- Osome SG

- Incorporation

- Aspire Business Account

Supercharge your business: save S$ 315 and get S$ 250 back

Starting fresh? We’ll cover your S$ 315 government registration fee and help you open an Aspire business account to get S$ 250 cashback. Already have a business? Simply switch to Osome Accounting and open your Aspire account for the same S$ 250 cashback reward.

How to supercharge your business in 4 steps

Choose your package

Choose the package for your stage. New founders can get Full Compliance for a total setup, from incorporation to secretarial services. Already running? Switch to Osome Accounting to qualify.

Open your Aspire business account

After picking your package, we’ll help you open an Aspire business account. It’s fast, paperless, and built for entrepreneurs. Remember to use your promo code during signup to claim your rewards.

Fund your account

To unlock your cash back reward with Aspire, deposit at least S$ 1,000 into your new Aspire account. Maintain this minimum balance for 30 consecutive days to meet the campaign eligibility criteria.

Claim your S$ 565 value

Osome covers your S$ 315 registration fee (new setups), while Aspire adds S$ 250 cashback once your account is funded. Existing businesses also get the S$ 250 cashback when switching.

Helping you succeed in Singapore

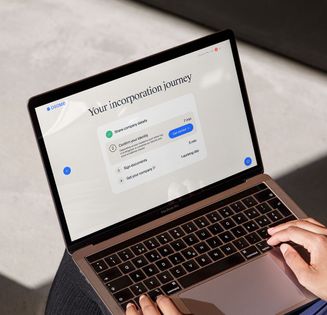

Digital incorporation

Our team of experts has simplified the process by making it fully digital and handling all requirements — from local directors to company secretaries and legal compliance.

Business account opening with Aspire

Aspire is a service partner of Osome that has revolutionised SME and startup finance. They offer a fee-free business account, corporate card, borderless payments, and leading FX services. The Aspire Advance Card ensures efficient corporate spend management and is connected shortly after business registration.

Seamless integration to make your life easier

We've made the data exchange between Osome and Aspire as simple as possible. Download your transactions to prepare for reports — our software will recognise them and populate your accounting reports and dashboards in as fast as 30 minutes.

Business support beyond starting

From registering to tax, accounting, and bookkeeping services, our local Chartered Accountants have you covered for the first year and beyond.

Power your global business from day one with Aspire

Why Aspire

$ 0 fees, unlimited cards, and unlimited cashback on your SaaS and marketing spend. Manage your SGD, USD, EUR, and GBP accounts all in one platform.

Costs of company incorporation in Singapore

Fully compliant

For business owners seeking a hassle-free, Singapore-based incorporation service

from

Incorporation

Government required services

Corporate secretary

Accounting and tax

Up to S$ 30,000 expected revenue for first financial year

Bookkeeping

Financial software

Fully compliant + Visa

For business owners seeking to incorporate with permission to live and work in Singapore

from

Incorporation

Government required services

Business immigration services

Corporate secretary

Accounting and tax

Up to S$ 30,000 expected revenue for first financial year

Bookkeeping

Financial software

Add-ons you might need

Letter of Consent (LOC)

S$ 400

Foreign nationals holding a Dependent Pass or Long-Term Visit Pass need an LOC to work in Singapore. For Employment Pass holders, an LOC is specifically required when seeking work and directorship at a company related to their current employer.

Dependant’s Pass (DP)

S$ 550

A Dependent's Pass is a Singapore visa for an Employment Pass holder's spouse or children (under 21). A DP holder can live and work in Singapore.

5 steps to setting up in Singapore

Meet the official requirements

We help you with everything Singapore's Accounting and Corporate Regulatory Authority (ACRA) needs from business founders:

Singapore law requires each company to have a secretary. This officer is in charge of state compliance. They file annual returns and resolutions on changes, prepare Annual General meetings, and processes dividends distribution.

At least one of your directors has to be a Singapore resident. Hiring a nominee is a common and legal practice.

A nominee puts their name on your papers but can’t make any core business decisions. If there’s any wrongdoing, such as late or incorrect reports, the nominee director shares legal responsibility. That’s why you have to get an accounting package with this service.

All Singaporean companies must have a local registered address. It goes on all legal documents. We receive your correspondence, scan and forward them to you.

Get your company registered

Foreigners need a certified agency to file for incorporation. We collect and sort all your documents online and send you the application to sign digitally. Here's how it works:

1. First, complete your identity verification (MyInfo Verification for Singapore Permanent Residents). All company directors and shareholders need to complete this to stay compliant.

2. Provide proof of address and company information, such as the share structure for your company constitution.

3. Let us know your paid-up capital — S$ 1 is enough.

Open Aspire business account

Aspire revolutionises finance for SMEs and Startups with an all-in-one platform, featuring a Business Account that's quick to open online in just 5 minutes, free from fees and minimum balance requirements.

The final decision of whether the account is approved is up to the bank — once approved, your Aspire account is seamlessly connected to your Osome account once business registration is complete. The process is seamless and designed to set you up for success as swiftly as possible.

Set up your accounting calendar

You need to submit several tax reports a year. Our Chartered Accountant will organise your docs, prepare reports, and file them neatly. We also proactively advise on exemptions so you pay taxes smartly as a foreign citizen.

Even if you have no transactions, you still need to submit annual reports: Estimated Chargeable Income, financial statements, and annual tax return called Form C or Form C-S. It’s crucial to prepare them right and on time, otherwise your company and the Nominee director can face fines and penalties.

Get an Employment Pass, move to Singapore

This is a permit that allows you to work, live and bring your family to Singapore. Only a company set up up and registered in Singapore can apply for an EP. It has to be a real operational business. We can register a company for you as a foreigner, set up the reporting and apply for EP.

We will file your CV with relevant professional experience, education data and the company profile to get the visa. The process can take up to 3-6 months depending on the requirements. Once you get it, the employment pass is valid for 1 or 2 years and can be renewed afterwards.

Boom!

What our clients think about Osome services

92 %of customers recommend us

“I use Osome to help me succeed”

“My company was successfully incorporated within just 3 days! I was blown away by the speed and efficiency of the process.”

Jason Choo

FAQ

What is an Aspire business account?

The Aspire Account is a business payment account that allows you to receive and send money through the Aspire App and the Aspire Visa Card. Account holders can open local receiving and sending accounts in USD, EUR, GBP, SGD, IDR and other major currencies for international business dealings.

What license does Aspire have?

Aspire FT Pte Ltd (“Aspire”) is currently exempted from holding a licence under the Payment Services Act for the provision of Account Issuance Service, Domestic Money Transfer Service, and E-money Issuance Service for a specified period. This can be confirmed on the MAS website.

Aspire is not licensed, nor exempt to provide cross-border money transfer services, and consequently provides these services in conjunction with MAS licensed partners. All corporate cards are issued and powered by Nium Pte Ltd. All partner terms and conditions can be found on the Aspire Terms and Conditions page.

What are the fees involved for opening an Aspire business account?

Registering for an Aspire Business Account is completely free. There are no monthly or fall-below fees.

How long does it take for my account to be approved?

Accounts are typically approved within 1 business day. Accounts opened using MyInfo are approved immediately.

Is Aspire regulated by MAS?

Aspire FT Pte. Ltd. is currently continuing business under an exemption granted by the Monetary Authority of Singapore and is currently exempted from holding a license to provide payment services under the Payment Services Act (No. 2 of 2019). Aspire FT Pte. Ltd. continues to provide such services pursuant to the Payment Services (Exemption for Specified Period) Regulations 2020.

Aspire Financial Technologies Pte. Ltd. is an excluded moneylender under the Moneylenders Act (Cap. 188). Under the Moneylenders Act, Aspire does not require a moneylender's license as we lend solely to corporations and limited liability partnerships.

How is my money safeguarded?

Aspire adheres to the safeguarding requirements set forth in the Payment Services Act (No. 2 of 2019) and the relevant MAS guidelines. Your monies are deposited in a trust account with DBS Bank Ltd, and you are the beneficial owner of the monies held in the account.

It may be worth also noting that your monies are kept strictly segregated in a trust account in a safeguarding institution, as prescribed by the Payment Services Act, and in line with MAS best practices. You are the beneficial owner of these monies and any potential insolvency of Aspire would not affect the beneficial ownership of the said funds.

What is the process exactly?

We check that the company name you’ve chosen is available. You send us your ID or passport copy, details on directors and shareholders. We prepare all the necessary documents, send them to you for electronic signature, and submit them to ACRA (The Accounting and Corporate Regulatory Authority of Singapore, the government entity). On your end, it’s just a message thread in a secure chat. Once a UEN has been issued, your company is operational.

How long does it take?

We can set up a company in as fast as 1-2 business days. The most important factor is to collect all the docs: once you’ve handed them over to us, we can act fast. Keep in mind that the authorities only process registrations during working hours.

Do I need a Company Secretary?

Every Singapore business must have a local resident company secretary. This officer is responsible for keeping your paperwork in order, making sure all changes to the company are processed correctly, on time and in compliance with the local legislation. This role can be performed by an individual or a corporation, known as a body corporate.

Can foreigners start a business in Singapore?

Singapore is very welcoming to foreigners who want to incorporate. Foreigners can become directors and shareholders here without any restrictions. The only requirement is that each local company must have at least one resident director — a Singapore national or a Permanent Resident. To comply with this law, you can hire a Nominee director.

Do I need a resident director (Nominee Director)?

Your company can have as many directors as you want, but at least one needs to be local. If you do not have someone who can play the role, hire a nominee director. For example, there can be two directors: you and the nominee. If you apply for an Employment Pass from your new company, you only need the nominee service while you wait for it (about 6 months). After that, you can be the only director.

A nominee is a Singapore resident who holds the director’s position in your company but doesn’t get involved with your business. Their responsibilities are to abide by the law and to always act in the best interest of your company.

Do I need a registered business address?

Yes, all Singaporean companies must have a local registered address. It goes on all legal documents. If you don’t have an office address, use our service. We handle your incoming letters, scan and store them in your Osome account so you have easy access to all your documents.

Fresh insights from our business blog

Top 8 Low Corporate Tax Countries to Consider for Business

When founders look abroad, many compare low corporate income tax countries to judge where their business will operate most effectively. Jurisdictions such as the UAE, Ireland, and Hong Kong often lead these lists, yet Singapore remains distinctive for its predictable tax framework and generous exemptions. Founders usually compare not just the corporate income tax headline but also their overall income tax exposure and how local taxes work once they start paying themselves and their teams. Low corporate tax rates can attract foreign investment, but the credibility of the jurisdiction is equally important.

Top Strategies on How to Find a Good Business Name

Need tips on how to find a good business name? You’re in the right place. This guide will walk you through defining your brand, brainstorming creative names, checking availability, and getting feedback. Let’s get started on finding the perfect name for your business.

Webinar Recap: How to Start a Business in Singapore – A Founder’s Practical Guide

Missed out our recent webinar? Here's your all-in-one recap from the first session of our new series: "Founder Secrets They Don’t Tell You."

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?