- Osome Blog SG

- Understanding the Importance of a Shareholders Agreement

Understanding the Importance of a Shareholders Agreement

- Modified: 29 August 2024

- 9 min read

- Better Business

Jon Mills

Business Writer

Jon gets his kicks writing content that educates and entertains. He has a background in copy and content writing for brands and has been lucky to share unique stories, adding value to luxury products. Now, he brings the journeys and advice of our in-house accounting experts and small business owners to life for Osome's readers. He wants to help entrepreneurs set their sights high and build flourishing, reputable businesses.

When it comes to running a business in Singapore, there are many legal considerations to keep in mind. One crucial aspect that often gets overlooked is the shareholders agreement. A shareholders agreement is a legally binding contract that outlines the rights, responsibilities, and obligations of shareholders within a company.

In this article, we will delve into the importance of having a shareholders agreement in Singapore, explore its main points, and discuss how it can benefit businesses of all sizes. As part of this journey, understanding how to issue a share certificate is also essential.

What Are the Main Points of the Shareholders' Agreement?

A shareholders agreement serves as a comprehensive guide that outlines the terms and conditions of the relationship between shareholders. It is a crucial document that helps establish a solid foundation for the smooth functioning of a company. The inclusion of details on roles such as the corporate secretary can be invaluable. Let's delve deeper into the main points of a shareholders' agreement.

Defining shareholder rights and responsibilities

One of the key aspects of a shareholders' agreement is to clearly define the rights and responsibilities of each shareholder. This ensures that everyone understands their role within the company and avoids any potential conflicts or misunderstandings. By explicitly stating the expectations and obligations of each shareholder, the agreement helps foster a harmonious working relationship.

Allocating company shares

Another important component of a shareholders' agreement is the allocation of company shares. This section specifies the percentage of shares held by each shareholder, providing transparency and preventing disputes. It ensures that the ownership structure is clearly defined, giving shareholders a clear understanding of their ownership stakes.

Outlining decision-making processes

Effective decision-making is crucial for the success of any company. The shareholders' agreement plays a vital role in establishing the mechanisms by which important decisions are made. To ensure adherence to Singaporean regulations, many companies opt for company secretary services. This section outlines the decision-making processes, such as voting procedures and quorum requirements, ensuring a fair and efficient process.

Establishing management and governance protocols

The shareholders' agreement also sets guidelines for the management structure, board composition, and voting rights. It establishes a clear and structured framework for the governance of the company. By defining the roles and responsibilities of the board of directors and outlining the decision-making authority, the agreement helps create a well-defined management structure. This promotes effective decision-making and ensures that the company is managed in the best interests of the shareholders.

The shareholders' agreement may also include provisions related to the transfer of shares, restrictions on share transfers, dispute resolution mechanisms, and confidentiality obligations. These additional clauses help address potential issues that may arise during the course of the company's operations.

Benefits of Implementing a Shareholders Agreement

Implementing a shareholders agreement brings several benefits to businesses operating in Singapore:

Ensuring clarity and minimising disputes

By clearly defining the rights and responsibilities of each shareholder, a shareholders agreement reduces the potential for disagreements and misunderstandings. It provides a solid foundation for smooth decision-making processes and creates a clear roadmap for resolving conflicts.

For instance, in the case of a company with multiple shareholders, a shareholders agreement can outline the specific roles and responsibilities of each shareholder, ensuring that everyone is aware of their obligations and the expectations placed upon them. This level of clarity helps to prevent any confusion or ambiguity that could lead to disputes.

A shareholders agreement can also establish mechanisms for dispute resolution, such as mediation or arbitration, which can help to resolve conflicts in a fair and efficient manner. This ensures that disagreements are addressed promptly, minimising any negative impact on the business.

Safeguarding the interests of minority shareholders

It's not just about the majority; it's about everyone. A well-crafted shareholders agreement ensures that even the interests of business shareholders holding minority stakes are safeguarded. It can include provisions to prevent any dilution of their shares and provide mechanisms for exit strategies if disagreements arise.

Minority shareholders often face challenges in having their opinions and concerns acknowledged, especially in situations where majority shareholders hold significant decision-making power. However, a shareholders agreement can address this issue by including provisions that require the majority shareholders to consult and seek the input of minority shareholders before making major decisions.

The agreement can also include safeguards to prevent the dilution of minority shareholders' ownership stakes. This can be achieved through pre-emptive rights, which grant minority shareholders the opportunity to purchase additional shares before they are offered to external parties.

Facilitating seamless business operations

Having a shareholders agreement in place allows for the smooth operation of the business. It sets out clear procedures for conducting meetings, appointing directors, and resolving disputes. This clarity eliminates potential roadblocks and promotes a cohesive working environment.

For example, a shareholders agreement can outline the process for appointing directors, ensuring that it is fair and transparent. This can help to prevent any conflicts or disagreements that may arise when selecting individuals to take on leadership roles within the company.

In addition, the agreement can establish guidelines for conducting meetings, including the frequency and format of such gatherings. This ensures that all shareholders have an equal opportunity to participate and contribute to important decision-making processes.

A shareholders agreement can provide a framework for resolving disputes in a timely and efficient manner. By clearly outlining the steps to be taken when conflicts arise, the agreement helps to prevent disagreements from escalating and negatively impacting the day-to-day operations of the business.

Crafting an Effective Shareholders Agreement

When deciding how to draft a shareholders agreement, it's essential to tailor it to the unique needs of your business. But if you're looking for a more generic version as a starting point, a standard shareholders agreement can be a good foundation. From there, you can adjust according to the nuances of your organisation.

Key considerations include:

Identifying essential clauses and provisions

Before embarking on drafting the agreement, carefully consider the clauses and provisions that are essential to your business. These might include buyback provisions, dispute resolution mechanisms, and restrictions on share transfers, or even specifics like a shareholding entrustment agreement, which entrusts one's share ownership to another, ensuring added security and commitment from key stakeholders. The importance of solid record-keeping cannot be overstated when considering the essential clauses and provisions in a shareholders' agreement.

Buyback provisions are important as they outline the conditions under which a shareholder can sell their shares back to the company. This helps maintain control and stability within the company by allowing the existing shareholders to have the first opportunity to repurchase the shares.

Dispute resolution mechanisms are crucial in any shareholders agreement. They provide a structured process for resolving conflicts and disagreements among the shareholders. This can include mediation, arbitration, or even the appointment of an independent third party to make a binding decision.

Restrictions on share transfers are necessary to protect the interests of the shareholders and maintain the stability of the company. These restrictions can include pre-emption rights, which give existing shareholders the right to purchase any shares being sold by another shareholder before they are offered to external parties.

Understanding the difference: investment Agreement vs shareholders agreement

While both are vital, an investment agreement mainly focuses on the terms and conditions under which an investor makes an investment in a company. On the other hand, a shareholders' agreement focuses on the relationship between shareholders, outlining their rights and responsibilities.

Shareholder Agreement vs subscription agreement

When considering how to protect shareholder rights, it's also crucial to understand the distinction between these two. A subscription agreement is between a company and a subscriber who wishes to invest in shares, whereas a shareholders' agreement outlines the relationship between all shareholders.

Seeking professional legal guidance

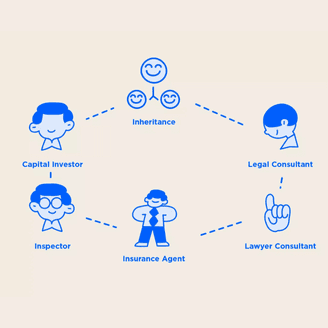

Engaging the services of a professional legal advisor is highly recommended when creating a shareholders agreement. Especially when dealing with complex clauses like a nominee shareholders declaration of trust basic agreement, which allows a nominee to hold shares on behalf of the beneficial owner, it's essential to have legal expertise on your side. A legal expert will have the knowledge and experience to ensure all legal requirements are met and that the agreement adequately protects the interests of the shareholders.

A legal advisor can help navigate the complex legal landscape and ensure that the shareholders agreement complies with all relevant laws and regulations. They can also provide valuable insights and advice based on their experience working with other businesses and shareholders.

Additionally, a legal advisor can assist in negotiating and drafting the agreement, ensuring that it accurately reflects the intentions and expectations of all parties involved. This can help prevent future disputes and misunderstandings.

Tailoring the agreement to specific needs

Remember that every business is unique, and as such, the shareholders agreement should be tailored to reflect the specific needs and goals of your company. It should address any potential issues that may arise and provide a comprehensive framework to guide the shareholders.

One important aspect to consider when tailoring the agreement is the allocation of voting rights among the shareholders. This can be based on the percentage of shares owned or other factors deemed appropriate for your business. Clear guidelines on voting rights can help prevent conflicts and ensure effective decision-making within the company.

Another consideration is the inclusion of non-compete clauses. These clauses can restrict shareholders from engaging in activities that directly compete with the business of the company. This helps protect the company's interests and prevents shareholders from using their position to gain an unfair advantage.

The shareholders agreement should address the issue of dividends and profit distribution. It should outline how profits will be allocated among the shareholders and whether any portion will be reinvested in the company for future growth.

Exploring Common Clauses in Shareholders Agreements

Shareholders agreements often contain various clauses that serve to protect the interests of the parties involved. Some common clauses include:

Understanding drag-along and tag-along rights

Drag-along rights enable majority shareholders to compel minority shareholders to sell their shares in the event of a sale of the company. Tag-along rights, on the other hand, protect minority shareholders by allowing them to sell their shares alongside the majority shareholders.

Implementing anti-dilution measures

Anti-dilution provisions safeguard shareholders' investments by adjusting the price of shares during subsequent funding rounds. They ensure that existing shareholders are not unfairly diluted when new shares are issued at a lower price.

Enforcing non-compete and confidentiality clauses

Non-compete and confidentiality clauses restrict shareholders from engaging in activities that may compete with the company or disclose its confidential information. These clauses safeguard the company's trade secrets and prevent potential conflicts of interest.

Maintaining confidentiality and ensuring no conflicts of interest are paramount. Apart from these clauses, aspects like bookkeeping play a crucial role in maintaining a company's financial integrity.

Enforcing and Adapting Shareholders Agreements

While a well-crafted shareholders agreement sets clear expectations and guidelines, there may still be situations where disputes arise or modifications need to be made.

Resolving disputes and breaches

If a disagreement or breach occurs, it is advisable to refer to the dispute resolution mechanism outlined in the shareholders agreement. Parties can attempt mediation or arbitration to resolve their issues in a fair and impartial manner.

Modifying the agreement through proper channels

As businesses evolve, it may become necessary to adapt the shareholders agreement to reflect changes in circumstances. Any modifications should be carried out through proper channels, with the agreement and consent of all shareholders involved.

Establishing exit strategies and buyout options

Including provisions for exit strategies and buyout options in your shareholders' agreement is essential. Not to be confused with a shareholder buyout agreement — which primarily focuses on the conditions under which one shareholder can buy out another's shares — exit strategies in a shareholders' agreement provide a holistic plan for various exit scenarios, ensuring smooth transitions and minimal disruptions.

Exit strategies typically outline the conditions under which a shareholder can leave or be bought out from the company. For instance, a shareholder might decide to sell their stake due to personal reasons, financial needs, or differing visions for the company's future. An effective shareholders' agreement should clarify the terms of this exit, whether it's based on a predetermined price, a valuation at the time of exit, or another mechanism.

Buyout options, on the other hand, can be activated in certain scenarios where the company or other shareholders might want (or need) to buy out a particular shareholder's stake. Reasons could range from the shareholder breaching the agreement, becoming insolvent, or even in cases of death or incapacitation. Buyout clauses can specify the method of valuation for the shares, timelines for the buyout, and terms of payment.

Conclusion

In the fast-paced and competitive business landscape of Singapore, having a comprehensive and clear shareholders' agreement is not just recommended – it's a necessity.

Every business is unique, and its shareholders' agreement should reflect its individuality. It's not just about anticipating challenges and mitigating them, but also about creating an environment where everyone's interests align for the collective success of the enterprise.

Take the time to craft a shareholders' agreement that stands the test of time. You're not just safeguarding your business; you're building the foundation for its enduring growth and prosperity.