- Osome Blog SG

- How are Singapore dividends obtained and taxed? This Osome article unpacks how to calculate and declare dividends in Singapore, take a look

Dividends in Singapore: Tax, Types & Key Concepts

- Modified: 29 April 2025

- 9 min read

- Money Talk

Nataliya Dzhariani

Author

A brand & marketing top-manager, Nataliya has been growing businesses in New York, Moscow, London, and Paris. She is a fierce amateur interior designer and a mixology devotee.

You’ve made a profit and thinking about paying it out to shareholders. Here’s all you need to know about dividends in Singapore

During a financial year, the board of directors of a company decides to share interim dividends with shareholders from its profits or reserves. But what exactly does this amount to in Singapore?

Dividend figures are distributed according to the number of individual shares held so the more shares investors own, the more dividends they receive. Under Singapore’s one-tier tax system, dividends shareholders receive from companies are not subject to tax.If you’re here, you’re probably an entrepreneur figuring out how to grow their business better. Why not focus on your sales and strategy while you pass the routine paperwork tasks of accounting to experienced accountants in Singapore? Otherwise, read on to learn more about dividends in Singapore.

What Is a Dividend?

Dividends are part of the profits a company shares with shareholders according to the dividend declaration rules in Singapore. Interim dividends are paid regularly by companies and earned by investors as one of the ways to get a return on investment (ROI). Not all stocks pay dividends. If potential shareholders are interested in stocks for dividends, they need to choose dividend stocks.

Singapore has a one-tier tax system so income is only taxed once. Dividends are tax-exempt to the shareholders.

Are There Singapore Dividend Taxes?

Dividends paid to shareholders by a Singapore resident company (excludes co-operatives) under the one-tier corporate tax system (as the tax paid by a company is final); Foreign dividends received in Singapore by resident individuals. If an individual resident in Singapore receives foreign-sourced dividends through a partnership in Singapore, these dividends may be exempt from Singapore tax if certain conditions are met. For details, please refer to Tax Exemption for Foreign-Sourced Income.

Singapore tax on dividends generally does not apply in the instances below:

- Resident individuals who receive foreign dividends in Singapore through a partnership, (if they meet certain conditions, dividend tax in Singapore may not be applicable but it’s best to check here: Tax Exemption for Foreign-Sourced Income)

- Distribution of income by Real Estate Investment Trusts (REITs) is also not subject to dividend tax (except dividends received by individuals through a partnership in Singapore or from conducting a business, trade, or profession in REITs)

How Do Singapore Dividends Work?

The value of a Singapore dividend is determined on a per-share basis. The Board of Directors must approve the payment, which is distributed equally to all shareholders in the same class (common, preferred or other). When a company declares dividends, it releases funds on a specific day, called the “payable date.” Let’s break it down:

- A company earns profits

- The Board of Directors decides to share excess profits with shareholders instead of reinvesting the amount

- The Board approves the dividend distribution amounts

- The dividend date is announced (along with the value per share, the record date, and other relevant detail)

- Dividends are issued to shareholders according to dates stipulated

Types of Singapore Dividends

A company usually pays dividends on its common stock. Here are several types of dividends a company can choose to pay shareholders:

- Cash Dividend: The most common dividend that companies pay in cash directly into the brokerage account of shareholders (remark: for a public listed company context) or bank account of shareholders (remark: for a private limited company).

- Stock Dividend: Companies often pay additional stocks to investors as dividends, instead of paying cash.

- Dividend Reinvestment Programs (DRIPs): Stockholders have the option to reinvest dividends back into the company's stock through DRIPs, sometimes at a discount.

- Special Dividend: Paid outside of a company’s regular policy. They share these dividends from the excess cash in hand.

- Preferred Dividend: Functions more like a bond instead of a stock. Companies usually pay dividends on preferred stock quarterly. However, dividends on these stocks are generally fixed, unlike dividends on common stock.

Examples of Singapore Dividends

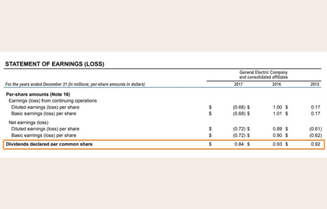

Here is an example of dividends based on the 2017 financial statements of General Electric (GE). In the screenshot below, we can see that in 2017, GE announced a dividend of $0.84 per common stock in 2016 - $0.93 and 2015 - $0.92.

We can compare this figure to Earnings per Share (EPS) from continuing operations and Net Earnings during the same period.

The Impact of Singapore Tax on Dividends

Once you declare a dividend in Singapore, payments are irreversible. They go out a company’s books and accounts permanently and ultimately impact the price of shares - which might go up by nearly the amount of the dividend payable or decline by a similar amount after.

Example

For example, a company is trading at S$60 per share and announces a dividend of S$2 on the date of the announcement. Soon after the news became public, the price of shares went up by nearly S$2 and reached S$62. The stock trading happened at S$63 one business day before the ex-dividend date.

Now, the stock was adjusted by S$2 on the ex-dividend date and began trading at S$61 at the initial phase of the trading session because whosoever was buying on the ex-dividend date could not have received the dividend. Although such things may or may not happen in reality, the price should be adjusted by reducing the stock price by the dividend on the ex-dividend date.

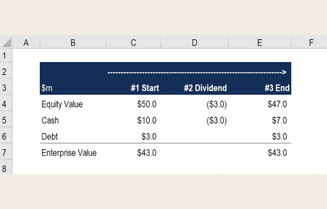

When a company distributes a dividend, it does not have any impact on its Enterprise Value. However, it reduces the Equity Value of the company based on the paid-out value of the dividend.

Important Dividend Dates

SG dividend payments follow a specific order of events. The relevant dates are important to figure out which shareholders are eligible to receive the dividend, take a look:

- Date of Announcement: The day the management of a company announces a dividend date, which shareholders must approve before they get paid.

- Ex-dividend Date: This is when dividend eligibility expires. Anyone who buys shares after this date will not qualify to receive the dividend.

- Record Date: Typically, this is the cut-off date a company sets up to determine the eligibility of shareholders to receive a dividend.

- Payment Date: The date a company pays the dividend and money is credited to shareholders’ accounts.

How Much Can I Distribute?

The IRAS dividend income distribution rules state that a company can share all net profit after paying taxes and settling losses.

Example

For example, after paying tax, the remaining profit of your business is S$40,000 in the current financial year. In the previous year, if you had losses of S$10,000, you have to offset this amount first. You can distribute the balance of S$30,000 as dividends.

How Much Does Each Shareholder Get?

The amount of dividends each shareholder receives generally depends on the shares they own. If you want to set up a different dividend ratio, you can mention that in your company’s shareholder distribution agreement.

Can I Distribute Dividends If My Company Hasn’t Made a Profit?

You cannot. If your company announces and pays dividends when it has not made any profit, the directors who approved the distribution payment will be subject to a criminal offence.

What Do I Need To Do To Declare Dividends?

Usually, a company declares interim and final dividends. The Board of Directors makes the decisions on interim dividends based on the quarterly gains. Passing a directors’ resolution is enough.

On the other hand, shareholders approve final dividends at the end of the financial year in Singapore. This requires an agreement, usually voted on during the Annual General Meeting (AGM).

When announcing interim and final dividends, the Corporate Secretary needs to issue warrants to all eligible shareholders. All the details will be entered into your accounting books. Soon after the agreement on the dividend distribution, it becomes the company’s debt to shareholders until the payment.

Can I Pay Dividends Instead of a Salary To Save on Tax?

As a director or employee, your salary should be sufficient for your role - a business owner who receives only dividends will not have enough income if their business is unable to generate profits. You can pay dividends to shareholders as a bonus (if your company makes enough profits, as we covered above)

If you are a foreign resident working in Singapore, the salary you receive and the taxes you pay will affect your legal status. The Ministry of Manpower will look into these details when deciding on your visa.

Declaration of Dividends: How Does It Work?

There is no legal obligation for the declaration of dividends. You only need to make sure that your business provides the relevant information regarding IRAS dividend income and mentions the same on the dividend voucher.

Does Total Return Include Dividends?

Yes, the total return includes both dividends and appreciation.

How To Calculate Dividends Payout Ratio From Balance Sheet

Here's how:

- Consider the total common equity figure of shareholders - which you can get from your company’s balance sheet

- Divide the amount by the current company share price

When Are Dividends Taxable in Singapore?

Relative taxation in the year Singapore dividends are declared payable.

Why Do Companies Pay Dividends?

A company needs to think about the interest of all its shareholders who have invested in the stocks. The company distributes dividends as a thank-you gesture for their support.

Are Dividends Recorded on the Balance Sheet?

After paying the dividends, a company does not need to record them on the balance sheet.

Do Dividends Go on the Balance Sheet?

Usually, the balance sheet contains the dividends that you declared but have not paid yet. You have to show them on the balance sheet as current liabilities.

Where Are Dividends Paid From & Why Are They Important?

A company pays dividends from its net profits, which indicates it has a steady cash flow and may provide consistent revenue to investors. Dividend distribution may also give insight into the intrinsic value of a company. Many countries have also rolled out preferential tax treatment to dividends where they are tax-free income. On the contrary, when investors sell shares at a profit they have a capital gains tax, up to 20%

How To Evaluate a Company’s Dividends

Investors can apply various methods to evaluate a company's dividend and make an apple-to-apple comparison with similar companies.

Dividend Per Share (DPS)

Businesses that can increase their dividend distribution every year are in high demand. The calculation of dividend per share (DPS) shows the distribution of dividends by a company for each stock holding for a specific period. Keeping track of the DPS of a company allows investors to learn about the companies that can grow their dividends over time.

Dividend Yield

Usually, online broker platforms or financial websites report the dividend yield of a company. You can calculate it by dividing the annual dividend of the company, divided by the stock price on a specific date.

The dividend yield is calculated as a percentage, which is a financial ratio (dividend/price) that shows the number of dividend payouts of a company every year based on its stock price.

Dividend Payout Ratio

Experts say that one of the easiest ways to measure the safety of a dividend is to check its payout ratio or the portion of its net income that a company intends to distribute as dividends. If a company wants to pay out 100% or more of its net income, it could be a problem. In difficult times, income may become too low to cover dividends. Usually, investors seek payout ratios that are at 80% or below. Similar to the dividend yield of a stock, the payout ratio of a company gets listed on broker websites or financial portals.

Dividends in Singapore: A Summary

If you need to grow a business as an entrepreneur, chat with one of our experienced corporate secretaries. Our Osome team will take over the routine paperwork, ensure compliance and adhere to Singapore dividend tax regulations.