Register for Sole Proprietorship in Singapore: A Step-by-Step Guide

- Modified: 10 July 2024

- 10 min read

- Starting a Company

Syahirah Aiman Abbas

Author

Syahirah Aiman Abbas is a writer and translator who loves languages. After learning Malay, English, Arabic, Indonesian and French, now she is on to Turkish!

If you like the idea of being fully in control of all aspects of running your business, then a sole proprietorship could be a great option for you. The company incorporation process is quick, and the fees are affordable. Follow our guide to find out how to register your business for a sole proprietorship.

What Is a Sole Proprietorship?

A Sole Proprietorship is a type of business structure where a single owner takes control of all aspects of the company. This includes making all business decisions and managing daily operations. While limited to only one owner, it's not uncommon for them to employ a staff team.

Regarding the legal setup, some marked differences exist with other business structures, such as Limited Liability Companies (LLC) and Partnerships. These structures legally require more than one stakeholder; however, sole proprietorships don't involve other parties.

Another big difference is that a sole proprietorship is not a separate legal entity from the business owner. This means all the business or personal assets and liabilities incurred during the course of business are the responsibility of a sole proprietor and he is personally liable for all the debts and losses of the company. So, sole proprietorship business liability is a personal unlimited liability rather than limited to a fixed sum, as in an LLC business structure.

For those looking to avoid such risks, consider incorporating your business. Osome's company incorporation services can help you transition from a sole proprietorship to a separate legal entity, providing you with limited liability protection and greater peace of mind.

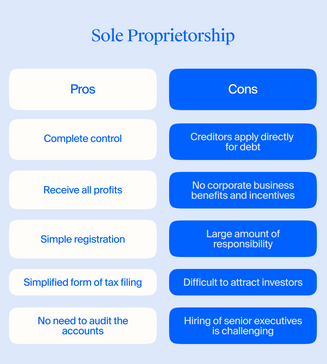

Pros and Cons of a Sole Proprietorship in Singapore

Consider your options and look at the pros and cons of sole proprietorship compared to other business types, such as limited companies.

Private limited companies (Pte Ltd) are popular for their flexible and scalable business structure. If you're unsure whether to choose a sole proprietorship or Pte Ltd, read our comprehensive guide: Sole Proprietorship vs Pte Ltd.

Sole Proprietorship Advantages

- As a sole proprietorship business owner, you have complete control and autonomy

- All profits generated by your activity go to you rather than shareholders. The business registration process is easy and cost-effective, and you can register a sole proprietorship with very little hassle.

- You don't have to file corporate income tax to the IRAS – instead, you file business returns along with your personal income tax

- Your profits will be taxed at a lower rate of personal income tax, instead of the higher corporate tax rate

- If you want to go down the route of incorporating a company in Singapore later on, this can be done easily

- There's no requirement to audit your accounts

Sole Proprietorship Disadvantages

- As you have no protection from business liabilities incurred, creditors will chase you directly for payment of debts

- As a sole proprietor, you will miss out on corporate tax benefits and incentives

- You may become overwhelmed with responsibility

- It can be hard to raise funds for a sole proprietorship as investors are often reluctant to support non-incorporated entities

- Hiring senior-level executives may also be difficult due to a lower public perception of this type of separate legal entity

- As a sole proprietor, you are personally liable for all your business activities

Documents Required and Registration Procedure

If you're asking yourself how to set up a sole proprietorship, the first step is gathering all the necessary documents and information for the business registration process. These include:

- The proposed name for your existing business

- A description of the main company activities

- The local address where it will be registered

- A copy of your Singapore ID

- Evidence of your local residential address

- Declaration of Compliance and Statement of Non-Disqualification

A sole-proprietorship is exempted from annual audit and is not required to file annual financial statements with ACRA

You must be at least 18 years old to register a sole proprietorship, and you must also be one of the following:

- A citizen of Singapore

- A Singapore permanent resident

- An eligible FIN holder (check on your eligibility before registering)

If you're self-employed, make sure you top up your Medisave account with the Central Provident Fund Board before you register.

Unlike a limited company, there is no requirement for sole proprietorship incorporation in Singapore since it is an unincorporated business. However, you must register online, which we'll cover in the next steps.

Keep in mind, that personal and business assets of a sole proprietor won't be protected from any business risks that come with your business.

How To Register a Sole Proprietorship in Singapore

The online registration procedure for sole proprietorship firms usually takes less than a day. Sometimes, it can take longer if referred to other Singapore government departments for review.

Once registered, you'll get a registration number, which must be used in communications like letterheads and invoices.

Step 1. Choose a name

First, as a sole proprietor, you'll need to choose a company name. This must be approved by the Accounting and Corporate Regulatory Authority (ACRA), and there are certain requirements, so you'll need to think carefully.

Follow these tips to avoid any delay in your registration:

- Choose a unique name

- Do not infringe any trademarks or copyright

- Avoid anything that might be interpreted as offensive or inappropriate

- Make sure the name is not already reserved

Remember that the name you select is also part of your brand, so be creative in your approach and make sure the name reflects your values and offerings.

If unsure, use a tool like the Singapore Company Name Check Tool to see if your name has already been taken.

It costs S$ 15 to register your chosen name, and once it's approved, it will be valid for 120 days. Make sure you reapply to keep your name within this time frame, or you will have to complete the process again, and the name could be snapped up by another operation in the meantime.

Step 2. Choose a local business address

Providing a local address is an important part of the Singapore sole proprietorship registration process — this must be a physical address, not a P.O. Box address.

If a business owner intends to work from home, he can use his home address as the main business address. He'll need to apply to the Home Office Scheme and get approval before submitting your registration to ACRA. He will also need written permission from the Urban Redevelopment Authority (URA) or the Housing & Development Board (HDB) to use your home as an office.

As a sole proprietor, you must submit your principal address even if you're not working from home. ACRA will list both addresses on its website, so be aware that the address of your separate legal entity will be available to the public.

Step 3. Appoint a local authorised representative (for foreigners)

If you are a foreigner (such as a Singapore citizen, permanent resident, or Employment Pass holder) and do not have a valid Singapore residential address, you cannot use your own address as the business address for your sole proprietorship.

To comply with this requirement, a business owner must appoint a local authorised representative of full legal capacity who meets the criteria set by Singapore authorities. This individual will serve as the local point of contact for official correspondence related to your sole proprietorship business and to safeguard your personal assets.

The representative must be either a Singapore citizen, permanent resident, or foreigner with a valid Employment Pass, S Pass, or Dependant Pass. This applies to any business owned by someone offshore.

Step 4. Register with ACRA's BizFile+

Now you have gathered all the required information, it's time to register your sole proprietorship online. You can do this through ACRA's filing portal called BizFile+. You'll need to log in and use SingPass. It will ask you to endorse your consent, which is needed before the business can be registered.

If there is no SingPass, the alternative is to appoint a registered filing agent like a law firm, accounting firm or corporate secretarial firm. Don't forget that Osome can help with corporate secretarial services in Singapore, helping to track deadlines, file documents and keep things on track.

For those considering the benefits of a separate legal entity, remember that transitioning from a sole proprietorship to a more structured business form, like a limited liability company, can provide significant legal protection. Feel free to contact Osome experts! The annual cost to register for a sole proprietorship is S$100, or you can pay S$175 for three years. Renewal fees are S$30 thereafter.

Considerations for Foreigners

Setting up this kind of business can be complex for a foreign sole proprietor, and it may be easier to incorporate a Singapore private limited company.

But if you are set on the idea, then follow these guidelines:

- Foreign sole proprietors who live abroad: appoint at least one resident-authorised representative and use a filing agent to file your application

- Foreign sole proprietorsliving in Singapore: apply for approval to register in front of the Ministry of Manpower

What's Next After Registering in Singapore?

You will receive an email with a registration number when your application has been approved. You'll also receive a Unique Entity Number (UEN) to use with government agencies.

Keep these details safe, as they may be required for other aspects of running your operations. For example:

- Opening a business bank account

- Signing an office lease

- Setting up a phone line

Don't forget to stay up to date with your operations. Tasks to keep on top of include:

- Annual business name renewals

- Filing financial records

- Keeping Medisave contributions with the CPF Board up to date

How Much Does it Cost To Register a Sole Proprietorship?

The cost of registering a sole proprietorship in Singapore includes several components:

- Business Name Reservation: To reserve a business name with the Accounting and Corporate Regulatory Authority (ACRA), there is a fee of S$ 15. This reserves the name for 120 days.

- Business Registration: The registration fee for a sole proprietorship is S$115. This fee is payable to ACRA when submitting the registration application.

- Local Address: Your sole proprietorship will need a local business address. The cost of renting or leasing a commercial space in Singapore can vary widely depending on location and size.

- Local Authorised Representative (for foreigners): If you are a foreigner without a valid Singapore residential address, you may need to engage a local representative. The terms of compensation or service fees for the representative can vary and should be agreed upon between you and the representative.

- Additional Costs: Depending on your business activities, you may incur additional costs for licenses, permits, and business insurance. These costs can vary widely depending on your specific industry and regulatory requirements.

How Do You Close a Sole Proprietorship in Singapore?

Closing a sole proprietorship involves a series of steps to legally wind up the existing business and fulfil any outstanding obligations. Here's an overview:

- Notify ACRA: Inform ACRA of your intention to close the Singapore sole proprietorship. This can typically be done online through the BizFile+ portal. You will need to submit a request for the cessation of business activities.

- Clear debts and obligations: Ensure all debts, taxes, and obligations are settled before closing the business. This includes paying outstanding bills, taxes, and salaries of local and foreign employees.

- Cancel licenses and permits: If your business holds any licenses or permits, cancel them with the relevant government agencies.

- Close bank account: Close the business bank account associated with the sole proprietorship.

- Dispose of assets: If you have business assets, such as equipment or inventory, decide whether to sell, transfer, or dispose of them as part of the closure process.

- Final tax returns: Complete and submit final tax returns, including the personal Income Tax Return for Sole Proprietorship.

- Deregistration: Once all obligations are met, submit a request for the deregistration of your sole proprietorship with ACRA.

The specific steps and requirements for closing a sole proprietorship may vary depending on individual circumstances and the nature of the business. Consulting with a corporate service provider or legal advisor is advisable to ensure a smooth closure and compliance with all regulatory requirements.

FAQ

Do I need to register for a sole proprietorship in Singapore?

If you're involved in any ongoing activities in Singapore that aim to make a profit, then you must register as a sole proprietor. You'll need to choose the best model for you, which could be a sole proprietorship or another type, such as a Pte Ltd or limited liability partnership.

Keep in mind, that personal assets of sole proprietors won't be protected from any business risks that come with your business. Unlike private limited liability company, Singapore sole proprietorship doesn't provide limited liability protection.

Do sole proprietors need to register with ACRA?

ACRA is a government regulatory authority that processes all applications in Singapore. If you're involved in ongoing profit-making activities, you must register on its BizFile+ portal as part of the application process. They must do the same if you use an authorised representative to submit your application.

Do sole proprietors pay income tax in Singapore?

As you aren't considered a company entity, you don't have to file corporate income tax to the IRAS – instead, it is determined at your personal income tax rate. This can range from 0% to a maximum of 22% if your business income exceeds S$320,000. This means that you do not benefit from the incentives available to a Pte Ltd. Additionally, you must pay taxes on your business income at your personal income tax rate. The maximum corporate tax rate in Singapore is 17%.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?