Annual Return Filing in Hong Kong: Essential Tips for Success

- Modified: 29 January 2025

- 9 min read

- Tax, Bookkeeping

Heather Cameron

Author

Heather is here to inform and inspire our readers. Boasting eight years in the world of digital marketing, working in diverse industries like finance and travel, she has experience writing for various audiences. As Osome’s resident copywriter, Heather crafts compelling content, including expert guides, helpful accounting tips, and insights into the latest fintech trends that will help entrepreneurs, founders and small business owners in Hong Kong take their businesses to the next level.

Iris Kwong

Reviewer

Iris Kwong is our Corporate Secretary Manager based in the Hong Kong office. With more than 10 years of experience navigating Hong Kong's Companies Ordinance and regulatory requirements, she is our go-to expert on everything from company formation and annual returns to board meetings and shareholder resolutions. She knows the secrets to ensuring smooth business operations and carefully reviews our Hong Kong-focused content, ensuring it's accurate, up-to-date, and packed with useful tips.

An annual return is a crucial document that all companies in Hong Kong must file annually. It includes key details about shareholders, directors, and the registered address. This complete guide covers everything you need to know about how to complete your annual return form successfully.

Key Takeaways

- Annual returns in Hong Kong (Form NAR1) must be filed by all registered companies within 42 days of their incorporation anniversary to maintain compliance and avoid significant penalties.

- Filing annual returns necessitates accurate and updated information on company particulars, shareholder and director details, and the registered office address.

- Companies can file annual returns either electronically through the e-Registry system or via physical delivery, with each method requiring adherence to specific procedures and supporting documentation.

What Is an Annual Return?

An annual return in Hong Kong is a record of publicly available information about a company. This compulsory document, known as Form NAR1, provides the government with important details, including shareholder and director information, registered address, and an overview of the company’s operations.

The annual return includes essential particulars such as the public company name, registration number, authorised representative, and the principal place of business. For public companies, this document is especially critical as it ensures transparency and compliance with regulatory standards. The return must be filed by all companies for registration within the stipulated time frame.

For a hassle-free experience, Osome offers comprehensive company secretarial services to assist with the preparation and filing of your annual return, ensuring compliance with all regulatory requirements.

Who Needs To File an Annual Return?

In Hong Kong, the obligation to file an annual return extends to a variety of entities. This includes all locally incorporated companies, which must submit their annual returns within 42 days of their incorporation anniversary date. Non-Hong Kong registered companies are also required to file an annual return within 42 days after their registration anniversary. This ensures that all active entities, regardless of their origin, comply with local regulatory standards.

Charities registered as companies limited might also need to file an annual return, depending on specific regulations. However, certain dormant companies may be exempt from this requirement, although this depends on jurisdiction-specific regulations. All entities must verify their specific obligations to steer clear of legal repercussions and maintain compliance with Hong Kong’s Companies Ordinance.

Key Information Required for Annual Returns

Filing an annual return requires providing a detailed snapshot of the company’s structure and operations. This includes company particulars, shareholder, director and company secretary details, and the registered office address. Each of these elements plays a critical role in ensuring the accuracy and completeness of the annual return, thereby supporting regulatory compliance and corporate transparency. Understanding the accounting reference period and ensuring all information is up-to-date is crucial.

Every registered company in Hong Kong, except for certain exempted businesses, must file an annual return within 42 days of the company’s incorporation anniversary date. Submitting this document on time is key to maintaining compliance, credibility, and smooth business operations. The consequences of failing to file your annual return form on time can be severe, ranging from default fines to the potential deregistration of the business. Additionally, the company and all responsible individuals are subject to prosecution, and the Registrar of Companies may consider striking off the company.

Company particulars

The private company details form the foundation of the annual return for a company limited, and they become especially significant during the company’s anniversary. Essential particulars include the public company name, registration number, and office address.

Additionally, the date of the company’s incorporation and the registration date are vital pieces of information that must be precisely noted. These details help in tracking the company’s compliance timeline and ensure that the annual return is delivered within the stipulated period each year, keeping in mind the accounting reference period and avoiding any higher registration fee.

Shareholder and director details

The annual return heavily relies on the accuracy of shareholder and director details. The return must include the full name, correspondence address, and a partial number of identity documents of each director, who is considered a responsible person in the private company. This information underscores the importance of having up-to-date and precise records of those responsible for the company’s governance.

Registered office address

Keeping an updated office address is paramount for the annual return filing process. This address must be a physical location where documents can be served, not a P.O. Box. Ensuring that the office address is current helps avoid missing important legal documents and communications.

Furthermore, the office address should be the place where the company’s statutory records are kept. Failure to maintain an accurate registered office address can lead to significant penalties, including those for a continuing offence.

Additionally, the return to the registrar of companies must include the details of the Queensway government offices if that is where the company's statutory records are kept.

By ensuring all these elements are accurately recorded, companies can avoid the severe consequences of non-compliance, such as those seen when a company fails to file timely returns. Companies limited by guarantee and other specific entities must pay particular attention to these details.

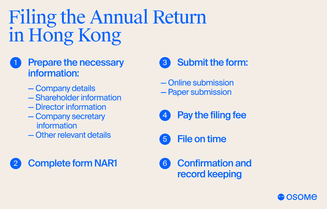

How To File Your Annual Return

Filing an annual return in Hong Kong can be done through two primary methods: electronic submission and physical delivery, both via the Companies Registry. Each method has its processes and requirements, offering flexibility to companies based on their preferences and capabilities. Understanding the steps and adhering to the deadlines, such as the incorporation date and the anniversary of the date of registration, is crucial for maintaining compliance.

A detailed understanding of these methods and the steps involved can highlight the advantages each offers for completing your annual return filing through the Companies Registry.

Electronic submission

Electronic submission of annual returns in Hong Kong is facilitated through the e-Registry system. Companies must follow these steps for filing annual returns electronically:

- Register for the e-Registry service to access the filing method.

- Log into the e-Services Portal of the Companies Registry.

- Complete the required web forms, ensuring that all supporting documents are accurately filled out.

- Review and sign the forms online.

This convenient filing method through the Companies Registry saves time and effort for companies in Hong Kong, allowing them to meet the registration within 42 days requirement from the anniversary of the date of incorporation.

Physical delivery

For those who prefer traditional methods, physical delivery of the annual return is also an option. Companies need to download the NAR1 form from the Companies Registry website, complete it accurately, and then submit it by post or in person.

The completed form can be sent to the Companies Registry at their designated address, ensuring it arrives within the registration within 42 days deadline. This method, while more manual, ensures that companies without access to digital platforms can still comply with the filing requirements through the Companies Registry.

Fees and Penalties

Being aware of correct fee and penalty related to annual return filing is key to maintaining compliance and circumventing unnecessary costs. The annual registration fee varies depending on the type of company, and timely payment is essential to avoid escalating penalties.

A breakdown of the specific fees and the implications of late filing beyond the due date will shed light on the financial aspects involved in the annual return process.

Annual filing fee

The annual registration fee in Hong Kong differs based on the company’s type, including registered non-Hong Kong companies. For instance, local private companies with a share capital must pay HK$ 105 if the return is delivered within 42 days after the company’s return date. Public companies having a share capital are required to pay HK$140 under the same conditions.

Companies limited by guarantee also face a similar fee structure, with HK$ 105 as the correct registration fee within the first 42 days. Adhering to these fees is vital for maintaining good standing and avoiding a higher registration fee for submissions after a company's return date.

Penalties for late filing

It is vital to ensure that the annual return is delivered within 42 days after the incorporation date each year. If the deadline falls on a Sunday or public holiday, the return should be submitted on the next working day, as public holidays can impact the filing schedule. Missing this deadline can result in significant penalties, including higher registration fees and daily default fines.

Ensuring that the return is delivered within the same year as the incorporation anniversary date is essential for maintaining compliance. Failing to deliver annual return on time can lead to significant penalties, which increase the longer the delay. For a private limited company, the fee can escalate from HK$870 to HK$3,480.

These escalating fees serve as a deterrent against late filing and emphasise the importance of timely compliance. In severe cases, companies may face prosecution for breaching the Companies Ordinance, with penalties reaching up to HK$50,000 for local private companies.

By keeping track of these deadlines and being aware of public holidays, you can ensure timely and accurate filings before your company's return date.

Role of a Company Secretary

The company secretary plays a pivotal role in the annual return filing process. This mandatory position for incorporated companies involves:

- Advising the board of directors

- Processing share transfers

- Keeping registers up-to-date

- Ensuring the return is filed correctly.

A competent company secretary:

- Ensures that all statutory requirements are met

- Ensures that the company’s filings align with the Companies Ordinance

- Provides guidance on corporate governance practices

A company secretary is indispensable for maintaining regulatory compliance.

Post-Filing Actions

Post filing of your annual return, certain actions must be taken to keep your company’s records up-to-date and compliant. At any time, you have the option to update any information in your annual return through online access.

Maintaining statutory registers and records is another critical responsibility post-filing. This ensures that all official documents are up-to-date and accessible for inspection.<br>

Summary

Filing an annual return in Hong Kong is a vital process that ensures your local company remains compliant with regulations and maintains its good standing. From understanding what an annual return is and who needs to file it to knowing the key information required and the methods of filing, this guide has covered all essential aspects.

Timely and accurate filing not only avoids hefty penalties but also supports corporate transparency and smooth business operations. If you need any assistance to streamline your accounting routine, feel free to contact our experts and get professional guidance!

FAQ

What is the definition of an annual return in Hong Kong?

An annual return in Hong Kong is a formal submission (Form NAR1) that compiles crucial company details for the government, such as shareholder and director information, company registered address, and operational overview.

What is the filing date for the annual return in Hong Kong?

The annual return must be filed within 42 days after the anniversary of incorporation for private companies. For public companies and companies limited by guarantee, it’s 42 days after the company’s return date. Registered non-Hong Kong companies must file within 42 days after their registration anniversary.

What are the annual fees for filing an annual return in Hong Kong?

The annual fees for filing an annual return in Hong Kong vary based on the type of company, with fees ranging from HK$ 105 to HK$180, depending on the company limited type.

How can you submit your annual return in Hong Kong?

You can deliver the annual return in Hong Kong by either sending a completed NAR1 form by post or in-person to the Companies Registry's office, submitting it electronically through the e-Registry, or having a company secretary handle the Companies Registry filing for you. All these options are viable for your annual return submission through the Companies Registry.

What documents are included in the annual return?

The annual return includes company details such as its name, registration number, registered office, directors, shareholders, and share capital structure. Any changes to this information during the year must also be reported.

What is the role of a company secretary in annual return filing?

The company secretary ensures the annual return is prepared and filed on time, maintaining compliance with Hong Kong’s legal requirements. They often coordinate the filing process for the company.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?