A Complete Guide to a Private Limited Company in the UK

- Published: 25 October 2024

- 12 min read

- Starting a Company

Heather Cameron

Author

Heather believes in the power of great storytelling and is here to craft compelling copy that informs and inspires readers. With an extensive background in digital marketing, she has experience writing for various industries, from finance to travel. As Osome’s copywriter, Heather creates content that empowers entrepreneurs and small business owners to boost their business with expert guidance, helpful accounting tips and insights into the latest fintech trends.

Yinghua Luo

Reviewer

Yin Luo is our Operations Manager based in the UK. She keeps our UK team running like a well-oiled machine and ensures our content resonates with our British audience. Before moving to operations, Yin had over 10 years of accounting experience and is an ACCA-qualified accountant. In her current role, she is our go-to expert for making complex topics easy to understand. Yin carefully reviews our UK-focused articles, ensuring they are accurate, relevant, and packed with actionable advice to help your business thrive on this side of the pond.

A private limited company is a business entity owned by a small group, protecting personal assets from company liabilities. Curious about its benefits, types, and setup process? This guide offers a thorough walkthrough, helping you decide if it’s the right structure for your business.

Key Takeaways

- A private limited company is a distinct legal entity that limits shareholder liability to the value of their shares, providing protections for personal assets.

- There are two primary types of private limited companies: those limited by shares, aimed at profit generation and investment, and those limited by guarantee, typically used by non-profits without share issuance.

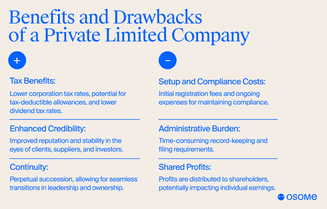

- Forming a private limited company offers benefits such as tax advantages, enhanced business credibility, and stronger resilience, though it also involves setup costs and administrative responsibilities.

What Is a Private Limited Company?

A private limited company (LTD) is a business entity formed by a small group of individuals where shares cannot be publicly traded. Unlike public companies, private limited companies are not allowed to issue a prospectus to the public for share subscriptions. This structure is particularly attractive for businesses that prefer maintaining control within a close-knit group of investors.

A limited company adopting a share structure needs at least one member and no maximum. The members hold at least one share that represents their ownership stakes. Company management is usually undertaken by directors, who may also hold company shares. This duality allows for a streamlined decision-making process while ensuring that the company’s strategic direction aligns with the owners’ interests.

Thinking about starting a private limited company? Osome offers comprehensive company registration services to guide you through the process. We'll handle the legalities and ensure your company is set up for success.

One of the defining features of a private limited company is its recognition as a separate legal entity independent of its owners. This means that the company can own property, enter into contracts, and be held liable for its debts in its own right.

Moreover, the name of a private limited company must include ‘Limited’ or ‘Ltd’, distinguishing it from other business types. Choosing a unique and non-offensive business name helps avoid legal issues and creates a distinct business identity.

Types of Private Limited Companies

Private limited companies can be broadly classified into two main types: those limited by shares and those limited by guarantee. Each type serves different purposes and suits various business needs, which we’ll explore in the following subsections.

Limited by shares

A company limited by shares is the most common form of private limited company, where ownership is divided into shares. Shareholders’ liability is limited to the value of their shares, protecting their personal assets from business debts and liabilities. This structure is particularly beneficial for businesses looking to raise capital without exposing shareholders to significant financial risk.

Shareholders in this type of company are only liable for the amount they have invested, keeping their personal finances separate from the company’s obligations. This feature offers peace of mind to investors and encourages investment by mitigating personal financial risk.

Furthermore, companies limited by shares can raise capital more efficiently by issuing additional shares to new investors. This ability to attract investment without going public on the stock exchange makes it an attractive option for growing businesses seeking flexible funding solutions.

Limited by guarantee

Companies limited by guarantee members act as guarantors, agreeing to pay a specific amount towards the company’s debts if the company fails. This company structure is popular among entities where profit distribution is not the primary goal, for example, non profits, charities, and foundations.

The guarantors’ liability is limited to the amount they agree to contribute, providing a safeguard against personal financial loss. This structure allows the company’s operations to continue independently of its members’ financial situations, maintaining stability and continuity even during challenging times. Though also a limited company, guarantee limited companies face a different set of tax requirements.

Key Features of Private Limited Companies

Key features of a private limited company include limited liability, separate legal identity, and specific methods for raising capital. These aspects make them distinct from other company structures and offer various benefits to business owners and investors.

Limited liability

A limited company safeguards shareholders’ personal assets with limited liability. Each member's liability is capped to the value of their shares/guarantees, so if the limited company incurs debts or faces legal action, shareholders are only at risk of losing the amount they invested in the company, not their personal belongings.

In comparison, a sole trader who runs and owns the business as an individual cannot separate their personal liability from company liability. If the company fails, the owner is personally liable for all financial and legal responsibilities. This association puts individual assets at risk.

Therefore, a sole trader may opt to operate as a single-member limited company. While the company is taxed as a sole trader, it still enjoys the advantages that come with a limited company.

This protection from personal liability encourages investment and participation. For many business owners, this feature alone makes the private limited company structure an attractive option compared to being a sole trader or forming a partnership.

Separate legal entity

Unlike a sole trader, a private limited company functions as a unique legal entity. It is independent of its directors and shareholders. This means the company can own property, enter into contracts, and conduct business independently of its owners. This separation provides a clear legal distinction between the company and its shareholders, offering additional protection and flexibility.

The company can sue and be sued in its own name, reinforcing its independent status. This independence enhances the company’s credibility and simplifies legal processes and transactions, making it easier to manage and operate.

Raising capital

Unlike sole traders or partnerships, a share-limited PLC can raise money during the early stages by issuing Initial Share Capital to early-stage investors. The company can then gather more money by selling shares as the company grows. This ability to attract investment without resorting to public stock offerings makes private limited companies particularly appealing for growing businesses.

Issuing shares to a select group of investors allows companies to secure the necessary capital while maintaining control over ownership and decision-making. This approach allows the company to grow and thrive without the pressures and complexities of public markets.

Advantages of a Private Limited Company

A limited company offers numerous advantages, including tax benefits, enhanced business credibility, and continuity in business operations. These benefits make the limited company structure a popular choice for most people.

Tax benefits

Private limited companies may enjoy several potential tax savings. Unlike sole traders who face high-income tax rates, LTDs benefit from lower corporation tax rates, allowing for strategic tax planning and savings. These companies can also take advantage of various tax-deductible allowances and costs, further reducing their tax liabilities.

LTDs can also distribute profits to shareholders through dividends, which may be taxed at a lower rate than income. This flexibility in profit distribution provides opportunities for further tax optimisation and financial planning.

Business credibility

The limited company status significantly enhances a business’s credibility and stability in the eyes of clients, suppliers, and investors. This formal business structure conveys professionalism and reliability, often making it easier to secure contracts and attract customers.

Incorporation can further enhance a business’s reputation, providing a competitive edge in the market. This improved perception can lead to stronger business relationships and increased opportunities for growth and success.

Continuity and succession

Continuity and succession planning are crucial for ensuring long-term business success. A private limited company continues to exist regardless of changes in ownership or the death of its members, ensuring perpetual succession. This stability allows for seamless transitions in leadership and ownership, maintaining business operations without disruption.

Moreover, the smooth transfer of ownership through share transfer facilitates succession planning, ensuring that the business ownership can continue to thrive even as ownership changes.

Disadvantages of a Private Limited Company

Business owners looking into forming private companies must also understand the potential downsides, including setup and compliance costs, administrative burdens, and shared profits.

Recognising these disadvantages helps in making informed decisions.

Setup and compliance costs

Setting up a private company with limited liability involves both initial and ongoing costs. The initial registration fee is £ 50 to register your company with companies house online. Additional costs can also arise once you're registered. For example, a company must file annual financial reports and maintain accurate records, which can add to the financial burden of running a private limited company.

Recognising these costs is crucial for budgeting and ensuring the business’s sustainability. Potential investors and business owners must be aware of these expenses to avoid financial strain and maintain the company’s long-term viability.

Administrative burden

Running a private limited company involves a significant administrative workload. Companies must maintain comprehensive records, including financial transactions and meeting minutes, to comply with legal requirements. For example, employing staff can lead to more administrative obligations, raising the need for accounting and payroll services.

The complexities of maintaining detailed records and filing the necessary paperwork once you've registered your company with Companies House also increase the overall administrative burden. This added workload can be a barrier for some entrepreneurs considering this business structure.

Shared profits

Profits can be distributed to shareholders in a private company limited by shares. Alternatively, they can be reinvested back into the business. This sharing of profits can impact the overall earnings of individual shareholders, as they receive money based on their shareholdings.

Recognising this aspect helps manage expectations and plan for financial growth.

How To Set Up a Private Limited Company?

You've got a business idea. What now?

Setting up a private limited company involves several steps, including choosing a company name, registering with Companies House, and appointing directors and shareholders.

Choosing a company name

Choosing a unique and appropriate company name is the first step in setting up a private limited company. It’s essential to ensure that the chosen name is not already in use by another company and does not contain offensive or sensitive words without permission. This process helps avoid legal issues and establishes a distinct business identity.

A well-chosen business name enhances brand recognition and credibility, setting the stage for successful business operations. Aligning the name with the business’s values and goals is crucial for long-term success.

Registering with Companies House

Registering with Companies House is a key step in UK company incorporation. The registration process can be completed online via the Companies House website and is typically faster than submitting paper forms. Ensure you can provide all necessary details, such as the name of your private company, address, and director information for UK company incorporation.

The registration process for a limited company usually takes around 24 hours, but delays may occur during high application volumes. Appointing at least one director and one shareholder is mandatory, ensuring that the company’s leadership and ownership are clearly defined.

Appointing directors and shareholders

Appointing directors and shareholders is a crucial step in setting up a private limited company. Directors are responsible for the day-to-day management and must act in the company’s best interest. They must ensure compliance with legislative requirements and hold regular meetings to discuss the company’s direction.

On the other hand, shareholders own the company and have the right to vote on significant company issues. Their voting rights exercise their influence on major decisions, such as mergers and acquisitions, making their role vital for the company’s strategic direction.

Financial Management in Private Limited Companies

Effective financial management is essential for the success of your new limited company. This involves understanding corporation tax obligations, rules for selling shares, filling annual income taxes and corporate taxes, and managing share payouts.

Corporation tax obligations

One of the primary financial obligations for private limited companies is paying corporation tax. Currently, each limited company must pay a tiered corporation tax rate ranging from 19% to 25%.

Profits up to £ 50,000 are taxed at 19%, and profits over £ 250,000 are taxed at 25%. A marginal relief rate is applied for profits between these thresholds. A company must fulfil its tax duties within 9 months after the accounting period ends. The return must be filed with HMRC within 12 months. Failure to meet these deadlines can result in automatic fines, starting at £ 100 for delays of up to three months, with further penalties for longer delays.

Preparing annual accounts

Preparing annual accounts is mandatory for private limited companies. These accounts must be prepared according to accepted accounting standards and submitted to Companies House. These accounts should provide a true and fair view of the company’s financial position and performance, ensuring transparency and compliance with legal standards.

Accurate and timely preparation has a significant influence on your company's credibility and avoiding legal issues and penalties. Companies must maintain detailed financial records throughout the year o facilitate this process.

Managing dividends

Dividends are portions of a company’s profits paid to shareholders as returns on their investments. It is crucial to adhere to legal requirements, ensuring dividends are declared from proper profits and distributed fairly. Dividends must be declared in a board meeting and documented for transparency.

The tax implications vary depending on the shareholders’ income levels, which can affect their overall earnings. Recognising these implications and planning accordingly can help maximise shareholder returns while ensuring compliance with tax regulations.

Private vs. Public Limited Company: Similarities and Differences

The key difference between private and public companies is that the latter operates in the public market and has a £ 50,000 minimum capital requirement.

A Public Limited Company (PLC) shares many similarities with a private limited company, such as providing limited personal liability by acting as a separate legal entity, mandatory registration with Companies House, and having at least one director. However, a public limited company may face more restrictions. For example, the business owner group has a lesser say because each shareholder or guarantor must approve major decisions. They also follow stricter income tax filing regulations.

Common Misconceptions About Private Limited Companies

There are several misconceptions about private limited companies that can deter potential entrepreneurs. One common belief is that incorporating a private limited company is prohibitively expensive, but the setup costs can be as low as £ 50, making it affordable for many.

Another misconception is that these companies must hold frequent formal shareholder meetings, but they can maintain their legal status with minimal effort. Additionally, some believe that a private limited company cannot be owned by just one person. However, it can be incorporated with only one shareholder, who can also serve as the sole director.

Understanding these misconceptions can help potential business owners make informed decisions and avoid unnecessary concerns.

Looking to form a private limited company? Partner with Osome's team of experts for seamless company registration services. We can guide you through the entire process, ensuring compliance with all legistrations and providing ongoing support for your business. Contact us today!

Summary

In conclusion, private limited companies offer numerous advantages, including limited liability, enhanced credibility, and potential tax savings. However, they also come with challenges, such as setup costs and administrative burdens. By understanding the key features, advantages, disadvantages, and practical steps involved in setting up and managing a private limited company, entrepreneurs can make informed decisions and successfully navigate the business landscape.