What Is Financial Reporting and Why Is It Important for Your Business?

- Published: 4 December 2023

- 11 min read

- Grow Your Business

Gabi Bellairs-Lombard

Author

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Financial reporting is a cornerstone of transparent and accountable financial management within organisations. This comprehensive guide delves into what financial reporting entails, its significance, key types of financial reports, benefits, limitations, and its critical role in various aspects of business operations.

Key Takeaways

- Financial reporting provides a clear and accurate view of a company's financial stability and position.

- It is essential for legal compliance, informed decision-making, and building trust with stakeholders.

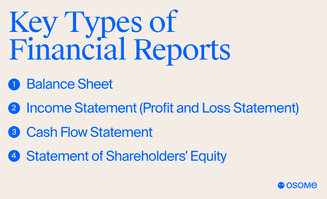

- Key financial statements and reports include the balance sheet, income statement, cash flow statement, and statement of shareholders' equity.

- While financial reporting offers many advantages, it also has limitations and risks, such as its historical nature and reliance on estimates.

What Is Financial Reporting?

Financial reporting encompasses preparing and disseminating financial statements and related information to provide a comprehensive overview of an organisation's financial performance, position, and cash flows. These reports are vital tools for internal and external stakeholders to assess a company's financial stability and make informed decisions.

In practical terms, financial reporting involves the preparation of key financial statements, including the balance sheet, income statement, cash flow statement, and statement of shareholders' equity. These statements offer a snapshot of the company's financial status at a specific point in time and its financial performance over a given period. Financial reporting involves disclosing additional information in footnotes, providing context, and explaining reported figures. Having a record of these financial statements over the years also gives a comprehensive snapshot into a company's performance over time.

With our accounting services, you can rest assured that your financial reporting is accurate, compliant, and transparent. Our team will handle the preparation of your financial statements meticulously, ensuring that they adhere to regulatory standards and provide meaningful insights into your company's financial health over time.

Why Is Financial Reporting Important?

Financial reporting plays a pivotal role in the world of business, serving as the bedrock of transparency, accountability, and informed decision-making. It's also an integral part of adhering to the International Financial Reporting Standards (IFRS), which help businesses worldwide to standardise their financial reporting and accounting practices. The only country exempt from adhering to these standards is the US, which is instead required to use Generally Accepted Accounting Principles (GAAP). Additionally, the US relies heavily on the Financial Accounting Standards Board for governance over financial reporting for businesses in the country.

But let's dive in! Financial reporting's significance can be dissected through three key issues: legal and regulatory compliance, transparent financial analysis, detailed insight into cash flow, and informed decision-making.

Legal and regulatory compliance

One of the fundamental reasons for the significance of financial reporting lies in ensuring legal and regulatory compliance. This aspect is particularly critical for publicly traded companies, which must adhere to stringent reporting standards and regulations. Here's why it matters:

- Regulatory mandates: Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States or the International Financial Reporting Standards (IFRS), globally establish reporting requirements. Compliance with these mandates is non-negotiable for public companies when filing their financial statements.

- Transparency: Compliance fosters transparency by ensuring that companies disclose their financial data in a standardised and comprehensible manner. This transparency is vital for investors, creditors, and the broader financial market.

- Accountability: Legal compliance through financial reporting holds organisations accountable for their financial activities. It acts as a mechanism to deter fraudulent or unethical practices, ultimately protecting shareholders and investors. Additionally, if there are problems with cash flow, financial statements can be used as a reference to solve the problem.

- Avoiding legal repercussions: Non-compliance can result in legal penalties, regulatory investigations, and reputational damage. Financial reporting serves as a safeguard against such consequences.

Transparent financial analysis

Financial reporting facilitates transparent financial analysis, offering a wealth of benefits for stakeholders:

- Assessing financial health: Stakeholders, including investors, creditors, and financial analysts, rely on financial reports to perform rigorous analysis. These reports provide a detailed view of a company's financial situation and cash flow, enabling stakeholders to assess its profitability, solvency, liquidity, efficiency and risk exposure.

- Comparative analysis: Through financial reporting, stakeholders can compare an organisation's performance with industry peers and benchmarks. This comparative analysis aids in evaluating how effectively a company competes and operates within its sector.

- Investment decisions: Investors use financial reports to make informed investment decisions. They analyse an entity's financial statements to gauge its potential for growth and profitability, ultimately determining whether to invest in the company's shares.

Informed decision-making

At its core, financial reporting enables informed decision-making in several key areas:

- Management decisions: Within organisations, financial reports are essential tools for management. Executives and decision-makers rely on these reports to evaluate the company's performance against targets and goals. They can also devise strategic plans for growth, expansion, or cost-cutting measures. A business owner can distribute the company's income and allocate resources effectively for future profitability. Financial reporting allows the company's management to assess the viability of new projects or investments.

- Investment and lending decisions: External stakeholders, such as investors and creditors, heavily depend on financial reports to decide whether to invest in or lend money to a company. These decisions have far-reaching implications for the organisation's access to capital and growth prospects.

Financial reporting is not just a routine financial exercise; it is the lifeblood of accountability, trust, and informed decision-making in the corporate world. Its importance extends beyond compliance with laws; it is an indispensable tool that empowers stakeholders to navigate the complex landscape of finance, make sound choices, and drive organisations toward sustainable growth and success.

Key Types of Financial Reports

Financial reporting includes several key types of financial statements and reports, each serving a specific purpose with its components.

Balance Sheet

The Balance Sheet is a fundamental financial statement that provides a snapshot of a company's financial position at a specific point in time, typically at the end of a fiscal period, such as a quarter or year. It is divided into two main sections:

- Assets: This section lists all the resources owned by the company, including cash, accounts receivable, inventory, property, equipment, and investments. Assets are categorised as current (short-term) or non-current (long-term).

- Liabilities and shareholders' equity include debts, accounts payable, and other obligations. Shareholders' equity represents the owners' claim on the company's assets and is the residual interest after deducting liabilities.

The balance sheet adheres to the accounting equation: Assets = Liabilities + Shareholders' Equity. It clearly shows a company's economic stability, liquidity, and solvency.

Income Statement (Profit and Loss Statement)

The Income Statement, often called the Profit and Loss (P&L) Statement, offers a comprehensive view of a company's financial well-being over a specific period, such as a month, quarter, or year. It reports the following key elements:

- Revenues: Also known as sales or income, revenues represent the money generated from primary business activities, such as selling products or providing services.

- Expenses: Expenses encompass all costs incurred to generate revenues, including operating expenses, interest, taxes, and other deductions.

- Net income: Net income, or profit, is the result of subtracting expenses from revenues. It represents the company's bottom-line profitability.

The income statement helps stakeholders assess a company's ability to generate profits, identify trends in revenue and expenses, and evaluate overall economic performance.

Cash flow statement

The cash flow statement provides a detailed account of a company's cash inflows and outflows over a specified period, typically divided into three categories:

- Operating activities: This section records cash transactions related to the business's core operations. It includes cash receipts from customers, payments to suppliers, and salaries.

- Investing activitie s: This section details cash flows related to the acquisition or disposal of long-term assets, such as investments, property, and equipment.

- Financing activities: This is where the company's capital structure is reported. This includes transactions involving borrowing, issuing or repurchasing stock, and payment of dividends.

The cash flow statement helps stakeholders understand how a company manages its cash resources, whether it is generating or using cash, and its ability to meet financial obligations.

Statement of shareholders' equity

The statement of shareholders' equity is one of the more important financial statements that tracks changes in shareholders' equity over a specific period, typically a year. It includes the following components:

- Beginning shareholders' equity: This is the starting point, reflecting the equity position at the beginning of the reporting period.

- Net income (from the income statement): Net income earned during the reporting period is added to shareholders' equity.

- Other comprehensive income includes items like gains or losses from investments that are not part of net income.

- Shareholder transactions: Changes in equity due to issuing or repurchasing shares are recorded here.

- Dividends: Any dividends paid to shareholders are deducted from equity.

- Ending shareholders' equity: This is the final figure, reflecting the equity position at the end of the reporting period.

The statement of shareholders' equity provides transparency regarding how changes in income, investments, and shareholder transactions impact the company's ownership structure.

With their structure, these financial statements offer a comprehensive view of a company's financial status, position, and cash flow, assisting stakeholders in making informed decisions and assessing the company's overall financial health. This is one of the core, most generally accepted accounting principles.

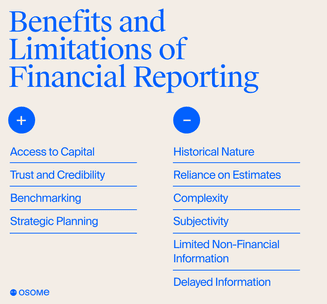

Benefits of Financial Reporting

Financial reporting offers a multitude of benefits for organisations and stakeholders alike. All contribute to the potential of the company and future growth.

Access to capital

Clear and accurate financial reporting attracts investors and creditors, making it easier for organisations to raise capital. Investors rely on quarterly and annual reports to assess a company's financial health and prospects, while creditors use them to determine creditworthiness. Access to capital is crucial for business growth, expansion, and day-to-day operations.

Trust and credibility

Credible and reliable company's financial reporting builds trust and credibility with stakeholders. When companies consistently deliver transparent and truthful financial information in a balance sheet, they earn the confidence of shareholders, investors, customers, and business partners. Trust is a valuable asset that can enhance a company's reputation and relationships within the industry.

Benchmarking

Good financial reporting enables stakeholders to benchmark a company's performance against industry peers and competitors. This comparative analysis provides valuable insights into how effectively a company competes and operates within its sector, guiding strategic planning and positioning.

Strategic planning

Financial reports serve as valuable tools for strategic planning. Organisations can use these reports to assess their financial status, identify growth opportunities, set financial goals, and allocate resources effectively. Strategic planning is crucial for long-term sustainability and competitiveness.

Accurate financial reporting is not just a regulatory requirement; it plays a pivotal role in an organisation's success and future growth. It promotes transparency, facilitates access to capital, builds trust, supports performance evaluation, and guides informed decision-making. These benefits collectively contribute to the overall financial health and sustainability of businesses.

Limitations of Financial Reporting

Financial reporting, while indispensable for transparency and accountability, has its limitations. Understanding these limitations is crucial for stakeholders who rely on financial reports to make informed decisions. Here are the main limitations of financial reporting.

Historical nature

Financial reporting is inherently historical. It presents financial data from past periods, typically covering months or years. While historical data is valuable for assessing trends and performance over time, it may not predict future outcomes accurately. Economic conditions, market dynamics, and business circumstances can change, making historical data less relevant for future projections.

Reliance on estimates

Certain figures in financial reports rely on estimates and assumptions. For example, calculating depreciation, allowances for doubtful accounts, and fair value assessments often involve estimation. These estimates are based on management's judgment and may not always reflect the exact values, leading to potential inaccuracies in financial statements.

Complexity

Financial reporting can be complex and challenging to understand. Financial statement terminology, accounting standards, and intricacies require financial literacy and expertise to interpret accurately. This complexity can lead to misinterpretations or errors in analysis, particularly for stakeholders with limited financial knowledge.

Subjectivity

Subjective judgments influence financial reporting. Accounting policies, such as the choice of depreciation methods or revenue recognition, can vary between companies. These policy choices can impact reported financial results and make it challenging to objectively compare companies in the same industry.

Limited non-financial information

Financial reporting primarily focuses on monetary aspects. While it provides insights into a financial performance of the business, it may not adequately capture non-financial factors such as employee satisfaction, customer loyalty, or environmental sustainability. These non-financial aspects can also be critical for assessing a company's overall health and sustainability.

Delayed information

The reporting process takes time, resulting in delayed information. By the time financial reports are published, the data may no longer accurately reflect the current financial position or market conditions. In rapidly changing industries, this delay can hinder timely decision-making.

Conclusion

Financial reporting is pivotal in ensuring transparency, compliance, and informed decision-making within organisations. It provides stakeholders with the essential information needed to assess a financial health of the business, make strategic choices and assess the value of shareholder equity. While it has inherent limitations, the benefits of financial reporting far outweigh its drawbacks, making it an indispensable tool in the world of finance and business.