How To Start a Business in 10 Steps: A Comprehensive 2025 Guide

- Modified: 26 December 2024

- 26 min read

- Starting a Company

Gabi Bellairs-Lombard

Author

Gabi creates content that inspires. She's spent her career writing compelling website copy, and now she specialises in product marketing copy. As the voice of our products and features, Gabi makes complex business finance and accounting topics easy to understand. Her top priority is ensuring that her words impact and inspire her readers.

Looking to start a business in Hong Kong? It's the perfect destination for budding entrepreneurs – a bustling hub of business in Asia, buzzing with innovation and a vibrant startup community. The government offers attractive tax rates, and there's no shortage of talented individuals eager to contribute to your venture.

Starting a Business in Hong Kong

Hong Kong has a dynamic economy and has established itself as a haven for startups and entrepreneurs looking to set up their own limited company. Not only that, but it's also a shopaholic's paradise and a breathtaking tourist destination. With all these enticing factors, it's no wonder Hong Kong is a fantastic place to run a business and establish a private limited company.

For everything you need to know about starting a business in the Pearl of the Orient, keep reading! And if you're ready to take the next step, our company registration services can help you establish your own business smoothly and efficiently.

1 Develop your business idea

Research existing companies in the industry your business idea lives in. Learn from the leaders and find ways to do things better. You've got a solid business idea and prospective business plan if you can offer something unique or provide the same thing faster and cheaper. We encourage you to take the time to meticulously research existing companies, examining their strategies, successes, and pitfalls. Embrace the role of a keen observer, gleaning insights from industry leaders while remaining vigilant for opportunities to innovate and improve upon existing practices.

Define your “why?”

Before going headlong into the intricacies of entrepreneurship, take a moment to reflect and heed the wisdom of industry pros like Simon Sinek's timeless question: "Why?" Dive deep into the core of your motivations and reasons driving your desire to embark on the journey of starting a business. This introspective exercise is not merely a formality but a pivotal step in laying the groundwork for your entrepreneurial endeavours. Differentiate between personal aspirations and market needs. Aligning with the market leads to success, while personal passion fuels drive. Indeed, many business owners discover unparalleled success by identifying and addressing specific market gaps or demands, forging a symbiotic relationship between personal fulfilment and commercial viability. So, before taking the plunge, grasp the essence of your "why" — this is the compass guiding your entrepreneurial journey.

Consider franchising

Consider another alternative: opening a franchise of an already well-established company in Hong Kong. Franchising a business offers a multitude of benefits for entrepreneurs venturing into the realm of business ownership. Firstly, it provides access to a proven business model, significantly reducing the risk associated with starting a new venture from scratch. Franchise systems typically come with established brand recognition and operational procedures, offering a solid foundation for success.

Furthermore, the collective purchasing power of a franchise network often translates into cost savings on supplies and services, enhancing profitability. Overall, franchising presents a compelling opportunity for aspiring entrepreneurs to realise their business dreams with reduced risk and enhanced support.

Brainstorm your business name

Stephanie Desaulniers, the owner of Business by Dezign and a former director of operations and women's business programs at Covation Center, advises entrepreneurs to write a business plan or brainstorm a company name before determining the true value of their business idea.

Identify your target audience

According to Desaulniers, one common mistake is diving headfirst into launching a business without considering who their potential customers are and what would motivate them to choose their products or services.

She emphasises the importance of understanding why you want to serve these customers. By identifying these motivations, you can gain clarity on your business mission.

Take the time to define your "why," identify your target market and customers, and come up with a compelling business name.

2 Create a business plan

After solidifying your business idea, it's time to ask yourself a series of important questions: What is the purpose behind your business? Who is your target audience? What are your ultimate goals? How will you secure the necessary funds to kickstart your venture?These questions can be effectively addressed through a well-crafted business plan.

Many small business owners need to thoroughly contemplate these fundamental aspects to run a successful business in the future.

Do market research

Engaging in extensive market research is crucial to create a comprehensive business plan. This entails conducting surveys, organising focus groups, and delving into SEO and public data to gather valuable insights. Starting a business in Hong Kong will require tailored research compared to starting a business elsewhere.

Market analysis is an indispensable step in laying the groundwork for a successful venture, offering invaluable insights that inform crucial business decisions. Here's why it's imperative to conduct market research when starting a new business:

- Understanding customer needs: The research helps identify customer preferences, pain points, and unmet needs, enabling businesses to tailor their offerings to meet market demands effectively.

- Assessing market viability: By analysing market trends, size, and growth potential, entrepreneurs can gauge the feasibility of their business idea and determine whether there's a viable market for their products or services.

- Competitive analysis: Studying competitors' strengths, weaknesses, pricing strategies, and market positioning provides valuable benchmarking insights, helping local businesses differentiate themselves and carve out a competitive edge.

- Identifying target audience: The research aids in defining target demographics and segments, facilitating targeted marketing efforts and maximising the return on investment in promotional activities.

- Mitigating risks: Through thorough market analysis, entrepreneurs can anticipate potential challenges, market fluctuations, and industry disruptions, enabling proactive risk management and strategic planning.

- Optimising product development: Feedback gathered from the research aids in refining product features, design, and pricing to align with customer expectations and enhance product-market fit.

- Informing business strategy: Market analysis serves as a foundation for developing informed business strategies, and guiding decisions related to pricing, distribution channels, marketing channels, and expansion plans.

In essence, conducting comprehensive market research empowers entrepreneurs to make informed decisions, mitigate risks, and position their new business for sustainable growth and success in a competitive marketplace.

Formulate an exit strategy

As you construct your plan, it's wise to consider an exit strategy. Contemplating how you will eventually exit the business encourages you to consider its future in Hong Kong.

According to Josh Tolley, CEO of Shyft Capital and Kavana, new entrepreneurs often get caught up in the excitement of their business and assume that everyone will be their customers, neglecting to allocate sufficient time to plan their eventual exit. Not having predetermined exit routes can result in diminished company value and strained relationships.

3 Evaluate your finances

It's crucial to determine how you will finance those business costs. Can you fund your startup from your resources, or will you need to secure a small business loan? If your plan involves leaving your current job to focus solely on your business, do you have savings until you start generating profits? What are the company registration costs, and will you need a business license? Will you need to outsource professional services such as an accountant? It's essential to ascertain the exact amount required for your startup costs.

Conduct a break-even analysis

Conducting a break-even analysis stands as a cornerstone in financial planning for startups and established businesses alike. This pivotal tool empowers business owners to not only gauge the threshold at which their company, product, or service begins to yield profits but also to gain nuanced insights into the intricate dynamics of their financial operations.

A break-even analysis serves as a financial compass, guiding entrepreneurs who want to start a successful business through the labyrinth of uncertainties by illuminating the minimum level of performance required to stave off financial losses. By meticulously scrutinising fixed and variable costs against revenue projections, businesses can pinpoint the precise moment when revenue surpasses total startup costs, signalling the onset of profitability.

Moreover, a break-even analysis transcends its role as a mere financial metric; it serves as a strategic blueprint for decision-making. Armed with a thorough understanding of their break-even point, entrepreneurs can chart a course towards profitability by setting realistic production goals and revenue targets that align with their overarching business objectives. This clarity of purpose not only fosters financial stability but also instils confidence in stakeholders, paving the path for sustained growth and success.

In essence, by harnessing the power of break-even analysis, entrepreneurs can navigate the turbulent waters of business with precision and foresight, transforming financial uncertainties into opportunities for strategic advancement and prosperity.

Keep an eye on your business expenses

It's crucial to avoid excessive spending. Take the time to understand which purchases align with your objectives, and refrain from splurging. When the time comes, it's worth considering a business bank account integrated with user-friendly accounting software to help give you clarity over how your money is moving.

Expert company registration

We guide small business owners through incorporation, advise you on the best business structure for your startup, and assist with a business license or a bank account if needed. We also offer our support beyond limited company registration as part of our subscription services, including smart accounting software and tips on paying the right tax for your small business.

Consider your funding options

The most suitable funding method depends on factors such as your creditworthiness, the required amount of funds, and the available options. Many small business owners rely on funding to get their feet off the ground, and the Hong Kong government is a huge advocate for the start-up community's success, but it's not always easy to access.

Choose the best bank

The institution's size plays a significant role. Founders of start-ups suggest considering smaller community banks in Hong Kong as a starting point. These banks have a better understanding of local market conditions. They are more likely to work with you based on your overall business profile, a solid business plan, and your character.

When choosing a bank in Hong Kong and business bank account, it's important to ask yourself the following questions:

- What is important to me?

- Do I want a close relationship with a bank willing to assist in any way possible?

- Do I want to be treated as just another business bank account, as is often the case with larger banks?

- Do I want a separate business bank account to keep my personal finances separate?

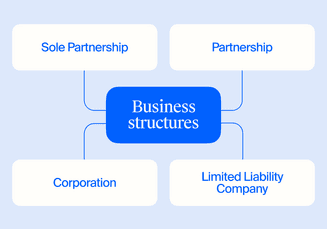

4 Choose the right business structure

After selecting a bank account, you have several options for choosing the appropriate business structure.

Each business structure has advantages and considerations, so it's important to evaluate your specific needs and consult with professionals to determine the most suitable option for your business in Hong Kong.

Limited Liability Company

The Limited Liability Company, also known as LLC, combines the benefits of a corporation's limited liability with a partnership's flexibility and tax advantages. This business entity functions as a separate legal entity, allowing its profits to be taxed as personal income without corporate taxes. Compared to corporations, a Limited Liability Company requires fewer formalities, making it one of the most appealing business structures for entrepreneurs.

Private Limited Company

The most common legal structure in Hong Kong is a private limited company. It offers legal entity status, providing personal liability protection for its owner. Ownership of shares in the company can belong to a single individual or multiple individuals.

Sole Proprietorship

Sole Proprietorship is the simplest form of ownership, owned and operated by a single individual with full financial control within the business model. However, as the company is not a separate legal entity, the sole proprietor is personally liable for all business debts and has unlimited liabilities.

General Partnership

Partnerships involve two or more individuals jointly owning the business. In general partnerships, all partners have equal management rights. Like a sole proprietorship, partnership is not considered separate legal entities, meaning partners bear personal liability for debts and liabilities.

Limited Partnership

Limited Partnerships consist of both general and limited partners. General partners have unlimited liability, while the liability of limited partners is limited to their capital contribution to the partnership.

You can establish a wholly-owned subsidiary company in Hong Kong, which enjoys the same incentives, tax exemptions, and legal obligations as locally based companies. This subsidiary operates as a private limited company formed in Hong Kong and also provides personal liability protection.

Branch Office

Branch Offices allow foreign-based companies to establish a presence in Hong Kong. This business model provides a formal business setup, with the foreign parent company assuming responsibility for the branch office's debts and liabilities.

5 Register your business with the government

It is essential to obtain the necessary business licences in Hong Kong. This typically involves registering your business with relevant federal, state, and local government entities. You must prepare and submit several required documents to complete the registration process. You must also register with the IRD (Inland Revenue Department) to collect sales tax.

Articles of incorporation and operating agreements

You must undergo a government incorporation process to establish your business as an official and recognised entity in Hong Kong. For corporations, this involves preparing articles of incorporation documents. These documents provide crucial details, such as the business name, purpose, corporate structure, stock information, and other pertinent company information. Similarly, certain Limited Liability Companies (LLCs) may be required to draft an operating agreement that outlines the operational guidelines and structure of the company.

Doing Business As (DBA)

If you still need articles of incorporation or an operating agreement, the next step is to register your business name. In Hong Kong, you can choose your legal name, a fictitious DBA (Doing Business As) name if you run a sole proprietorship or the unique name you have selected for your company. To enhance legal protection, you might also consider trademarking your brand name.

Employer identification number (EIN)

Obtaining an employer identification number (EIN) from the IRS may still be necessary, depending on your circumstances. While sole proprietorships without employees are not obligated to have an EIN, it is advisable to consider applying for one. Doing so allows you to separate your personal and corporate taxes and save you from potential complications if you hire employees. The IRS offers a checklist to help determine whether you need an EIN. If you need an EIN, you can conveniently register for one online at no cost.

Income tax forms

To meet your federal and state income tax responsibilities in Hong Kong, it is necessary to complete specific forms. The forms required depend on the business structure. It is important to visit the official websites of the relevant tax authorities in Hong Kong to obtain information regarding any specific tax obligations at the state or local level. Once you have all the necessary information, utilising reliable online tax software can assist you in accurately filing and paying your taxes quarterly and annually.

Federal, state, and local licences and permits

In addition to the requirements above, certain businesses in Hong Kong may need to acquire federal, state, or local licences and permits to operate legally. You should contact the relevant local government office or city hall to obtain a licence.

Certain trades and professions in Hong Kong mandate professional licences for businesses and independent contractors. A commercial driver's licence (CDL) is an example of a professional licence. This licence allows individuals to operate specific types of vehicles, including buses, tank trucks, and tractor-trailers. CDLs are classified into three categories: Class A, Class B, and Class C.

6 Get business insurance

It is crucial to recognise the importance of acquiring appropriate business insurance coverage— incidents such as property damage, theft, or customer lawsuits can have significant financial implications for your small business.

While considering various types of insurance, there are a few fundamental plans that most startups in Hong Kong can greatly benefit from, especially if you're a new startup. For instance, if you plan to hire employees, obtaining workers' compensation and unemployment insurance is essential to meet legal requirements.

It is generally advisable for small businesses in Hong Kong to acquire general liability (GL) insurance or a business owner's policy to protect your business and personal assets. GL insurance covers property damage, bodily injury, and personal injury to yourself or third parties.

7 Assemble your team

Recognising that building a strong team is essential, especially if you don't have a business plan to be the sole employee of your new business. Joe Zawadzki, a general partner at AperiamVentures, emphasises that entrepreneurs with their own business should dedicate the same level of attention to the "people'' aspect of their businesses as they do to their products.

8 Select your suppliers

Managing every aspect alone can be overwhelming for those wanting to run a business. This is where third-party vendors can play a significant role. Regardless of your industry, some companies specialise in various services, such as HR or accounting services, and are dedicated to partnering with you and enhancing your corporate operations.

There are certain products and services that almost every small business will need. Consider the following essential functions:

- Enabling multiple customer payment types: Providing customers with various payment options ensures convenience and increases the likelihood of making a sale (and subsequently collecting sales tax). Compare different credit card processing providers to find the one that offers the best rates for your business, as small business credit card processing can directly contribute to revenue growth and expand your customer base.

- Facilitating customer payments: Set up a state-of-the-art point-of-sale (POS) system to streamline sales transactions. The best POS systems combine payment technology, including credit card processing, with inventory and customer management features. This becomes especially important if your business sells products rather than services.

- Managing finances: While many business owners handle their own accounting functions during the initial stages, as your business grows, hiring an accountant or selecting the right accounting software provider can save you valuable time and streamline financial management processes.

9 Establish your brand and promote it

For individuals looking to start a small business in Hong Kong, it is crucial to establish a strong brand presence and cultivate a loyal customer following even before launching your products or services. Comprehensive marketing plan is important to establish a business's online reputation, which is where most potential customers in your target market will spend their time.

- Company website: Take your business online by building a company website. As many customers rely on the internet to learn about businesses, a website serves as digital proof of your small business's existence and your business name. It also provides a platform for engaging with current and potential customers.

- Social media: Use social media platforms to generate buzz and spread awareness about your business name and unique selling points. You don’t need to be on every social media platform, but you should be presented at least on Facebook and Instagram. Both platforms offer ecommerce features that let you sell directly from your social media accounts. Select the social media platforms that align with your target audience.

- CRM (Customer Relationship Management): Implement an effective CRM system to store customer data and enhance marketing strategies for your small business. A well-planned email marketing campaign can greatly contribute to reaching and engaging with customers. It is crucial to build your email marketing contact list strategically, even if you are a brick-and-mortar business.

- Logo: Create a distinct logo representing your brand and use it consistently across all your platforms. A recognisable logo helps customers easily identify and connect with your new business.

Ensure your digital assets are regularly updated with relevant and captivating content related to your business and industry. According to Ruthann Bowen, chief marketing officer at EastCamp Creative, many startups underestimate the value of their websites and see them as expenses rather than investments. In today's digital age, this mindset is a significant mistake.

10 Expand your business

As an aspiring entrepreneur in Hong Kong, it's important to understand that launching a business and making initial sales is just the beginning of your business journey. Beyond the excitement of inception lies the arduous yet exhilarating path towards sustained profitability and exponential growth. This journey demands unwavering dedication and relentless effort, for the trajectory of your business is intricately tied to the magnitude of your input and determination.

Entrepreneurs who are looking for ways to achieve perpetual growth can use various strategic avenues to take their businesses to new heights. A well-crafted business plan serves as the foundation for this growth, outlining key strategies and objectives that guide decision-making. One of these methods involves forming strategic alliances with established brands within their industry. By approaching complementary businesses and proposing synergistic partnerships, entrepreneurs can unlock a plethora of opportunities for mutual growth and collaboration. Whether through cross-promotional initiatives, co-branded campaigns, or joint ventures, these partnerships not only expand reach and customer base but also foster innovation and market penetration.

Furthermore, entrepreneurs can amplify their brand's impact and visibility by aligning with charitable organisations and engaging in philanthropic endeavours. A thoughtful plan can incorporate these efforts, ensuring that social responsibility aligns with the company's broader objectives. By contributing time, resources, or products to meaningful causes, businesses not only fulfil their corporate social responsibility but also cultivate a positive brand image and garner goodwill within the community. This heightened visibility not only attracts socially conscious consumers but also bolsters brand loyalty and differentiation in an increasingly competitive landscape.

Why Set Up a Business in Hong Kong?

When considering why you should establish a new business in Hong Kong, there are several compelling reasons beyond the city's abundance of attractions and breathtaking natural beauty. Hong Kong's jurisdiction, culture, and business environment present unique advantages for entrepreneurs.

Streamlined and cost-effective setup process

Registering your company in Hong Kong is seamless and affordable. With a well-prepared plan, it only takes 48 hours to complete, making it one of the fastest in the world. Hong Kong's business regulations also offer numerous benefits uncommon in other countries. These include no minimum registered capital requirement, no necessity for a local director, no restrictions on foreign investment, and more.

Dynamic business environment

Hong Kong is renowned for its vibrant business landscape, ranking as the third most competitive economy according to the World Economic Forum's Competitiveness Index 2019. Many entrepreneurs choose Hong Kong as a strategic gateway to expand their businesses throughout the region. With a thriving community of 340,000 SMEs and a bustling startup hub, the city fosters innovation and offers excellent growth opportunities. Moreover, the Hong Kong government has committed to investing HKD 100 billion in innovation and technology, further enhancing the business ecosystem.

Favourable taxation system

Hong Kong's business-friendly tax structure is another compelling advantage. Corporate tax is only 16.5%, with the first HKD 20,000 of profit being exempted. Additionally, no value-added tax (VAT), dividend sales tax, or tax on capital gains provides further business incentives.

Affordable social charges

In Hong Kong, companies are not burdened by monthly social charges, with the maximum payment capped at HKD 1,500 per employee. This favourable arrangement helps businesses maintain a cost-effective approach while operating in the city.

I believe Hong Kong is the place to be if you’re an entrepreneur seeking success. The transparent tax system, with no value-added or capital gains taxes, is a big financial advantage for businesses while its strategic location as a gateway to China and the wider Asia-Pacific area unlocks huge market potential.

Corporate Secretary Manager

Hong Kong's economic growth

The dynamic economy of Hong Kong serves as a primary motivation for entrepreneurs looking to run a business in the city. Hong Kong's economic freedom ranks high both regionally and globally, and several key factors influence it:

- Favourable economic policies: Hong Kong implements policies that promote business growth and encourage investment, fostering an environment conducive to entrepreneurial success, especially when aligned with a business plan.

- Transparent legal laws: The legal system in Hong Kong is known for its transparency and reliability, providing a solid foundation for conducting business operations with confidence.

- Open market: Hong Kong boasts an open and competitive market, offering many opportunities for businesses to thrive and expand. This market openness facilitates trade and encourages innovation.

- Efficient regulatory systems: Hong Kong is recognised for its efficient regulatory frameworks, enabling businesses to navigate processes smoothly and with minimal bureaucracy. This efficiency streamlines operations and supports a conducive business environment.

- Protection of property rights: Hong Kong upholds the security of property rights, ensuring that businesses can operate confidently and safeguard their intellectual and physical assets.

By capitalising on these factors, entrepreneurs can, with a strong plan, tap into the vibrant and dynamic economy of Hong Kong, benefiting from its economic freedom and conducive business environment to launch and grow successful ventures.

Investment opportunities in various sectors

Starting a business in Hong Kong is comparatively easier than in other countries. The registration process is streamlined and cost-effective, making it an attractive destination for entrepreneurs with a well-defined business plan. As a result, the region has witnessed a surge in start-ups, positively impacting the local economy. Hong Kong is experiencing notable growth in various sectors, including:

- Information & technology: The tech industry is thriving in Hong Kong, with advancements in software development, artificial intelligence, and digital innovation driving its growth.

- Ecommerce: The rise of online retail has created opportunities for ecommerce businesses in Hong Kong, leveraging the city's robust logistics infrastructure and tech-savvy consumer base.

- Hardware: Hong Kong serves as a hub for hardware manufacturing and innovation, attracting businesses involved in electronics, consumer goods, and hardware development.

- Financial technology: The fintech sector is flourishing in Hong Kong, with companies specialising in digital payments, blockchain technology, and financial services revolutionising the financial landscape.

- Professional services: Hong Kong's position as a global financial centre has fostered the growth of professional service providers, including legal, consulting, accounting, and advisory firms.

- Healthcare: The healthcare industry is expanding in Hong Kong, driven by advancements in medical technology, pharmaceuticals, and healthcare services.

- Data analysis: The demand for data analysis and business intelligence solutions is rising in Hong Kong, with companies specialising in data-driven insights and analytics experiencing significant growth.

- Education and Learning: Hong Kong is witnessing developments in educational technology, e-learning platforms, and specialised training services to cater to the continuous learning needs of individuals and businesses.

By venturing into these growing sectors, entrepreneurs can capitalise on the thriving business landscape of Hong Kong and contribute to the region's economic prosperity.

Appealing government policies and programs

Foreign investors are attracted to jurisdictions where the government actively supports business ventures. In Hong Kong, foreign entrepreneurs can have full ownership of their businesses, granting them the opportunity to hold top executive positions within their companies. The Hong Kong government has established InvestHK, a dedicated department that provides free investment promotion and valuable services to foreign companies. This initiative aims to facilitate the growth and success of businesses operated by foreigners in Hong Kong.

Hong Kong's geographical location

Located in Central Asia, Hong Kong serves as a gateway to various trade markets, notably mainland China. Its strategic position is a significant factor that attracts investors to the region. The accessibility Hong Kong provides to diverse markets is highly appealing to investors eager to expand their business. With its advantageous location, Hong Kong presents abundant opportunities for businesses seeking growth and expansion.

Exceptional banking services

Foreign investors in Hong Kong can take advantage of the availability of multi-currency bank accounts. Hong Kong's banking sector is renowned worldwide for its exceptional services. In addition to the comprehensive range of banking facilities, Hong Kong maintains a comparatively low corruption rate compared to countries such as the UK, USA, and Germany. This is crucial for individuals planning to open a bank account in Hong Kong.

Lower taxation burden

Hong Kong stands out with its exceptionally low corporate tax rate compared to other countries. Moreover, no VAT or dividend sales taxes are imposed in Hong Kong. The current tax rates in Hong Kong are 16.5% for profit tax, 15% for property tax, and 15% for salaried taxes. This favourable tax regime established by the Hong Kong government is a significant driving force behind the increasing number of companies choosing to expand their business in Hong Kong.

Government's special initiatives

To draw foreign investment, the government has implemented effective programs that have yielded successful results. Recognising the direct correlation between investment and economic growth, the Hong Kong government has supported foreign investors.

The government of Hong Kong has established various special programs, including small business loans, loan funding, market funds, and incubator programs, specifically designed to attract foreign investors. These initiatives have proven to be enticing factors for foreign investors considering business opportunities in Hong Kong.

Apply for a Visa To Start a Business in Hong Kong

The wait to start a business in Hong Kong is worthwhile, considering its numerous advantages. With attractive government initiatives and a rapidly growing economy, Hong Kong has the potential to enhance your company's financial prospects significantly.

Before entering the Hong Kong market, it's crucial to understand its dynamics. Setting up a representative office can be beneficial to establish professional contacts for supply and sales and improve your Chinese language skills. However, patience is key, as building a successful business takes time. It's important to have a comprehensive business plan in place. You can rest assured that our highly experienced professionals will guide you in areas such as accounting, taxation, and consultancy, providing local support throughout your journey.

You must apply for a visa to invest or seek employment in Hong Kong. This entails completing a visa application form and meeting specific educational and professional qualifications requirements. A clean criminal record is also necessary for those who want to run a business in Hong Kong.

You can access the visa application form (ID 999A) from the Immigration Department's website and submit it online. The required documentation includes a copy of your passport photograph, passport copy, evidence of your educational and professional qualifications, and a two-year business plan. Background information about your business should also be provided.

Hong Kong Business 101: The Official Stuff

Navigating the landscape of entrepreneurship in Hong Kong entails adhering to a series of obligations and regulations set forth by the government. From registration requirements to tax obligations and compliance with labour laws, new businesses must navigate a complex web of regulations to ensure legal and operational compliance. Understanding these obligations is paramount for entrepreneurs embarking on their business ventures, as compliance not only fosters transparency and accountability but also establishes a solid foundation for sustainable growth and success in the dynamic business environment of Hong Kong.

Here is a summary:

- Local address: Your business must have a physical address in Hong Kong. P.O. boxes are not permitted.

- Corporate secretary: You are required to appoint a local corporate secretary. They ensure compliance with government regulations and document any structural or managerial changes.

- Business registration certificate: To formalise your business, you must obtain a Business Registration Certificate, which must be renewed annually. Contact the Business Registration Office at the Inland Revenue Department for this purpose.

- Local director: You must maintain at least one director for your business, who can be a local resident or a foreigner. The director must be at least 18 years old.

- Shareholder: Your business should have at least one shareholder, an individual or an entity. If the shareholder is an individual, they must be at least 18 years old.

- Annual General Meeting: Hold an Annual General Meeting and record the meeting minutes.

- Accurate accounting records: Maintain precise and detailed accounting records, including receipts, customer payments, income and expenditure, invoices, bank statements, and a daily record of money received.

FAQ

How easy is it for a foreigner to start a business in Hong Kong?

Hong Kong is a hub for business in Asia, and it’s open to foreigners running and starting businesses. Its Branch Office and Subsidiary business structures make it easy for foreign companies to operate in the area too.

If you are going to start a company in Hong Kong, it’s important to note that you will need an address in Hong Kong to set up your business, and P.O. boxes are not allowed.

What’s the easiest way to set up a business in Hong Kong?

Hong Kong allows people to launch businesses as sole proprietors. A single person owns these entities, and setting one up is very straightforward. However, it’s important to note that the individual is personally liable for business debts under this structure if the business fails.

The most common way of starting a business in Hong Kong is through a Private Limited Company, which is also relatively easy to set up and provides limited liability to the business owner.

Is Hong Kong a good place to start a business?

Hong Kong is a fantastic place to start a new business. It’s the centre of business in Asia, and you’ll be surrounded by a melting pot of startups and exciting, growing companies. The government supports businesses with competitive tax rates, too.

What’s the best way to organise my finances?

Like in other countries, businesses in Hong Kong must file financial returns, including reporting on their tax liability. That means it’s important to keep on top of your finances.

Osome offers an all-in-one platform to manage your finances and on-demand access to an accountant. We charge based on turnover so you get access to the support you need when you need it.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?