Top 7 Advantages of Outsourcing Payroll Services

- Published: 5 July 2024

- 9 min read

- Grow Your Business

Gabi Bellairs-Lombard

Author

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Companies looking to save money, save time, reduce costs and stay compliant turn to outsourcing payroll. This can bring big benefits like better data security and streamlined processes. Here, we look at the top 7 benefits of outsourcing payroll processing and how they can help your business.

Key Takeaways

- Outsourcing payroll services helps companies save time and money, enhance accuracy, and ensure compliance with regulations, making it a strategic decision for improved business efficiency.

- Key benefits include access to expert payroll service providers, often expensive payroll software and payroll data, improved security, scalability, and seamless integration with existing HR and accounting systems.

- Potential drawbacks include loss of control over payroll processing, dependence on third-party providers, and potential hidden costs, making it essential to carefully select the right payroll outsourcing provider to maintain trust in your payroll operations.

What Is Payroll Outsourcing?

Payroll outsourcing is the strategic handing over of payroll processes, including processing payroll, to an external payroll provider who takes care of tasks from tax filing and direct deposits to administrative headaches. This magic turns complex payroll management and manual bookkeeping into a show of precision and simplicity. By outsourcing your payroll to a payroll outsourcing company, you’re not just handing over numbers and spreadsheets to the latest payroll technology; you’re handing over the heart of your business – employee payroll outsourcing services. The benefits of outsourcing your payroll extend beyond cost savings to strategic business growth.

At Osome, we offer comprehensive payroll solutions tailored to your business needs, ensuring accuracy, compliance, and peace of mind so you can focus on what truly matters—growing your business.

Outsourcing payroll is like opening a box of efficiency. It’s not just about numbers; it’s a complex dance of compliance, tax and making sure every employee gets their pay on time. The decision to outsource often comes when you realise the time and resources spent on the time-consuming process of every payroll period could be spent on your business growth and core activities – a turning point that can be the key to success.

Why Businesses Outsource Payroll Services

The winds of change are blowing through the business world, and companies are hoisting the sails of outsourcing payroll. As companies grow, the demands on their internal payroll functions increase, and the question is, should they continue managing payroll in-house or outsource payroll processing? The scales are often tipped by the sheer weight of time and resources required to manage payroll – a key consideration in any business decision.

There’s magic in the freedom that comes with outsourcing payroll. HR professionals and HR teams are unchained. Their time is now free to focus on strategic activities, employee management and human resource management rather than being caught up in the complexity of managing payroll. After all, wouldn't any HR professional rather spend their time focusing on employee benefits instead of payroll systems?

The jungle of legislative requirements is a scary place, full of compliance risks and penalties for getting it wrong – a minefield that payroll outsourcing services can navigate with ease. By putting their trust in the hands of payroll experts with top payroll software, companies can avoid the pitfalls of errors and noncompliance and stay on top of the ever-changing regulatory landscape -- something that can be especially beneficial for small businesses with limited resources.

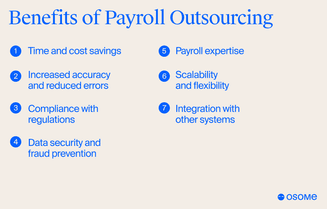

Key Advantages of Outsourcing Payroll Services

Outsourcing payroll reveals a world of advantages. From the mountains of cost savings to the valleys of compliance, the benefits are many and varied. Companies that outsource payroll get access to time and cost savings, peace of mind and better security.

This section will explore the benefits, one by one.

1 Time and cost savings

Time, the most valuable resource, and the almighty dollar are saved by outsourcing payroll. Companies’ financials are boosted as they eliminate the need for in-house teams to manage the mundane tasks of payroll – a great way to reduce administrative costs.

Imagine the freedom when manual and time-consuming tasks related to payroll responsibilities disappear and are replaced by a payroll outsourcing partner. It’s not just a myth; studies show companies saving up to 120 hours a year on tax prep alone – showing the time-saving pros of outsourcing payroll processing.

2 Increased accuracy and reduced errors

Accuracy in payroll is key, as even small payroll mistakes can lead to financial and reputational disaster. The expertise of outsourced payroll professionals with the latest technology is a shield against payroll errors. This is not a bonus – it’s a necessity in a world where the consequences of payroll processing mistakes can be severe.

3 Compliance with regulations

Navigating the ever-changing payroll processing regulations requires a compass that only experienced payroll outsourcing providers have. Their watchfulness ensures you are compliant with the latest government regulations and other local regulations – not caught out by compliance risks.

With the threat of IRS penalties and tax filings looming, outsourcing payroll is a beacon of compliance that guides companies to safety. Managing payroll taxes is a critical function that top payroll partners handle with utmost precision.

4 Data security and fraud prevention

In a world where data breaches are around every corner, the secure fortress of reputable payroll providers is a safe haven. Advanced technology and monitoring across multiple server locations keep sensitive employee data out of the hands of cyber threats. Direct deposit services reduce the risk of payroll fraud. This ensures your payroll data remains secure and easily accessible to you but protected from unauthorised access.

5 Payroll expertise

By outsourcing payroll, companies are essentially hiring a team of experts with payroll experience while avoiding the cost and complexity of growing their in-house team. These payroll professionals bring a wealth of experience to the table. Access to expertise is a key ally in the fight for efficiency and compliance.

With Osome’s comprehensive payroll solutions, you gain access to top-notch professionals dedicated to streamlining your payroll operations, ensuring accuracy and compliance, and allowing you to focus on growing your business. Feel free to reach out!

6 Scalability and flexibility

The ability to scale and flex with the ups and downs of business growth is a characteristic of outsourced payroll services. As the market tides rise and fall, the outsourcing partner adjusts their sails accordingly and offers scalable outsourced payroll solutions that grow with the company. Adjusting your pay cycle can be easily managed with up-to-date payroll solutions.

This is can serve as an essential lifeline, especially for small business owners.

7 Integration with other systems

The integration of outsourced payroll services with existing in-house HR teams and accounting systems, including payroll software, is like finding the missing piece of a jigsaw. This harmony between systems simplifies operations, supporting overall business strategy.

Potential Drawbacks of Outsourcing Payroll Services

However, for all its benefits, outsourcing payroll processing is not without its pitfalls. Control, dependency and unexpected costs are the shadows that loom and cast doubt on the decision to outsource.

It’s a trade-off, weighing the benefits against the drawbacks. This section will lift the lid on the not so glamorous side of payroll outsourcing.

1 Loss of control over the payroll process

Handing over your payroll system to an external provider can leave companies feeling lost at sea, no longer in control of their own ship. The fear of not having instant access to payroll data can be unsettling, like navigating without a map. But with the right measures in place – clear communication channels and regular reporting – control can be regained, and confidence in the outsourcing journey can be restored.

2 Dependence on third-party providers

The reliance on external payroll experts is a vulnerability, a single point of failure that can spook even the most hardened business leader. However, this dependence is also a shield against the disruption that can come from internal staff changes and ensures continuity in the payroll function.

Customisation by the provider means the heart of in-house processes is not lost in translation, and there is a sense of familiarity with the new arrangement.

3 Additional costs

The cost savings can be obscured by the fog of hidden fees and additional service charges that come when you let a payroll provider process payroll. Year-end reporting and other bolt-on services can add to the cost, so it’s important to navigate the waters carefully and know the total cost of ownership.

How To Choose the Right Payroll Outsourcing Provide

With the pros and cons revealed, the search now turns to choosing the right payroll outsourcing provider. This critical choice depends on expertise, technology and cost, so the chosen provider matches the company’s business plan.

Expertise and experience

The wisdom of a reputable payroll provider is measured by their ability to navigate the complexities of payroll and compliance. Their expertise is the compass by which businesses can set their course and know their payroll journey is in good hands.

Technology and security measures

In the digital age, the strength of a payroll provider’s technology is key. Advanced security features and process automation are the walls that protect against data breaches and inefficiencies. The ability to adapt to budget and changing threats means the company’s payroll ship stays afloat in the face of cyber storms.

Service offerings and costs

Unpicking the service offerings and costs is the final piece of the jigsaw in choosing a payroll provider. The complexities of additional services, such as managing garnishments and terminations, are threads that can either strengthen or trip up a business.

Knowing the potential hidden fees is the key to avoiding a costly trap and keeping the financial journey on course.

Real-Life Examples of Successful Payroll Outsourcing

The stories of BlueByte Technologies, BoldBrand Advertising and HealthPro Alliance are case studies of success, shining a light on the real benefits of payroll outsourcing. These stories show how companies from different industries have navigated the payroll outsourcing waters. Their journeys are proof that outsourcing payroll can be the wind in a business’s sails.

Conclusion

So there you have it: the benefits of outsourcing payroll are clear. The journey through time and cost savings, accuracy, compliance, security, expertise, scalability and integration has mapped out the path to business efficiency. However, the wise navigator is always aware of the risks – loss of control, dependence and unexpected costs. With the right payroll outsourcing partner, you can set sail for success with confidence. armed with this information. So, why not work with a payroll company?

FAQ

What are the most important factors to consider when outsourcing payroll?

When outsourcing your payroll, you need to consider the provider’s expertise, technology, security measures, service offerings and costs, including hidden fees. These will all contribute to a successful outsourcing process.

Can outsourcing payroll really save my business time and money?

Yes, outsourcing to a payroll provider can save time and money by removing the need for an in-house payroll department and leveraging cost-effective technology and expertise.

How does outsourcing payroll improve data security?

Outsourcing payroll improves data security by allowing providers to invest in the latest security measures, protecting employee data and preventing fraud. This means better protection of payroll information.

Will I lose control over my payroll process if I outsource it?

No, you can maintain control by setting up clear communication channels and regular reporting with the provider. You need to actively manage the process and stay involved.

How can I ensure compliance with payroll regulations if I outsource payroll?

By outsourcing to professional providers, you can be compliant with all government regulations, reducing the risk of fines and penalties for non-compliance. This will save you time and resources in the long run.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?