Setting Up a Private Limited Company (Pte Ltd) in Singapore

- Modified: 19 July 2024

- 14 min read

- Starting a Company

Gabi Bellairs-Lombard

Business Writer

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Considering a Singapore Private Limited Company (Pte Ltd)? Learn why this business structure, with its limit on shareholder liability, is ideal for entrepreneurs and how it contrasts with other types of business entities. Our guide outlines the advantages of establishing a Singapore private limited company, the incorporation process, and the ongoing compliance for operating this kind of company, providing a clear roadmap to start and sustain your business in the region efficiently.

Key Takeaways

- In Singapore, a Private Limited Company offers limited liability protection, separation from its owners, perpetual succession, and is a recognised taxable entity, which makes it a preferred structure for scalability and credibility in business.

- Registering a Private Limited Company in Singapore is streamlined with reduced corporate income tax rates and tax exemptions, particularly for startups, and the ability to raise capital through issuing shares.

- Post-registration requirements for a Pte Ltd in Singapore include holding an Annual General Meeting (AGM), filing an Annual Return, opening a corporate bank account, and obtaining necessary licenses and permits.

What Is a Private Limited Company (Pte Ltd)?

A Singapore Private Limited Company (Pte Ltd), one of the most popular business entities, is recognised for its dynamic, credible, and scalable nature, making it a well-suited structure for prospective business owners. This company incorporation results in a separate legal entity, also known as a private company, which distinguishes itself from its shareholders and is viewed as a taxable entity in its own capacity. This means that the shareholders of such a limited liability company are not held personally accountable for its debts and losses beyond their investment in paid-up share capital.

Key characteristics

As a separate legal entity, a Singapore Private Limited Company can enter into contracts, employ personnel, and hold assets under its own distinct legal identity. Once incorporated, the company receives a company business profile (which includes the company name and registration number) and a Unique Entity Number (UEN). Shareholders in a Pte Ltd enjoy liability protection, which safeguards their personal assets from business debts and liabilities. Shareholders are liable only to the extent of their capital investment.

Comparison with other business structures

While a Private Limited Company stands as a separate legal entity, offering shareholders liability protection, a partnership does not afford the same luxury. Partners in a partnership may be personally liable for the business's debts and obligations. Also, while partners possess and directly manage the business in a partnership, shareholders in a Pte Ltd own the company but may not necessarily manage it.

In the realm of taxation:

- Sole proprietors are subject to personal income tax on their business profits

- Pte Ltds are taxed at a corporate tax rate of 17%

- Partnerships don’t incur separate taxation. Partners are instead taxed individually on their share of the profits.

A Singapore Private Limited Company can benefit from its separate legal entity status, which allows it to raise capital by selling shares. This capability is not available to sole proprietorships.

Why Should You Incorporate a Private Limited Company?

A business owner seeking to form a holding or offshore company will benefit significantly from the Private Limited Company structure as it will exist as its own legal identity. The high ranking of Singapore in the Ease of Doing Business Index signifies the efficiency of incorporating and operating businesses within the country.

Establishing a Private Limited Company is a great option for starting a business in Singapore. It provides various benefits such as limited liability, perpetual succession, and tax advantages that make it an attractive choice for both locals and foreigners.

Advantages of Operating a Private Limited Company in Singapore

Incorporating a Private Limited Company offers significant benefits for ambitious entrepreneurs. A key advantage is liability protection, ensuring shareholders are not personally accountable for the company's debts beyond their investment. This safeguards personal assets from company liabilities.

Additionally, Private Limited Companies in Singapore enjoy tax incentives, including reduced corporate tax rates and exemptions, particularly advantageous for startups and SMEs.

Raising capital is also easier for Private Limited Companies, as they can issue new shares to existing or new shareholders within 2 to 3 working days, facilitating business expansion.

Tax incentives

The tax benefits available to Pte Ltds make it a popular business structure in Singapore. The corporate tax rate for Private Limited Companies is set at 17% by the Inland Revenue Authority of Singapore. New start-ups can enjoy a 75% tax exemption on the first S$100,000 of chargeable income for their first three years.This allows new businesses to retain more profits for growth and expansion. Additionally, Singapore's single-tier taxation regime means incomes taxed at the corporate level are not taxed again at the shareholder level, resulting in tax-free income for company directors, shareholders, and proprietors, with no capital gains tax.

The various tax exemptions and tax benefits available to Pte Ltds are possibly the biggest reasons why it is such a popular business structure, specifically in Singapore.

Limited liability protection

Shareholders in a Singapore company can benefit from this protection, which means that they are not held personally responsible for the company's debts and losses beyond the amount they invested in share capital. This also means that their personal assets are protected from any liabilities that the company may incur. In contrast, a private company owned by a sole proprietor or two or more partners rely on private assets to raise capital and often pays more to secure debt capital. The liability of shareholders, compared to a sole proprietor, is limited only to the amount of their share capital, whether it has been fully paid, partially paid, or not paid at all. Individual shareholders and owners have distinct personal assets that are protected. This protection helps maintain separate financial identities for individuals and businesses.

Fun fact: you will always know if a Singapore company has share capital if it has "Pte Ltd" attached to the end of its company name!

Ease of raising capital

A Singapore Private Limited Company can secure funds by issuing new shares to existing or new shareholders, which can also impact the company's paid-up capital. This process is typically completed within 2 to 3 working days. This flexibility aids in business expansion and attracting new investors, leading to growth opportunities and partnerships. Company directors can further attract investors and enhance financial stability by networking with foreign investors, showcasing strong business plans, and investing in high-quality products and services.

How To Register a Singapore Private Limited Company

Registering a Private Limited Company in this booming economic region is a straightforward process for aspiring company directors and hassle-free if you partner with a reputable corporate services provider. It necessitates specific documentation, including detailed information about specific business activities and paid-up capital, to ensure compliance and adherence to the requirements stipulated by the Accounting and Corporate Regulatory Authority (ACRA), but this is what your chosen provider for company registration assists you with. Non-residents must enlist the incorporation services of a registered filing agent, such as a corporate secretarial company(like Osome!), law firm, or accounting firm, to submit the application of the Singapore Pte Ltd to ACRA via BizFile+ on their behalf.

To register a Private Limited Company in Singapore, the minimum paid-up capital required is S$1. This nominal amount is sufficient for registration purposes.

Engaging a registered filing agent

To ensure smooth Private Limited Company registration in Singapore, especially for non-residents, it's crucial to engage a registered filing agent. These agents handle document submission and registration fee payments to ACRA, saving you stress and time. Registered filing agents, such as corporate secretarial companies, law firms, or accounting firms, must meet ACRA qualifications, complete mandatory training, and be registered with ACRA. Their services streamline the Singapore company establishment process and ensure all legal formalities are met.

Required documents and information

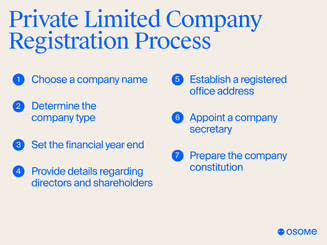

Numerous requirements must be met to register a Private Limited Company in Singapore. These requirements must be met in order to establish the company successfully. These include:

- Choosing a company name

- Outlining specific business activities

- Determining the company type

- Setting the financial year-end

- Providing details of at least one shareholder

- Establishing a registered office address

- Appointing a company secretary

- Preparing the company constitution

Submission and approval process

Once all necessary documents are gathered, the approval process from the Singapore Company Registrar for a Pte Ltd in Singapore usually takes a few hours to 1 day but can extend to 2 months if referral to another agency is needed. Non-compliance or application errors may cause delays. Engaging a corporate service provider can expedite and simplify the registration process, especially for those abroad looking to benefit from Singapore's business advantages.

Post-Registration Compliance and Requirements

Following the successful Private Limited Company registration, there are several post-registration compliance requirements to meet. These include:

- Organising an Annual General Meeting (AGM) within six months of the fiscal year-end.

- Filing an Annual Return within 30 days following the AGM.

- Completing financial statements submission within seven months of the fiscal year-end.

Additionally, you will need to:

- Open a corporate bank account for your business entity.

- Ensure that the registered office address is a physical location where the company receives official correspondence. Note that a P.O. Box is not acceptable.

- In certain circumstances, residential addresses may be used.

- Ensure up-to-date information on your company business profile.

- Provide company secretary details, including the name and contact information of the appointed company secretary, who will be responsible for ensuring compliance with statutory obligations.

Annual General Meetings (AGMs) and Annual Returns (ARs)

The annual compliance obligations for Private Limited Companies in Singapore include holding annual general meetings and filing annual returns. Following Private Limited Company registration, business owners in Singapore must conduct their Annual General Meeting (AGM) within four months following the end of their financial year.

Neglecting to comply with the AGM requirements may lead to legal prosecution, potential disqualification or debarment from directorship, and imposition of composition fines by ACRA. In the event of conviction, directors may face fines of up to a maximum of $5,000 per charge.

Corporate bank account

As a distinct legal entity, a Pte Ltd in Singapore must possess a corporate bank account to conduct business transactions. Singapore provides a range of banking options for corporate bank accounts, encompassing traditional banks like DBS, UOB, and OCBC, as well as digital banks and neobanks, such as Aspire. Here at Osome, we are proud partners with multiple mainstream and digital banks in Singapore — we can help choose the best account for your business's needs.

To establish a corporate bank account, you need to provide the following documents:

- Certified True Copies of the Company’s Constitution

- Passport (or Singapore IC) and Residential Address Proof of the Directors, Signatories, and Ultimate Beneficiary Owners

- Board resolution indicating the appointment of signatories

Licenses and permits

Certain licenses and permits may be necessary depending on the nature of your corporate entity. Failure to obtain the requisite licenses or permits for operating a Pte Ltd in Singapore can lead to severe consequences, including monetary penalties, disqualification, and potential business closure.

The nature of the business determines the required licenses and permits, which should be outlined when you submit your company name during the private limited company registration process. Obtaining the necessary licenses and permits in Singapore can vary in duration, typically ranging from two weeks to two months, depending on the specific type of license or permit needed.

Tips for Successfully Running Your Private Limited Company

Effective management and careful planning are required to run a Private Limited Company in Singapore. Financial management is crucial to the success of your company. This includes:

- Enhancing the invoicing process

- Engaging in negotiations with vendors

- Closely monitoring expenses

- Adjusting prices as needed

- Closely monitoring financial performance

- Utilising accounting software

- Appointing a local company secretary to manage compliance obligations

Ensuring legal compliance is another vital aspect of managing this corporate entity in Singapore. This includes:

- Maintenance of accurate corporate registries

- Organisation of an AGM within six months of the fiscal year-end

- Filing of an Annual Return within 30 days following the AGM

- Completion of financial statements submission within seven months of the fiscal year-end

Many Singapore companies choose to seek professional guidance to help streamline the management of their finances and compliance. Professional accounting businesses, such as Osome, can provide expert advice, offer comprehensive business support, and aid in managing multiple operational areas of the company. This can streamline the formation process, provide expert advice, offer comprehensive business support, and aid in managing multiple operational areas of the company. Over 10, 000 Singapore companies have trusted us with their company registration, company secretary and accounting services, serving as their partners in business growth. Get in touch with our team of experts if you want to become one of them!

Financial management

Competent financial management is vital for ensuring the organisation’s sustainability. It forms the foundation for:

- Fiscal governance

- Strategic planning

- Identification of financial requirements

- Financial reporting

- Record-keeping

- Capital budgeting to assess profitability and inform investment decisions.

Furthermore, an exempt private company, which is a different type of Private Limited Company in Singapore, can effectively plan its taxes by gaining a comprehensive understanding of local tax laws and identifying relevant tax exemptions and reliefs. This can lead to a significant reduction in the tax burden, particularly for new private companies that are leveraging Singapore's tax exemptions.

Legal compliance

Observance of the legal frameworks governing corporate governance of Private Limited Companies in Singapore, including the Singapore Companies Act, is of paramount importance. The primary regulatory bodies for Private Limited Companies in Singapore are the Accounting and Corporate Regulatory Authority (ACRA) and the Economic Development Board (EDB).

Failure to comply with the Companies Act as a Private Limited Company in Singapore may lead to penalties, including fines not exceeding $10,000 or imprisonment for a term not exceeding 2 years. Additionally, there are late lodgement fees ranging from S$50 to S$350 for delayed submission of documents.

Seeking professional services

Professional assistance can bring significant benefits to a private limited company, including:

- Streamlining the formation process

- Providing expert advice

- Offering comprehensive business support

- Appointing a professional company secretary

- Aiding in the management of various operational areas.

Corporate service providers in Singapore offer a variety of services to Private Limited Companies, which include:

- Registration and renewal for filing agents and qualified individuals

- Making changes to company details

- Providing business support services such as tax accounting, company incorporation, and legal assistance.

Legal advisors can offer assistance to Private Limited Companies in Singapore by providing legal advice and guidance on various matters, protecting the company’s interests and ensuring legal compliance.

Summary

In conclusion, setting up a Private Limited Company in Singapore offers numerous advantages, including tax incentives, shareholders liability protection, and ease of raising capital. While the registration process requires careful planning and adherence to specific regulations, the benefits outweigh the challenges. By ensuring proper financial management, and legal compliance and seeking professional assistance, you can successfully run your Private Limited Company in Singapore.

FAQ

What is a private limited company in Singapore?

A private limited company in Singapore is a limited liability company with less than 50 shareholders whose shares are not available to the general public. Most privately incorporated businesses in Singapore fall under this category, and their names typically end with "Private Limited" or "Pte Ltd."

What is the difference between an Ltd and a Private Ltd?

The main difference between an LTD and a private LTD is that a public LTD company has shares freely traded on the stock exchange, while a private LTD company has fewer shareholders, often friends or relatives, and is smaller in nature and operations. This can provide more clarity on their structures and operations.

What is a private company vs a Public Ltd?

Shareholders own a public limited company (Pte Ltd) and allow members of the public to purchase stock, while a private limited company (Ltd) does not publicly trade shares and is limited to a maximum of 50 shareholders.

What is the corporate tax rate for private limited companies in Singapore?

The corporate income tax rate for private limited companies in Singapore is 17%. This differs from an individual income tax rate of 20% (maximum) if you are self-employed.

What are the annual compliance requirements for Private Limited Companies in Singapore?

Private Limited Companies in Singapore must fulfil annual compliance obligations, such as holding annual general meetings and filing annual returns. If you're a foreigner, submit your company secretary details to represent your business and ensure legal compliance on the ground so that you have peace of mind offshore.

What are the costs of setting up a private limited company in Singapore?

The costs of setting up a private limited company in Singapore typically include an incorporation fee (ranging from S$300 to S$1,200), a name reservation fee (S$15 per name reservation), a business registration fee (S$100), and the potential expenses of a registered office address (annual fees of S$300 to S$800 or more), a company secretary (annual fees of S$300 to S$800), and other possible expenses like company seals or additional licenses and permits. The exact costs can vary based on specific requirements, service providers, and any additional licenses needed for specific business activities.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?