Singapore Personal Income Tax Rates 2021 & How They Work

We break down Singapore income tax rates and how they apply to foreigners and locals. We will do some counting, so grab your calculators and let’s go!

Singapore’s personal income tax is low and can be reduced even further thanks to reliefs and rebates. Here we have some information about the Singapore income tax rates and how they apply to foreigners and locals.

Osome does accounting for companies in Singapore, but we can help with personal tax filings, too. Just saying.

If you are interested in how to calculate the tax on your own, let's do some counting. So grab your calculators and let’s go!

Personal Tax Rates

Based on a progressive rate structure, Singapore's personal tax rate is one of the lowest in the world. The tax rate starts from 0% and ends at 22% for all. What a person pays as his/her annual tax is determined by the individual's residency status and annual earnings. Taxes must be filed by April 15 (hard copy) or April 18 (e-filing) by all individuals and is mandatory for all residents who earn S$22,000 or more annually. Individuals earning under S$22,000 do not need to pay any income tax but might have to file a return if asked by the Singapore tax authority.

Personal tax in Singapore does not attract any capital gain or inheritance tax, and people are only taxed for what they earn in Singapore (with a few exceptions, all income derived from outside Singapore is not taxed).

Residents

Singapore Tax Rates For Residents

In Singapore, the personal income tax rates are progressive. This means that if Joanna earns twice as much as Jack, she will be taxed at a higher rate. The highest personal income tax rate is currently set at 22%.

So how does it work? There are earnings thresholds that influence which rate applies. However, the higher rate is only applied to the surplus:

If you make S$20,000 a year, the tax is 0% as the first twenty thousand are tax-free. If you earn S$10,000 more than that, the rate will be 2%. But it will only apply to the additional S$10,000, not to the total S$30,000 that you earned.

Ready for the next thing? If you earn more than $S30,000, some of the money will be taxed as a fixed sum and the remaining part will be taxed the way we just described. In other words, beyond the $S30,000 threshold, there is always a fixed sum to pay on one part of the money and a rate to apply to the remaining part.

Non-Residents

Do Foreigners Pay Personal Income Tax in Singapore?

It depends on tax residency. Singapore may oblige you to pay taxes even if you are a foreigner and your personal income tax rates depend on your residency status. A foreigner who has stayed or worked in Singapore either for 183 days or more in a year or has lived and has been employed in Singapore for three straight years (they look at calendar years — those that start on January 1 and end on December 31) is treated as a resident and will need to pay the IRAS as per their applicable personal tax rate.

Also, you are a tax resident if you worked in Singapore for a period spanning two different calendar years and you were in the country for a total of 183 days (or more).

These rules apply to employees who entered Singapore except for directors of a company, public entertainers or professionals.

If you are a tax resident of Singapore and you earn, derive, or receive income there, you must pay income taxes every year as per Singapore's current personal income tax rates. There are some exceptions for this rule outlined in the Income Tax Act or by way of an Administrative Concession.

All people who make S$22,000 a year or more must file their personal income with IRAS. Mind that the sum means chargeable income, i. e. only the earnings on which you must pay tax.

Singapore Tax Rates for Non-Residents

Even if you are deemed non-resident, there are still taxes to pay, yet the rates and the rules are different:

- You will only pay tax on the income earned in Singapore.

- There will be no tax reliefs.

There are two possible ways of taxing your salary, and IRAS will pick the one that results in higher tax payments:

- Income taxed at a flat rate, which is 15%.

- Income taxed at resident rates listed above.

Speaking of other types of income, the director's fees and other income earned in Singapore or derived there will be taxed at 22%.

Personal Income Tax Calculation

To understand what you owe to the IRAS, you need to know how personal tax calculations are done under the progressive rate system. Here is a table with details of all the income tax slab structures. You can also visit the IRAS website for an updated tax calculator.

Income Tax Rates for Singapore Residents YA 2019 Onwards

| How much you earned | How the sum is split | How much you pay on both parts |

|---|---|---|

| S$20,000 | — | S$0 |

| S$20,001—S$30,000 | S$20,000 + S$10,000 | S$0 + 2% |

| S$30,001—S$40,000 | S$30,000 + S$10,000 | S$200 + 3.5% |

| S$40,001—S$80,000 | S$40,000 + S$40,000 | S$550 + 7% |

| S$80,001—S$120,000 | S$80,000 + S$40,000 | S$3,350 + 11.5% |

| S$120,001—S$160,000 | S$120,000 + S$40,000 | S$7,950 + 15% |

| S$160,001—S$200,000 | S$160,000 + S$40,000 | S$13,950 + 18% |

| S$200,001—S$240,000 | S$200,000 + S$40,000 | S$21,150 + 19% |

| S$240,001—S$280,000 | S$240,000 + S$40,000 | S$28,750 + 19.5% |

| S$280,000—S$320,000 | S$280,000 + S$40,000 | S$36,550 + 20% |

| S$320,001 and more | S$320,000 + In excess of S$320,000 |

S$44,550 22% |

Let us calculate somebody’s tax using the table above. To make it clearer, let us assume that there are neither tax reliefs or tax rebates in place.

Mr Hau earned S$90,000 and now has to pay income tax. As he sees from the table, his income falls under this category:

| Earned | Split | How Much to Pay |

|---|---|---|

| S$80,001—S$120,000 | S$80,000 + S$40,000 | S$3,350 + 11.5% |

As we can see, for S$80,000 out of S$90,000 there is a fixed amount of S$3,350 to pay. The remaining S$10,000 are taxed at 11.5%. 10,000×0,115=1150. S$3,350+S$1,150=S$4500 — that is how much Mr Hau must pay.

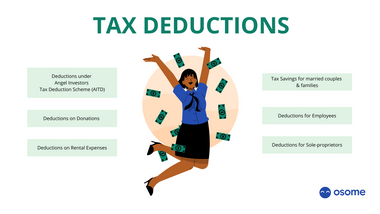

Filing & Relief Taxes

Singaporean Tax laws provide plenty of relief and rebates for tax residents based on certain eligibility criteria. These rebates are offered to encourage specific social and economic activities or help certain target groups (such as married, divorced or widowed taxpayers).

Some of these are deductions (relief and rebates) are:

- Tax Savings for Married Couples and Families

- Deductions for Employees

- Deductions for Sole-Proprietors, Self-Employed Individuals or Partners in a Partnership

- Deductions on Rental Expenses

- Deductions on Donations

- Deductions under Angel Investors Tax Deduction Scheme (AITD)

Tip

You can find a detailed description of each of these headings on the IRAS website and use this personal relief checker to better understand what you can claim.

Do keep in mind that personal income tax relief is capped at S$80,000 in every assessment year. You can, of course, claim more personal reliefs if you qualify but will not actually reap any monetary benefits from the same once your early relief amount touches S$80,000.