- Osome SG

- Accounting for Tech Companies

Accounting for tech companies, simplified

Ready to scale? Join the 30,000+ companies who have chosen Osome to help them grow. Osome accounting is designed to support tech companies with smart automation, easy-to-use software, and expert insights from trusted specialists.

You focus on innovation, we’ll handle the financial admin

Automated accounting

Leave the manual data entry behind and reclaim your time. Our smart software streamlines your finances and the compliance calendar feature will remind you of upcoming financial events, saving you hours of admin each month and boosting your efficiency.

Enhanced tax planning

Leverage our expertise in Singapore’s tax landscape. Our accountants ensure full compliance with tax regulations while helping you unlock valuable incentives to maximise savings and support business growth.

Expert financial guidance to grow your business

Our experts handle all your compliance needs, ensuring you meet deadlines and requirements, and avoid costly penalties, so you can scale with confidence.

Smart solutions to simplify your business operations

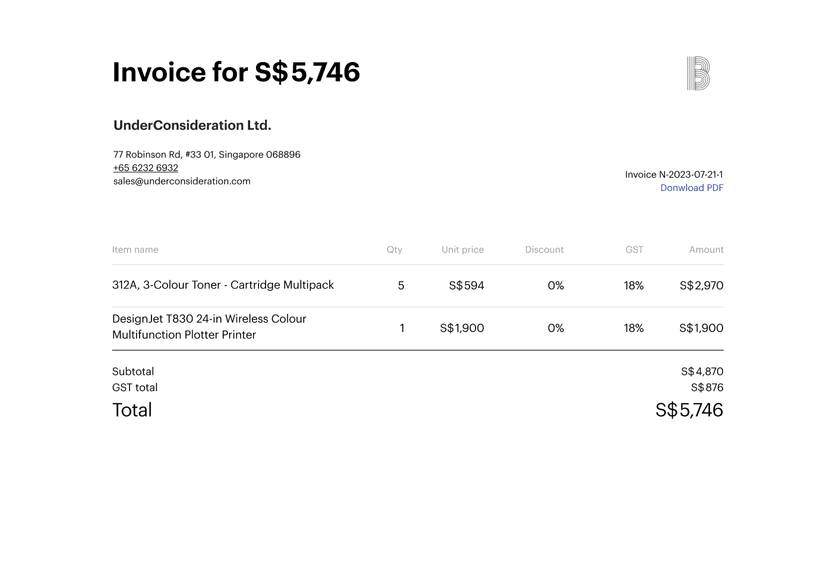

Get paid faster

With automated invoicing, you can spend less time chasing payments and more time coding. Osome automates your invoicing process, reducing errors and ensuring timely payments.

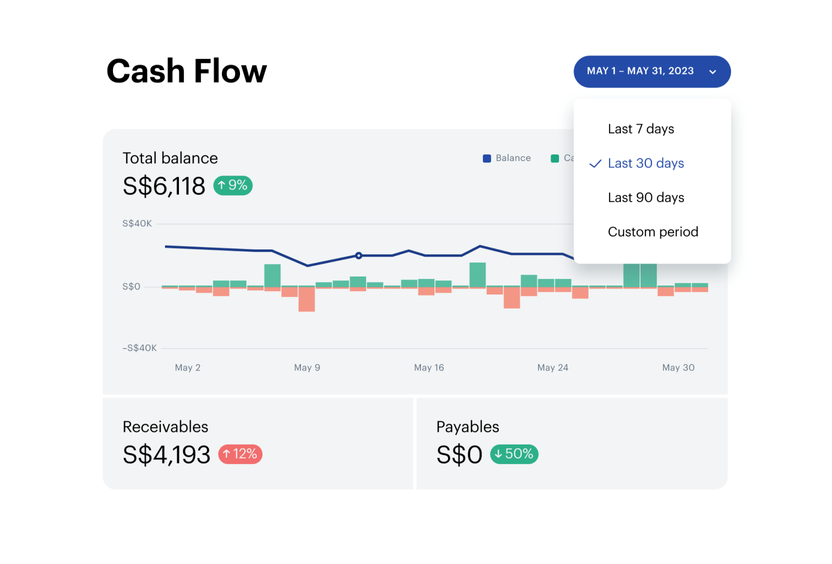

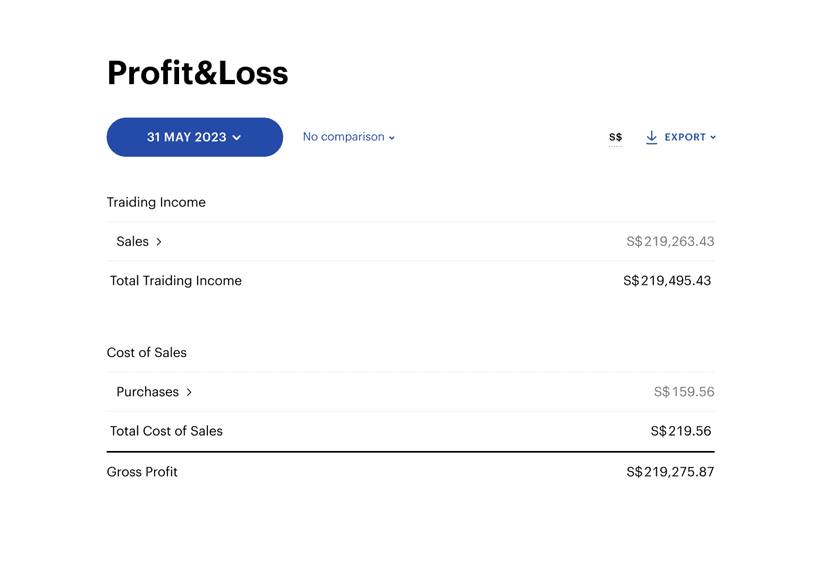

Stay on top of your cash flow

Get a clear, real-time view of your finances and track your income and expenses effortlessly to make informed decisions for your tech company. Plus, you could reduce monthly OpEx.

Simplify your bookkeeping and tax filing

Osome handles your accounting tasks, from processing documents to generating tax reports. You’ll never miss a deadline with Osome’s compliance calendar.

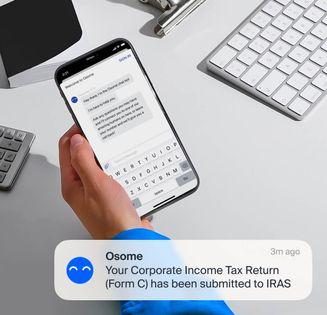

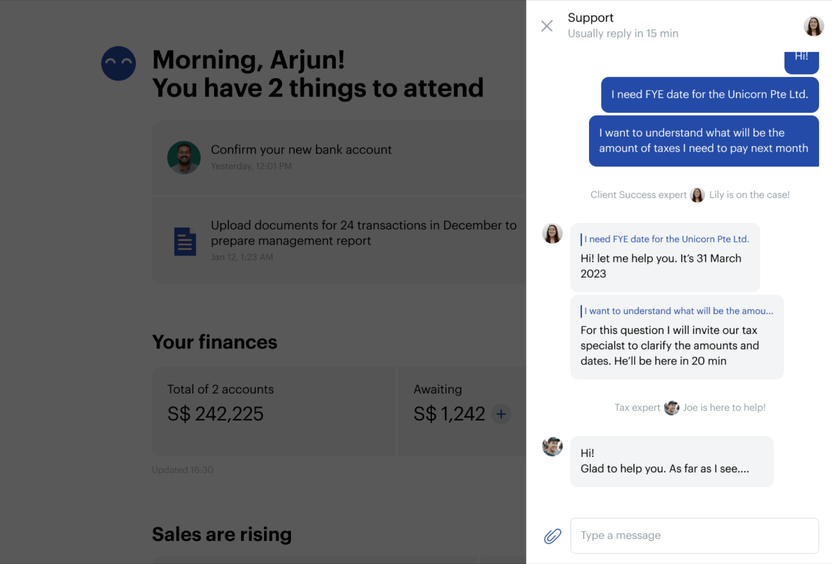

Dedicated accounting support

Have a question about your tech company's finances? Get quick answers and personalised guidance from your dedicated Osome accountant via live chat.

First-time business owners and entrepreneurs looking to scale

Software companies

Let our experts guide you along your growth journey, with industry-specific insights and actionable financial admin advice.

IT consultants

Whether you’re starting out or scaling up, we can help boost your technology business, just like we’ve helped thousands of other business owners.

Tech developers

We’ll handle your financial admin, from taxes to filing, while you focus on building your products and growing your revenue sources.

Plans to fit your business

Our packages are tailored to your business stage and annual revenue. When your revenue falls above or below the selected threshold, we'll either invoice you for the difference or credit your account. As your business grows, you can customise your package with add-ons to meet your evolving needs.

Operate

If you want to nail your first year of business and stay compliant

from

S$ 898 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Optional add-ons

Grow

For those growing a team and needing payroll and employee services

from

S$ 1,188 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Optional add-ons

Scale

For founders wanting a financial co-pilot and strategic accounting support

from

S$ 2,728 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Optional add-ons

Add-ons you might need

Urgency filing

S$ 750

Where applicable, an urgency fee may be applied depending on your filing deadline.

Simplified XBRL filing

S$ 330/y

The Simplified XBRL template caters to smaller businesses and non-publicly traded companies in Singapore. It provides a simple report and a complete set of financial statements in PDF format.

Full XBRL filing

S$ 550/y

Osome will provide a Full XBRL report including primary statements and selected notes to the financial statements. This comprehensive report represents a company’s financial performance and position.

What our clients think about Osome services

92 %of customers recommend us

“I use Osome to help me succeed”

“The onboarding was seamless, and everything was up and running within a day. I highly recommend them for their service and efficiency.”

Luigi Carecci

FAQ

What is accounting for tech companies?

Accounting for tech companies involves systematically recording, analyzing, and reporting financial transactions specific to the technology sector. This includes managing revenue from software sales, subscription services, and intellectual property, as well as tracking expenses related to research and development. Proper accounting ensures compliance with financial regulations, provides insights into financial health, and aids in strategic decision-making.

By leveraging Osome's expertise and technology, you can ensure your tech company's accounting and compliance functions are efficiently managed, allowing you to concentrate on innovation and growth.

What should I consider when setting up my accounting function in Singapore?

When establishing your accounting function in Singapore, consider the following:

- Compliance with Singapore Financial Reporting Standards (SFRS): Ensure your financial statements adhere to local accounting standards.

- Setting Up a Robust Accounting System: Invest in reliable accounting software that supports multi-currency transactions and integrates with other business tools.

- Hiring a Qualified Accountant: Engage an accountant experienced in the tech industry to provide strategic financial advice and ensure compliance with local regulations.

- Separating Personal and Business Finances: Maintain separate bank accounts to simplify accounting and protect personal assets from business liabilities.

- Understanding Tax Obligations: Familiarize yourself with Singapore's tax incentives and schemes for startups, such as corporate tax exemption.

What is cost of setting up in-house accounting operations?

Many businesses consider setting up an in-house finance team, but the costs can quickly add up. Here’s what you’re looking at for a company generating more than $900K in annual revenue:

- Staffing Costs: Hiring a full-time accountant or finance manager can cost anywhere from $50,000 to $70,000 annually, including salaries and benefits.

- Tool Costs: Essential tools like QuickBooks, Xero, document processing and payroll management software can cost an additional $1,000 to $5,000 per year.

- Hidden Costs: Training staff, ensuring compliance, and correcting errors add further expenses, not to mention the opportunity cost of your time spent overseeing these operations.

With Osome, the cost starts from around $3,000 annually (both for services and software)

Which accounting software and bookkeeping software do you use?

We've developed proprietary software that you can access from your desktop or a mobile app. This software provides daily updates of your balance from all linked bank accounts, your pending invoices, and lists documents that need to be uploaded. Additionally, we provide swift responses to queries via chat, keep track of important deadlines, and reconcile daily transactions.

Can I transition from another accounting firm to Osome?

Absolutely. We make the transition seamless on your end. We’ll get in touch directly with your current accounting service provider, take over all your financial documents, and audit them to make sure your company is compliant. We check for any loose ends with HMRC, organise historical data, and then prepare and file necessary reports. We offer up ongoing advice about relevant tax exemptions, helping you be smarter with your taxes. Now that your accounting is in good hands, you can focus on what you do best: running your business.

What if my actual annual revenue differs from my chosen accounting plan's revenue range?

No worries! We'll adjust your accounting plan to match your actual revenue — either by sending you an invoice for the pro-rated package or crediting the amount back to your account.

Fresh insights from our business blog

Top 10 Singapore Startup Grants: A Detailed Guide

Singapore offers one of the most generous government funding ecosystems for early-stage businesses, as a leading startup hub with grants and funding support designed to support everything from product development to overseas expansion, coordinated by agencies such as Enterprise Singapore and the Economic Development Board. For founders, these schemes can meaningfully reduce burn, improve cash flow, provide early stage funding and financial support, and accelerate validation without diluting equity. Here is a clear, practical overview of the funding schemes and funding support available to you as you plan for long-term business growth.

Why Founders Delay Switching Their Accounting Provider — Why That’s Risky

Most founders delay switching bookkeepers not out of neglect, but out of uncertainty. They wait for timing, bandwidth, or stability — but in doing so, they let friction compound quietly beneath growth. The longer the wait, the harder it becomes to gain back control and clarity. We unpack the most common founder mind blocks behind delay and reframe them as opportunities to build leverage.

Why Healthcare Startups in Singapore Are Switching Their Bookkeepers

In Singapore’s fast-growing healthcare sector, the cost of “good enough” bookkeeping is catching up. With subsidies, reimbursements, and audits becoming increasingly complex, founders are realising that generic bookkeeping can quietly erode visibility and compliance. Healthcare startups are now switching to domain-aware partners who understand claims cycles, grants, and data integrity — not as an administrative upgrade, but as a growth necessity.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?