Total visibility over your finances

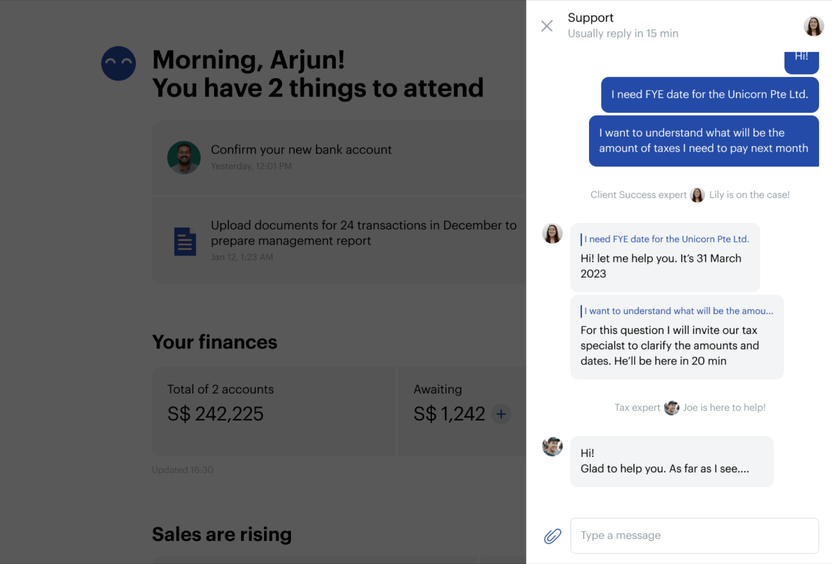

Dedicated accounting team

Your accounting experts are on-call through live chat and responds within one working day.

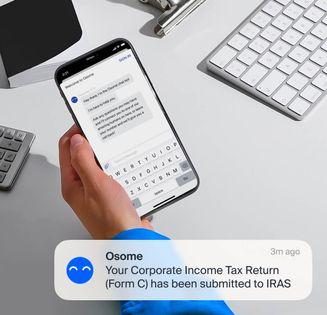

Filing and compliance

Leave the tax, deadlines, and filing with IRAS to us. We’ll make sure you pay the right tax and stay compliant.

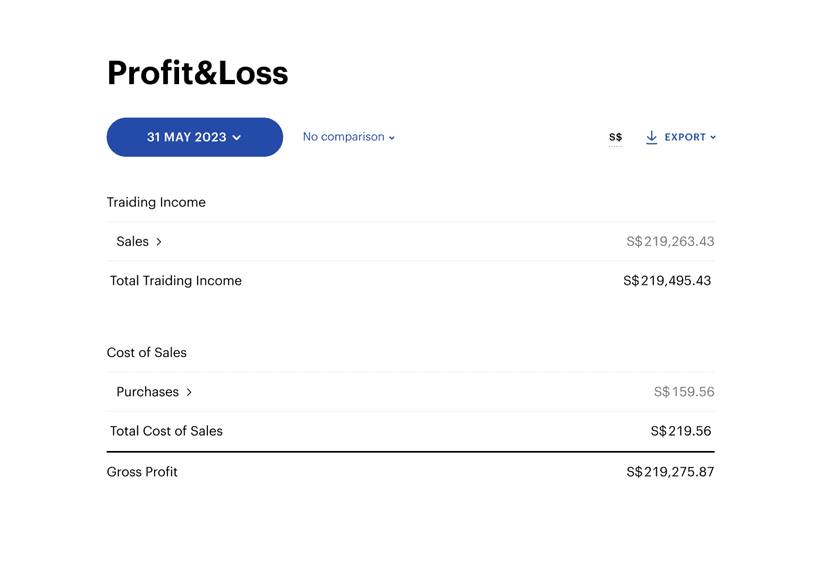

Easy-to-use software

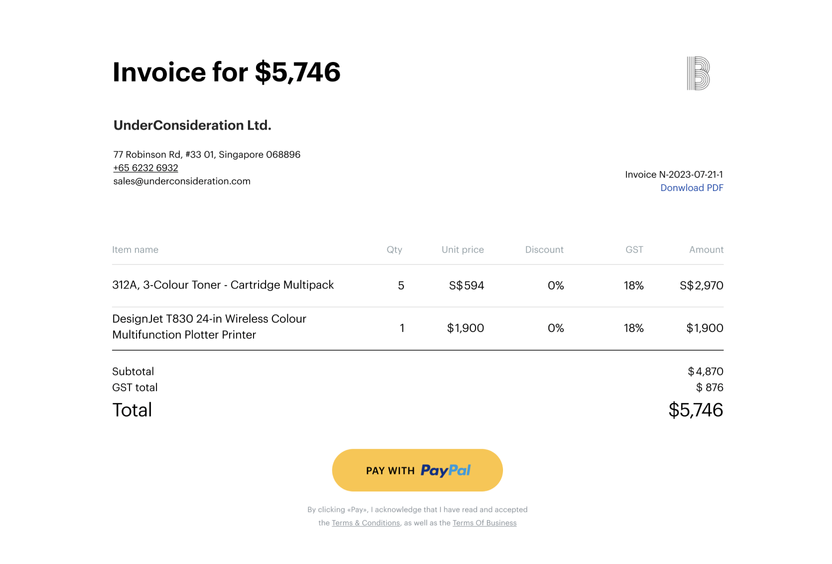

Our tools give you control over your finances with automated invoicing, expenses monitoring, and cash flow insights.

Unlimited bookkeeping

Bookkeeping is part of your package. We'll take care of your financial records, taxes, transaction matching, and billing.

For new founders and seasoned entrepreneurs

Solo founders

You don't have to do it alone. We’ll get you up and running quickly with guidance on tax deadlines and compliance with the authorities.

Small businesses

We give you the experts to calculate your Corporate Tax and file with IRAS, and the tools to manage your money, so that you can grow with confidence.

Ecommerce

Forget generic accounting solutions. Our accountants know ecommerce and our software integrates with Amazon, Shopee, Lazada, and more.

Feel fully in control of your business finances

Experts on your side

Get an expert accounting team for your business from day one. Our Singapore-based team helps founders get their taxes right from the start. Got questions? Get a response via live chat within one working day.

Pay the right tax

We help you stay on top of your finances. We keep track of deadlines and remind you about GST and other compliance needs. Plus, our experts handle tax returns and filing, so you’re free to focus on your business.

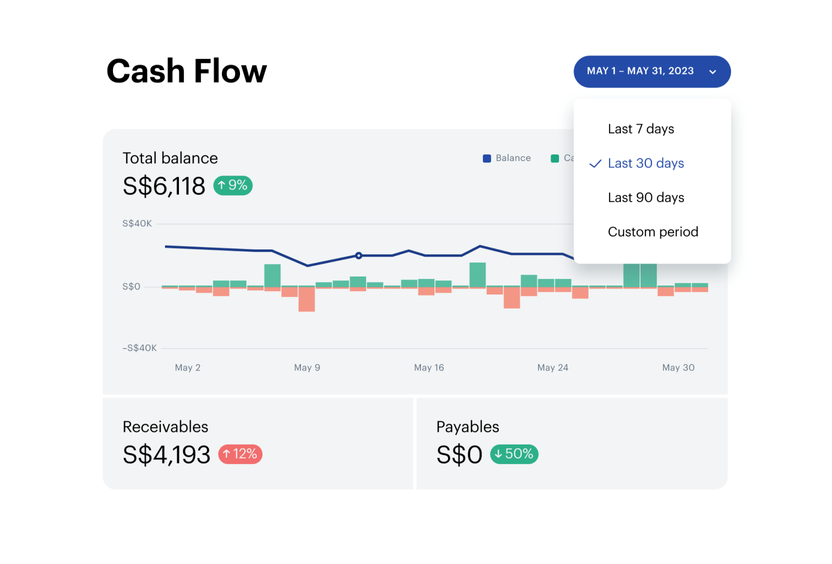

Get clear on cash flow

With our dashboard, your cash flow info is at your fingertips. We’ll use these metrics to create reports that show you where your money is coming from and where you’re spending it.

Bookkeeping?

Easy-to-use tools to handle all your business operations

Your accountant is always there

Talk to your accountant via live chat, ask questions and get answers within one business day.

From bookkeeping to filing tax

We process documents within 24 hours, giving you an up-to-date snapshot of your financials. Come filing time, we'll sort the reports; you just need to click ‘approve’.

Get your invoices paid quicker

Issue invoices, nudge late payers and get paid faster. Pre-filled fields in the invoice template means there’s no need for manual data entry.

Get clear on your cash flow

See a combined view of all your connected business bank accounts to see how your money is moving.

Plans to fit your business

Operate

If you want to nail your first year of business and stay compliant

S$48/mS$576 billed annually- Osome Accounting software

- Create, send, and chase invoices

- Capture bills and receipts easily

- Expense Management

- Real-time financial reports (Profit & Loss, Balance Sheet, Aged Payables, Aged Receivables)

- Use multiple currencies

- Ecommerce

- Connect one marketplace

- Bookkeeping

- Unlimited bookkeeping

- Automatic reconciliations

- Expert service

- Annual Management reports

- In-app chat

- Payroll and dividends tax advice

- Dedicated accounting team

- Tax and filings

- Unaudited Financial Statements (UFS)

- Annual tax return filling

Optional add-ons

- Xero SubscriptionS$600/y

- Video call with an expertS$100/h

- Personal Income TaxS$150

- Full XBRL reportS$500

- Simplified XBRL reportS$300

Grow

For those growing a team and needing payroll and employee services

S$90/mS$1,080 billed annually- Osome Accounting software

- Create, send, and chase invoices

- Capture bills and receipts easily

- Expense Management

- Real-time financial reports (Profit & Loss, Balance Sheet, Aged Payables, Aged Receivables)

- Use multiple currencies

- Ecommerce

- Connect unlimited marketplaces

- Bookkeeping

- Unlimited bookkeeping

- Automatic reconciliations

- Expert service

- Monthly Management reports

- Video calls with an expert

- Ad-hoc tax advice

- In-app chat

- Payroll and dividends tax advice

- Dedicated accounting team

- Tax and filings

- Unaudited Financial Statements (UFS)

- Annual tax return filling

Optional add-ons

- Xero SubscriptionS$600/y

- GST filingS$1,200/y

- GST registrationS$300

- Personal Income TaxS$150

- Full XBRL reportS$500

- Simplified XBRL reportS$300

- Payroll services, per employeeS$300/y

- Employee leave tracking, per employeeS$80/y

Scale

For founders wanting a financial co-pilot and strategic accounting support

S$250/mS$3,000 billed annually- Osome Accounting software

- Create, send, and chase invoices

- Capture bills and receipts easily

- Expense Management

- Real-time financial reports (Profit & Loss, Balance Sheet, Aged Payables, Aged Receivables)

- Use multiple currencies

- Ecommerce

- Connect unlimited marketplaces

- Bookkeeping

- Unlimited bookkeeping

- Automatic reconciliations

- Expert service

- Monthly Management reports

- Video calls with an expert

- Ad-hoc tax advice

- Quarterly strategic session

- In-app chat

- Payroll and dividends tax advice

- Dedicated accounting team

- Tax and filings

- GST filing

- GST registration

- Unaudited Financial Statements (UFS)

- Annual tax return filling

Optional add-ons

- Xero SubscriptionS$600/y

- Personal Income TaxS$150

- Full XBRL reportS$500

- Simplified XBRL reportS$300

- Payroll services, per employeeS$300/y

- Employee leave tracking, per employeeS$80/y

What our clients think about Osome services

“I use Osome to help me succeed”

91 %of customers recommend Osome services

“Osome and their team makes accounting and getting the correct documents in order for company and bookkeeping easy and reliable.”

Peter Riverwind

FAQ

How does accounting work?

Accounting tracks all your business activities and assets. Whenever you spend, lose or make money, your bookkeeper adds it to your records. Your accountant then builds reports using these numbers. The government requests these reports to calculate how much tax you owe and whether you are exempted from some of it.

Why is accounting important?

First of all, you have an obligation to report your accounts to the government: that’s how your tax is calculated. Secondly, accounting is crucial for internal planning and management. Mistakes could be costly: the government will fine business owners for inaccurate reports. You will also probably base your evaluations and plans on the same numbers. So, making sure your accounting is accurate is crucial.

What are the accounting standards in Singapore?

Singapore has its own system called Singapore Financial Reporting Standards (SFRS). It’s similar to IFRS and it’s accrual-based accounting. This means transactions are recognised when they occur and not when the money is paid. Outsourced accounting services in Singapore must comply with SFRS requirements.

Can I switch from another accounting firm to Osome?

Absolutely. We make the transition seamless on your end. We’ll get in touch directly with your current accounting service provider, take over all your financial documents, and audit them to make sure your company is compliant. We check necessary reports and migrate all your data. We offer ongoing advice about relevant tax exemptions, helping you navigate the tax system smartly. Now that your accounting is in good hands, you can focus on what you do best: running your business.

What accounting services do you have for small businesses?

We help small businesses in Singapore with all necessary accounting services. We prepare financial statements, ECI tax reports, XBRL (full and highlights) and handle bookkeeping. We can apply for GST registration and submit regular reports for GST-registered companies. If your case is special, let us know and our specialists will be happy to help with accounting for your company.

In what form should I submit my data?

Osome is an online accounting company. Send us your records in whichever format you have them. Drop your files in our app, store them in a cloud, send them to us via the live chat or email to our experts — we’ll take care of the rest.

What do I have to report to the Inland Revenue Authority of Singapore (IRAS)?

All companies are required to submit two corporate income tax returns annually: Estimated Chargeable Income (ECI) within three months from the financial year end and Corporate Income Tax Return (Form C/C-S) by 30th November or 15th December if via e-filing. This applies for all businesses unless qualifying conditions are met for an ECI waiver or the company has been granted Waiver of Income Tax Return Submission by IRAS.

How does your accounting software work?

We have developed our own software to make the lives of business owners easier. We let you manage invoices and receipts, reconcile them with transactions, and update your documents and outstanding bank balance daily. We support single and multiple currencies, show an actual list of all unpaid invoices and report to you if anything document is missing. Your personal dashboard will give you a snapshot of your business’s finances, including Profit&Loss, whether you’re at home or on the go.

How is income assessed to tax?

Tax is assessed on income earned in the preceding financial year. For example, a tax return for the Year of Assessment (YA) 2022 would be to declare the income earned during the financial year 2021. This tax return must be submitted by the 30th of November 2022 or e-filed by the 15th of December 2021.

What is the price of accounting services?

There are several types of accounting services in Singapore. Some of the common ones are tax preparation and consultation, along with tracking expenses and revenues. Apart from this, record-keeping services include billing, taxes, bank reconciliations, general ledger and payroll records. Some bookkeepers also generate financial statements for review.

For those seeking affordable accounting services in Singapore, you can use the below figures as a benchmark:

- Company incorporation services for locals cost about S$350 per annum, at a minimum

- Accounting and bookkeeping costs start at S$800 per annum

- For corporate secretary services, the average fee is S$350

- Corporate taxation services typically start at S$400 per annum

- Payroll services cost roughly S$25 per employee

How to outsource accounting services in Singapore?

When it comes to outsourcing, you need to look for an accounting services provider in Singapore. They usually offer accounts receivables and payables management, bookkeeping, financial statements and reporting, controller services, financial planning and analysis, cost accounting, forensic accounting and tax reporting and filing.

Additionally, small business entrepreneurs or new foreign investors may require specific accounting services in Singapore. These include GST calculations and the conversion of financial statements to XBRL (extensible business language) format. Generally, most companies incorporated in Singapore and branches of foreign companies (apart from exempt companies) are mandated to prepare annual financial accounts and company financial reports according to the Singapore Financial Reporting Standards (SFRS). If you aren’t familiar with these regulations, it’s best to outsource an accounting service to guide you.

Since the year 2011, the Accounting and Corporate Regulatory Authority (ACRA) has established the Financial Reporting Surveillance Programme (FRSP). With this, a selected pool of your company’s financial statements is reviewed to determine if they comply with the SFRS. It is important to note that Singapore is moving towards adopting the International Financial Reporting Standards (IFRS). Accordingly, the preparation of the financial accounts in XBRL format is challenging for those unfamiliar with filing. In this case, it is best to consult a qualified professional from an experienced accounting firm.

How does your pricing work?

Our pricing is revenue-based. We don’t charge on the number of transactions in your account or the number of invoices you upload. All prices are based on the financial year, not the calendar one.

Fresh insights from our business blog

Fiscal Year: What Is It and Why Does It Matter?

In Singapore, companies have the flexibility to select their fiscal year-end based on their business needs. It can align with the calendar year, financial quarter-ends, incorporation anniversary, seasonal cycles, or business cycles. Find out more in this article written by Osome experts.

How a Revenue-Based Accounting Plan Can Help You Grow

A revenue-based accounting plan offers businesses in their first year of business a flexible approach to financial management and an opportunity to grow their revenues. Learn more about how this strategy can benefit your business.

Understanding the Workflow of Transfer Pricing in Singapore

Affiliated businesses often trade on preferential conditions and thus pay less tax. To prevent that, countries developed a system to control the “family business” — the transfer pricing rules. Let’s see how they influence the prices you set, how to play by these rules and what documents to prepare.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?