A Complete Guide on Company Registration For Non-UK Resident

- Published: 6 November 2024

- 9 min read

- Starting a Company

Heather Cameron

Business Writer

Heather believes in the power of great storytelling and is here to craft compelling copy that informs and inspires readers. With an extensive background in digital marketing, she has experience writing for various industries, from finance to travel. As Osome’s copywriter, Heather creates content that empowers entrepreneurs and small business owners to boost their business with expert guidance, helpful accounting tips and insights into the latest fintech trends.

Yes, non-UK residents can register a company in the UK. The process is straightforward and can be completed entirely online through the online register. This article will guide you through the key steps, eligibility criteria, and necessary documents you need to know if you are considering starting your own business in the UK.

Key Takeaways

- Foreigners can easily register a UK LTD company online by completing the necessary non-UK resident form and meeting eligibility criteria, with access to company formation packages that simplify the process.

- Key steps for registration include choosing a business name, registering with Companies House, and establishing a business address in the UK.

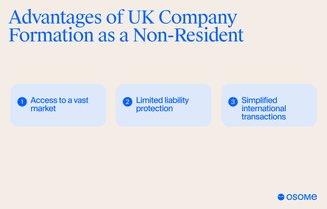

- Forming a UK company offers numerous benefits, such as access to a larger market, limited liability protection, and potential tax incentives for non-resident entrepreneurs.

Understanding UK Company Formation for Non-UK Residents

Registering a company in the UK as a foreigner is not just a possibility; it’s a straightforward process that can be completed without visiting the UK, allowing for easy setup even if you’re based in another European country. The most critical aspect is understanding the eligibility criteria and the necessary documents required to get started. Foreigners are fully eligible to register a UK limited company, and the process is designed to be inclusive and accessible.

Owning a UK LTD company means having a legally registered company address in the UK, with access to its market and legal framework. This section delves into the specifics of who can register a company and what documents are needed, setting the stage for a successful business venture in the UK.

Ready to start your UK business? Osome offers comprehensive company registration services to guide you through the process. We'll handle the legalities and ensure your company is set up for success in the UK market.

Eligibility criteria

To register a UK limited company, non-UK residents must meet specific eligibility requirements.

First and foremost:

- Both the company director and at least one shareholder must be at least 16 years old to meet UK registration criteria.

- Non-British nationals are permitted to register a company in the UK.

- There is no requirement for the company director to be a UK resident.

This flexibility makes the UK an attractive destination for international entrepreneurs.

Additionally, a registered company address is mandatory for all foreign nationals establishing a company in the UK. This physical address will be the official location where all legal documents and correspondence will be sent. Foreigners residents should consider their visa requirements if they plan to visit the UK to operate the business, to ensure compliance with immigration laws.

Necessary documents

To register a UK limited company, several documents are needed, including the non-UK resident form for streamlined approval and potentially address services to satisfy registration requirements.

First of all, you'll need to provide personal information such as the full legal name, date of birth, nationality, service address, and proof of ID (passport or national ID card) for all directors and shareholders. You'll also need to provide details about the proposed business name, registered office address in the UK, nature of business, identified by Standard Industrial Classification (SIC) codes, and the proposed share capital and structure.

Additionally, you may need to provide proof of your home address or company address, especially if you're appointing yourself as a director or person with significant control (PSC). Although having a UK resident director is not legally required, it can simplify processes such as opening business bank accounts, as some banks prefer at least one UK-resident director for anti-money laundering checks. Given the nuances of registration, banking, and compliance requirements, seeking professional assistance is advisable to ensure full compliance with UK regulations.

Steps to Register a UK Limited Company as a Non-UK Resident

The process of registering a UK limited company as a non-UK resident may initially seem daunting, especially for those without an offshore company background, but it is designed to be as straightforward as possible. The registration process is completed entirely online, simplifying the experience for foreigners. The main steps include choosing a business name, registering with Companies House, and setting up a physical office or home address.

These steps allow non-British residents to successfully establish their company in the UK without being physically present. The subsequent subsections will provide detailed guidance on each of these steps, ensuring a smooth and efficient registration process.

Choosing a company name

Choosing a unique and compliant company name is a critical first step in the registration process, reflecting your intended business structure and brand identity. The name must be distinctive and not closely resemble that of existing competitors to avoid legal issues and confusion among customers. This not only helps establish a distinct market identity but also ensures compliance with Companies House regulations, as a legal statement signed may be required to affirm your name choice

When selecting a name, consider how it reflects your business’s values and services. A well-chosen name can significantly enhance your brand’s recognition and reputation in the marketplace. It’s advisable to conduct a thorough search on the Companies House website to ensure that your chosen name is available and compliant with the naming rules.

Registering with Companies House

Registering with Companies House is a crucial step in forming your business in the UK, and establishing it within the official UK company register. Non-UK residents can complete this process online, providing details of the directors, shareholders, and a Memorandum of Association. Submitting translated versions of all necessary documents into English is required to meet the UK company bank account and registration requirements, ensuring compliance with local regulations.

Once the registration is complete, you will receive official paperwork via email or post, including your certificate of incorporation and other essential documents. This paperwork confirms the legal status of your company registered and allows you to commence operations in the UK.

Setting up a UK-registered office address

A UK-registered office address is mandatory for any UK LTD company. This company address will be the official location for all legal documents and correspondence. Non-British residents can obtain this address through various government agencies, which often provide prestigious addresses in cities like London. Securing a prestigious London address for your registered business address can enhance credibility among UK customers and partners.

Alternative options for a physical address include using a PO box or an accounting office address, depending on your needs and budget. The key is to have a genuine physical address in the UK to meet the legal requirements and ensure smooth communication with UK authorities.

Opening a Business Bank Account in the UK

Opening a business bank account in the UK is highly recommended for separating your personal and business finances. It enhances your company’s credibility with customers and suppliers, making it easier to conduct business transactions. Non-UK residents can open a UK bank account without needing to visit the country, thanks to virtual office addresses and banks offering international services.

Company formation agencies can assist with the process, ensuring a smoother banking experience for non-residents. They can guide you through the stringent checks imposed by UK high-street banks, which can be complex for non-residents. Although UK companies are not legally required to hold a UK bank account, having one is highly beneficial for managing your business operations and properly submitting your non-UK resident form.

Setting up a UK bank account can be helpful for managing a UK-based LTD company remotely. However, having a UK bank account simplifies financial management and enhances your company’s standing in the UK.

Benefits of Forming a UK Limited Company as a Non-UK Resident

There are numerous benefits to forming a limited company as a foreigner. One of the most significant advantages is access to a vast and diverse market, which can greatly enhance your business’s growth potential. A UK-based company can also attract more investors due to the country’s strong reputation in international business.

Another key benefit is the limited liability that protects non-resident company owners from losing personal assets beyond their investment in the company. This legal protection, coupled with the UK’s stable legal system, adds to the credibility of limited companies registered with a UK address. Non-residents can also benefit from tax incentives, potentially enjoying exemptions from certain UK taxes.

Moreover, registering a company in the UK simplifies international banking and transaction processes, making it easier to manage your business finances than it may be in some other European country. These advantages make the UK, from England to Northern Ireland and beyond, an attractive destination for non-resident entrepreneurs looking to expand their business horizons.

Tax Obligations and Compliance

Tax obligations are a crucial aspect of operating a UK limited company. Companies are liable for corporation tax and, if they employ someone in the UK, must also register for PAYE and National Insurance with HMRC. Understanding these responsibilities is essential to ensure compliance and avoid penalties.

Companies that receive UK property income are obligated to pay Corporation Tax instead of Income Tax as of April 6, 2020. If the company’s only UK income is from property, they may not need to make payments for future tax years after 2020. Accurate accounting records must be maintained for a minimum of six years, tracking all financial transactions, income, expenditures, assets, and debts.

Filing Company Tax Returns requires submitting accounts and tax computations in iXBRL format. Services are available to facilitate compliance with PAYE and VAT registration requirements, aiding non-residents in adhering to UK regulations.

Support Services for Foreigners

Company formation services can significantly simplify registration for foreigners, covering documentation, a company secretary, and registered address setup. These services provide expert guidance on the various business structures available in the UK, ensuring you make informed decisions. Formation agencies can offer comprehensive online portals for managing company details and provide support throughout registration.

Many foreign nationals find it useful to obtain a personal bank account in the UK to simplify business transactions for their UK LTD company. For example, Osome's incorporation services provide expert support and document submission assistance, making the entire process smoother and more efficient, especially when dealing with HMRC and Companies House.

Maintaining Your UK Limited Company

Maintaining your UK limited company involves adhering to several ongoing compliance requirements. Annual returns must be filed with Companies House, providing updated information about your company, including financial details and director information. Proper record maintenance is essential, and records must be kept for at least six years to comply with UK law.

Failing to maintain an up-to-date company register or meet compliance obligations can lead to penalties or even dissolution. Therefore, it is critical to understand and fulfil all legal obligations to ensure the smooth operation and legality of your business.

Need assistance with UK company maintenance and compliance? Partner with Osome! Our team of experts can help you file annual returns, maintain proper records, and ensure your company remains compliant with all relevant regulations. Contact us for reliable and efficient services.

FAQ

Can a non-UK resident register a company in the UK?

Yes, non-UK residents can register a UK limited company without needing to visit the UK. In other words, this can be an offshore company operated from one's own country.

What documents are required to register a UK limited company as a non-UK resident?

To register a UK company, you need details of directors and shareholders, a UK-registered office address and a Memorandum and Articles of Association. These documents are essential for compliance with UK regulations.

Do I need to have a UK business bank account to register a UK company?

No, you do not need a UK business account to register a UK company. You can choose to open one after the company is registered if needed.

What are the tax obligations for non-UK resident companies in the UK?

Companies must register with HMRC and are liable for corporation tax, PAYE, and National Insurance contributions if they employ someone in the UK. Compliance with these tax obligations is essential to avoid penalties.

How can company formation services help non-UK residents?

Formation services assist foreigners by simplifying registration and providing expert guidance through online portals. This makes establishing a company in the UK both efficient and accessible, and can you help navigate steps like creating a business plan or planning for business expenses.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?