Dormant Company in Singapore: A Comprehensive Guide for Business Owners

- Modified: 16 April 2025

- 11 min read

- Grow Your Business

Gabi Bellairs-Lombard

Author

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Are you wondering what defines a dormant company in Singapore and the implications for it on your business? Are you also wondering how to file income tax returns for the previous financial year or how does the Companies Act apply to your specific situation?

A dormant company is categorised as an inactive entity that doesn’t engage in any business transaction, accounting transactions or income-generating activities. Yet, this status plays a crucial role in strategic business planning, income tax return filing, and preserving company assets. This guide provides an essential overview of dormant companies, clarifies their benefits, outlines their necessary compliance and responsibilities according to ACRA and IRAS in any given financial year, and explains the process for both revival and closure.

Key Takeaways

- A dormant company in Singapore is essentially an inactive company that is kept on the register for potential future revival, with ACRA and IRAS having distinct criteria for what is considered dormant.

- Maintaining a dormant company can lead to cost savings, afford protection to brand and intellectual property and allow for easy resumption of operations. However, some statutory obligations like end of financial year annual filings and tax returns persist.

- Dormant companies are easier to ‘revive’ when needed compared to starting a new entity, but if a company holder decides to close the company, the ‘striking off’ process must be followed after settling all liabilities and obtaining consent from members.

What Is a Dormant Company?

In the vibrant business ecosystem of Singapore, you’ll come across a variety of companies, each with its unique characteristics. Among these are dormant companies, entities that have paused their business operations but remain ready to spring back to life when required. They stand like sleeping giants amidst the bustling commerce, marked by the absence of business activity yet holding the potential for future growth. For assistance with navigating these regulatory complexities, consider our expert company incorporation services!

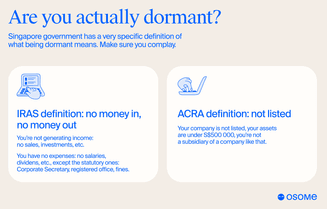

While the general idea might be clear, how do regulatory bodies view dormant companies? Interestingly, the Accounting and Corporate Regulatory Authority (ACRA) and the Inland Revenue Authority of Singapore (IRAS) each view a dormant company differently, with different sets of criteria. Let’s delve into both ACRA and IRAS definitions to get a clearer understanding of the distinctions.

ACRA's definition and criteria

ACRA, the national regulator of business entities and public accountants in Singapore, has a distinct perspective on what constitutes a dormant company. According to ACRA, a company is considered dormant if it has had no accounting transactions during a financial year, barring those strictly related to maintaining the company.

However, being classified as dormant is not merely about inactivity. There are certain conditions that a company must meet. For instance, the company must not be a listed company, must not have assets exceeding S$500,000, and must not be a subsidiary of any listed company. In some cases, a dormant company exempted from certain requirements may still need to fulfil specific criteria.

Although a dormant company can possess assets, the total value on its financial statements should not surpass S$500,000 at any time during the financial year.

IRAS's definition and criteria

On the other hand, IRAS, Singapore’s tax authority, views dormancy from the lens of income and business activity. The IRAS considers a company dormant if it has not earned any revenue or income, including goods and services tax, during the financial year. This classification applies even if the company incurs some statutory expenses in the given financial year, as shown in its financial statements or tax computations.

In addition, a dormant company, as defined by IRAS, should not carry out any business activity, trading activities or generate income. The only expenses allowable are statutory ones. In a significant relief for dormant companies, IRAS permits them to carry forward unutilised losses to future years if they pass the shareholding test, even though capital allowances, trade losses, and donations cannot be claimed in the Year of Assessment or financial period while dormant. However, it’s crucial to note that dormant companies must e-file their Income Tax Returns (Form C-S/C) for that financial period with IRAS unless they have been granted a specific e-filing exemption.

The Benefits of Maintaining a Dormant Company

Having understood what a dormant company is and how it is recognised by ACRA and IRAS, let’s shift gears and focus on the advantages of maintaining such a company. Why would a business owner choose to keep a company dormant with no trading activities rather than closing it down completely?

The answers lie in the unique benefits that such companies offer. These benefits range from cost savings and brand protection to ease of resuming operations, making them an attractive option for business owners. Plus, there’s the potential for future use of the dormant entity, which often makes maintaining it more favourable than closing it.

Cost savings

One of the key benefits of maintaining a dormant company is related to cost savings. Unlike active companies that must bear various operational costs, a dormant registered company in Singapore generally has lower administrative costs.

For instance, costs related to accounting or tax computations for the previous financial year, preparation of financial statements, and tax returns are significantly reduced for a dormant company. In addition, dormant companies in Singapore may be eligible for waivers from certain regulations, which leads to reduced maintenance costs. However, it’s important to note that these companies are not able to claim capital allowances or deduct expenses incurred during the period they are dormant when they file income tax.

Brand and intellectual property protection

Another major advantage of maintaining a dormant company is the protection it affords to the company’s brand name, reputation, and intellectual property. By keeping the company dormant, these assets remain under the ownership of the company, safeguarded from potential misuse or misappropriation.

This retention of the dormant company’s structure also preserves its established reputation and intellectual property for potential future activation or use. Thus, maintaining a dormant company safeguards the efforts and resources that were initially invested in developing the business’s reputation and intellectual property, ensuring that these intangible assets remain an advantage.

Ease of resuming operations

A key benefit dormant companies offer is the ease of resuming operations. A dormant company can quickly re-enter the market without the need to set up a new company, which offers a strategic advantage.

To resume business activities, a dormant company in Singapore must simply notify IRAS, streamlining their return to operations as they do not have to establish a new legal entity. This brings us to another important aspect of dormant companies - their responsibilities and compliance requirements.

Responsibilities and Compliance for Dormant Companies

While dormant companies offer various benefits, they also come with their share of responsibilities and compliance requirements. From annual filings and tax returns to the appointment of a company secretary, these requirements are crucial to ensure that the company maintains its dormant status.

These responsibilities may seem overwhelming at first, but with a clear understanding, they can be easily managed. Let’s delve into these compliance requirements in detail.

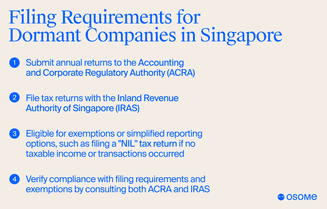

Annual filings

Among the responsibilities of a dormant company, annual filings with ACRA stand out. These filings are vital to maintain the company’s dormant status and ensure its compliance with statutory requirements.

To make things easier, dormant companies in Singapore can be exempt from preparing financial statements if they meet certain criteria. However, they must file their annual returns within seven months following the end of their previous financial year, and failing to do so can result in enforcement actions as it is a statutory duty under the Companies Act. The company must also prepare a Confirmation Statement detailing compliance with statutory requirements, which must be submitted along with the annual return.

Tax returns

In addition to annual filings, dormant companies in Singapore are obligated to submit a nil tax return using the ‘File Form for Dormant Company’ digital service unless a filing waiver is granted.

The process of filing a nil Corporate Income Tax Return is simple; just use the ‘File Form for Dormant Company’ digital service available at mytax.iras.gov.sg to file income tax while also keeping in mind the goods and services tax requirements, including the submission of the tax return form c.

In some cases, a waiver from filing the Corporate Income Tax Return can be granted to companies that are dormant, do not own any investments, and have no intention to start a business or engage in business transactions within the following two years.

Company secretary

Despite their inactivity, dormant companies are legally required to appoint a company secretary within six months of incorporation, also known as the company date. This role is crucial for ensuring the company’s compliance with statutory requirements and the maintenance of its records.

The principal activity of a company secretary involves managing compliance requirements effectively, even when the company is not actively trading. Having a competent company secretary helps dormant companies to maintain their status and avoid unnecessary penalties or breaches of regulations.

The Process of Reviving a Dormant Company

While a dormant company serves as a strategic reserve, there may come a time when it needs to spring back into action. The revival process is relatively straightforward, allowing the company to return to active status and resume its business activities.

The process involves two key steps: First, to notify IRAS and second, meet additional requirements. Let’s delve into these steps to understand what reviving a dormant company entails.

Notify IRAS

The first step to reviving a dormant company is notifying IRAS. This has to be done within one month from the date the business activity occurs or from the date when income is received.

The notification process for the recommencement of business activities is straightforward. To notify the relevant authorities, you need to submit an email to ctmail@iras.gov.sg with the following details:

- Subject header: ‘Recommencement of business and request for Income Tax Return’

- Company name

- UEN (Unique Entity Number)

- Date of business recommencement

- New principal activity (if changed)

- Any other sources of income (if applicable)

Additional Requirements

In addition to notifying IRAS, there are a few additional requirements that dormant companies need to meet when reviving their business operations. These include passing the shareholding test and assigning an ‘Approver’ for corporate tax matters.

Moreover, dormant companies that have made donations to approved institutions or the Singaporean government can claim these when filing via appropriate digital services. However, while using the filing service to revive a dormant company, users should be aware of the 15-minute timeout feature for inactivity.

How To Close a Dormant Company

While maintaining a dormant company offers its share of benefits, there might come a time when closing the company is the best decision. This process, however, requires meeting specific criteria, such as solvency, and following the ‘striking off’ process.

Whether you wish to wind down your dormant company or continue maintaining it, ensuring solvency is essential. This safeguards the company’s ability to meet its liabilities and plays a crucial role in deciding whether to close the company or maintain its dormant status.

Process and criteria

Closing a dormant company involves the ‘striking off’ process. A ‘striking off’ application must be made to ACRA by:

- a company director

- a secretary

- a registered filing agent

- via the BizFile Portal.

However, to be eligible for being struck off, a dormant company must clear all liabilities and receive consent from its members. This ensures a smooth closure process and prevents any future complications.

Closing vs. maintaining dormant status

The choice between closing a company and maintaining its dormant status often comes down to the company’s future prospects. Closing a company completely removes it from the register and ends all administrative requirements.

On the other hand, maintaining dormant status allows for taking breaks from running the company, such as during illness or temporary relocation. Moreover, there is no time limit for how long a company can remain dormant, providing the flexibility needed to adapt to changing business landscapes.

Summary

As we come to the end of our journey through the world of dormant companies in Singapore, it’s clear that these entities offer unique strategic advantages. From cost savings and brand protection to ease of resuming operations, there are many benefits. However, maintaining a dormant company also comes with its share of responsibilities, from preparing financial statements, annual filings and tax returns, keeping the company compliant, to the appointment of a company secretary.

In conclusion, whether to keep a company dormant, revive it, or close it down depends on the specific circumstances and future plans of the business owner. Whatever the choice, a comprehensive understanding of the processes and compliance requirements is crucial to make informed decisions. So, the next time you find yourself contemplating the fate of a dormant company, remember—you’re not just holding a sleeping giant but a potential powerhouse ready to spring back to life!

If you’re looking to find out more about a dormant company—or looking for expert company secretarial services in Singapore right from the company date, contact us. With offices in Singapore, Hong Kong and the UK, we offer you considerable expertise and over a decade of experience in handling an array of company secretary functions. We ensure your statutory registers are maintained and updated accordingly and ensure compliance with the authorities as your company evolves.

We are also registered with ACRA and certified by ISCA.

Allow Osome to take care of the details as you supercharge your business.

FAQ

What is a dormant company?

A dormant company is a company that registers no business activities on its financial statements, including no sales, purchases, employment, dividends, or income, and is also not a listed company.

How to apply for a dormant company?

To apply for dormant company status in Singapore, confirm eligibility, inform ACRA, adhere to IRAS requirements, and fulfil filing obligations while dormant. Seeking guidance from professionals is advisable for a smooth process and for keeping the company compliant.

Who defines a company as dormant in Singapore?

ACRA and IRAS are responsible for defining a company's status as dormant in Singapore.

Can a dormant company hold assets?

Yes, a dormant company can hold assets, but the value of the assets cannot exceed S$500,000.

Does a dormant company need to file a tax return?

In Singapore, dormant companies typically still need to file a tax return, but they may be eligible for simplified reporting options, such as filing a "NIL" return if they have no taxable income or transactions on their management accounts to report. It's important for dormant companies to check with the Inland Revenue Authority of Singapore (IRAS) to ensure compliance with tax filing requirements.

How to file the annual return for a dormant company?

To file for an annual return, a dormant company can use Form C-S or Form C for Dormant Company online through the e-Service at mytax.iras.gov.sg e-Filing.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?