5 Benefits of Outsourcing Accounting Services

- Modified: 10 February 2026

- 6 min read

- Running a Business

Heather Cameron

Author

From expert guidance and helpful accounting tips to insights on the latest trends in fintech, Heather is here to empower entrepreneurs and small business owners in Singapore with great content. With a background in digital marketing spanning eight years, she has experience writing for various industries and audiences. As Osome’s copywriter, she’s here to inform and inspire our readers with great storytelling.

John Yap

Reviewer

John Yap, our Head of the Accounting Team in Singapore, brings over a decade of expertise in SFRS, corporate tax, and GST compliance. As a key blog reviewer, John ensures our accounting content is accurate and relevant, transforming complex concepts into actionable advice. With John's meticulous oversight, you can trust that our blog provides reliable and up-to-date information to help you navigate the intricacies of financial management and compliance in Singapore.

Outsourcing your accounting can be a strategic move to save a company's time and money by eliminating the need for in-house accounting staff and their associated overhead costs, further improving the efficiency of your business operations. This article delves into the benefits of outsourcing accounting services for businesses in Singapore, addresses concerns, and provides tips for selecting the right accounting firm.

Key Takeaways

- Outsourcing finance and accounting services can be cost-effective by eliminating the need for in-house staff and additional costs. It also streamlines processes and improves efficiency.

- Outside accounting firms provide access to experienced accountants who can handle complex accounting tasks, provide comprehensive financial management services, ensure compliance with local regulations, and identify potential tax savings.

- Independent accounting also allows businesses to leverage experienced finance professionals and their valuable insights and expand their accounting operations without hiring and managing additional staff.

- Businesses can free up time and resources to focus on their core business functions and strategic initiatives by outsourcing accounting services.

Why Outsource Accounting?

In Singapore's fast-paced business landscape, streamlining operations and maximising efficiency are crucial for a business's success. One great way of doing so is by outsourcing your accounting services to free up valuable resources from financial management while ensuring the accuracy of your unaudited financial statements, accessing valuable insights and advanced tools, accomplishing financial tasks with perfection and helping businesses to make informed financial decisions for stronger growth.

There are many benefits of outsourcing accounting in Singapore. For example, businesses can streamline operations and reduce costs by eliminating the need for an in-house accountant and the associated employee benefits costs. Outsourcing accounting services also provides access to professionals who can handle complex accounting tasks, provide accurate financial reporting, uncover potential tax savings, and ensure compliance with local regulations.

Additionally, outsourcing allows companies to scale business operations by enhancing their accounting functions without hiring and managing additional staff. For small businesses that cannot afford an in-house bookkeeper, cost-effectiveness is one of the key benefits of outsourcing accounting services.

Top 5 Benefits of Outsourced Accounting in Singapore

Hiring an outside firm streamlines accounting function, reduces other costs related to retaining a full-time accountant in-house, and provides access to experienced professionals who can handle complex accounting tasks, ensuring compliance with local regulations and uncovering potential tax savings. Additionally, outsourcing offers scalability, allowing companies to adapt to changing needs without the burden of hiring and managing additional staff, ultimately driving growth and success.

1 Cost savings and improved efficiency

When companies outsource their bookkeeping services, they no longer need to handle in-house accounting staff salaries, benefits, and accounting software costs. Outsourcing firms often leverage economies of scale to provide these services at a lower cost per unit, freeing up capital for core business activities. Additionally, experienced outsourced accounting teams can handle tasks efficiently, saving valuable time for business owners and employees.

2 Access to expertise and specialised skills

Engaging a reputable outsourced accounting firm in Singapore grants access to a team of highly skilled and experienced professionals. These professionals stay up-to-date on the latest Singaporean tax laws, accounting regulations, and industry best practices. This expertise ensures your business receives accurate financial reporting, complies with local regulations, and potentially uncovers tax-saving opportunities.

3 Enhanced scalability and flexibility

As your Singapore business grows, your accounting needs will evolve. Therefore, businesses sometimes outsource accounting services to gain agility and scale up or down based on specific requirements without the hassle of managing an in-house accounting team. This frees your business from the burden of hiring and training in-house staff to stay on top of peak seasons or periods of expansion.

Osome provides comprehensive accounting services tailored to your Singapore business needs. Our experienced team can help you with everything from bookkeeping and tax compliance to financial reporting and strategic planning. Let us help you streamline your financial operations and achieve your business goals!

4 Improved security and reduced risk of errors

Concerns over data theft are another reason some companies prefer an in-house team over hiring an independent accounting service provider. An in-house accounting department keeps all sensitive information within the organisation. If you're switching from an internal team to an outside partner, make sure your provider invests in data security measures and employs only experienced professionals bonded by professional ethics to ensure security and confidentiality.

5 Time savings and increased focus on business

Outsourced services free up valuable time for business owners and employees in Singapore. Instead of handling routine bookkeeping tasks, they can focus on strategic planning, customer relationship management, and business development.

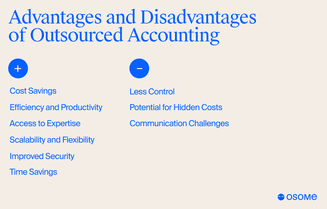

Potential Concerns About Outsourced Accounting in Singapore

It requires trusting an external provider with your financial data. Reputable firms prioritise transparency and provide regular updates to maintain client trust. It's crucial to thoroughly evaluate pricing structures and communication channels to avoid hidden costs and ensure effective collaboration. Consider factors like time zone differences and preferred communication methods when selecting a provider.

Less control over your financials

Some Singaporean business owners may be apprehensive about relinquishing control of their financial data. However, reputable accounting firms prioritise transparency and provide regular reports and communication channels to ensure you stay informed and involved.

Hidden costs

It's essential to thoroughly evaluate the pricing structure offered by an outsourced accounting provider to avoid hidden costs. Ask for a detailed breakdown of fees and ensure the services offered align with your specific needs.

Communication delays

Clear communication is paramount for a successful relationship with your accounting team. Choose finance professionals with strong communication skills and a proven track record of responsiveness. Consider factors like time zone differences and preferred communication methods when selecting a firm.

How To Select the Perfect Outsourced Accounting Service?

To select outsourced accounting services for your Singapore business, assess your specific needs based on size, complexity, and compliance requirements. Then, research potential firms, considering their experience, qualifications, and client testimonials. Finally, evaluate the value proposition offered by each firm, focusing on services, expertise, and communication strategies rather than solely on cost.

Identifying your requirements

The first step for outsourcing your accounting is to define your business's financial needs. Consider the size and complexity of your operations, the volume of transactions, and your specific compliance requirements. This will help identify the level and kind of services required.

Evaluating qualifications and experience

When hiring an outsourced accounting partner, look for experienced professional accountants in Singapore with a strong track record of serving your industry. Investigate their qualifications, experience with relevant accounting software, and professional memberships.

Client testimonials and industry reputation

Read client testimonials and reviews to gauge the quality of service offered by different firms. Research their industry reputation and consider awards or recognition they may have received.

Cost comparison and value proposition

Cost is a factor, but it shouldn't be the sole deciding factor. Focus on the value proposition offered by each firm. Compare their services, level of expertise, and communication strategies to determine the best fit for your needs.

How Osome Can Help

Outsourced accounting can transform how you manage your finances, and Osome offers a complete solution designed for Singapore businesses. With Osome, you get expert bookkeeping, statutory compliance, tax filing, and real‑time financial insights — all managed by a dedicated team so you can focus on growth. Our platform automates invoicing, expenses, payroll, and reporting, reducing manual work and improving accuracy. Whether you’re a startup or an established SME, Osome ensures your accounts are up to date and compliant with Singapore regulations, helping you make smarter business decisions with confidence. Check out our pricing packages!

Summary

Outsourcing accounting offers a strategic advantage for Singapore companies seeking to optimise efficiency, gain access to specialised knowledge, and free up valuable resources. By carefully evaluating the benefits and considering potential concerns, companies can leverage an outsourced accounting team to achieve financial clarity, propel business growth, and ultimately focus on achieving core business goals.