- Osome SG

- Ecommerce Accounting

Time-saving ecommerce accounting

It's time to leave traditional accounting behind. Our software integrates with multiple ecommerce platforms to keep your bookkeeping accurate. Choose Osome for ecommerce accounting services, tax filings, and reporting.

Automated financial management solutions for online sellers

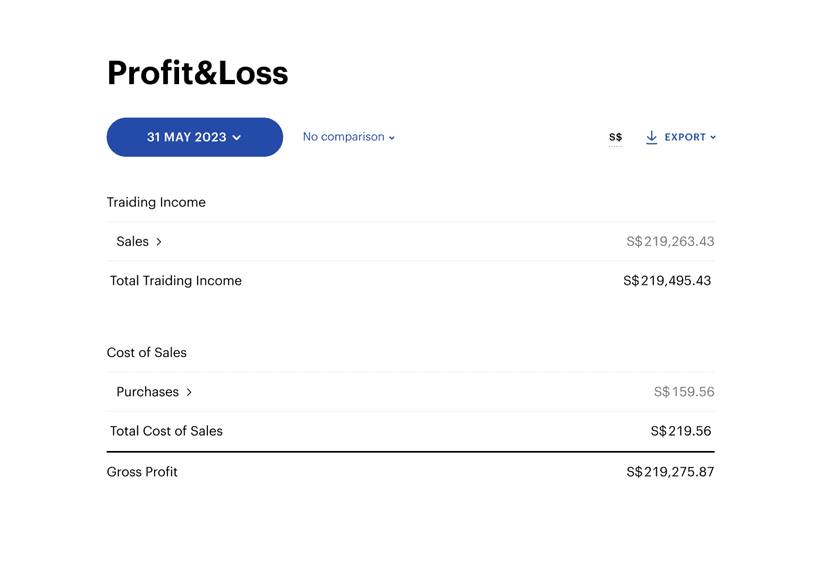

Real-time sales insights

Our API automatically synchronises with ecommerce data from your marketplace into Osome Accounting. You'll always know how your online sales are doing.

Integrate your online sales platforms

Say goodbye to platform hopping for sales insights. We process platform fees, discounts, returns, and gift cards with Lazada, Shopee, Amazon, Shopify, and eBay connections. We also support payment gateway with PayPal and Stripe.

Accountants that know ecommerce

We handle processing sales platform fees, discounts, refunds and gift cards. Always be clear on your commission — our accountants will help you with GST and the relevant marketplace calculations.

Simple software to manage all your business operations

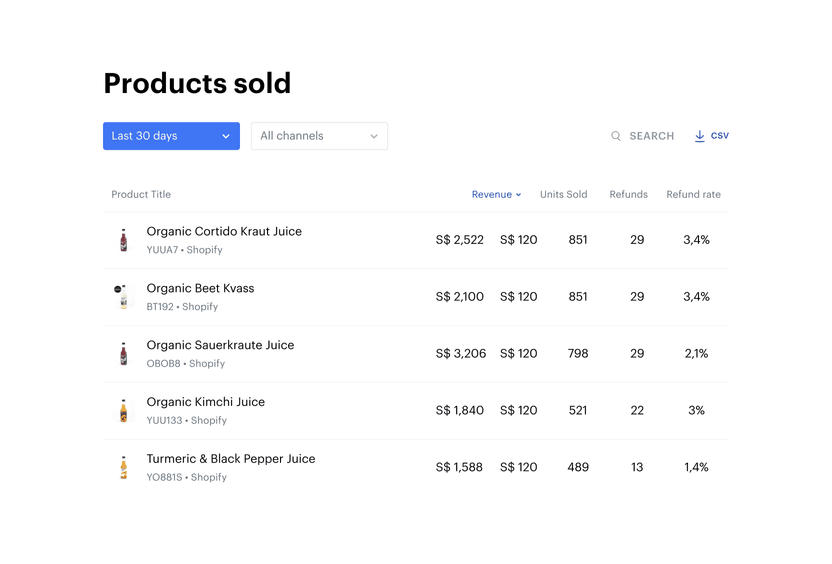

Restock what sells

Know the best performing SKUs so you can order them before they run out.

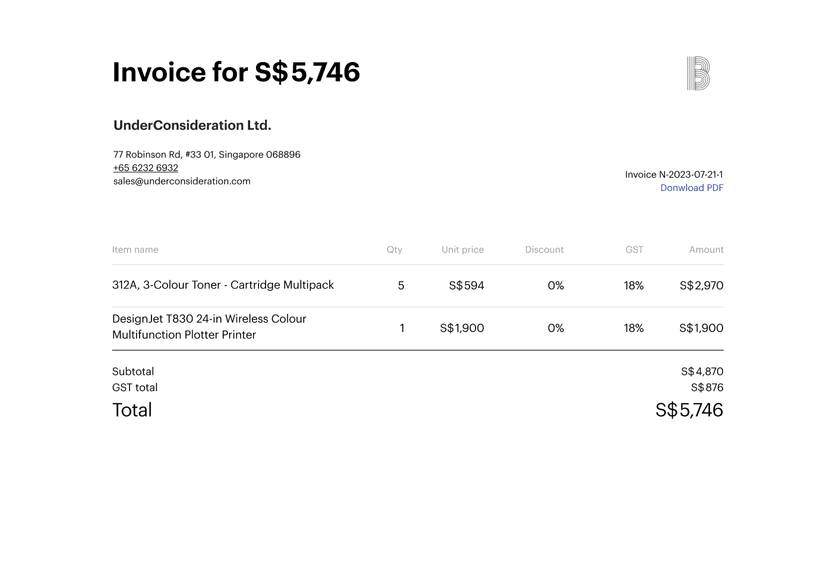

Get paid quicker

Issue invoices, nudge late payers and get paid faster. Pre-filled fields in the template means there's no more need for manual data entry whenever you need to issue an invoice.

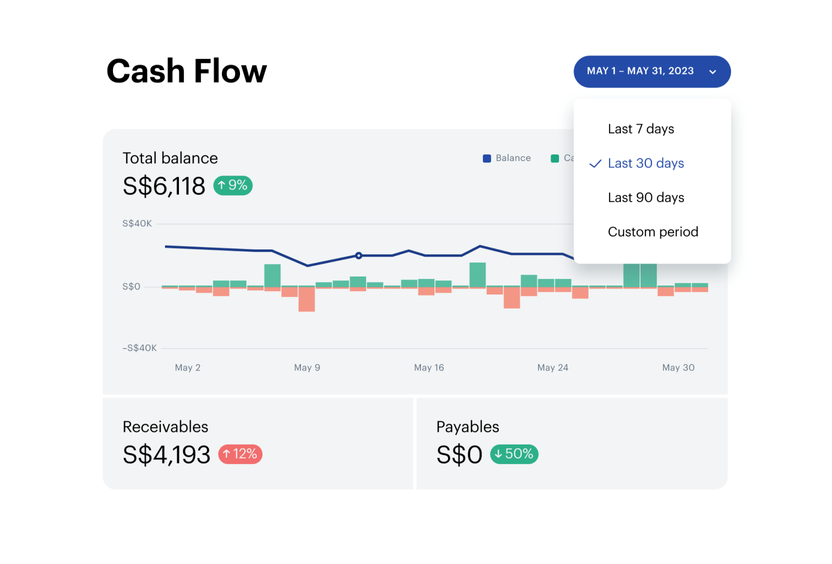

Know your cash flow

See all your business bank account transactions in one place to see how your money is moving.

From bookkeeping to filing tax

We process documents within 24 hours, giving you an up-to-date snapshot of your financials. Come filing time, we'll sort the reports; you just need to click ‘approve’.

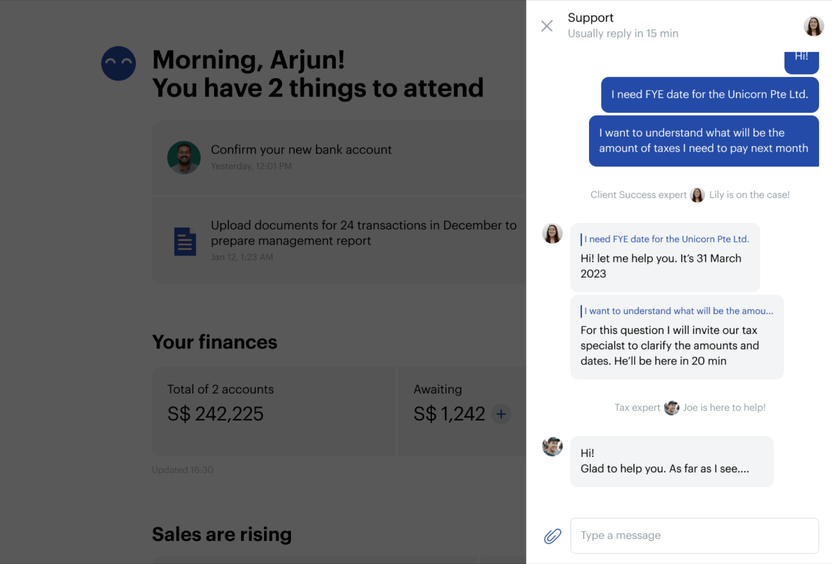

Your very own, reliable accountant

Talk to your accountant via live chat, ask questions and get answers within 24 hours.

For novice and established digital business people

Dropshippers

Make the most of your margins and grow into a bigger ecommerce business. All with the help of our experts.

Own and grow your brand

Whether you work from your garage or renting out your first office, our services scale as and when you need them.

White-label sellers

Focus on growing your products and revenue sources. We’ll handle the taxes, filing and financial back end.

Plans to fit your business

Our packages are tailored to your business stage and annual revenue. When your revenue falls above or below the selected threshold, we'll either invoice you for the difference or credit your account. As your business grows, you can customise your package with add-ons to meet your evolving needs.

Operate

If you want to nail your first year of business and stay compliant

from

S$ 816 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Optional add-ons

Grow

For those growing a team and needing payroll and employee services

from

S$ 1,080 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Optional add-ons

Scale

For founders wanting a financial co-pilot and strategic accounting support

from

S$ 2,480 billed annually, per financial year

Financial software

Bookkeeping

Expert service

Tax and filings

Optional add-ons

Add-ons you might need

Urgency filing

S$ 750

Where applicable, an urgency fee may be applied depending on your filing deadline.

Simplified XBRL filing

S$ 300/y

The Simplified XBRL template caters to smaller businesses and non-publicly traded companies in Singapore. It provides a simple report and a complete set of financial statements in PDF format.

Full XBRL filing

S$ 500/y

Osome will provide a Full XBRL report including primary statements and selected notes to the financial statements. This comprehensive report represents a company’s financial performance and position.

What our clients think about Osome services

“I use Osome to help me succeed”

91 %of customers recommend Osome services

“The onboarding was seamless, and everything was up and running within a day. I highly recommend them for their service and efficiency.”

Luigi Carecci

FAQ

What is ecommerce accounting?

The definition of ecommerce accounting is reporting your ecommerce business financials to the government. As an online vendor, you move products in and out, manage stock, and sell to customers in different countries via different channels. So, there are several things your ecommerce accounting includes:

- Bookkeeping, which lists every transaction. For example, when you accept products to your storage, sell on Amazon, or have to accept a return on a pair of shoes on eBay. Bookkeeping keeps track of every money or asset movement and provides a document covering every event.

- Management reports gather all the sales data and try to make sense of it. For example, how much of each product you sell, the costs of operating every channel, and where you make money.

- Tax filing and statutory reports. These depend on where you sell; each government has a different tax system. Tax reports constitute a very detailed recount of every transaction and the categories they fall under. Depending on the categories, different types of tax are derived. An experienced accountant can also help ensure you get the benefits and exemptions available to your business under each tax code.

How do I start an ecommerce business account?

When reconciling accounting for ecommerce sales you need to make sure that you have all your needs covered.

- All your channels. Do you sell via different platforms? You need a way to consolidate reports from various sources.

- All your tax jurisdictions. Do you sell in more than one country? You need to report for VAT everywhere you make money.

- No manual paperwork. Processing invoices and receipts is tiresome, and you probably have better ways to spend your time than that.

How do I record online sales on Amazon?

The best way to track online sales on Amazon is to connect directly to a bookkeeping software. We use our own software: we connect the feed automatically and switch you seamlessly. After that, any time you receive a statement from Amazon, it will automatically appear in our system, where we take it, sort it into categories, tag, and deliver up-to-date financials daily.

Which accounting software and bookkeeping software do you use?

We've developed proprietary software that you can access from your desktop or a mobile app. This software provides daily updates of your balance from all linked bank accounts, your pending invoices, and lists documents that need to be uploaded. Additionally, we provide swift responses to queries via chat, keep track of important deadlines, and reconcile daily transactions.

Can I transition from another accounting firm to Osome?

Absolutely. We make the transition seamless on your end. We’ll get in touch directly with your current accounting service provider, take over all your financial documents, and audit them to make sure your company is compliant. We check for any loose ends with HMRC, organise historical data, and then prepare and file necessary reports. We offer up ongoing advice about relevant tax exemptions, helping you be smarter with your taxes. Now that your accounting is in good hands, you can focus on what you do best: running your business.

What if my actual annual revenue differs from my chosen accounting plan's revenue range?

No worries! We'll adjust your accounting plan to match your actual revenue — either by sending you an invoice for the pro-rated package or crediting the amount back to your account.

Fresh insights from our business blog

Singapore Company Constitution — Everything You Need To Know

The Company Constitution is one of the legal requirements in your company’s incorporation process in Singapore. As a new business owner, you would need to know about Singapore’s Company Constitution as you are required to submit it during incorporation.

A Complete Guide to Ecommerce Accounting

Ecommerce accounting covers all your financial management as an online seller, from bookkeeping and invoices to record keeping and filing your taxes.

Top 15 Ecommerce Trends To Watch For in 2025

We read through the most trusted reports to bring you the top 15 ecommerce trends small businesses in Singapore should look out for this year; from social commerce and sustainability, to augmented reality and crypto. Read it now to see how Osome’s expert suggestions could help your business grow.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?