- Osome Blog SG

- IRAS Document Identification Number Explained

DIN It: IRAS Document Identification Number Explained

- Modified: 28 August 2024

- 5 min read

- Money Talk

Osome Content Team

VIP Contributor

Osome has been collaborating with 21 authors from 4 countries. We embrace diversity and are proud that lawyers and founders, journalists and financial analysts choose to work with us.

The Inland Revenue Authority of Singapore (IRAS) generates a Document Identification Number or DIN in short, for identifying each issued income tax return. Simply put, IRAS assigns DIN to companies to identify income tax returns for companies. The filing of DIN happens using the Form C-S/C for every Year of the Assessment period (YA). Companies in Singapore can receive a unique DIN directly via the DIN e-service on the IRAS website.

To get a more detailed and customised assistance regarding your DIN, you can consult a professional accounting company in Singapore. Otherwise, do read on.

What Is DIN?

DIN is a unique numeric code issued by IRAS for every company to identify each tax return it submits annually.

DIN is a set of letters and figures, here is an example of one: SC 206 16264567890 023.

Why Do I Need a DIN?

A DIN is needed when you are filing your tax return on paper using the Form CS/C. You will be able to find your company's DIN for each specific Year of Assessment (YA) on this form.

IRAS has made submitting the Form CS/C mandatory in 2018 and has gradually switched to this system in 2020. There are different due dates for the format of submission you submit your application - whether in paper form or digital form.

If a business still files the paper return, they must file their income tax returns before November 30. If companies file it online the second year following the end of the tax year, they can do that by December 15. It means businesses have 11 months to close their account to file taxes with the government.

The need for DIN arises only for appointing an individual as a Director in a company or a partner in a Limited Liability Partnership. If the individual already has a DIN, then they cannot get another one. After obtaining the DIN, Directors can use it for appointments in other companies.

Companies will need DIN when submitting paper documents to IRAS after downloading copies of the C-S/C form. Businesses that already have a DIN may also submit a paper C-S/C form. You can get this form either by downloading from the official website of IRAS or using the software of a tax agent. Companies need to mention their DIN numbers on C-S/C Form for reference.

Where Would I Get a DIN From?

You can get a DIN from the “View DIN” option in the e-Service section of the IRAS website. This service is also easy to access, and you do not need any prior registration to use this service.

How To Get a DIN?

IRAS generates the DIN after the issuance of your C-S/C Form. While e-filing your income tax, you need to log on to the IRAS myTax portal and select “File Form C-S/C.”

Your DIN will be generated automatically after you complete your tax filing on the portal. You will not see the DIN number in this instance because it happens electronically.

How To Get Your DIN Through the IRAS Website if You File Paper Returns:

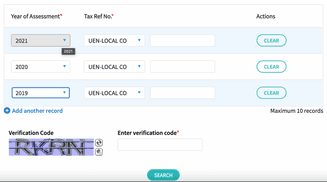

- Go to mytax.iras.gov.sg website

- From the dropdown, choose the Year of Assessment (YA) to view DIN for the current YA and two previous YAs

- Enter your tax reference number

- Type in the verification code

- Get your DIN

It is mandatory to file C-S/C Form regardless of whether your company has earned profits or suffered losses. This is why you need to keep your tax-related documents handy to meet this requirement.

Form C-S/C

What Is Form C-S/C?

C-S/C Form is a simple 3-page form for filing the tax return. Companies use the form to file their income to IRAS. Businesses that qualify for C-S/C Form may opt for this in the place of Form C for filing their income details.

You can get the online version of C-S/C Form on the mytax.iras.gov.sg portal. Businesses find it convenient due to the benefits below:

- You can get instant estimates of your tax payable;

- The portal outlines step-by-step procedures of filing for businesses.

- The availability of automatic calculation in specific fields minimises the chances of errors.

- You will get an additional 15 days for e-Filing.

When Should I Submit My Form C-S/C?

IRAS encourages all the businesses in Singapore to initiate the e-Filing procedure for their Corporate Tax Return using Form C-S/C.

Companies will receive a notification letter from the authorities, delivered at their registered address.

The submission of Form C or C-S (also called an income tax return) is for declaring income for the relevant year of assessment (YA).

All the businesses need to comply by submitting one of these forms to the Inland Revenue Authority of Singapore or IRAS by November 30 every year.

You can fulfill this filing requirement with the help of a Singapore tax agent, who knows all the tax regulations, can fill out Form C-S or C and file it with IRAS.

However, the primary responsibility of filing the tax return ultimately lies with the directors of the company. The applicable corporate tax rate in Singapore is at a flat rate of 17 percent.

When You Are Not Able To Get a DIN

Although getting a DIN is easy for companies. However, in certain cases, businesses may not qualify to receive a DIN.

Here are some examples of such cases:

- If a company has incorporated for less than two years, IRAS will deny issuing the DIN. It means you will not receive an e-filing or Form C-S/C notification from IRAS before completing two years of business.

- If a business has received a waiver for income tax return filing, IRAS will not issue DIN for that company.

- If an organisation has already filed Form C-S/C for a particular Year of Assessment, IRAS will not assign it a DIN. So, companies should track the status of their corporate tax return.

What To Do When Facing Problems Submitting Tax Returns

We understand. Entrepreneurs like you would rather spend time on activities that would grow your business over administrative tasks like these. If you ever face a road block, know that you’re not alone and that you don’t have to do it all yourself! You can always talk to the experienced accounting professionals and tax advisors at Osome to figure it all out.