GST Return Filing in Singapore: Essential Tips and Deadlines

- Modified: 16 April 2025

- 11 min read

- Tax & GST

Heather Cameron

Author

From expert guidance and helpful accounting tips to insights on the latest trends in fintech, Heather is here to empower entrepreneurs and small business owners in Singapore with great content. With a background in digital marketing spanning eight years, she has experience writing for various industries and audiences. As Osome’s copywriter, she’s here to inform and inspire our readers with great storytelling.

John Yap

Reviewer

John Yap, our Head of the Accounting Team in Singapore, brings over a decade of expertise in SFRS, corporate tax, and GST compliance. As a key blog reviewer, John ensures our accounting content is accurate and relevant, transforming complex concepts into actionable advice. With John's meticulous oversight, you can trust that our blog provides reliable and up-to-date information to help you navigate the intricacies of financial management and compliance in Singapore.

GST, or goods and services tax, return filing is crucial for businesses with a GST registration in Singapore. The return summarises your sales, purchases, and the GST collected and paid. Learn who needs to file, the key filing date, and how to prepare your GST returns accurately.

Key Takeaways

- GST is applicable to most goods and services in Singapore, other than a few exempted categories.

- GST returns are mandatory for all GST-registered businesses in Singapore. They must be filed quarterly before the due dates to avoid penalties and audits, and for the refund to be distributed.

- Accurate calculation of output tax and input tax, along with organised documentation, is essential for properly preparing GST returns and receiving your refund on time.

- Non-compliance with GST regulations can lead to severe penalties, including late fees and increased scrutiny from tax authorities, emphasising the need for timely and accurate filing.

Understanding GST Returns

GST returns are vital for compliance for GST-registered businesses in Singapore. GST returns summarise all business transactions subject to GST within the company's accounting period, including the total value of standard-rated supplies, output tax due, and input tax claims. Prompt filing helps avoid penalties and audits, which can be costly and time-consuming.

The GST rate in Singapore is currently 9% (increased in 2024) and applies to almost all goods and services. Businesses must file their GST returns quarterly, within one month after each reporting period.

To help you navigate these obligations with ease, we offer comprehensive GST return filing services. Our team of experts ensures that your returns are accurate, compliant with regulations, and submitted promptly, giving you peace of mind and allowing you to focus on growing your business. Feel free to contact us!

IRAS offers various e-services to simplify filing, including online submission and payment options through the GST portal. Reliable accounting software can further streamline the process, ensuring accuracy and compliance. Regularly reviewing GST classifications and maintaining accurate records of invoices and receipts is crucial for effective GST management.

Who Needs To File a GST Return?

Most businesses in Singapore with an annual taxable turnover exceeding S$ 1 million are mandated to register for and file GST returns. This requirement applies to all GST-registered businesses, regardless of whether registration is compulsory or voluntary. Even if you do not meet the turnover threshold but have completed a voluntary GST registration, you are still required to file GST returns.

Resident and non-resident taxable person must file their returns accurately and on time.

Understanding these requirements is the first step toward seamless compliance with the goods and services tax regulations.

Key Deadlines for Filing GST Returns

Every GST-registered business must be aware of key deadlines for filing GST returns. They are required quarterly, with a due date of one month after the end of each accounting period. For example, if your accounting period ends on June 30, the due date is July 31.

All GST returns must be submitted via the myTax Portal, where businesses can also pay any GST owed or claim any refund. Missing a due date can result in penalties and interest charges, which can be avoided by ensuring timely submission.

Monitoring these due dates and using the myTax Portal efficiently helps GST-registered businesses stay compliant and avoid complications.

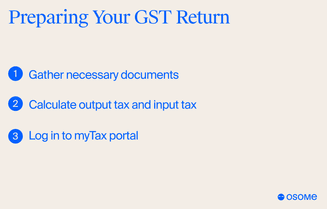

Preparing Your GST Return

Preparing your GST return involves crucial steps to ensure accuracy and compliance. Start by gathering your supporting documents, including sales invoices, expenses (such as receipts for purchases), and records of GST collected and paid. Organised documents are key to accurate GST filing.

Calculate your output taxes (GST collected from sales) and input taxes (GST paid on services and goods purchased by the company). Accounting software can streamline this process, making tracking and reporting easier.

Finally, log in to the myTax Portal with your CorpPass to access the GST e-filing system and submit your return. Following these steps meticulously prevents errors and ensures your GST return is filed correctly.

Gather necessary documents

Collecting all necessary documents, such as sales invoices, purchase receipts, and records of GST collected and paid, is foundational for a precise GST return. Thorough organisation ensures accuracy and helps prevent potential errors and complications.

Having everything in order before beginning the filing process can save significant time and stress.

Calculate output tax and input tax

Accurately calculating output tax (GST collected on sales) and input tax (GST paid on business purchases and expenses) is vital for a compliant GST return.

Accounting software can automate these calculations, reducing the risk of manual errors and helping meet all tax obligations.

Log in to myTax portal

Next, log into the myTax portal using your CorpPass to e-file GST. First-time filers or those using a tax agent should secure authorisation from the CorpPass account.

Select ‘File GST Return/Edit Past Return’ from the GST tab to begin filing. After submitting, an acknowledgement page will summarise the data provided.

Completing the GST F5 Return

The GST F5 return is the primary form for accounting for all business transactions during the filing period. Accurate completion is critical for compliance. This form includes various boxes detailing different aspects of your GST obligations, from the total value of standard-rated supplies to input tax claims.

Success in completing the GST F5 return depends on understanding each box’s purpose and ensuring accurate information. Errors can lead to audits and penalties, highlighting the need for thoroughness.

Total value of standard-rated supplies

Box 1 of the GST F5 return requires the total value of standard-rated supplies, excluding the net GST amount, to avoid overreporting. All figures must be reported in Singapore dollars.

Precise reporting in this section helps maintain compliance and avoid discrepancies.

Output tax due

Box 6 of the GST F5 return reports output tax due, calculated based on the GST charged on standard-rated taxable supplies. Accurate calculation ensures compliance and avoids penalties. Be sure to record GST collected on low-value goods, as low-value goods (S$ 400 or below) are no longer exempted since January 2023.

Including the correct amount of GST charged on your supplies is crucial for an accurate return.

Input tax and refunds claimed

Box 7 of the GST return reports input tax and any refunds claimed, including GST incurred on business-related purchases and expenses, subject to conditions for claiming input tax.

Accurate reporting of taxable supplies purchased by the company ensures you claim the correct GST refund amount and maintain compliance with regulations.

Handling Errors and Amendments

Despite best intentions, errors can occur in GST returns. You must make immediate corrections if mistakes are identified after submitting your final return.

You can do so by making adjustments in the next return or submitting an amended return using the GST F7 form. Inaccurate GST fillings not only affect your refund but also risk your company's compliance.

Correcting mistakes after submission

If you discover a mistake in a submitted GST return, notify IRAS immediately. Depending on the error’s nature and size, you might need to amend the current return or make adjustments in the next one.

Prompt action helps mitigate potential penalties and ensures ongoing compliance.

Submitting an amended return

File the GST F7 form to correct errors from earlier GST returns. This form replaces the previous filing and should include a brief description of the mistakes made. For example, did you miscalculate taxable purchases? Was any exempted item included as taxable supplies?

Accurate and timely amendments are crucial for maintaining compliance and avoiding further complications.

Consequences of Non-Compliance

Failure to file GST returns by the due date is a serious offence. IRAS may issue an estimated Notice of Assessment with a 5% late payment penalty on the estimated tax and potentially summon the responsible person to court. If your business had no activity during the accounting period, you must file a 'Nil' GST return. If your business has ceased, apply for cancellation. Late submission penalties start at $200 and increase by $200 for each month the tax return remaining unfiled, up to a maximum of $10,000.

Ensuring Accuracy in Your GST Return

Accuracy in GST returns is paramount to maintaining compliance and avoiding penalties. Proper record-keeping, including maintaining invoices and receipts for at least five years, is essential for effective GST filing. Regularly reviewing GST classifications can prevent costly errors and ensure accurate tax filings.

GST-compliant accounting software can reduce the risk of manual errors. Training employees on GST regulations enhances operational efficiency and compliance.

Importance of detailed records

Maintaining detailed records of transactions is crucial for accurate GST returns. Proper record-keeping includes keeping invoices and receipts for at least five years. Separate the document by financial year can help make auditing much easier.

Using accounting software can further reduce the risk of manual errors.

Using accounting software

The GST-compliant accounting software Osome uses can automate tax filing from computations to submission. Osome ensures accurate filings by reducing manual entry errors and streamlining your financial processes, allowing you to stay compliant with ease and focus on growing your business.

Functionalities like automated invoicing and expense tracking simplify financial management for business owners.

Special Cases in GST Filing

Certain situations in GST filing require specific procedures to ensure compliance. Understanding special cases like nil returns and GST refunds is crucial for accurate filing. Even with no transactions during the accounting period, businesses must file a ‘Nil’ GST return.

The Tourist Refund Scheme allows tourists to claim a GST refund on eligible purchases made in Singapore. Understanding the conditions and process for these refunds is important for businesses and tourists.

Nil returns

If your business had no transactions during the accounting period, you must still file nil returns by filling in ‘0’ for all boxes on the GST return form. Filing a nil return ensures compliance with GST regulations and avoids potential penalties for non-filing.

GST refunds

GST refund can be claimed under specific conditions, such as the Tourist Refund Scheme, which allows tourists to get a GST refund on purchases made in Singapore. To qualify, tourists must present their original passport at the time of purchase and use designated kiosks or mobile applications to claim refunds.

Tourist Refund Scheme (TRS)

Administered by Singapore Customs on behalf of IRAS, TRS allows tourists to claim a tax refund on qualified purchases. A person can claim the refund using the eTRS self-help kiosks at the Departure Check-in Hall. To refund purchases made after checking in, use the kiosks at the Departure Transit Lounge.

Tourists can also claim import relief on personal souvenir purchases at the customs inspection counter if the item is worth less than S$ 400. To claim GST paid on imported goods, fill out Box 5 (Total value of taxable purchases) and Box 7 (Input tax and refunds claimed).

GST InvoiceNow Requirement

The GST InvoiceNow Requirement will be progressively implemented starting 1 November 2025. From this date, newly incorporated companies with a voluntary GST registration must use InvoiceNow solutions to send invoice data to IRAS. This requirement will expand on 1 April 2026 to include all new voluntary GST registrants. A soft launch for early adoption will begin on 1 May 2025, allowing existing GST-registered businesses to transition early.

InvoiceNow is an e-invoicing network introduced by the Infocomm Media Development Authority (IMDA) in 2019, based on the international Peppol standard. It facilitates the digital transmission of invoices in a structured format, aiming to reduce manual processing and errors. Companies can find more online information on IMDA's InvoiceNow webpage.

Summary

Understanding and managing GST returns is crucial for your business's smooth operation and compliance. From knowing each filing date to preparing the necessary documents, calculating taxes, and using the myTax portal, each step plays a vital role in ensuring accurate and timely GST filings. Handling errors promptly and understanding special cases like nil returns and GST refunds further ensure that you stay compliant and avoid penalties.