

5 Focus on Solutions, Not Problems

Critical thinking and problem-solving are crucial attributes to have when you’re running a business, but especially when dealing with finances and numbers when accounting. Addressing problems when they arise is vital, especially as it often seems easier to bury your head in the sand.

It’s also important not to panic — many of the skills we’ve mentioned above will help with this. If you’re organised, manage your time effectively and aren’t afraid to ask for help and listen when you need to, most problems can be resolved quickly and efficiently.

When it comes to accounting, it can feel overwhelming to see all the numbers in one place. When things don’t add up, you need to be able to remain calm and think clearly to find a solution. Don’t ignore a problem — acknowledge it, work out what you can do alone, and recognise when you might need professional assistance from an accountant.

Top Accounting Principles

There are several core principles underpinning accounting which help to ensure accuracy and consistency in financial reporting. Being aware of these will help you to understand and manage the legal work that’s required for your company.

Consistency Principles

This principle requires all information to be reported consistently, and any changes in data or statements to be declared. Any method you adopt should be the same from one period to another, making it easier to compare financial reports. Create clear processes from the outset to make life easier for yourself.

Sincerity Principles

The Principle of Sincerity dictates that the presentation of all financial information and analysis is as fair and accurate as possible. This is a commitment from the accountant that they haven’t tried to mislead anyone, so try to make your records as honest and accurate as possible.

Principles of Performance and Methods

Similar to the sincerity and consistency principles, this principle makes it easier to compare financial records. It states that all procedures used for financial reporting should be consistent over time. Organise your accounting and bookkeeping, and define clear processes to avoid inconsistencies.

Regulatory Principles

The principle of regularity helps to regulate accountancy and make sure that every company manages their finances in the same way. It states that all accountants must adhere to the agreed rules and regulations to help keep things fair and, again, maintain consistency.

Continuity Principles

The continuity principle states that you should maintain a consistent process for financial reporting and bookkeeping, based on how the company runs now rather than how it might run in the future. This prevents an accountant from valuing assets based on future plans instead of existing operations.

Basic Accounting Terms You Should Know

Ever wondered what an accounting period is? Searching for an accrual accounting definition, or accounting year definition?

There’s plenty of economic and legal jargon out there that may be completely foreign to you. Without knowing what it all means it can be hard to get started with your accounting, even if you’ve hired a professional accountant.

Whether you’re looking to understand some key tax terminology or just want a basic accounting definition, we’ve got you covered.

Debits & Credits

Debits and credits help track where your money is going and coming from. Debits refer to money coming in, and credits refer to money going out. Credits increase revenue but decrease assets, and the opposite applies to debits.

Burn Rate

This refers to how quickly a company spends money. This is crucial in helping calculate and manage cash flow — and understand how much runway you have.

To calculate your monthly burn rate, subtract your end-of-period amount from your start-of-period amount, then divide it by the number of months in that period.

The results show the amount of extra cash you need each month to keep trading. This is particularly important for startups that rely on raising investment capital, rather than growing organically.

Assets

Quite simply, this includes any resource you own or control that holds value and could be made available to sell or meet debts. This could be anything — tangible or intangible — from cash, property or people to trademarks and copyrights.

Capital

Capital is the money available to spend or invest in order to grow. These are funds or liquid assets which can be held or accessed for expenditure. Often these resources provide a buffer against unexpected losses.

Fiscal Year or Financial Year

The financial year is normally a 12-month period a company uses for accounting and reporting finances. The start and end dates can be determined by you, and are often based on the calendar or tax year, or when the business is established.

Liabilities

Liabilities refer to everything a company owes, usually in the form of a financial obligation. This might include wages, tax, accounts payable or loans. Liabilities can be long or short-term, and may be paid as a monetary sum or via goods and services. You can read more about liability in our glossary.

Invoice

This is a document created once goods or services have been delivered, but not yet paid for. This is a way for you to get payment from a client, or for a freelancer to bill you for the work they’ve completed.

Keeping your invoicing records neat is important and outsourcing your bookkeeping can help with that.

Petty Cash

Petty cash is an amount of money that you keep at hand, in case you need to pay for some small or unexpected expenses or transactions. There’s no fixed range and it depends on your needs. It should be kept in a special box or cash register, and should be recorded in a petty cash book.

Turnover

On a basic level, turnover refers to sales turnover — the amount of revenue you have generated. But there are also accounts receivable turnover and inventory turnover, which you can find out more about in our business glossary.

How Can I Teach Myself Accounting?

Thanks to our beginner’s guide, you’re well on your way to grasping the basics of accounting. But there are other ways to improve your accounting skills. Get comfortable with numbers and familiarise yourself with data analysis using spreadsheets.

Basic mental maths and knowledge of Excel formulas are helpful, and there are lots of books and courses out there to help take your skills to the next level. If you’re after some more expert advice, check out our accounting tips for small business owners.

1 Learn How To Analyze Financial Statements

Financial analysis helps reveal your business’s performance. It looks at margins and profitability, risk, efficiency, cash flow, and what’s driving revenue.

2 Learn Accounting Terminology and Skills

Familiarise yourself with the key terms we’ve shared in our guide and put these into practice. It’s also worth learning the basics of accounting software. Check out our list of accounting tools for businesses to save valuable time and money.

3 Get Comfortable With Numbers

We can’t stress this enough. You’re going to be dealing with a lot of numerical data when accounting and running your business, so it pays to make sure you don’t spend valuable time trying to decipher the data before you can even get started on the reporting and analysis.

Running a company also comes with reporting requirements. You need to file end-of-year accounts and pay your tax to stay compliant. An accountant can help with this.

Finally, it’s great to have a good grip on your company expenses and transactions, so that you can preserve cash and drive profitability.

Let’s Wrap Up

So, there you have it, a whistle-stop tour of accounting basics. We hope you’ve found the information in this guide useful and feel ready to take on your first accounting challenge! Management of your company finances can be daunting, especially if you’re just starting out, so get in touch if you’re looking for more expert advice from a qualified accountant, accounting services or ecommerce accounting solutions.

FAQ

What is the best way to study for accounting?

There are lots of free courses out there if you’re looking to improve your skills. If you want to become an accountant or study in-depth, an ACCA accountancy qualification is the leading, globally-recognised qualification for financial professionals.

What are the 7 basic accounting categories?

The seven accounting categories or concepts are: revenue, expenses, assets, liabilities, capital, accounts and statements. These concepts allow you to create accurate reports and efficient processes.

What is a simple definition of accounting?

Accounting is the process of measuring, recording and sharing a business’s financial transactions and information. This includes tracking your income and expenses, and using that information to calculate your profitability.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?