- Osome Blog SG

- How a Revenue-Based Accounting Plan Can Help You Grow

How a Revenue-Based Accounting Plan Can Help You Grow

- Modified: 5 May 2025

- 3 min read

- Money Talk

Gabi Bellairs-Lombard

Author

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

As a small business owner in Singapore, you're constantly looking for ways to optimise your finances and fuel growth. One area where you can make a significant difference is in your accounting practices. This can be a major burden for small businesses, especially in their early stages when cash flow is tight.

A revenue-based accounting plan offers a more equitable and cost-effective solution. With this approach, you pay for accounting services as a percentage of your revenue and dependent on your stage of business. This means that as your business grows, so does your accounting support… without breaking the bank.

Key Benefits of a Revenue-Based Accounting Plan

- Fairer pricing: Revenue-based pricing ensures that you're paying for accounting services in proportion to your income. This eliminates the unfairness of fixed fees, which can be particularly burdensome for small businesses with limited revenue.

- Affordability: Revenue-based pricing makes accounting services more affordable for small businesses, especially when cash flow forecasts are tight in their early stages. This allows you to access the financial expertise you need without straining your budget.

- Predictable costs: Revenue-based pricing provides predictability, as the cost of accounting is directly tied to your business's financial performance. This makes budgeting and financial planning more straightforward, allowing you to focus on growing your business.

- Encourages growth: Revenue-based accounting encourages business growth by linking accounting costs to the amount of revenue generated. This incentivises you to invest in accounting support as your business grows, ensuring you have the financial guidance you need to succeed.

At Osome, expense or transaction-based accounting is not as conducive to our clients’ growth as revenue-based accounting We want to help them grow their revenues with a package that means still receiving a comprehensive accounting service but from S$0.027 for every dollar they make at our entry-level accounting package (just S$ 68/m, billed annually).

This makes quality accounting more accessible even for business owners with revenues of less than S$2,500 per month. Their accounting costs do not get bigger, even as they grow, which means inevitable savings.

We want Accounting made more accessible to business owners because it makes for good business practice, even when you are just starting out.

At Osome, we believe revenue-based accounting plans are fairer because the cost of accounting is priced proportionately to a company's financial capacity and success.

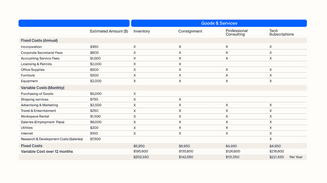

Common Expenses in Your First Year of Business

You'll incur various expenses in your first year of business, from incorporating your business to paying bank charges. These upfront costs can be significant, especially before you start generating revenue. A revenue-based accounting plan can help you manage these expenses and ensure you have the financial resources you need to get off the ground.

Making the Best Choice for Your Business

Consider a revenue-based accounting plan if you're a small business owner in Singapore looking for a more affordable and equitable accounting solution. This approach can help you manage your finances effectively, support your business growth, and set yourself up for long-term success.