Multi-Currency Account in Singapore: What Is It and How Does It Work?

- Modified: 8 December 2023

- 8 min read

- Grow Your Business

Gabi Bellairs-Lombard

Author

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

If you're a frequent traveller, an international businessperson, or simply want to manage multiple currencies efficiently, a Multi-Currency Account (MCA) in Singapore can simplify your spending and foreign currency management. In this guide, we'll explore an MCA's ins and outs, its advantages, and the top MCA options available in the Lion City.

Key Takeaways

- A Multi-Currency Account (MCA) allows you to hold and transact in various currencies within a single account.

- MCAs simplify foreign currency exchange and benefit international transactions and frequent travellers.

- Top banks in Singapore offer MCAs, each with unique features and benefits.

What Is a Multi-Currency Account?

An MCA or Multi-Currency Account is a flexible financial tool that lets you hold and manage multiple currencies using a single account. Unlike traditional bank accounts, which usually support only one currency, an MCA allows you to transact in different foreign currencies without needing multiple accounts. With an MCA, you can easily switch between currencies and avoid the hassle of currency conversion fees that come with traditional bank accounts.

The need to transact in multiple currencies has become commonplace in an increasingly interconnected world. Whether you're a foreign entrepreneur looking to set up a foreign company in Singapore, a frequent traveller, or simply someone with global financial interests, handling various currencies efficiently is essential. This is where multi-currency accounts (MCAs) can be handy.

How Does a Multi-Currency Account Work?

The functionality of an MCA is straightforward yet powerful. Here's how it works:

- Currency sub-accounts: When you open an MCA, you are provided with a primary account in your local currency, whether it's the Singapore Dollar, Hong Kong Dollar, Australian Dollar, or Canadian Dollar. Additionally, you gain access to currency-specific sub-accounts, each dedicated to a foreign currency of your choice.

- Currency selection: Account holders can choose from various supported foreign currencies based on their needs. The number of available currencies can vary depending on the bank offering the MCA.

- Deposits: To fund the MCA, you can deposit money into any of the foreign currency sub-accounts. For example, if you plan to hold US Dollars (USD), you can deposit funds directly into the USD sub-account.

- Transactions: When you need to make a transaction, such as a purchase, transfer, or withdrawal, the MCA system automatically selects the appropriate sub-account based on the currency of the transaction. For instance, if you pay in Euros (EUR), the MCA will use the EUR sub-account for that transaction.

- Automatic currency conversion: If you don't have a sufficient balance in the required currency, the MCA automatically converts funds from one foreign currency to another at competitive exchange rates. This feature eliminates the need for manual currency conversion and simplifies the transaction process.

- Online banking platform: MCAs often come with user-friendly online banking platforms allowing you to easily manage your various currencies. You can monitor balances, review transaction history, initiate transfers between sub-accounts, and track exchange rate information.

- Debit cards or multi-currency cards: Some MCAs provide linked debit cards or multi-currency cards. These cards allow you to purchase and withdraw foreign currency purchases directly from your MCA balances. This is especially useful for travellers and international shoppers.

Pros and Cons of a Multi-Currency Account

Multi-currency accounts in Singapore offer the advantages of currency diversification, cost savings, convenience, and streamlined international transactions. With the ability to hold various currencies such as the Canadian Dollar, Australian Dollar, Hong Kong Dollar, and Singapore Dollar, these accounts provide a convenient solution for individuals and businesses engaged in international transactions.

However, potential downsides include maintenance fees, exposure to exchange rate fluctuations, and varying eligibility criteria. It's essential to carefully assess your financial needs and objectives to determine whether an MCA aligns with your overall financial strategy.

Advantages

- Currency diversification: MCAs allow you to hold and manage multiple currencies within a single account. This enables you to diversify your funds, reducing the risk associated with fluctuations in a single currency's value. It's particularly advantageous for investors seeking to spread their risk across different currencies.

- Cost savings: MCAs often provide more competitive exchange rates than traditional banks or currency exchange services. This means you can save on the relevant foreign currency conversion fees, especially if you frequently deal with multiple currencies. Reduced transaction costs can be significant for individuals and businesses engaged in international transactions.

- Convenience: Managing finances becomes more convenient with an MCA. You no longer need to maintain multiple accounts in different currencies, making keeping track of your funds and foreign currency spends easier. This streamlines your financial affairs, simplifying transactions and fund management.

- International transactions: MCAs are ideal for international travellers, businesses with global operations, and individuals who frequently make cross-border payments (for example, if you're in Asia and trade beyond your borders and need to pay in the Australian Dollar or Hong Kong Dollar, an MCA is highly useful to have as a business owner). You can easily receive payments in foreign currencies, make purchases in those currencies, and conduct international money transfers. This eliminates the need for manual currency conversion calculations and reduces the associated costs.

Disadvantages

- Maintenance fees: Some MCAs may come with maintenance fees. These fees can vary between banks and account types. It's essential to carefully review the fee structure of your chosen MCA to ensure it aligns with your usage patterns. Failure to do so may result in unexpected expenses.

- Exchange rate fluctuations: Holding multiple currencies exposes you to exchange rate fluctuations. The value of your holdings in foreign currencies can rise or fall, impacting your overall wealth. While currency diversification can mitigate risk, it doesn't eliminate the potential for losses due to currency depreciation.

- Eligibility criteria: Not everyone may qualify for an MCA. Eligibility criteria can vary from one bank to another and can depend on factors such as your existing relationship with the bank, your account balance, and your intended usage. It's crucial to check the specific requirements for the MCA you're interested in to ensure you meet the criteria.

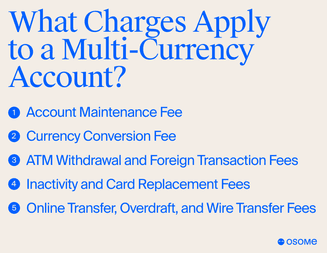

What Charges Apply to a Multi-Currency Account?

Fees associated with a Multi-Currency Account in Singapore can vary depending on the bank or financial institution providing the account. Here are some common fees you may encounter:

- Account maintenance fee: Some MCAs may have a monthly or annual maintenance fee, typically waived if you maintain a minimum balance in the account.

- Currency conversion fee: A currency conversion fee may apply when you convert funds from one currency to another, such as the Singapore Dollar to the Canadian Dollar. It's essential to check the prevailing rates to ensure you get a competitive rate.

- ATM withdrawal and foreign transaction fees: If you use an ATM to withdraw cash from your MCA while abroad, you may incur fees for overseas ATM withdrawals, including both a fee from the bank and a fee from the ATM operator.

- Inactivity and card replacement fees: Some MCAs may charge inactivity fees if you don't use the account for a specified period. This fee encourages account usage.

- Online transfer, overdraft, and wire transfer fees: While many MCAs offer free online transfers between your sub-accounts, it's essential to confirm this, as some banks may charge fees for online transfers on all your foreign transactions.

Top Multi-Currency Accounts In Singapore

Here are some of the leading Multi-Currency Accounts offered by banks in Singapore for you to seamlessly spend or trade in the Singapore Dollar with other currencies.

1 DBS My Account

DBS My Account is a comprehensive multi-currency banking solution that supports 12 major foreign currencies (Japanese Yen, United States Dollar, Sterling Pound, Chinese Renminbi, New Zealand Dollar and others). It offers a user-friendly online platform for convenient currency management. One of its key benefits is that there is no minimum balance requirement, which enhances flexibility. This makes DBS My Account an ideal choice for individuals and businesses who want to diversify their currency portfolio and enjoy competitive rates. With DBS My Account, you can enjoy a seamless and hassle-free experience for all your multi-currency banking needs.

2 OCBC Global Savings Account

The OCBC Global Savings Account allows you to hold funds in 9 foreign currencies (Chinese Yuan Offshore, British Pound Sterling, US Dollar, Japanese Yen and others), making it an ideal choice for international travellers and businesses. It comes with a linked OCBC debit card for convenient spending in foreign and local currencies and offers competitive interest rates on Singapore Dollar balances, potentially boosting your savings.

3 UOB Mighty FX

A UOB Mighty FX account offers 11 different currencies (US Dollar, Swiss Franc, Japanese Yen, New Zealand Dollar, British Pound and others) and provides real-time exchange rates through the UOB Mighty app. It is designed for travellers and individuals frequently dealing with foreign currencies, ensuring quick access and efficient currency management.

4 POSB My Account

The POSB My Account supports 11 major currencies, making it suitable for various foreign currency-related needs. It is designed for everyday banking and foreign currency transactions, typically with no monthly account fees, making it a cost-effective option.

5 HSBC Everyday Global Account

An HSBC Everyday Global Account is available in 11 foreign currencies (New Zealand Dollar, Singapore Dollars, Ringgit Malaysia, etc.) and offers access to HSBC Premier benefits. It includes a linked debit card for worldwide spending, making it a comprehensive choice for international financial activities.

6 Citibank Global Foreign Currency Account

The Citibank Global Foreign Currency Account allows you to manage 10 foreign currencies, convenient online transfers between currencies, and free fund transfers to Citibank accounts worldwide, ensuring efficient currency management and transfers.

7 Standard Chartered Wealth $aver Priority Banking

This account provides sub-accounts in 7 major currencies and offers priority banking services. It is ideal for high-net-worth individuals seeking currency diversity and personalised banking services, enhancing their overall banking experience.

Conclusion

A Multi-Currency Account (MCA) in Singapore is a valuable tool for individuals and businesses with international financial needs. It simplifies currency management, reduces transaction costs, and enhances convenience.

It allows individuals and businesses to hold and manage multiple currencies within a single account. Unlike traditional savings or checking accounts that are typically denominated in a single currency, MCAs offer the flexibility to transact in various foreign currencies alongside the local currency — in your case, the Singaporean Dollar (SGD).

Explore the offerings from top banks to find the MCA that aligns with your financial goals and lifestyle.

FAQ

What is a multi-currency account in Singapore?

A Multi-Currency Account (MCA) in Singapore is a bank account that allows you to hold and manage multiple currencies within a single account. It simplifies foreign currency exchange and is beneficial for international transactions and frequent travellers.

What is the best multi-currency bank account?

The ideal multi-currency bank account in Singapore varies based on individual needs. Consider supported currencies, fees, exchange rates, and features offered by different banks to find the best fit.

How do I use a DBS multi-currency account?

Using a DBS MCA is straightforward. You can open an account online or at a DBS branch, deposit funds in your chosen currencies, and then use the account for international transactions. DBS offers a user-friendly online platform for managing your currencies and making transactions.

What is the best multi-currency bank account?

The ideal multi-currency bank account in Singapore varies based on individual preferences and requirements. DBS Account is known for its extensive currency support, competitive FX rates, and user-friendly online platform. OCBC Global Savings Account appeals to international travelers and savers with its comprehensive foreign currency options and linked debit card. Meanwhile, HSBC's Everyday Global Account offers Premier benefits, a linked debit card, and access to 11 currencies. The best choice hinges on factors like currency needs, spending habits, and personal banking preferences, so carefully assessing these factors is essential to selecting the most suitable option.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?