What is a Special Purpose Vehicle in Singapore?

- Published: 26 April 2024

- 11 min read

- Starting a Company

Gabi Bellairs-Lombard

Business Writer

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Those exploring Singapore’s financial strategies wouldn't be unfamiliar with SPV. A Special Purpose Vehicle (SPV) is a pivotal financial component that acts as a separate legal entity, guarding a parent company’s assets from financial risks. Therefore, it is critical for safeguarding asset protection and risk isolation.

Key Takeaways

- A Special Purpose Vehicle (SPV) in Singapore is a bankruptcy-remote entity that operates independently from a parent company. SPVs isolate financial risk, manage asset liabilities, building investor confidence and security.

- An SPV is often a subsidiary company with its own legal status. It is a separate legal entity unaffected by any negative financial impact that may harm the parent company.

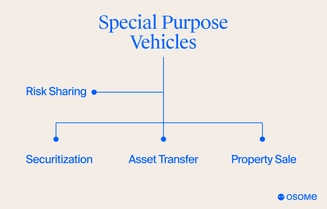

- SPVs are utilised in Singapore for various purposes, including risk sharing, securitisation strategies, property transfer mechanisms, and property sale arrangements, offering operational benefits and tax advantages.

- Establishing an SPV in Singapore begins with choosing an appropriate business structure, incorporating the entity, crafting a comprehensive constitution, and understanding the tax and accounting essentials while ensuring ethical use and legal compliance.

What Is a Special Purpose Vehicle?

A Special Purpose Vehicle (SPV) is a separate legal entity created for a particular project or business goal. It works as a shield that safeguards your company’s assets against financial uncertainties. Since an SPV operates independently from the parent company, it provides additional protection for the parent company’s finances. For expert assistance in setting up your SPV, consider our comprehensive company incorporation services!

Many Singapore private limited companies will establish a special purpose vehicle (SPV) because it is a bankruptcy-remote entity. This allows the SPV to fulfil its financial obligations even if the parent company faces insolvency. This offers a layer of financial security that can bolster investor confidence in your venture.

Common Uses of Special Purpose Vehicles

Private limited companies use SPVs for various purposes. They can be used to securitise assets, structure finances, raise funds for startup ventures, and isolate financial risk. In the next sections, we’ll delve into four common uses of special purpose vehicles: risk-sharing, securitisation, asset transfer, and property sale arrangements.

1 Risk-sharing

A special purpose vehicle (SPV) can:

- Share and isolate financial risk

- Protect mortgage backed securities and asset backed loans by distributing the credit risk among investors

- Decrease the bank’s exposure to credit risks

- Raise additional capital

Risk diversification is a key strategic advantage of special purpose vehicles, making them especially appealing for high-risk ventures.

Limited liability companies and limited partnerships in Singapore may leverage a special purpose vehicle (SPV) as an investment vehicle since it has its own assets and own balance sheet. This allows the SPV to stay autonomous from the parent company's operations while completing financial transactions independently.

An SPV can also serve as a project management tool for the government. For instance, the Government of India used special purpose vehicles for its Smart City initiatives. The government created a special purpose vehicle (SPV) for each smart city to plan, appraise, approve, fund, implement, manage, operate, monitor, and assess each development. By doing so, the SPV network keeps officials sufficiently informed on each moving piece in a comprehensive initiative.

2 Securitisation strategies

A special purpose vehicle (SPV) also securitised the assets of ordinary investors. By establishing an SPV system, a privately limited company can consolidate future account receivables into a single group. They then sell the SPV to investors or other firms, which allows the parent company to:

- Manage its financial assets more effectively

- Diversify its funding sources

- Improve its liquidity position

- Reduce its credit risk exposure

This process is known as debt securitisation.

Financial institutions like banks and credit unions also implement this process and use SVPs to transform debts, such as mortgage-backed securities and loans, into tradable securities.

This strategy allows these institutions to sell future cashflows to interested parties, thereby managing their financial assets and transactions more effectively within the investment fund industry.

3 Transfer mechanisms

Special purpose vehicles (SPVs) can facilitate asset transfers as a separate management or holding company. This strategy significantly reduces the financial impact of risky ventures on the parent company. For instance, a special purpose vehicle can act as a holding company for debt securitisation, assuring investors of repayment.

SPVs can also sanitise toxic assets for damage control and disaster management by focusing on only acquiring and financing specific assets. Since an SPV has its own balance sheet, it isolates these assets from the parent company, making SPVs an invaluable tool in venture capitalism. Since these financial transactions are conducted independently, they will not affect the parent company's activities.

4 Property sale arrangements

Finally, a special purpose vehicle also provides significant advantages for property sales tax.

For example, a Singapore company can establish an SPV to hold properties for sale, particularly if the property sales tax exceeds the taxes it pays for the capital gain. Instead of selling the property directly, the company can sell the SPV. Since the SPV is often a private limited company that owns the properties, the sellers now pay tax at the capital gains rate instead of the higher real estate sales tax rate.

This methodology allows companies to:

- Sell the SPV company rather than the actual properties for a lower tax rate

- Result in significant capital gain

- Make the sales of specific assets more profitable and less financially burdensome

Benefits of an SPV

Special purpose vehicles (SPVs) allow organisations to isolate risks associated with specific projects or assets to prevent potential financial fallouts from impacting the parent company’s financial health. In addition, SPVs can enable direct ownership of a specific asset, simplifying asset transferring and management.

This autonomy SPV has is highly beneficial for companies in highly innovative industries or with complicated financial structures. For example, medical companies can establish an SPV for a new line of medication. Financial institutions also utilise SPVs to work with mortgage backed securities or debt transfers for the same reasons.

Furthermore, an SPV can offer significant tax advantages and is often favoured by multi-location corporations. Such companies can create an SPV in a tax haven, such as the Cayman Islands, resulting in significant tax savings for the parent company. Most SPVs set up for tax purposes operate as private limited companies. As an originating company, the SPVs pay tax as independent entities unassociated with their parent company and have their own balance sheet.

Similarly, an SPV is also a useful investment vehicle if you're trying to start something new. Investors typically pool funds into an SPV established for a specific project. The contributed funds stay within the SPV without affecting the rest of the company. This helps mitigate any potential financial risks that come with a new company or project and thus increases investor protection and confidence.

Who Should Consider Establishing an SPV?

Given these benefits, who should consider establishing an SPV? Essentially, any entity considering engaging in risky ventures that wish to protect the parent company from severe risks might establish an SPV to recover assets and securitise new investments.

Investors

For investors, establishing an SPV provides:

- A secure platform for investment since you can claim an SPV’s assets even if its associated company goes bankrupt.

- A convenient method to limit unnecessary influence a new project may have on the existing corporation

- A simplified process for transactions since they enable direct ownership of a specific asset and can easily transfer ownership.

Moreover, an SPV increases the confidence of a startup's angel investors by providing benefits such as immediate equity, asset protection, and risk mitigation.

Startups

Startups also gain significantly from establishing an SPV. The main benefits include:

- Keeping each balance sheet and investment separate, trackable, and manageable creates a more appealing appearance for investors.

- Streamline investor relations through centralised communications via an SPV

- Bolster their standing with venture capitalists

- Provide additional protection and assistance for the incorporation process by safeguarding the parent company's assets and liabilities.

- Access to lower borrowing rates for funding.

Key Steps to Establishing an SPV in Singapore

Establishing an SPV in Singapore involves a few key steps, from crafting a suitable structure to incorporating your SPV and developing its constitution. We’ll guide you through these steps in more detail in the following sections.

Step 1. Develop the necessary business structure

The first step to establishing an SPV is developing an appropriate business structure. This structure should be tailored to the SPV’s purpose and objectives. For instance, if you’re a startup looking to attract investors, you might choose to set up your SPV as a limited liability company or a trust.

The chosen structure should be flexible enough to accommodate the SPV’s specific functions and goals and robust enough to provide a solid legal and financial foundation for its operations. This step is crucial as it determines your SPV's operational scope and regulatory obligations.

Step 2. Incorporate your SPV(s)

Once you’ve developed an appropriate structure, the next step is to incorporate your SPV. In Singapore, this process involves:

- Submitting a name application

- Preparing all necessary documents

- Appoint an independent director if you'd like your company to be listed in Singapore

- Registering the SPV as a Private Limited Company, either with the Accounting and Corporate Regulatory Authority (ACRA) or through a corporate service provider.

Upon incorporation, the SPV will operate like any regular company, with its assets, liabilities, and balance sheets separate from the parent company's. It’s important to note that the SPV must also create a constitution stating its regulations, business purpose, structure, and other specifics.

Step 3. Craft a company constitution

Crafting a comprehensive company constitution is the third step in establishing an SPV. The constitution should clearly define the SPV’s:

- operations

- purpose

- business structure

- functions

- specific objectives

It should also indicate the SPV’s nature of business and operational scope.

Key provisions to include in the company constitution are:

- The company’s name

- Type of business

- Member liability

- Contribution requirements for companies limited by guarantee

- Provisions for unlimited liability companies

The company constitution must also reflect specific provisions tailored to the SPV’s unique functions, goals, and business structure. And if you need help establishing an SPV, Osome's Singapore business formation expert can help you navigate the process.

The Taxation Landscape for SPVs

Another important aspect to consider when establishing an SPV is the taxation landscape. In Singapore, SPVs are taxed at a corporate tax rate of 17% on their chargeable income. However, SPVs that meet certain criteria may be eligible for special tax incentives and exemptions from Goods and Services Tax (GST).

It’s also worth noting that SPVs, with their own legal status, must pay stamp duty on relevant documents and could face withholding taxes on payments to non-residents. Understanding these tax obligations is crucial for ensuring the financial viability of your SPV.

Accounting Essentials for SPVs

Just like any other company, SPVs must meet standard annual filing requirements. These requirements include presenting the consolidated accounts and balance sheet at the Annual General Meeting. Compliance with these requirements is crucial for maintaining your SPV's legal and financial standing.

Moreover, financial statements and balance sheets, including the parent company’s balance sheet, must comply with International Financial Reporting Standards (IFRS) to accurately depict the company’s financial status. If the SPV is listed on the Singapore Exchange or meets specific control and benefit conditions, the originating company must include the SPV’s assets and liabilities in its financial statements.

If you need help navigating paying taxes on SPV's capital gain, reach out to Osome and let one of our expert accountants. Our accounting professionals have the technical expertise required to ensure the compliant operations of your SPV.

Potential Risks and Ethical Considerations

While SPVs offer many benefits, they are not risk-free.

The structure and disclosure practices of SPVs can potentially lead to significant ethical breaches, as seen in past financial scandals like Enron. Misusing SPVs can obscure important information and mislead investors who may not be privy to the parent company's complete financial situation.

Moreover, exploiting accounting loopholes with SPVs can damage the parent company's reputation and misrepresent its financial health. Therefore, it’s crucial to ensure that the use of SPVs is in accordance with ethical business practices and transparent financial reporting.

Legal Protections and SPVs

In addition to financial benefits, SPVs also provide legal protections. Since SPVs are legally distinct entities from their parent companies, they can fulfil their commitments independently. This structure enables investors to claim against the SPV’s assets even if the connected company goes bankrupt.

In Singapore, limited liability companies and limited partnerships, such as a Limited Liability Company (LLC) or a private company, are often used for SPVs due to their status as separate legal entities, differentiating them from their shareholders and directors. This independence provides an added layer of security for investors, assuring them that their investments are protected in a subsidiary company.

Future Outlook: Regulatory Changes and SPVs

Looking ahead, it’s important to stay informed about future regulatory changes that could impact the operation of SPVs. Compliance with legal and regulatory requirements is essential for effectively operating SPVs. Anticipated regulation changes may have tax and regulatory implications for SPVs, necessitating proactive strategies to ensure compliance.

For instance, the Central Bank of Ireland’s public consultation on proposed guidance for addressing climate change risks may indirectly affect SPVs involved with insurance. Therefore, staying informed and seeking professional advice on upcoming tax and regulatory implications for SPVs is crucial.

Summary

We’ve journeyed through the intricacies of Special Purpose Vehicles, examining their use, benefits, risks, and legal aspects. We’ve seen how these unique legal entities can provide financial risk isolation, simplify asset transfer, and offer tax advantages. We’ve also discovered how investors and startups can benefit from establishing SPVs and explored the key steps in setting up an SPV in Singapore.

However, as we’ve also seen, staying informed about regulatory changes and ensuring ethical practices in using SPVs is crucial. With careful planning, transparent communication, and a clear understanding of their function and benefits, SPVs can provide a robust mechanism for managing financial risks and facilitating business ventures.

FAQ

What is an SPV in Singapore?

SPV in Singapore refers to a Special Purpose Vehicle, also known as a Special Purpose Entity, which is a company created for a specific project or business goal. This allows for focused execution and risk management.

What financial benefits does an SPV bring to a startup?

Singapore offers many tax benefits tailored for an SPV. For example, qualifying companies may access lower borrowing rates operating as an SPV under an existing private limited company. You can also save your capital gain for a specific project with an SPV.

Individual investors tend to find a company in the form of an SPV more appealing since it lowers their risk. An SPV is also extremely helpful during the incorporation process.

Who should establish an SPV?

Both investors and startups should consider establishing SPVs to enjoy benefits like risk sharing, streamlined transactions, legal protections, consolidated investments, streamlined investor relations, and access to tax incentives.

What are the potential risks and ethical considerations of SPVs?

Misusing SPVs can obscure important information and mislead investors, potentially leading to significant ethical breaches if not managed correctly. It's crucial to ensure that SPVs are in line with ethical business practices and transparent financial reporting.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?