Guide to a Limited Liability Company in Singapore

- Modified: 23 December 2024

- 8 min read

- Starting a Company

Francesca Del Giudice

Author

Francesca is a content creator with over 5 years of cross-industry experience that spans academic research, consulting, venture, and tech startups.

Deepti Laddha

Reviewer

Deepti Laddha, our Head of Corporate Operations in Singapore, brings a decade of experience to her role, supporting our business writers in crafting insightful and engaging articles. With a strong background in corporate services, Deepti is a rich source of knowledge and expertise. We can count on her to assist in transforming any definition, concept or complicated jargon into helpful tips that help our readers take their businesses to the next level.

A Limited Liability Company (LLC) is a business type that exists as a separate legal entity from its owners and directors. This means that the company, rather than its owner, enters into contracts, owns assets and can be sued.

Directors' liabilities in a limited liability company are restricted to the amount of share capital they hold. The advantages of a Limited Liability Company make it a sensible choice – owners' personal assets are protected from lawsuits and being pursued for debts.

What Is a Limited Liability Company (LLC)?

A limited liability company (LLC) in Singapore is a type of business structure designed to protect its members by limiting their financial liability to the amount they have invested in the company. This means that the personal assets of the members are safeguarded and cannot be used to cover the company’s debts or liabilities, offering a significant degree of financial security to those involved in the company.

This corporate structure ensures that the company is treated as a separate legal entity, distinct from its owners. As a separate business structure, an LLC in Singapore can engage in a variety of legal and business activities on its own behalf. It has the capacity to own and manage property, enter into legally binding contracts, and carry out transactions independently of its members. Additionally, the LLC has the legal standing to initiate lawsuits against other entities or individuals, and conversely, it can be sued in its own name. This distinct legal status provides continuity and stability to the business, as its operations and existence are not directly tied to the personal circumstances of its owners.

Types of Limited Liability Companies

In Singapore, there are three primary types of limited liability companies, each with distinct characteristics and purposes.

Please note that there is no LLC legal company structure in Singapore. Instead, the main types of limited companies are: Private Company by Shares (Pte Ltd), which suits small to medium-sized businesses with up to 50 shareholders; Public Limited Company (Ltd), which can offer shares to the public and have more than 50 shareholders; and Public Company Limited by Guarantee, typically used for non-profits without share capital, where members act as guarantors.

Private Limited Company

The first type is the Private Company Limited by Shares, denoted as Pte. Ltd. This is the most common business entity in Singapore. The liability of shareholders in a Private Limited Company is limited to the amount they have invested, unlike a sole proprietorship, where the owner has unlimited personal liability. Such companies can have up to 50 shareholders, and their shares cannot be offered to the general public. This corporate structure is well-suited for small to medium-sized businesses.

Public Limited Company

The second type is the Public Limited Company, denoted as Ltd. Unlike private companies, Public Limited Companies can offer their shares to the public. The liability of shareholders remains limited to their investment. These companies can have more than 50 shareholders and can be listed on the Singapore Stock Exchange. They must comply with stringent regulatory requirements, making them suitable for larger businesses seeking to raise capital from the public.

Public Company Limited by Guarantee

The third type is the Public Company Limited by Guarantee. This type does not have share capital but instead has members who act as guarantors. The liability of these members is limited to the amount they agree to contribute if the company winds up. Public Companies Limited by Guarantee are typically used by non-profit organizations, charities, trade associations, and clubs. Their focus is usually on promoting a cause or managing a mutual interest rather than generating profit.

These types of limited liability companies cater to various business needs and organisational structures in Singapore, offering flexibility depending on the entity's objectives and scale.

| Type of Company | Private Limited Company (Pte. Ltd.) | Public Limited Company (Ltd.) | Public Company Limited by Guarantee |

| Shareholders | Up to 50 ✅ | More than 50 ✅ | No shareholders, only members ❌ |

| Liability | Limited to the amount invested 💵 | Limited to the amount invested 💵 | Limited to the agreed contribution of members 💵 |

| Shares | Cannot be offered to the public ❌ | Can be offered to the public ✅ | No shares ❌ |

| Purpose | Suitable for small to medium businesses 📊 | Suitable for large businesses raising public capital 💼 | Focus on non-profit, promoting a cause, or mutual interest 🌱 |

| Regulations | Less stringent ✔️ | Stringent; may be listed on SGX 📜 | Subject to specific regulations for non-profits ⚖️ |

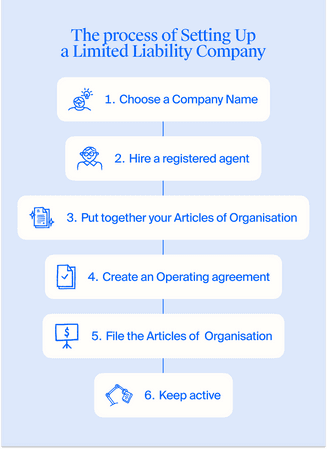

How To Set Up a Limited Liability Company (LLC)

Company registration in Singapore is an involved process. You must get approval from ACRA of your eligibility, collate all the documents required and submit your application.

It's recommended that you hire a professional firm (whether that's an accounting, corporate secretarial or law firm) to take care of the initial setup, alongside the ongoing filing requirements, including annual accounts, tax returns, running Annual General Meetings and more. Here are some useful steps.

1 Choose a business name

For anyone about to start a business in Singapore, choosing a name should be the first thing on your to-do list. Remember that it can't be similar to an existing company's name or trademark, and avoid bad language or controversial connotations. You can then submit your name to ACRA for approval.

2 Hire a registered agent

You can make incorporation simple by hiring a registered agent like Osome. We take care of all the steps, from purchasing the name and processing all legal documents to setting up your business bank account.

3 Obtaining a copy of your articles of association

Articles of association are also known as your company constitution. These documents outline your limited liability company structure, your operating agreement, and how the relationship with shareholders will be conducted. They also include your company name and office address.

4 File the articles of association

Once you have gathered your articles of association, containing name, registered office, liability, capital and subscriber clauses, and your Memorandum of Association, submit them to ACRA as your Company Constitution. The standard registration fee is S$300.

Before submitting your company constitution to ACRA, double-check that you have all the essential clauses in your Articles of Association, such as liability and capital. This step is crucial to ensure a smooth registration process and avoid delays.

5 Create an operating agreement

An operating agreement is a document that outlines how you will operate. It should lay out what should happen in various circumstances, such as if the owner can no longer play a role. The operating agreement should also state the division of ownership, labour and profits, as well as voting rights and who has authority over what.

6 Keep your LLC active

Regulatory compliance requirements include having a secretary, keeping a registered address, creating and maintaining an operating agreement, and filing annual and corporate tax returns. A registered agent can support you with all of this.

Limited Liability Company Advantages

Limited liability companies (LLCs) in Singapore offer several benefits that make them a popular choice for businesses. These advantages include:

- Limited Liability Protection: Shareholders' liability is limited to their investment in the company, unlike sole proprietorship, where the owner has unlimited liability. This means that personal assets are protected from business debts and liabilities, reducing the financial risk for investors. These limited liability benefits make investing in the company more attractive by safeguarding individual wealth.

- Separate Legal Entity: An LLC is considered a separate business structure from its owners. This means it can own property, enter into contracts, sue, and be sued on its own behalf. This separation provides continuity and stability, as the company's existence is not affected by changes in ownership.

- Tax Benefits: Singapore has a competitive corporate tax rate, with various tax incentives and exemptions for new startups and small to medium-sized enterprises (SMEs). LLCs benefit from these favourable tax policies, which can significantly reduce the overall tax burden.

- Ease of Raising Capital: LLCs, especially Public Limited Companies, have greater ease in raising capital through the issuance of shares. This can attract a larger pool of investors and provide the necessary funds for expansion and growth.

- Professional Image and Credibility: Operating as an LLC enhances the company’s professional image and credibility. It can instil confidence in customers, suppliers, and potential investors, as it signals a commitment to compliance and good governance practices.

- Perpetual Succession: The company continues to exist even if shareholders change or pass away. This ensures business continuity and stability, as the company's operations are not disrupted by changes in ownership.

- Flexibility in Management: LLCs offer flexibility in the distribution of management roles. Shareholders can be individuals or corporate entities, and the company can structure its board and management to best suit its needs.

- Global Reputation and Supportive Business Environment: Singapore is known for its robust legal framework, political stability, and business-friendly environment. Establishing an LLC in Singapore provides access to international markets, world-class infrastructure, and a supportive regulatory environment.

These advantages make limited liability companies in Singapore an attractive option for both local and international entrepreneurs looking to establish or expand their business operations.

A Private Limited Company (Pte. Ltd.) offers the best of both worlds — asset protection, tax advantages, and business continuity. It’s the top choice for entrepreneurs seeking growth, credibility, and a flexible structure in Singapore’s dynamic market.

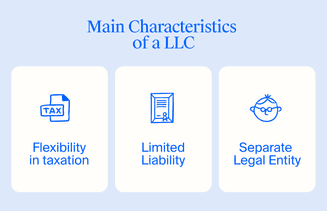

Characteristics of a Limited Liability Company

Are you weighing up limited liability companies vs private limited companies and trying to understand the difference? Don't worry, the former is a type of the latter. Most LLCs in Singapore are private limited companies.

1 Tax Flexibility

An LLC in Singapore is taxed at the corporate rate and can apply for various tax exemptions. For the first three years, there's no tax on the first S$100,000 of profits each year. Singapore's single-tier tax policy means that once corporate profit has been taxed, distributed dividends are tax-free.

However, please note that tax exemptions may vary depending on the company's residency and specific circumstances. For instance, start-ups may qualify for a start-up tax exemption scheme, while more established companies might benefit from partial tax exemptions. Additionally, tax policies and exemption criteria can change annually, so it is important for companies to stay informed about the latest tax regulations and consult with professional accountants to ensure compliance and optimal tax planning.

2 Limited Liability

Members have limited liability for the actions of the business and for those of other members. Limited liability provides a valuable layer of financial and legal protection. This means it can be scaled and take risks, without creating liability for a member's personal assets.

3 Separate Legal Entity

The structure is such that it's a separate entity from its members. This means that the company transacts business, enters into contracts, owns property and assets, and takes part in lawsuits in its own name, not in the name of any member.

FAQ

What are the directors' liabilities in a limited company?

Directors' liabilities in a limited company are generally limited to their actions within the scope of the company. However, they can be held personally liable for breaches of fiduciary duties or legal obligations, such as wrongful trading or tax evasion.

How to apply for a Limited Liability Company?

To apply for a Limited Liability Company, you must register with the relevant authority (e.g., ACRA in Singapore), submit necessary documents like the Articles of Association, and pay the registration fee.

Is a Limited Liability Company a Corporation?

Yes, a Limited Liability Company (LLC) is a type of corporation, offering limited liability protection to its owners while being a separate legal entity.

What is Limited Liability Company debt responsibility?

It's useful when you want to limit the extent of your personal liability for the organisation's activity and when you want to influence how to pay taxes and the regulations you have to comply with as an owner.

What are the types of a Limited Liability Company in Singapore?

The main types of LLCs in Singapore are the Private Limited Company (Pte. Ltd.), Public Limited Company (Ltd.), and Public Company Limited by Guarantee.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?