GST Deregistration in Singapore: Essential Guide

- Modified: 16 April 2025

- 12 min read

- Tax & GST

Gabi Bellairs-Lombard

Author

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

If you’re considering GST deregistration in Singapore, you’ll need clear-cut guidance through the process. Our article provides the key criteria, steps for deregistration, and how to handle post-deregistration duties, ensuring your company remains compliant and your GST registration number is properly cancelled. This guide is any registered company's go-to for understanding GST deregistration implications and should help you determine the best path forward.

Key Takeaways

- GST deregistration in Singapore may be mandated by operational cessation, reduction in turnover below the registration threshold, or business structure changes, and applications must be submitted within 30 days of qualification to cancel your GST registration.

- GST deregistration involves the preparation of detailed documentation, transparent communication with tax authorities through myTax Portal or email, and adherence to strict timelines before, during, and after the application.

- Post-deregistration responsibilities include finalising GST obligations on business assets and stock, adjusting operations to exclude GST, navigating potential re-registration, ensuring all dues are paid and forms are approved, and maintaining accurate records for at least five years for compliance and audit purposes, including all GST returns.

What Is GST Deregistration?

If continuing to charge GST no longer aligns with your business model or financial goals, it may be necessary to cancel your GST registration. This is where the concept of GST deregistration comes into play. Essentially, Goods and Services Tax (GST) deregistration involves cancelling your GST registration number, a move that can be catalysed by various business changes or strategic decisions. Whether it's, for example, the cessation of taxable supplies, a shift in business structure, or a decision to improve cash flow, deregistration could be the key to unlocking a new level of financial agility for your enterprise.

Understanding when to deregister is critical, as it can impact your financial management, competitiveness, and potentially even require consulting with accounting experts to ensure a smooth transition, especially regarding input tax credits. Let's delve into the criteria that necessitate this change and explore the potential benefits and considerations of choosing to deregister voluntarily, particularly if you belong to a GST group.

Criteria for mandatory deregistration

Certain scenarios mandate a business to cancel its GST registration, ushering it into a new phase of its fiscal lifecycle once cancellation is approved. If your company ceases operations or stops making taxable supplies, it is imperative to submit your application to cancel your GST registration within 30 days of cessation. Moreover, if your turnover dips below the mandatory GST registration threshold and is expected to stay there, you’re looking at a mandatory need to deregister.

Significant restructuring, such as a shift from a partnership to a limited liability partnership or transitioning to predominantly exempt supplies, can also trigger the need for deregistration and cancellation of your GST registration. But what if your company simply anticipates a lower turnover, and deregistration becomes a choice rather than a requirement? Should your company remain registered?

Voluntary GST deregistration: pros and cons

Voluntarily stepping back from GST registration is a move that companies can consider if they foresee their taxable turnover falling below the SGD 1 million threshold, particularly if they are part of a GST group. However, this isn’t a decision to be taken lightly. If you’ve voluntarily registered for GST, you’re required to maintain this status for at least two years before you can consider deregistration. Additionally, it’s important to ensure that the drop in turnover isn’t just a temporary fluctuation or a seasonal dip – you wouldn't want to have to register again.

When applying for voluntary deregistration, you’ll need to provide supporting documentation to prove your turnover projections and confirm the expected decrease in revenue over the period to come. This helps the authorities approve your decision to step away from charging GST and to transition your company into its next chapter, free of and no longer liable to the obligations of GST registration, including the management of input tax credits.

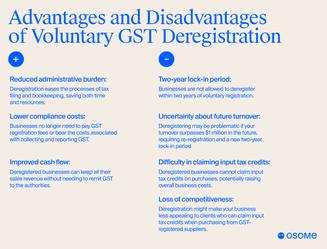

Pros of voluntary GST deregistration:

- Reduced administrative burden: Deregistration simplifies tax filing and bookkeeping, saving time and resources you'd have to account for when registered.

- Lower compliance costs: Businesses no longer need to pay for GST registration fees or incur costs associated with collecting and reporting GST.

- Improved cash flow: Deregistered businesses can retain all their sales revenue without the need to remit GST to the authorities.

Cons of voluntary GST deregistration:

- Two-year lock-in period: Businesses cannot deregister within two years of voluntary registration.

- Uncertainty about future turnover: Deregistering may be disadvantageous if your turnover increases above $1 million in the future, requiring re-registration and complicating the process of reclaiming an input tax credit.

- Difficulty in claiming input tax credits: Deregistered businesses cannot claim input tax credits on purchases, potentially increasing overall business costs.

- Loss of competitiveness: Deregistration might make your company less attractive to clients who can claim input tax credits when purchasing from GST-registered suppliers.

GST Deregistration Process in Singapore

Embarking on the GST deregistration process in Singapore is a straightforward affair when you know the right channels to submit your application, ensuring that all required documents are included. The myTax Portal stands out as the go-to online platform for authorised individuals to submit their deregistration applications. Typically, you can expect approval within the same day, although it could take up to 10 working days in some cases, depending on the details provided and the complexity of your application.

Regarding communication, emailing domestic GST enquiries with the necessary details for cancellation is another viable route. Be sure to confirm you have all your ducks in a row before hitting ‘submit’ on your application.

How to prepare your deregistration application?

Preparing to cancel your GST registration involves a bit more than just filling out a form. When you register, you must submit your application under specific conditions, such as business closure or cessation of taxable supplies, within a 30-day window to cancel your GST registration. Remember, if you’ve registered voluntarily, you need to have been registered for a minimum of two years.

The application process includes:

- Completing the necessary online forms through the myTax Portal by the authorised individual who handles GST matters for your company.

- Once your application is approved, you’ll receive notification of the cancellation date and the authorisation to stop charging GST.

- From that point onwards, you must stop charging GST or collecting GST, and all existing tax invoices should be marked as ‘GST cancelled.

It’s also critical to continue fulfilling all GST obligations until the last day of GST registration, including charging GST and submitting your final GST return. And don’t forget, you’ll need to keep your business records for at least five years following the transaction date.

How to communicate with tax authorities?

Effective communication with tax authorities is a cornerstone of GST deregistration to ensure your application is processed smoothly and efficiently. It’s essential to inform the government of your intended deregistration date and to continue to charge GST until your cancellation is officially confirmed, as the value of transactions needs to be accurately reported. After you’ve submitted your application, you should receive an official letter, which includes the approval and the effective date of your deregistration.

If there are any significant changes to your business details, such as a new mailing address or amendments to your business constitution, these need to be reported to the tax authority within 30 days of the change. Timely and transparent communication not only ensures compliance but also aids in a smooth transition out of GST registration.

How To Finalise Your GST Obligations?

When finalising your GST obligations and cancelling your GST registration, it’s important to account for output tax on business assets, such as non-residential properties and inventory, if their combined value surpasses $10,000. Even if you’ve imported goods under special schemes, like the Major Exporter Scheme (MES), these must be considered when settling your final GST obligations.

Your final GST return should include output tax for supplies where delivery occurred before deregistration, even if the invoicing happens later. Be aware that post-deregistration, you can’t claim input tax credits for purchases, but you can claim input tax for goods or services bought before deregistration if certain conditions are met.

What should be included in the last GST return?

Completing the final GST return requires meticulous attention to detail. Don't forget to account for every detail so you have full confirmation you won't be liable for any mistakes! It’s not just a matter of reporting usual transactions; you must include output tax for any business assets you hold if their total value on your last day of GST registration is more than $10,000. If you’ve misplaced supporting documents for exports or international services tax, treat these sales as local supplies and include the current GST rate on your final return.

Before you complete the process and file your return, make sure to adjust the value of standard-rated supplies and any affected output tax using credit notes if there was a GST rate change. This is crucial for ensuring that your final GST return is comprehensive and accurately reflects your tax requirements up to the very last moment of your GST registration.

Handling of business assets and stock

When you’re in the throes of GST deregistration, handling your business assets and stock, such as your property or other sources of value, takes precedence. You’re required to report the market value of these assets in your final GST return, and if you’ve claimed GST on these assets and their total market value is above $10,000 on the last day of GST registration, you’ll need to account for GST on these assets.

The valuation should include all stock at the time of cancellation, along with any imported goods and assets. It’s a relief that intangible assets, such as intellectual property, don’t need to be included in this valuation.

Post-Deregistration Considerations

Has your deregistration been processed? Post-deregistration is not just about breathing a sigh of relief after approval; it’s about being proactive in adjusting your business practices. Once you have your deregistration approval and the effective cancellation date, it’s critical to ensure that you do not collect GST beyond this point. Any slip-ups, like issuing a GST invoice after your GST registration has been cancelled, might attract fines.

However, your journey isn't quite complete. There are additional considerations, such as handling rebates or goods returns and understanding when you might need to re-register for GST.

How to adjust business operations after deregistration?

Adjusting your business operations after GST deregistration involves a few key steps:

- Ensure that GST is no longer included in your displayed prices or advertised as such.

- For any supplies or services provided after deregistration, you’ll need to account for price adjustments, even for an agreement entered into before the deregistration date.

- If rebates are given or goods are returned after you’ve deregistered, adjust the GST amount according to the rate initially charged at the time of sale.

- In the instance of a goods exchange, GST applies only to any additional consideration received, provided no refund is made for the original items.

When re-registering is necessary?

Occasionally, the winds of change may blow in a direction that calls for re-entering the GST registration fold. This is particularly relevant when a company undergoes a change in ownership. The new owner must then ensure that they comply with GST regulations, which may include re-registering for GST, especially if the previous owner had deregistered.

Timeliness is of the essence here, as delays in re-registering can result in penalties, underscoring the importance of keeping a pulse on your business’s GST registration requirements.

Record Keeping and Compliance

Even after you’ve cancelled your GST registration, the saga of record-keeping and compliance continues. The legal necessity to preserve financial records remains, irrespective of whether your company is actively registered for GST. This continued diligence in maintaining records is mandated to facilitate any potential future audits or inquiries that may arise.

Document retention policies

The document retention policies in place require businesses to maintain their accounts and transaction records for a minimum of five years from the date of the transaction. This holds true even if the business has ceased operations or is no longer registered for GST.

By ensuring that proper records related to all business transactions are kept, you’re not only adhering to the law but also safeguarding your company from any penalties or legal complications in the event of an audit.

How to deal with audits and compliance checks?

Being well-prepared for audits or compliance checks means having accurate records and documentation readily available. This is where adhering to the prescribed retention period becomes invaluable. Remember, you can keep these records in electronic format as long as the requirements set forth by the Comptroller of GST are met.

A robust document management system can be a lifesaver when it comes to proving your past tax positions if audited.

GST Deregistration and Transferring a Business

If you’re contemplating transferring your business to another GST-registered new entity or altering your business structure, it’s essential to understand the implications of your GST status. These changes might lead to GST deregistration or adjustments to your current registration.

Selling Your Business and GST Implications

Selling your business, property, or other related assets comes with its own set of GST implications. If you’re transferring your business as a going concern to another GST-registered new entity, you may not need to account for output tax on the last day of your registration. However, for the transfer to be considered an excluded transaction, certain criteria must be met, including the continuity of the same business and the use of assets for the same business purpose.

If your business entity type changes without interrupting business operations, this may result in a transfer that’s viewed as an excluded GST transaction. But in the case of an assets, property, or company sale, both the seller and the new owner must be meticulous about keeping records of the assets transferred to ensure a smooth transition for the new entity.

Changing business structure and GST status

When a business structure undergoes a significant transformation, such as moving from a sole proprietorship to a partnership, it may necessitate a change in GST registration. This could mean either deregistering or re-registering.

It’s crucial to file for cessation of business on BizFile+ and cancel the GST registration with the Inland Revenue Authority of Singapore (IRAS) if you’re selling your sole proprietorship or transforming it into another entity form, ensuring all necessary documents are included.

Summary

GST deregistration can reshape the financial contours of your company. From understanding when to deregister, either mandatorily or voluntarily, to navigating the application process and finalising your GST obligations, it’s clear that each step requires careful consideration and meticulous attention to detail.

The journey doesn’t end with deregistration. Post-deregistration considerations, assets management, compliance with record-keeping, and understanding the implications of business transfer or changes in structure are crucial to maintaining the integrity of your business operations. It’s about staying informed, staying compliant, and being ready to adapt to the ever-evolving landscape of tax laws. May this guide lead you towards informed decisions and successful transitions in your business’s GST journey.