Requirements for ACRA and IRAS Tax Filing: What All SG Companies Need To Know

Every year, Singapore companies are required to file their annual returns and tax returns to two government agencies – the Accounting Corporate Regulatory Authority (ACRA) and Inland Revenue Authority of Singapore (IRAS).

Every year, companies registered in Singapore are required to file their annual returns and tax returns to two government agencies – the Accounting Corporate Regulatory Authority (ACRA) and Inland Revenue Authority of Singapore (IRAS).

The filing requirements are based on the company’s financial year. In fact, different types of companies have certain IRAS tax filing requirements that apply to them.

As business owners, it is important to take note of the filing obligations, especially those which may be unique to your company to comply with Singapore law. Understanding ACRA and IRAS-related filing requirements helps you to plan effectively to ensure that your company submits the required documents on time, as late filing can result in a penalty or fines.

If you are an entrepreneur, or the director of a newly-formed company, you might be wondering what kind of documents are required during IRAS filing.

In this article, we break it down into two main sections, ACRA Tax Filing and IRAS Filing. and share an overview of requirements for each.

How To Be Compliant with ACRA

To meet your obligations as a company to ACRA, you need to submit an annual return and hold an Annual General Meeting (AGM).These come with exceptions, so read on for more information on how to best prepare for each.

What Is an Annual Return?

When filing your annual return to ACRA, you’re required to submit an electronic form comprising the following important particulars:

- Directors

- Secretary

- Members

- Financial year-end for the financial statements to be reported to, and lodged (if needed to)

- Business activities and registered office address

- Share capital

The purpose of an annual return filing is to provide the above critical information to your company stakeholders so that they can make informed decisions in the coming financial year. Your annual return filing due date and associated submission deadline is within 7 months of the financial year-end, and after you have held your Annual General Meeting (AGM).

What Do I Need to Know About Annual General Meeting (AGM) Filing Requirements?

An AGM is a meeting when companies present their financial report to their shareholders. During this gathering, members are allowed to ask any questions relating to the financial standings of the company. On the other hand, the company may use this opportunity to address any concerns raised by the members.

Annual return filing requirements stipulate that all Singapore companies must hold an AGM. If you have just formed a new company, you will need to hold your first AGM within 6 months of your financial year-end.

For non-listed companies with a financial year ending after 31 August 2018, do bear in mind that your financial statement has to be dated not more than 6 months before the AGM. For listed companies preparing AGM filing for submission to ACRA, the date of your financial statement has to be not more than 4 months before the AGM.

Springs Motoring Pte Ltd is an SME with a financial year ending on 31 December 2020. They usually hold their AGM in mid-June. As they are planning to hold their AGM on 15 June 2021, their financial statement must be ready by 15 June 2021 with the consent of shareholders obtained.

Exemptions from holding an AGM

Although all companies must hold an AGM, some are exempt. For dormant relevant companies (i.e. not a listed company nor a subsidiary of a listed company) with total assets of less than or equal to S$500,000 (consolidated value if it is an ultimate parent company), you are exempted from preparing financial statements and therefore do not need to hold an AGM.

Despite this exemption, you are still required to submit the details during your filing of the company's annual return.

Likewise, a private company does not need to hold a physical AGM if all the members pass the AGM resolutions via written means. The written resolution can be performed through hardcopies or softcopies as agreed by all members.

ACRA Filing: What Documents Are Required?

- Financial Statements

All Singapore companies are required to prepare their financial statements for annual return purposes, except for those dormant relevant companies. The financial statements must be prepared according to the Financial Reporting Standards of Singapore (FRSS). The documents consist of:

- Profits and loss account

- Balance sheet

- Cash flow statement

- Statement of changes in equity

- Notes to the financial statements (accounting methods applied in the preparation of the financial statements)

You are exempted from lodging your financial statements with ACRA if your company is an Exempt Private Company (i.e. not more than 20 shareholders, none of them a corporation) and solvent.. Otherwise, ACRA requires financial statements to be lodged in XBRL format in the annual return itself.

- Audited statements

When ready, your company will get your financial statements audited by independent auditors.

You are required to have your financial statements audited if your company meets any 2 of the following criteria:

- Your total revenue exceeds S$10 million

- Your total assets have amounted to more than S$10 million

- You have more than 50 employees

However, your company is qualified for audit exemption if you meet any 2 of the following 3 criteria where you are then considered and put in the category of a small company:

- Total revenue is less than S$10 million

- Total assets are less than S$10 million

- Less than 50 employees

If your small company is part of a group, you will be assessed as a whole (consolidated basis).

Pebble Café is a subsidiary of a wholesale food company. Its parent company sells imported food products around the Asia Pacific region. Though Pebble Café does not have more than $2 million in revenue and has less than 30 employees, this subsidiary company will be assessed based on a consolidated group, rather than as a separate entity.

What Kind of Format Do I Need To File for My Financial Statements?

You are required to file your company’s financial statements in XBRL format. Once you have formatted your documents to XBRL, you may upload your file to the BizFin server.

Do take note that ACRA has recently revised the filing requirements and data elements in XBRL format for companies. It is important to keep yourself up to date with the revised requirements so that you do not submit the incorrect file format. You may refer here for more information.

What is the deadline for filing my Annual Return?

There are two deadlines for filing an Annual Return, and it depends on your company’s financial year.

For the financial year that is ending before 31 August 2018, you will need to file your annual returns within 30 days after your AGM is held.

For the financial year that is ending after 31 August 2018, you will need to file your annual returns within 5 months (for listed companies) or 7 months (non-listed companies) after the financial year-end, and only after your AGM is held.

Kinetics Pte Ltd supplies dancing materials to schools in Singapore and the Asia Pacific region. Their financial year is 31 July 2018 (which is before 31 August 2018), they have decided to hold its AGM on 30 January 2019. Before 15 January 2019, the financial statements have to be ready and signed off by the company directors for the AGM to be held on 30 January 2019, and thereafter, the Annual Return is required to be lodged by 1 March 2020 (which is within 30 days after the AGM).

Wakin Pte Ltd is a growing IT start-up company. Their financial year is 31 December 2018 (which is after 31 August 2018). They decided to hold its AGM on 30 June 2019. As it is a non-listed company after its AGM is held, they just need to ensure the Annual Return is submitted or lodged, latest by 31 July 2019 which means the Annual Return is lodged within the 7 months time frame.

How To Be Compliant with IRAS

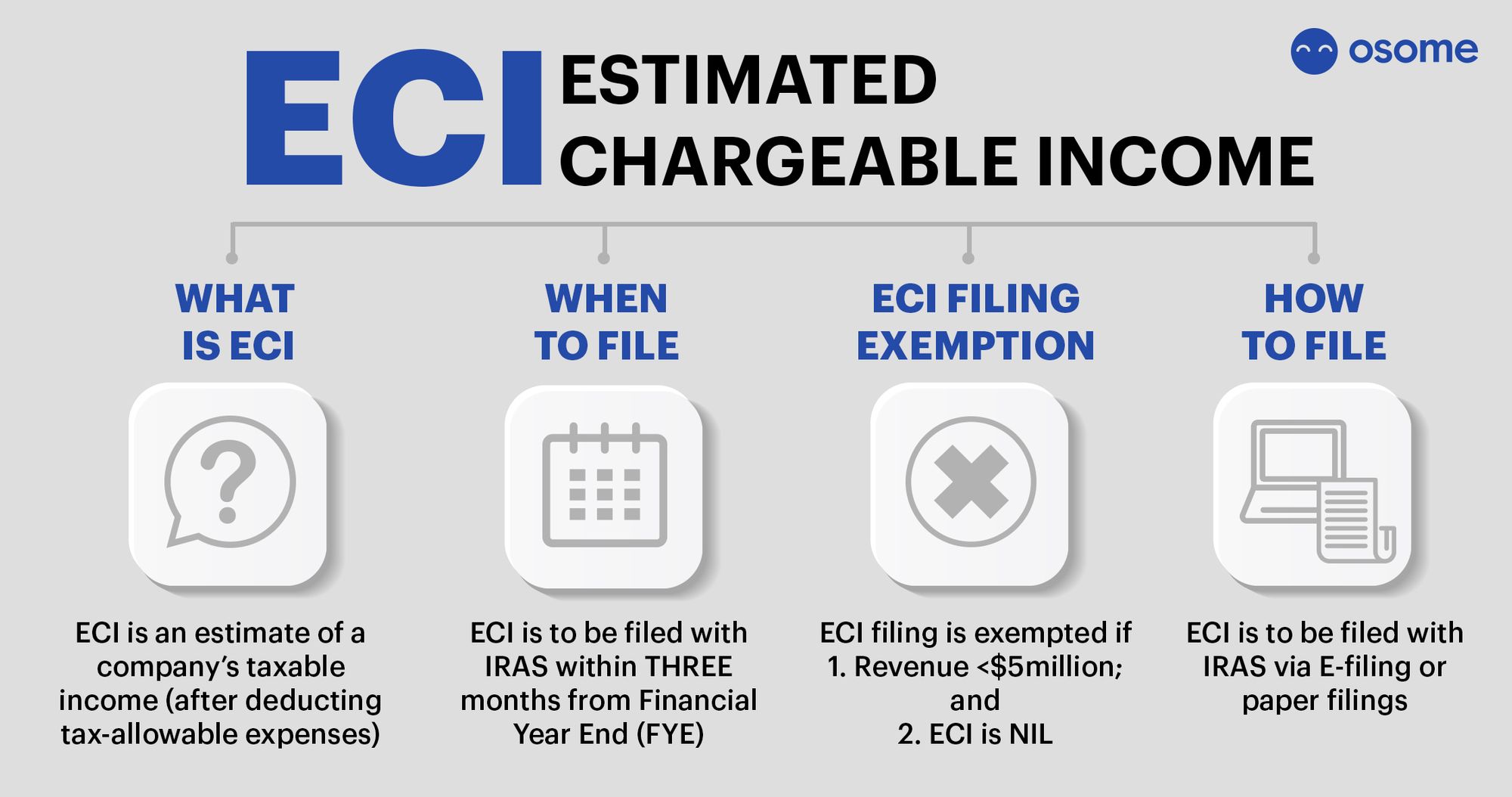

To be compliant with IRAS, you need to take note of submitting your Estimated Chargeable Income, and your Corporate Income Tax. Take note of if you can be exempted and when the deadlines are for these.

Estimated Chargeable Income (ECI)

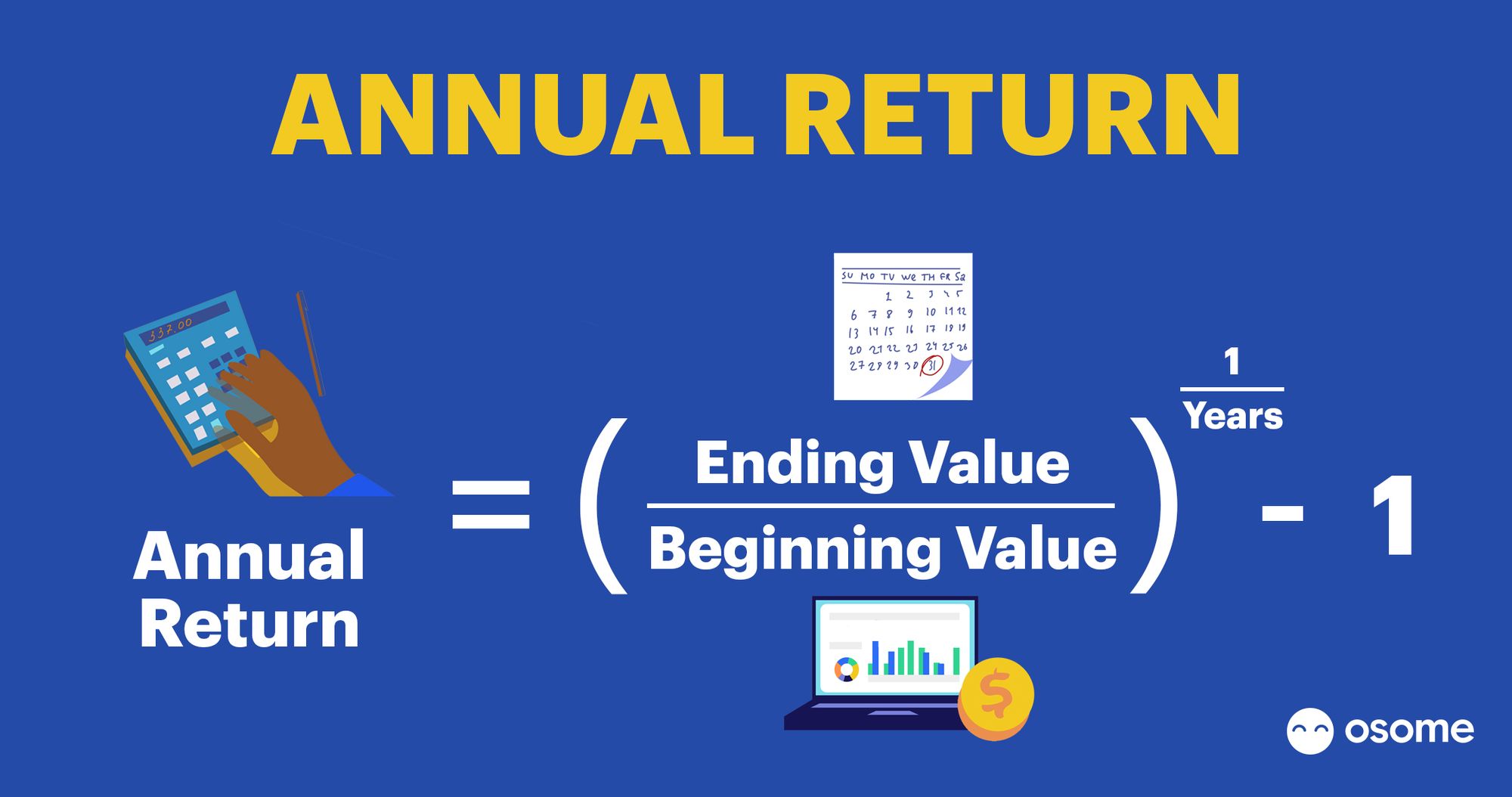

Estimated Chargeable Income refers to the estimated income of the company’s taxable income (after deducting taxable-allowed expenses) in the Year of Assessment (YA). All companies, including newly-formed companies, are required to file ECI within 3 months from the end of the financial year. Do bear in mind that starting from January 2017, you will need to fill in your company’s revenue in ECI.

For newly-formed companies, you will need to submit ECI within 3 months from your company’s first financial year.

Cindy starts a bakery business in March 2019. She closes her first set of accounts on 31 December 2019. In this case, she will not receive a notification about filing the ECI. However, she is still required to file the ECI within 3 months of her first year of incorporation (i.e by 31 March 2020).

So what about companies that close their set of accounts in the following year?

Audrey starts her artisanal chocolate business in June 2019. She closes her set of accounts on 31 December 2020. In this case, she will receive a filing notification from IRAS about ECI on 31 December 2020. In this example, she will have to file her ECI by 31 March 2021.

On the other hand, your company is exempted from filing ECI if your company’s revenue does not exceed more than S$5 million for the financial year and ECI is NIL for the particular YA.

IRAS Filing & Corporate Income Tax

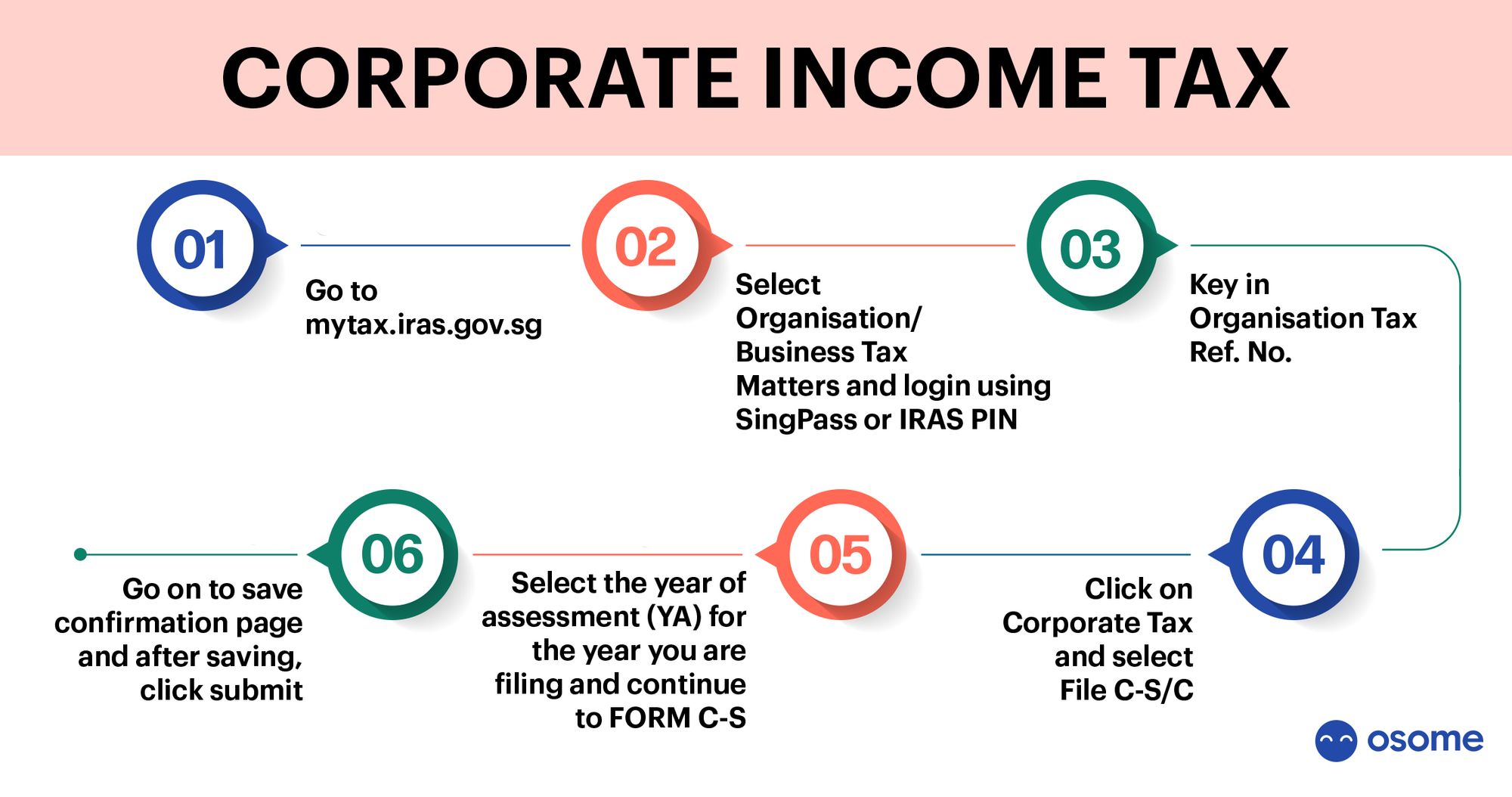

All companies in Singapore must file their corporate income tax return (Form C-S/C) to the IRAS every year.

There are two types of income tax forms: Form C-S and Form C. Despite the difference in name, both Form C-S and Form C are declaration forms to report actual income for the financial year. Companies are advised to ensure that the income reported is accurate and completed.

Even if your company is making a loss, you will still need to file C-S/C as part of your your IRAS tax filing obligations.

What Is the Annual Tax Filing Deadline in Singapore?

All companies must file their annual tax return with IRAS by 30 November of the year of assessment (YA). Singapore companies use the preceding year basis for taxation. This means, if your company earns S$500,000 in the financial year of 2020, this amount will be taxed in 2021.

What If I Do Not Comply With the Filing Requirements?

As a business owner, it’s easy to neglect to file annual returns and annual tax returns or even keep a proper record for that matter. But there are consequences if your company is found not to be in compliance with filing the necessary documents.

An ACRA penalty framework has recently been revised for non-compliance in filing annual returns, which will take effect from 30 April 2021. Companies that do not file their annual returns within threemonths after the deadline will receive a late filing penalty of S$300. If the company does not file more than three months after the deadlines, ACRA will issua a late filing penalty of S$600.

Likewise, IRAS will issue an estimated Notice of Assessment (NOA) if you do not file your annual tax returns before the given deadline. This estimated NOA might be higher than your actual income. After receiving a NOA, you are required to pay the estimated tax within one month. In extreme cases, if your company fails to comply, IRAS might take legal action against your company.

We understand that there is simply too much paperwork to handle during the tax season. With the authorities taking this submission seriously, you do not want to be involved in any form of legal action or paying a late filing penalty to ACRA. So it’s important to keep a proper record and comply with the authorities. You may engage our experienced secretary services to help with the filing of your annual returns and annual IRAS tax returns so that you can just focus on the running of your business.

Can I Apply for a Tax Filing Extension?

No. Previously, IRAS extended the filing of Form C-S/C of the 15 December deadline. But with the effect of 2021, this extension will no longer be applicable. Starting from the Year of Assessment 2021, all companies have to file their Form C-S/C by 30 November 2021.

ACRA & IRAS Tax Filing: Key Takeaways

- An annual return is an electronic form, which all Singapore companies are required to submit to ACRA annually. It contains relevant and important information such as the director’s name, appointed secretary, members and date of financial statements.

- All Singapore companies must hold an AGM. Newly-formed companies must hold an AGM within 18 months after incorporation. The purpose of an AGM is to present the financial standings of your company to the shareholders.

- You have to submit your financial statements when you file your annual return to ACRA. The format to file your financial statements should be in XBRL.

- All Singapore companies, including newly-formed companies, are required to file ECI within 3 months from the financial year.

- Filing of corporate income tax annually is mandatory for all companies. The forms, C-S/C, are a declaration form to report your actual income. The deadline to file ECI is 3 months after the company’s financial year end. There is no extension for this deadline.

- The deadline for filing annual tax returns is 30 November of the Year of Assessment.

- ACRA and IRAS take non-compliance seriously. If a company files their annual return 3 months after the deadline, the late filing penalty will be S$300. If it exceeds more than 3 months after the deadline, the penalty will be S$600.

- IRAS will issue a Notice of Assessment if you do not file your annual tax returns before the deadline. The estimated tax must be paid within 1 month.

Need Help To Be a Compliant Company?

Tip

Make the day-to-day running of your company easier with a company secretary and accountants on your side, available to chat with you on the cloud. With our certified secretaries who have years of experience, you’ll be able to figure out what documents you need and be reminded of deadlines.