- Osome Blog SG

- Incorporation Q&A with Osome’s Expert

Incorporation Made Easy: Q&A with Osome’s Chief Product Officer

- Modified: 4 November 2025

- 8 min read

- That’s Osome

Heather Cameron

Author

From expert guidance and helpful accounting tips to insights on the latest trends in fintech, Heather is here to empower entrepreneurs and small business owners in Singapore with great content. With a background in digital marketing spanning eight years, she has experience writing for various industries and audiences. As Osome’s copywriter, she’s here to inform and inspire our readers with great storytelling.

We sat down with Osome's Chief Product Officer Tamás Gögge to dive into the details of Osome’s latest incorporation features. Learn all about the new digital incorporation process and get a teaser of more exciting updates currently in the works.

Business Set Up: Old vs New

Picture this: you spend hours filing documents, completing complex paperwork and triple-checking that each step is met correctly. Finally, after sweat, stress and possibly even a few tears, your business is set up. That’s the traditional incorporation process for many. And around here, that’s old news.

At Osome, our fast, online incorporation services free you from this admin headache. To date, we’ve helped over 15,000 businesses incorporate. Going forward, we’re aiming to raise that number even higher. That’s why our team has been hard at work over the past few months, developing a brand new online incorporation process which is now available to local business owners in Singapore and soon to be Hong Kong. Previously, it would take an average of a couple of working days to be successfully incorporated. Now, you could have your business set up and ready to go in a couple of hours.

New Osome feature, same Osome promise. We save you time and money by taking care of the admin so you can focus on making your business successful.

Find out all you need to know about Osome’s new digital incorporation process in our Q&A with our Chief Product Officer below.

Digital Incorporation in Singapore

How does the new digital incorporation feature simplify the process for entrepreneurs looking to incorporate in Singapore?

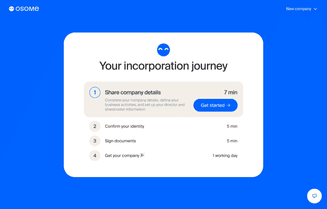

Tamás: “It makes the process much simpler because we’re moving away from a very manual flow - which was great as well because entrepreneurs got to interact with our agents - to a more digital incorporation process where the benefit is that it will be much faster. So we can incorporate very very quickly, not even within one day but within a couple of hours. I think we used to be around up to a week or 10 days on average and now it’s down to sub-one day, so that’s a huge step.

And the other benefit is that, as an entrepreneur, when you’re actually doing the incorporation you can follow every single step on the interface. So you can sign documents on the interface, you can see the status on the interface, even things like KYC checks, which used to be done by separate teams, are now all real-time, automated and in most cases you can do it in a couple of steps.

[You get a] digital incorporation flow, seeing every step, seeing what the status is, seeing the documents, doing everything in an automated way. And zero need to interact with anyone, which makes it a lot faster. And you can do it at your own pace.”

Can digital incorporation clients who need advice or extra information chat with an Osome team member?

Tamás: “100%. I think that’s very important. So our vision is not to be a fully automated black box for people. The vision for all of the Osome products is to get to a point where you can do 99% of the task by yourself. But if you have a problem or if you have a question (and it’s the same with the incorporation flow) you can immediately ask and our onboarding team will help right there.

There are people behind the process. [It’s] real people helping real people. And 99% of the time you shouldn’t need them, but when you do need help, we won’t ask you to answer 22 IVR (interactive voice response) questions and have you talk to too many bots. You’ll talk to a person.”

How does Osome's fast incorporation service translate into cost savings for entrepreneurs?

Tamás: “I think you save time, and when you’re an entrepreneur, time is money, especially when you want to set up a business. Additionally, if you want to set up a business remotely or far away from where you’re located, there’s always the insecurity and you don’t even know what to expect right? So if you can do that super quickly, in one day, in a couple of hours, this just gives you that peace of mind that it gives you back a week [of time] that you can spend building your business and actually generating some money.”

Levelling Up With the Latest Osome App

Can you tell us about Osome's revamped mobile app?

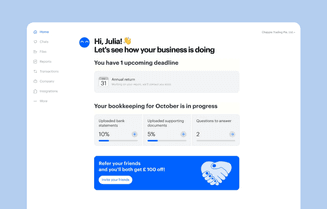

Tamás: “We’ve been on quite a journey with the mobile app for the past six to nine months. Historically, the app was always a place where you could chat… It looked like a version of WhatsApp with a bunch of chats, some of them were with accountants, some of them were with corporate secretary, and so on. Which is nice for WhatsApp but we realised that it was difficult for users to actually get the info they need without chatting. And that means users waste time, our team wastes time and it’s not really efficient.

So we started going in a direction where we revamped the navigation [to make it] easier to find things in the menu. More importantly, on the home page, you’ll now very clearly see your bookkeeping information, real-time status, all the upcoming filing events - everything that we’re doing - so you don’t have to wonder about your status. You’re also seeing what you should be doing if you don’t want to be late or don’t want to get a penalty.

This is kind of a neverending journey - we started from having a basic framework and now we’re adding [updated features]. We are building some cool things in the next four to six weeks as well where we take this a step further. So document uploading will be a lot more transparent. The uploading experience will be nicer, what you have to do and why you have to do it will be nicer.

So we just keep going along on the journey and doing what the clients are asking us, which is “show me the information, don’t make me wonder or work” because everyone wants peace of mind and that’s what we’re trying to build here.”

How can you use the Osome App as an incorporation client?

Tamás: “One of the great things in the new app design is that you don’t actually have to be an accounting client or a Corporate Secretary client or an audit client to use the App. And you can always make up your mind later [about if you want to subscribe to more Osome services]. So the idea is that if you incorporate the company, after incorporation you can already login and you will see your incorporation documents in your files folder, and then in the very near future, you’ll be able to see your onboarding checklist.

You’ll see incorporation documents, you’ll be able to chat with us, that’s all on the App. And then of course, if you realise you do want bookkeeping or you do want accounting in the future, it’s all there in one place.”

Expert Support: Incorporation and Beyond

How does Osome’s expert guidance benefit entrepreneurs during and after the incorporation process?

Tamás: “I think the main benefit is after the incorporation process because talking to the accounting team happens when you’re already a client. Before that, of course, we have our sales advisors who can help with fairly complicated questions, so we’re happy to advise and help everyone figure out what kind of business they should be opening, what’s the best way of doing that and how we can help. Once you’re a client, there is the ability to get help from our accountants, tax advisors, bookkeepers, client success agents and corp sec agents so we have different specialised teams there to help our clients.

I think it really helps in two different ways. One is just pure peace of mind. So, knowing there is one place where you get correct information. Whoever starts a company knows that most of the questions you’d ask your accountant, you can just type into Google and you’ll get two million answers, it’s all been answered before. But you’re really looking for a place you trust, one answer you can trust. It’s not an FAQ - you want to have a conversation with an actual person who's actually in that country.

Then the second thing is advice. When it comes to tax advice or planning we also do that. So if you’re wondering about specific tax advisory questions, then your tax advisor is the person who can help you. You can have tax advisory planning calls, set them up with our team and talk about whatever business questions you might have.”

Beyond incorporation, how does Osome continue to support businesses as they grow and expand in Singapore and Hong Kong?

Tamás: “That’s a really good question. So, our whole product is built to grow with clients. And this is usually the journey we’re on - we do have a lot of clients who switch providers and come to us - but the majority of our clients are entrepreneurs who incorporate their company with us, and then they become successful, and they stay, and they need more [support].

So we can help with your accounting, we can help you even with setting up a second business, setting up subsidiaries, we can help you with tax advice.

I think that’s going to be the really interesting thing - when our clients get to the point that their businesses are not as straightforward anymore and you’re growing. The level of support you can get from us, and the level of advice you get from us grows as well.”

There are many options on the market, what distinguishes Osome from its competitors?

Tamás: “I think there are two different things here; one is Osome and other competitors are disrupting the market both for incorporation and for accounting, and I think that’s the journey we have to be on together, and it really helps entrepreneurs if more and more companies do that and we can really change the market. So I don’t think it’s about the competition there. If you look at accounting, if we can get a significant percentage of entrepreneurs an accounting solution that is super quick and real-time, then you don’t have to deal with paper. It's all automated, it's in an app. However, you still get advice from humans, that’s amazing, and I think we’re doing something great for entrepreneurs globally. If that's us or a competitor, I think that's making the world a better place for entrepreneurs.

Where we are slightly different, what we are focusing on, and what we believe in is that we are not purely an ‘accounting software’. So the idea with Osome is not that you simply get accounting software - there are a lot of amazing accounting solutions out there. It’s the idea is that you get a super intuitive interface where you still get the end-to-end support of experts actually being there [to do the work]. So we don’t just help you do your bookkeeping, we do your bookkeeping. We don’t just help you do your books, we actually do your books. And we don’t just help you figure out what to file, we actually file; we help to keep you compliant. So, I think peace of mind is again the word. It’s not just software - it's two things together. We’re definitely trying to provide the experience to clients that it’s easy and simple, but it's end-to-end, so you don’t have to worry about learning some software.”

New Features on the Horizon

Finally, are there any exciting new features in development at Osome?

Tamás: “For incorporation clients, a very exciting thing that we’re working on in Q4 is bank account opening - easy bank account opening because, of course, when you incorporate a company, the first thing you need is a bank account. We are trying to get to a point where we can really support our clients, even in getting that bank account in a country they’re not located in, to set it up quickly and easily and get started with the business.”

Thinking of setting up a business? Find out everything you need to know about registering a company in Singapore with Osome’s complete guide. If you’re ready to do business, you can get started today.