How To Effectively Prepare Unaudited Financial Statements

- Modified: 16 April 2025

- 10 min read

- Grow Your Business

Gabi Bellairs-Lombard

Author

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Unaudited financial statements are internal records that show a company’s financial status without external audit verification. They offer quick insights for internal use, helping management make informed decisions, and are particularly important for small companies and dormant entities that do not require statutory audits.

Meanwhile, audited financial statements undergo extensive reviews by a certified external auditor or an accounting service provider to ensure compliance and are often a must for any company's operations.

Key Takeaways

- Unaudited financial statements capture a company’s financial performance without external verification, serving as essential tools for internal management and strategic decision-making. Audited financial statements are validated by an external professional to ensure accuracy and compliance.

- Small companies, small groups, and dormant companies in Singapore may be exempt from statutory audit requirements if they meet specific criteria outlined by the guidelines, providing a simpler reporting process.

- Accurate unaudited financial statements are crucial for compliance, informing stakeholders, and aiding in business decisions, while professional services can assist in ensuring the accuracy and regulatory adherence of these reports.

What Are Unaudited Financial Statements?

An unaudited financial statement is a snapshot capturing a company’s financial position and performance without external verification. These documents serve as internal compasses for management, guiding strategic decisions and providing vital insights into a company’s economic journey.

Unlike an audited financial statement, an unaudited financial statement offers an immediate view of financial data for specific reporting periods and is perfect for internal use.

For expert assistance in preparing these financial documents, consider our comprehensive accounting services to ensure accuracy and strategic financial planning.

On the other hand, according to Singapore's tax laws, audited financial statements are a must for most companies. Audited financial statements provide an accurate, comprehensive, and validated description of a company's financial position. These statements must be assessed and verified by an independent licensed auditor, a CPA, or a professional auditing service provider.

Additionally, small companies and small companies in a small group may be exempt from preparing an audited financial statement if they meet the criteria.

Unaudited financial statements are a strategic tool for internal analysis and regulatory compliance, like filing income tax with IRAS or Annual Returns with ACRA in Singapore. Hence, properly preparing your unaudited financial statement is crucial to your company's successful and compliant operations.

An unaudited financial statement showcases a company's financial well-being and advises leaders to assess and adjust operational strategies. Preparing an unaudited yearly financial statement covering your activities within the financial year is important.

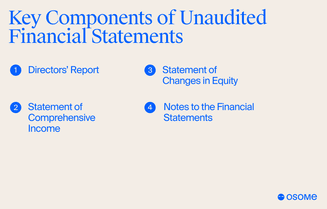

Key Components of Unaudited Yearly Financial Statements

An unaudited financial statement consists of several key components, including:

- Directors Statement

- Comprehensive Income Statement

- Financial position statement (balance sheet)

The Directors Statement declares a company's compliance and responsibility by statutory requirements. The Statement of Comprehensive Income, or the profit and loss statement, reflects the company’s cash flow activity over the financial year. The financial position statement, or the balance sheet, reflects any changes and movements in a company's total assets based on other comprehensive income and incurred expenses.

Sometimes, your unaudited financial statement also includes an Equity Statement, which records any change in shareholders' equity and investments. When applicable, you can add necessary notes to your to offer additional details to ensure clarity and precision of your financial statement.

Who Needs To Prepare an Unaudited Financial Statement?

Most private limited companies and corporations in Singapore must submit audited financial statements each financial year. However, small companies, small groups, and dormant companies may be exempt from audited financial statement obligations if they meet the criteria. These special entities can present unaudited accounting records without any independent verification when filing annual returns.

Small company

A small company may receive audit exemption if it is a private company and meets at least two of the three following criteria.

- Fewer than 50 full-time crew members

- No more than SGD$10 million in treasure (total annual revenue)

- SGD$10 million or less in the total value of their cargo (total assets)

A private company that meets the required criteria for two consecutive financial years is to be categorised as a "small company." Under small company status, you can file an unaudited financial statement and be exempted from auditing.

Small group

All companies in a small group must meet at least two of the three quantitative criteria mentioned above for two consecutive years. This consolidation must reflect the combined total revenue, assets, and employee count. For example, joint ventures with two or three subsidiary companies must ensure that each company stays under the limitations of staffing, revenue, and total assets.

Dormant Company

Dormant companies are silent vessels in the harbour without commercial movement or income during a financial year. ACRA considers a company dormant if it hasn’t engaged in any accounting transactions within a fiscal period, though it may still incur certain expenses like mooring fees (selected transactions). These quiet entities are granted safe harbour from the statutory audits that busier ships must endure.

The stillness of a dormant company’s operations offers it a reprieve from vigorous auditing waves, but only if it has remained inactive. Maintaining this status requires careful monitoring to ensure that no unexpected currents of business activity disrupt its tranquil waters.

Statutory Audit Exemptions

Statutory audit exemptions are the lifeboats for small and dormant companies, offering a safe passage from the otherwise mandatory auditing process. Exempt private limited companies, particularly those with an annual bounty of no more than SGD 5 million, can navigate the waters of financial reporting without external scrutiny. This also frees a small company from the obligation of appointing an independent licensed auditor within 3 months of its formation.

However, while these companies may be exempt from statutory audit, they must still abide by Singapore Financial Reporting Standards (SFRS) or International Financial Reporting Standards (IFRS), maintain all necessary accounting records, and prepare and file financial statements for each financial year.

The Preparation Process for Unaudited Financial Statement

The standard workflow behind preparing financial statements in Singapore includes the following steps:

- Gathering financial data in the financial year

- Gathering supporting documents

- Create annual financial reports

- Review the statements in annual general meetings to ensure compliance

- Filing annual returns

Let's look deeper into each step.

Gathering financial data and supporting documents

Gather everything and anything that reflects your company's financial activities, including cash flows, unaudited profit, incurred expenses, any government grants you may have received, and changes in equity.

You should also gather any supporting documents at this stage, including bank statements and all necessary receipts.

Create annual financial statements

Now that you have everything you need, it's time to put the data into corresponding reports. As mentioned earlier, you will need a comprehensive income statement detailing your unaudited profit, a financial position statement, and an equity statement.

Reviewing for Companies Act compliance

Financial statements in Singapore must comply with the Companies Act, regulations from the Accounting Standards Council, and the IFRS. Your executive management team and company secretary should conduct the review together. Once completed, you must draft the Director's Statement to declare compliance.

If you need help preparing unaudited financial statements in Singapore, financial professionals at Osome can help you navigate each stage.

Differences Between Audited and Unaudited Financial Statement

Audited reports undergo a rigorous verification process by a Certified Public Accountant (CPA), ensuring that every financial detail withstands the scrutiny of external auditing. This comprehensive review provides added assurance that the financial statements reflect the company's true financial standing, as viewed through the unbiased lens of a qualified independent auditor.

On the other hand, unaudited financial statements are prepared without the external audits’ magnifying glass. They provide a less formal report of a company’s financial position, mainly for internal management and compliance. While lenders and investors often require audited statements for their higher credibility, unaudited statements can be prepared quickly and at a lower cost, making them a practical choice for eligible small companies and dormant entities.

Services Available for Preparing Unaudited Financial Statements

Navigating the process of preparing financial statements can be smoother with the right crew, and professional services from Osome provide that experienced support. These financial helmsmen specialise in:

- Preparing accurate and compliant unaudited financial statements according to regulations in the Companies Act and Singapore Financial Reporting Standards.

- Tracking equity changes and cash flows

- Providing advisory services for navigating the complexities of financial reporting

These services ensure that the company’s internal accounting team stays the course.

Importance of Accurate Unaudited Financial Statements

The accuracy of unaudited financial statements is the compass by which a company navigates its fiscal future. Accurate records are the cornerstone of evaluating a company’s cash flow, informing stakeholders, and steering informed business decisions.

These documents, required for filing income tax and presenting at AGMs, must reflect the company’s financial prowess to avoid running aground on regulatory sanctions and penalties.

Poorly charted financial statements can lead to disastrous miscalculations, impacting growth strategies and stock prices. The reputational storm that follows inaccurate reporting can have lasting effects, such as higher interest rates on loans or even being denied financial backing. Therefore, diligence in preparing unaudited financial statements is about compliance and maintaining a course true to a company’s values and vision.

Summary

Unaudited financial statements play a critical role in Singapore and are a crucial part of annual tax returns for small companies and groups that are exempt from filing an audited report. They also provide immediate insights for company management to adjust their operational strategies in response to profits and losses.

Unaudited financial statements also serve as the foundation for companies required to file audited reports. You're likely to submit the same documents to your financial or auditing partner, along with all supportive materials, for them to review, validate, and audit your company's finances.

Accurate and compliant financial reporting is a regulatory requirement and a beacon guiding businesses toward sustainability and growth. It ensures you're aware of your company's financial well-being and that you are on good terms with the Inland Revenue Authority of Singapore (IRAS). If you need help preparing your unaudited financial statements, Osome's outsourced accounting services can be your solution. We offer comprehensive services that will keep you informed of your company's performance, prepare all necessary reports and annual financial statements, and ensure your company's tax compliance.

FAQ

What are unaudited financial statements in Singapore?

Unaudited financial statements in Singapore are financial reports that have been prepared internally by a company's management but have not undergone an independent verification or review process by the Accounting and Corporate Regulatory Authority (ACRA). These statements include the company's income statement, balance sheet, and cash flow statement, among other financial documents. While they provide a snapshot of the company's financial position and performance, they lack the external validation that audited statements possess. To become audited, these unaudited financial statements must be examined and approved by a certified external auditor, ensuring their accuracy and compliance with relevant accounting standards.

What makes a company eligible to prepare unaudited financial statements in Singapore?

A Singapore private company can prepare unaudited financial statements if it meets two of the three size-related criteria, including having fewer than 50 employees, less than SGD$10 million in total annual revenue, or less than SGD$10 million in total assets. A company must remain a small company last two consecutive financial years to be exempt.

Can a small group of companies prepare unaudited financial statements?

Yes, a small group can prepare unaudited financial statements if they meet at least two of the three quantitative criteria for the past two consecutive financial years. Keep the financial records accurate and up-to-date.

What happens if a dormant company starts generating income or has accounting transactions?

Suppose a dormant company starts generating income or has accounting transactions. In that case, it may lose its dormant status and the audit exemption and could be required to prepare and possibly audit its financial statements. This could result in increased regulatory and compliance obligations for the company.

Are there any risks associated with inaccurate unaudited financial statements?

Inaccurate unaudited financial statements can lead to poor business decisions, reputational damage, regulatory fines, and potential issues with creditworthiness. Therefore, maintaining precision in financial reporting is essential to avoid these risks.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?